Key Insights

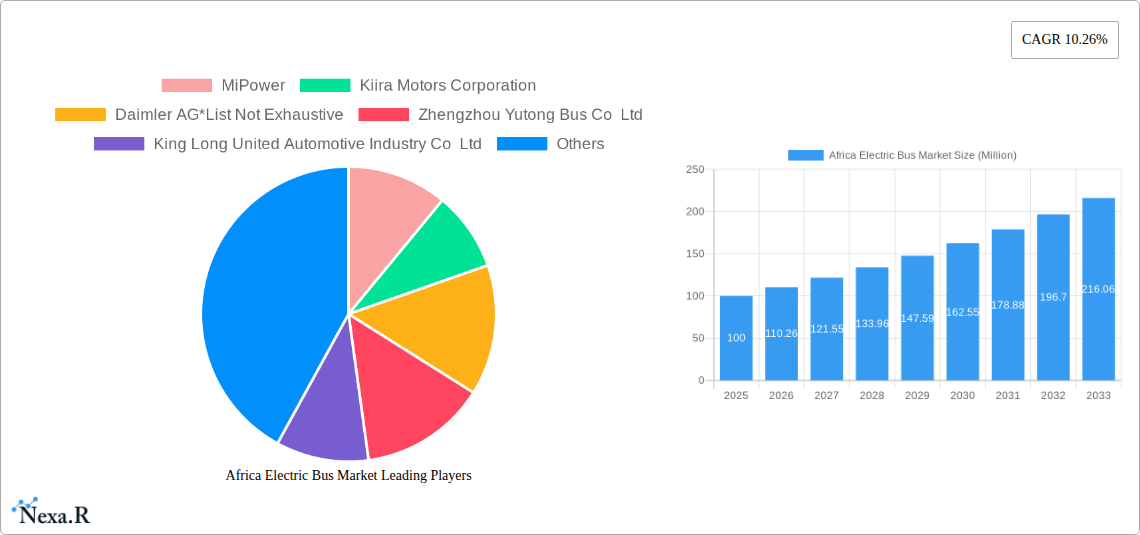

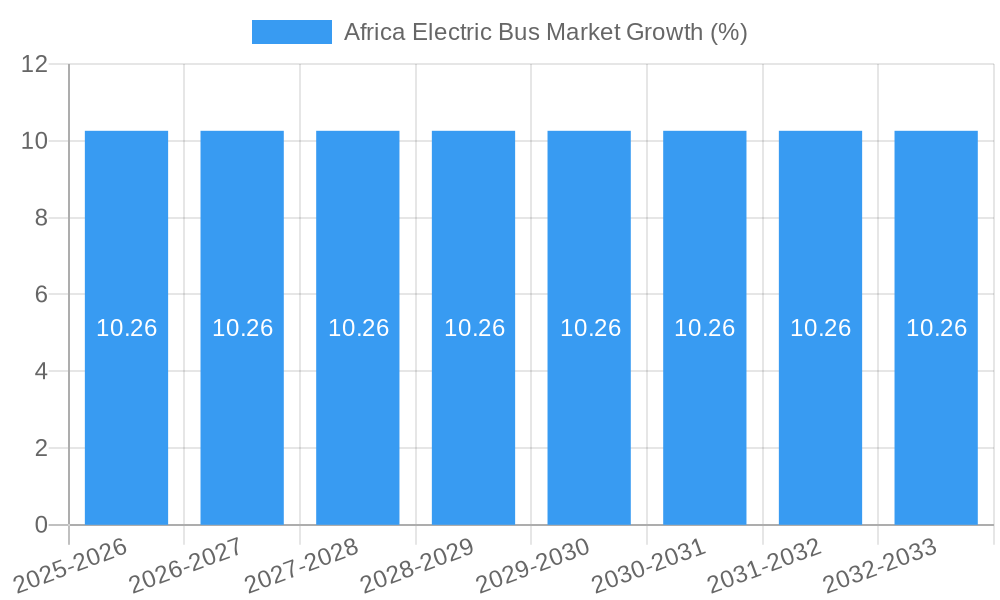

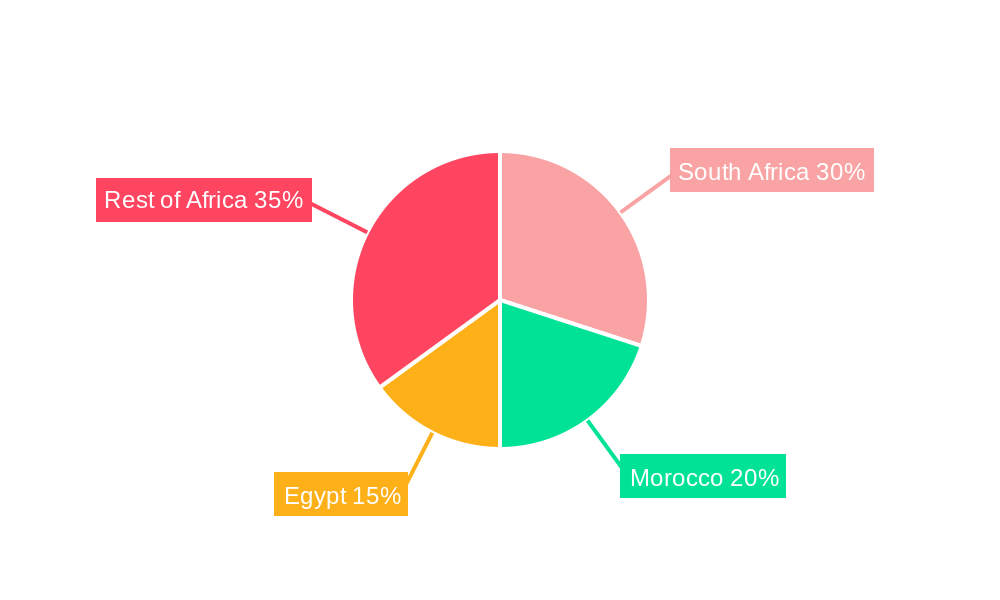

The African electric bus market is poised for significant growth, driven by increasing urbanization, rising environmental concerns, and supportive government initiatives aimed at reducing carbon emissions and improving public transportation. The market, currently valued at an estimated $XX million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of 10.26% from 2025 to 2033. This robust growth is fueled by several key factors. Firstly, a growing number of African cities are experiencing rapid population growth and increased traffic congestion, creating a strong demand for efficient and sustainable public transportation solutions. Secondly, governments across the continent are actively investing in electric vehicle infrastructure and enacting policies to incentivize the adoption of electric buses. This includes subsidies, tax breaks, and the development of charging networks. Thirdly, the decreasing cost of electric bus technology and the increasing availability of domestically produced components are making electric buses a more economically viable option for fleet operators and governments. South Africa, Morocco, and Egypt are expected to be leading markets within Africa, benefiting from more developed economies and infrastructure. However, challenges remain, including the need for further development of charging infrastructure in less developed areas, and the need for continued investment in training and maintenance expertise.

Despite these challenges, the long-term outlook for the African electric bus market is extremely positive. The increasing affordability of electric buses, combined with growing environmental awareness and government support, will likely drive substantial market expansion over the next decade. Key players like MiPower, Kiira Motors Corporation, and international manufacturers such as BYD Auto are actively competing in this burgeoning market, further stimulating innovation and competition. The segment breakdown, including battery electric, plug-in hybrid electric, government procurement, and fleet operator adoption, will be crucial in shaping future market dynamics. The market’s growth trajectory is also likely to be influenced by the success of pilot programs and the gradual integration of electric bus technology into existing public transportation systems. As technological advancements continue and economies mature, the African electric bus market is expected to become a significant contributor to sustainable urban mobility across the continent.

Africa Electric Bus Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Africa electric bus market, offering invaluable insights for industry professionals, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, growth trends, key players, and future opportunities within this rapidly expanding sector. The report segments the market by propulsion type (Battery Electric, Plug-in Hybrid Electric), consumer type (Government, Fleet Operators), and country (South Africa, Morocco, Egypt, Rest of Africa), providing a granular understanding of regional variations and growth drivers.

Africa Electric Bus Market Market Dynamics & Structure

The Africa electric bus market is characterized by a dynamic interplay of technological advancements, evolving regulatory landscapes, and increasing consumer demand for sustainable transportation solutions. Market concentration remains relatively low, with several key players vying for market share. However, significant growth potential exists, particularly given the supportive government initiatives and the increasing focus on reducing carbon emissions.

- Market Concentration: Currently, the market exhibits fragmented nature with no single dominant player. Market share is predicted to be xx% for the top 3 players by 2025.

- Technological Innovation: Rapid advancements in battery technology, charging infrastructure, and vehicle design are key drivers. Innovation barriers include high initial investment costs and limited access to charging infrastructure in certain regions.

- Regulatory Framework: Government policies promoting electric vehicle adoption, including subsidies and tax incentives, are crucial catalysts for market growth. However, inconsistencies in regulations across different African countries can pose challenges.

- Competitive Product Substitutes: Diesel and petrol buses remain significant competitors, though their market share is expected to decline as electric bus technology matures and becomes more cost-competitive.

- End-User Demographics: Government agencies and fleet operators are currently the primary adopters. However, growing private sector involvement and the expansion of public transport networks will broaden the end-user base.

- M&A Trends: The number of M&A deals in the African electric bus market is currently low (xx deals in the last 5 years) but is predicted to increase as larger players seek to expand their market presence and gain access to new technologies.

Africa Electric Bus Market Growth Trends & Insights

The African electric bus market is experiencing exponential growth, driven by a confluence of factors. From 2019 to 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%, reaching a market size of xx million units in 2024. This upward trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. Market penetration remains relatively low compared to other regions, indicating significant untapped potential. Technological disruptions, including advancements in battery technology and charging infrastructure, are accelerating adoption rates. The shift in consumer preferences toward environmentally friendly transportation further fuels market expansion.

Dominant Regions, Countries, or Segments in Africa Electric Bus Market

South Africa currently holds the largest market share within the African electric bus market, driven by its relatively developed infrastructure and supportive government policies. However, other countries like Morocco and Egypt are showing significant growth potential. The Battery Electric segment dominates the propulsion type category due to its improved efficiency and longer range compared to plug-in hybrid electric buses. Government agencies are the largest consumer segment due to their large-scale procurement capabilities and commitment to sustainable transport initiatives.

- Key Drivers for South Africa: Strong government support, existing infrastructure, and a growing urban population.

- Key Drivers for Morocco & Egypt: Government investments in public transportation and renewable energy initiatives.

- Segment Dominance: Battery Electric buses are predicted to maintain the largest market share (xx%) by 2033 due to continuous technological improvement and cost reductions. Government procurement accounts for the lion's share (xx%) of the market due to their large-scale purchasing power.

Africa Electric Bus Market Product Landscape

The Africa electric bus market showcases a diverse range of electric bus models, each tailored to meet specific regional needs and challenges. Innovations focus on optimizing battery performance, enhancing charging infrastructure compatibility, and improving vehicle durability to withstand the varied climates and road conditions across the continent. Key selling propositions include reduced operating costs, lower emissions, and improved passenger comfort compared to conventional buses.

Key Drivers, Barriers & Challenges in Africa Electric Bus Market

Key Drivers:

- Increasing government regulations and incentives supporting electric mobility

- Growing environmental awareness among consumers and businesses

- Technological advancements in battery technology and charging infrastructure

- Rising fuel costs

Challenges & Restraints:

- High initial investment costs for electric buses and charging infrastructure

- Limited access to financing for electric bus projects

- Lack of skilled technicians for maintenance and repair

- Inadequate charging infrastructure in many regions.

Emerging Opportunities in Africa Electric Bus Market

- Expansion into smaller cities and towns with limited public transport services.

- Development of innovative business models, such as bus rapid transit systems.

- Partnerships between electric bus manufacturers and local assemblers to boost local production.

- Integration of electric buses with smart city technologies.

Growth Accelerators in the Africa Electric Bus Market Industry

Strategic partnerships between international electric bus manufacturers and local businesses are crucial for market expansion and technology transfer. Technological breakthroughs in battery technology, along with the development of robust charging infrastructure, will further accelerate market growth. Government initiatives promoting electric mobility, including subsidies and tax incentives, will play a crucial role in driving adoption rates.

Key Players Shaping the Africa Electric Bus Market Market

- MiPower

- Kiira Motors Corporation

- Daimler AG

- Zhengzhou Yutong Bus Co Ltd

- King Long United Automotive Industry Co Ltd

- BYD Auto Co Ltd

- Zhongtong Bus Holding Co Ltd

Notable Milestones in Africa Electric Bus Market Sector

- August 2022: ROAM launches its first all-electric bus, the ROAM Rapid, in Kenya.

- January 2022: Opibus introduces Kenya's first African-designed and manufactured electric bus.

In-Depth Africa Electric Bus Market Market Outlook

The Africa electric bus market holds immense potential for long-term growth. Continued technological advancements, supportive government policies, and increasing consumer awareness of environmental issues will propel market expansion. Strategic partnerships and investments in charging infrastructure will be key to unlocking the full potential of this sector. The market is poised for significant growth, presenting lucrative opportunities for investors and industry players.

Africa Electric Bus Market Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric

- 1.2. Plug-In Hybrid Electric

-

2. Consumer Type

- 2.1. Government

- 2.2. Fleet Operators

Africa Electric Bus Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market

- 3.3. Market Restrains

- 3.3.1. High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion

- 3.4. Market Trends

- 3.4.1. Battery Electric Bus to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric

- 5.1.2. Plug-In Hybrid Electric

- 5.2. Market Analysis, Insights and Forecast - by Consumer Type

- 5.2.1. Government

- 5.2.2. Fleet Operators

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. South Africa Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 MiPower

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kiira Motors Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Daimler AG*List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Zhengzhou Yutong Bus Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 King Long United Automotive Industry Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BYD Auto Co Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Zhongtong Bus Holding Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 MiPower

List of Figures

- Figure 1: Africa Electric Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Electric Bus Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Africa Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 4: Africa Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Africa Electric Bus Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Africa Electric Bus Market Revenue Million Forecast, by Consumer Type 2019 & 2032

- Table 14: Africa Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Nigeria Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Africa Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Egypt Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kenya Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ethiopia Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Morocco Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ghana Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Algeria Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ivory Coast Africa Electric Bus Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Electric Bus Market?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the Africa Electric Bus Market?

Key companies in the market include MiPower, Kiira Motors Corporation, Daimler AG*List Not Exhaustive, Zhengzhou Yutong Bus Co Ltd, King Long United Automotive Industry Co Ltd, BYD Auto Co Ltd, Zhongtong Bus Holding Co Ltd.

3. What are the main segments of the Africa Electric Bus Market?

The market segments include Propulsion Type, Consumer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding the Presence of Automobile Assembly Plants in Ghana to Drive Demand in Target Market.

6. What are the notable trends driving market growth?

Battery Electric Bus to Witness Growth.

7. Are there any restraints impacting market growth?

High Import Tariffs and Taxes on Vehicles May Stymie Industry Expansion.

8. Can you provide examples of recent developments in the market?

In August 2022, ROAM, a Swedish-Kenyan mobility company, launched its first all-electric bus built for mass transit in Africa, following the launch of its first production-intent model of electric motorcycles. The ROAM Rapid is an electric bus that was created to address the unique challenges of public transportation in Nairobi and throughout Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Electric Bus Market?

To stay informed about further developments, trends, and reports in the Africa Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence