Key Insights

The North American used truck market is projected for significant expansion, estimated at $16103.28 million in 2024, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This growth is primarily driven by the logistics and freight sectors' increasing need for cost-effective transportation solutions. Businesses are increasingly choosing pre-owned trucks to optimize fleet expenses, especially amid volatile new vehicle pricing and supply chain disruptions. Enhanced fuel efficiency and extended vehicle lifespans, due to technological advancements, further bolster the appeal of used trucks. The proliferation of online marketplaces and auction platforms is also improving accessibility and streamlining the purchasing process for a wider customer base.

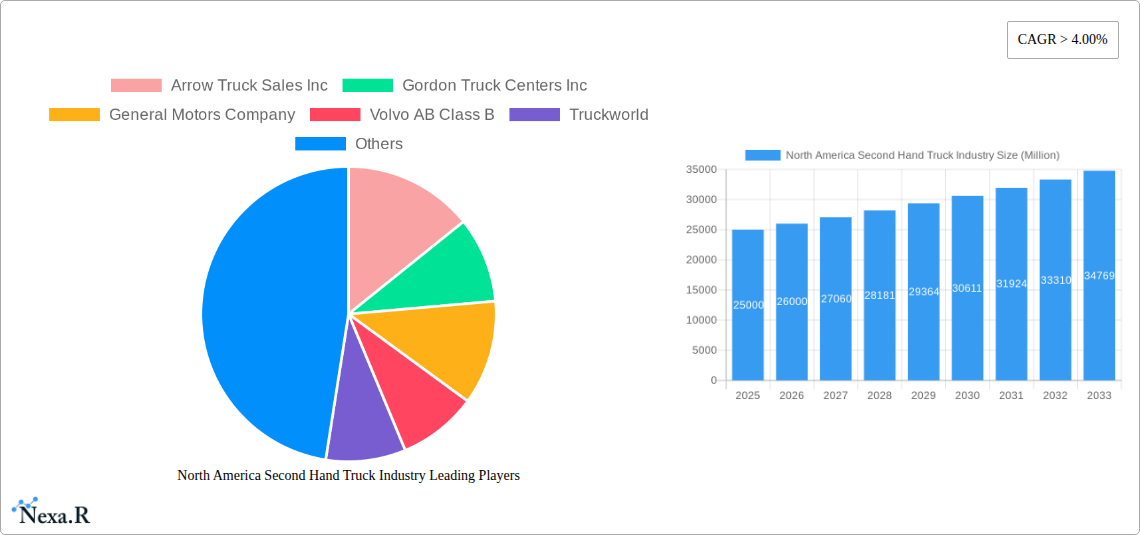

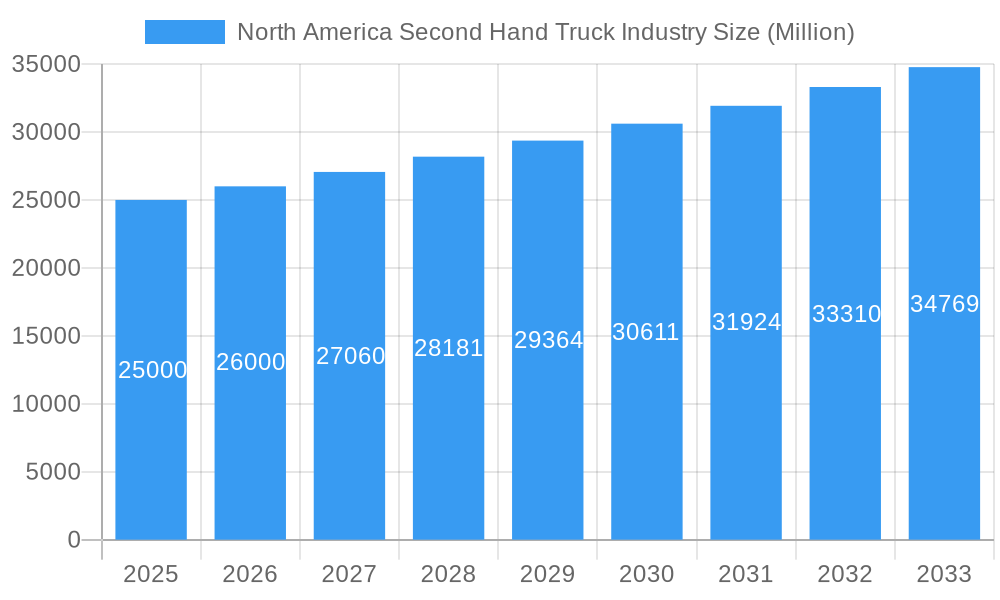

North America Second Hand Truck Industry Market Size (In Billion)

Key challenges influencing the market include the impact of fluctuating fuel prices and macroeconomic conditions on demand, alongside potential limitations in the availability of high-quality pre-owned vehicles, particularly heavy-duty segments. Stringent emission regulations also pose a consideration for the resale value and operational lifespan of older trucks. The industry is actively addressing these challenges through enhanced maintenance practices, extended warranty options, and the rise of certified pre-owned programs. Intense competition among key players such as Arrow Truck Sales, Gordon Truck Centers, Paccar, and Volvo is fostering innovation and elevating customer value. While the United States is expected to maintain its market leadership, Canada and Mexico present substantial growth opportunities with their developing logistics infrastructures.

North America Second Hand Truck Industry Company Market Share

North America Second Hand Truck Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America second-hand truck market, covering the period 2019-2033. It delves into market dynamics, growth trends, key players, and future opportunities within the parent market of commercial vehicles and the child market of used trucks. This detailed analysis will equip industry professionals with the insights needed to make informed strategic decisions. The report's base year is 2025, with estimations for 2025 and forecasts extending to 2033, encompassing a historical period of 2019-2024. Market values are presented in million units.

North America Second Hand Truck Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the North American used truck industry. We examine market concentration, identifying the leading players and their respective market shares. We also investigate M&A activity, quantifying deal volumes and analyzing their impact on the market structure. Furthermore, the report explores the influence of technological innovation, regulatory frameworks, and the presence of substitute products. End-user demographics and their evolving needs are considered, along with an assessment of innovation barriers and their impact on market growth.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Telematics integration and improved online marketplaces are key drivers. Barriers include the high cost of implementing new technologies and integration challenges with older truck models.

- Regulatory Framework: Emissions regulations and safety standards significantly influence the market for used trucks. Compliance costs impact pricing and availability of certain models.

- M&A Activity: An estimated xx M&A deals occurred between 2019-2024, primarily driven by expansion strategies and market consolidation efforts.

- Competitive Product Substitutes: The rise of alternative transportation methods (e.g., rail) and the increasing popularity of leasing options represent potential substitutes.

North America Second Hand Truck Industry Growth Trends & Insights

This section provides a detailed analysis of the North American second-hand truck market's growth trajectory. Using robust data analysis, we examine market size evolution, adoption rates across different vehicle types, the impact of technological disruptions, and shifts in consumer behavior. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are included to offer a comprehensive understanding of the market's dynamic evolution. The analysis incorporates insights into factors influencing growth, including economic conditions, infrastructure development, and technological advancements.

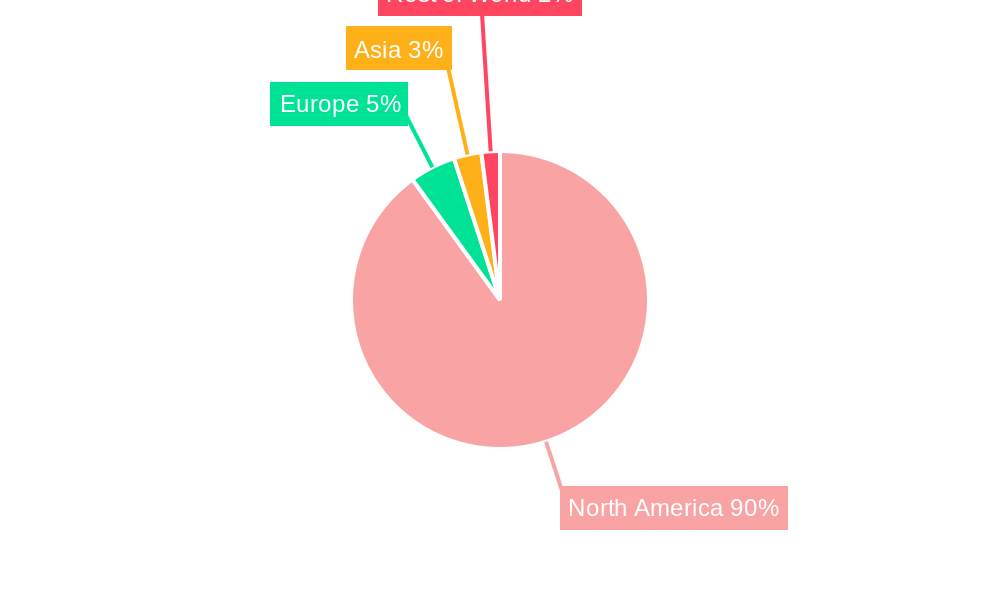

Dominant Regions, Countries, or Segments in North America Second Hand Truck Industry

This section pinpoints the leading regions, countries, and segments within the North American used truck market based on vehicle type (light-duty, medium-duty, heavy-duty). We identify the key factors driving market growth in these dominant areas, including economic policies, infrastructure investments, and industry-specific regulations. A detailed analysis of market share and growth potential further reinforces the understanding of regional and segmental dominance.

- Dominant Segment: The heavy-duty truck segment is projected to hold the largest market share, driven by the robust logistics and transportation sectors.

- Key Drivers: Strong economic growth, expansion of e-commerce, and increasing cross-border trade are major growth catalysts.

- Regional Dominance: The US is expected to remain the largest market, followed by Canada and Mexico.

North America Second Hand Truck Industry Product Landscape

This section details the characteristics of used trucks available in the market, highlighting innovations in vehicle technology, applications, and performance metrics. We examine unique selling propositions of different truck models and discuss technological advancements influencing the quality and desirability of used trucks.

Key Drivers, Barriers & Challenges in North America Second Hand Truck Industry

This section outlines the key factors driving growth and the challenges hindering its expansion. Drivers include increasing demand from the logistics sector and the cost-effectiveness of used trucks compared to new ones. Challenges include fluctuations in fuel prices, stringent emission regulations, and competition from alternative transportation options. Supply chain disruptions and their impact on availability and pricing are also analyzed.

- Key Drivers: Growing e-commerce, cost advantages, and a large existing fleet of trucks nearing end-of-life.

- Key Challenges: Fluctuating fuel prices, stringent emission norms, supply chain disruptions, and competition from leasing models.

Emerging Opportunities in North America Second Hand Truck Industry

This section explores emerging trends and untapped potential within the market. Opportunities include the growing demand for used trucks in emerging economies, the expansion of online marketplaces for used trucks, and the potential for specialized services in truck maintenance and refurbishment.

Growth Accelerators in the North America Second Hand Truck Industry Industry

This section highlights catalysts driving long-term growth. Technological advancements, strategic partnerships among key players, and expansion into underserved markets are discussed as potential growth accelerators.

Key Players Shaping the North America Second Hand Truck Industry Market

- Arrow Truck Sales Inc

- Gordon Truck Centers Inc

- General Motors Company

- Volvo AB Class B

- Truckworld

- Isuzu Motor Ltd

- Paccar Inc

- International Used Trucks

- Ryder System Inc

- Ford Motor Company

Notable Milestones in North America Second Hand Truck Industry Sector

- 2020: Increased demand for used trucks due to supply chain disruptions.

- 2022: Several major players invested heavily in online platforms for used truck sales.

- 2023: Stringent emission regulations implemented in several regions.

In-Depth North America Second Hand Truck Industry Market Outlook

The North America second-hand truck market is poised for continued growth, driven by robust demand from the logistics sector and the cost-effectiveness of used trucks. Strategic investments in technology and expansion into new markets will further enhance market potential. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033).

North America Second Hand Truck Industry Segmentation

-

1. Vehicle Type

- 1.1. Light-duty Truck

- 1.2. Medium-duty Truck

- 1.3. Heavy-duty Truck

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Second Hand Truck Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Second Hand Truck Industry Regional Market Share

Geographic Coverage of North America Second Hand Truck Industry

North America Second Hand Truck Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure May Hamper the growth of the Market

- 3.4. Market Trends

- 3.4.1. Heavy Duty Trucks will Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light-duty Truck

- 5.1.2. Medium-duty Truck

- 5.1.3. Heavy-duty Truck

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light-duty Truck

- 6.1.2. Medium-duty Truck

- 6.1.3. Heavy-duty Truck

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light-duty Truck

- 7.1.2. Medium-duty Truck

- 7.1.3. Heavy-duty Truck

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light-duty Truck

- 8.1.2. Medium-duty Truck

- 8.1.3. Heavy-duty Truck

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Arrow Truck Sales Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Gordon Truck Centers Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo AB Class B

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Truckworld

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Isuzu Motor Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Paccar Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Used Trucks

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ryder System Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ford Motor Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arrow Truck Sales Inc

List of Figures

- Figure 1: North America Second Hand Truck Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Second Hand Truck Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: North America Second Hand Truck Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Second Hand Truck Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Second Hand Truck Industry?

Key companies in the market include Arrow Truck Sales Inc, Gordon Truck Centers Inc, General Motors Company, Volvo AB Class B, Truckworld, Isuzu Motor Ltd, Paccar Inc, International Used Trucks, Ryder System Inc, Ford Motor Company.

3. What are the main segments of the North America Second Hand Truck Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16103.28 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicles are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Heavy Duty Trucks will Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure May Hamper the growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Second Hand Truck Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Second Hand Truck Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Second Hand Truck Industry?

To stay informed about further developments, trends, and reports in the North America Second Hand Truck Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence