Key Insights

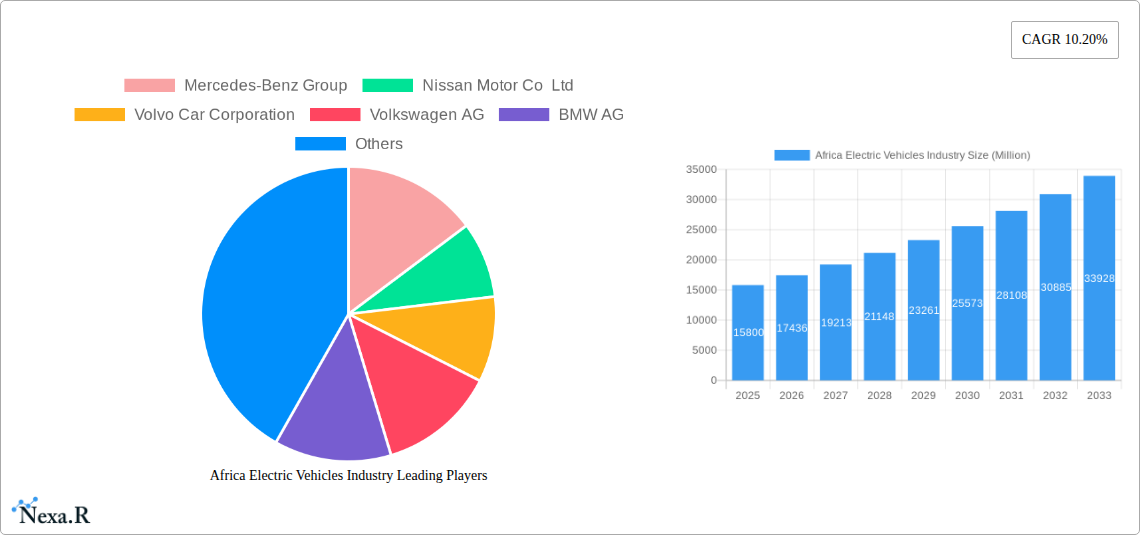

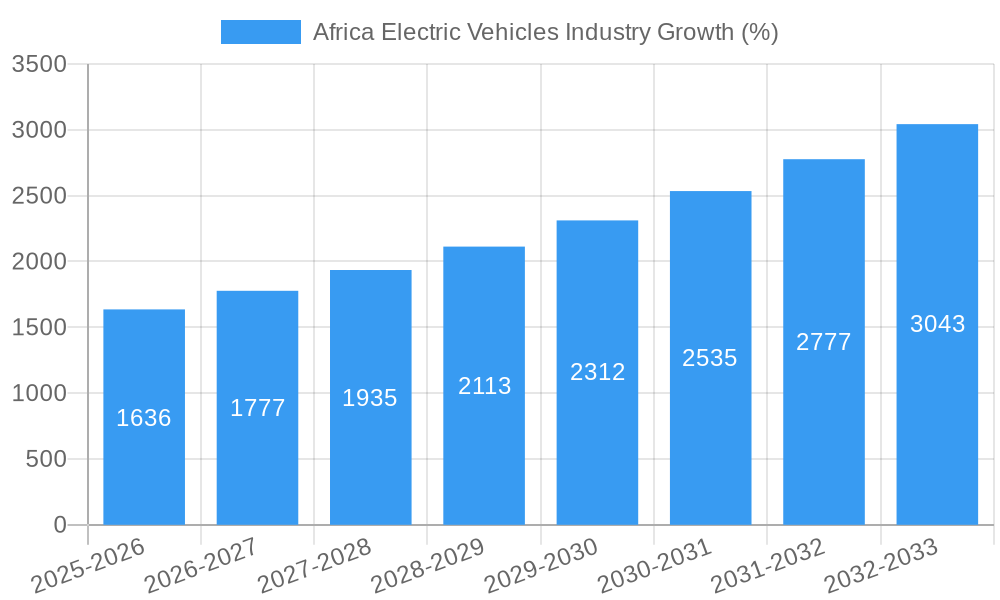

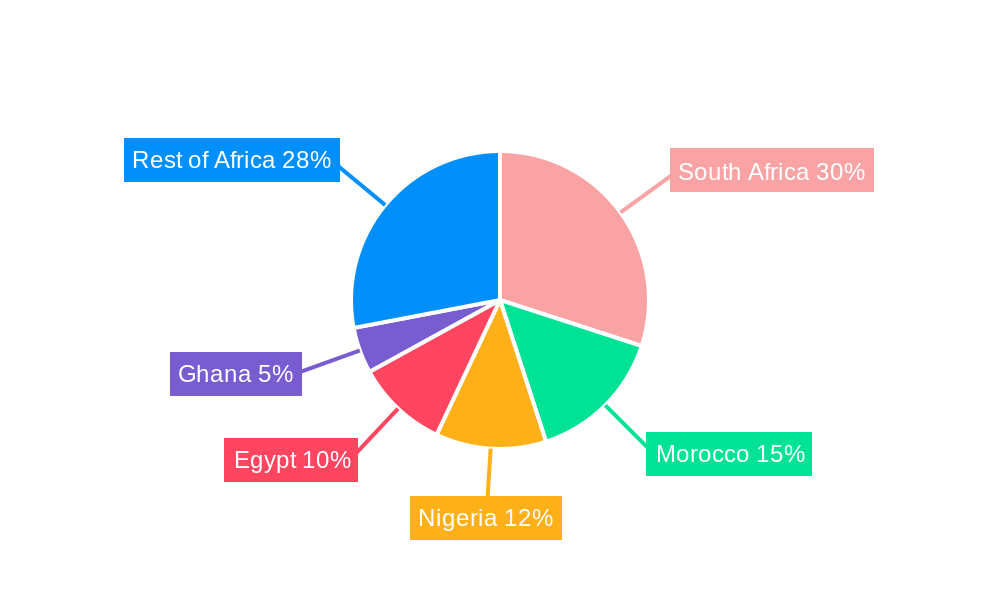

The African electric vehicle (EV) market, valued at $15.80 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.20% from 2025 to 2033. This expansion is driven by several factors. Government initiatives promoting sustainable transportation, coupled with increasing environmental awareness among consumers, are fueling demand for EVs. Furthermore, declining battery costs and advancements in EV technology are making these vehicles increasingly affordable and attractive. The market is segmented by vehicle type (passenger cars and commercial vehicles), drive type (front-wheel, rear-wheel, and all-wheel drive), and propulsion type (battery electric, hybrid electric, plug-in hybrid electric, and fuel cell electric). Key players like Mercedes-Benz, Nissan, Volvo, Volkswagen, BMW, Kia, Tesla, Renault, Toyota, and Rivian are actively investing in the region, recognizing its substantial growth potential. South Africa, Morocco, Nigeria, and Egypt are currently leading the market, but other nations like Ghana are showing promising signs of adoption. However, challenges remain, including limited charging infrastructure, high initial purchase costs compared to conventional vehicles, and the need for improved electricity grid reliability across the continent. Overcoming these hurdles will be crucial for accelerating EV adoption and realizing the full potential of this burgeoning market.

The forecast period (2025-2033) anticipates substantial growth, fueled by ongoing investments in charging infrastructure, supportive government policies, and increasing consumer preference for eco-friendly transportation. Specific growth will be influenced by the rate of economic development in various African nations, along with the success of government incentives aimed at promoting EV adoption. The diverse landscape of the African market necessitates a nuanced approach, tailoring strategies to the unique circumstances and infrastructure capabilities of each nation. Future success hinges on addressing the challenges of affordability, charging accessibility, and grid stability, ensuring the sustainable development of the African EV market. Furthermore, the growth of the commercial vehicle segment within the EV market is expected to be substantial, driven by the potential for fleet electrification and cost savings in the long term for businesses.

Africa Electric Vehicles Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning Africa electric vehicles (EV) industry, offering invaluable insights for industry professionals, investors, and policymakers. Spanning the period from 2019 to 2033, with a focus on 2025, this report examines market dynamics, growth trends, and key players shaping this rapidly evolving sector. The report segments the market by vehicle type (passenger cars and commercial vehicles), drive type (front-wheel drive, rear-wheel drive, all-wheel drive), propulsion type (battery electric vehicle, hybrid electric vehicle, plug-in hybrid electric vehicle, fuel cell electric vehicle), and country (South Africa, Morocco, Nigeria, Egypt, Ghana, and Rest of Africa). The market size is presented in million units.

Keywords: Africa Electric Vehicles, EV Market Africa, Electric Car Africa, African EV Industry, Hybrid Vehicles Africa, Plug-in Hybrid Africa, Battery Electric Vehicles Africa, EV Adoption Africa, South Africa Electric Vehicles, Nigeria Electric Vehicles, Morocco Electric Vehicles, Electric Vehicle Market Size Africa, EV Infrastructure Africa, Africa Automotive Industry, Mercedes-Benz EV Africa, Tesla Africa, Toyota EV Africa.

Africa Electric Vehicles Industry Market Dynamics & Structure

The African EV market, while nascent, demonstrates significant growth potential. Market concentration is currently low, with several international and domestic players vying for market share. Technological innovation is a key driver, particularly in battery technology and charging infrastructure. Regulatory frameworks are developing rapidly, with various countries implementing policies to encourage EV adoption. However, competitive substitutes, primarily internal combustion engine (ICE) vehicles, remain prevalent due to affordability and charging infrastructure limitations. End-user demographics are shifting towards younger, environmentally conscious consumers. M&A activity is expected to increase as larger players seek to consolidate their presence and access local expertise.

- Market Concentration: Low, with a fragmented landscape.

- Technological Innovation: Key driver, focusing on battery technology, charging solutions, and vehicle design.

- Regulatory Framework: Evolving, with policies encouraging EV adoption but facing challenges in implementation.

- Competitive Substitutes: ICE vehicles remain dominant due to lower costs and wider accessibility.

- End-User Demographics: Shifting towards younger, environmentally aware consumers.

- M&A Activity: Expected to increase, particularly in the forecast period (2025-2033). Estimated M&A deal volume: xx deals.

Africa Electric Vehicles Industry Growth Trends & Insights

The African EV market is poised for significant expansion, driven by increasing environmental concerns, government incentives, and technological advancements. Market size is projected to grow from xx million units in 2025 to xx million units by 2033, with a Compound Annual Growth Rate (CAGR) of xx%. Adoption rates remain relatively low compared to global averages, but are expected to accelerate rapidly. Technological disruptions, such as the development of more affordable and efficient battery technologies, will be crucial. Consumer behavior is evolving, with growing awareness of environmental sustainability and the benefits of EVs. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Africa Electric Vehicles Industry

South Africa is currently the leading market for EVs in Africa, driven by supportive government policies and a relatively developed automotive industry. However, other countries like Morocco, Nigeria, and Egypt are also witnessing rapid growth. The passenger car segment dominates the market, but the commercial vehicle segment presents significant growth potential, particularly in urban logistics. Battery electric vehicles (BEVs) are the most prevalent propulsion type.

- Leading Region: Southern Africa (South Africa leading)

- Key Country Drivers: South Africa (developed infrastructure and policies), Morocco (investment in renewable energy), Nigeria (large population and growing middle class).

- Dominant Segment: Passenger Cars (by volume), with commercial vehicles showing strong growth potential.

- Key Propulsion Type: BEVs, followed by PHEVs.

- Growth Potential: High for commercial EVs and within fast-growing urban centers.

Africa Electric Vehicles Industry Product Landscape

The African EV market features a diverse range of products, including both imported and locally assembled vehicles. Innovations are focused on improving battery range, affordability, and charging infrastructure compatibility. Key selling propositions include reduced running costs and environmental benefits. Technological advancements are continuously enhancing performance metrics, safety features, and overall driving experience. The market is seeing introduction of more affordable models and improved charging solutions.

Key Drivers, Barriers & Challenges in Africa Electric Vehicles Industry

Key Drivers:

- Government incentives and policies promoting EV adoption.

- Growing environmental awareness among consumers.

- Technological advancements leading to improved battery technology and affordability.

Challenges:

- High upfront cost of EVs compared to ICE vehicles.

- Limited charging infrastructure limiting range anxiety.

- Lack of skilled labor and technical expertise.

- Supply chain issues impacting availability of components (impact: xx% delay in 2024).

Emerging Opportunities in Africa Electric Vehicles Industry

- Development of localized charging infrastructure and battery manufacturing.

- Expansion into rural markets through innovative financing models and off-grid charging solutions.

- Growth in the commercial EV segment, particularly in last-mile delivery and public transportation.

Growth Accelerators in the Africa Electric Vehicles Industry

Technological advancements, such as solid-state batteries and improved fast-charging technologies, will accelerate market growth. Strategic partnerships between automakers, energy providers, and governments are crucial for developing a comprehensive EV ecosystem. Expansion into new markets and segments, particularly commercial EVs, will unlock further growth potential.

Key Players Shaping the Africa Electric Vehicles Industry Market

- Mercedes-Benz Group

- Nissan Motor Co Ltd

- Volvo Car Corporation

- Volkswagen AG

- BMW AG

- Kia Corporation

- Tesla Inc

- Groupe Renault

- Toyota Motor Corporation

- Rivian Automotive Inc

Notable Milestones in Africa Electric Vehicles Industry Sector

- December 2024: South Africa outlines plans for its green transport transition, aiming for first domestic EV production in 2026.

- January 2024: Toyota sells its first EV in South Africa; the BZ4X model is slated for launch in 2025.

In-Depth Africa Electric Vehicles Industry Market Outlook

The African EV market presents immense long-term growth potential. Continued technological advancements, supportive government policies, and increased consumer awareness will drive market expansion. Strategic investments in charging infrastructure, battery manufacturing, and skilled workforce development are crucial for realizing this potential. The market will likely see increasing participation of local players and innovative business models. The focus on commercial and public transport sectors will drive further adoption and stimulate overall market growth.

Africa Electric Vehicles Industry Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Vehicles

- 1.2. Hybrid Electric Vehicles

- 1.3. Fuel Cell Electric Vehicles

- 1.4. Plug-in Hybrid Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Vehicle Drive Type

- 3.1. Front-wheel Drive

- 3.2. Rear-wheel Drive

- 3.3. All-wheel Drive

Africa Electric Vehicles Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Electric Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Policies to promote electric Vehicles Sales

- 3.3. Market Restrains

- 3.3.1. High Cost of Capital Expenditure for Electric Vehicle Infrastructure

- 3.4. Market Trends

- 3.4.1. Passenger Car holds Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Vehicles

- 5.1.2. Hybrid Electric Vehicles

- 5.1.3. Fuel Cell Electric Vehicles

- 5.1.4. Plug-in Hybrid Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Drive Type

- 5.3.1. Front-wheel Drive

- 5.3.2. Rear-wheel Drive

- 5.3.3. All-wheel Drive

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. South Africa Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Africa Electric Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Mercedes-Benz Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Nissan Motor Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Volvo Car Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Volkswagen AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 BMW AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kia Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Tesla Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Groupe Renault*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Toyota Motor Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Rivian Automotive Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Mercedes-Benz Group

List of Figures

- Figure 1: Africa Electric Vehicles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Electric Vehicles Industry Share (%) by Company 2024

List of Tables

- Table 1: Africa Electric Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Electric Vehicles Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Africa Electric Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: Africa Electric Vehicles Industry Revenue Million Forecast, by Vehicle Drive Type 2019 & 2032

- Table 5: Africa Electric Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Africa Electric Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Africa Electric Vehicles Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 14: Africa Electric Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: Africa Electric Vehicles Industry Revenue Million Forecast, by Vehicle Drive Type 2019 & 2032

- Table 16: Africa Electric Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Nigeria Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Egypt Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Ethiopia Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Morocco Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Ghana Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Algeria Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Tanzania Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ivory Coast Africa Electric Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Electric Vehicles Industry?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Africa Electric Vehicles Industry?

Key companies in the market include Mercedes-Benz Group, Nissan Motor Co Ltd, Volvo Car Corporation, Volkswagen AG, BMW AG, Kia Corporation, Tesla Inc, Groupe Renault*List Not Exhaustive, Toyota Motor Corporation, Rivian Automotive Inc.

3. What are the main segments of the Africa Electric Vehicles Industry?

The market segments include Propulsion Type, Vehicle Type, Vehicle Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Policies to promote electric Vehicles Sales.

6. What are the notable trends driving market growth?

Passenger Car holds Highest Share in the Market.

7. Are there any restraints impacting market growth?

High Cost of Capital Expenditure for Electric Vehicle Infrastructure.

8. Can you provide examples of recent developments in the market?

In December 2024, South Africa’s motoring industry will likely produce its first electric vehicle (EV) in 2026 and outlined plans for the country’s green transport transition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Electric Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Electric Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Electric Vehicles Industry?

To stay informed about further developments, trends, and reports in the Africa Electric Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence