Key Insights

The Indonesian used car market, valued at $18.1 billion in 2024, is poised for significant expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 4.5%, driven by increasing middle-class disposable income, rising vehicle ownership, and a sustained preference for cost-effective transportation solutions. This growth trajectory anticipates the market reaching substantial new valuations by 2033. Key growth drivers include the proliferation of online automotive marketplaces, enhancing accessibility and transaction transparency, and the availability of diverse financing options from original equipment manufacturers (OEMs), financial institutions, and non-banking financial companies (NBFCs). Market segmentation highlights strong demand for SUVs and MPVs, reflecting their suitability for Indonesian households. Geographically, West Java, East Java, and Central Java are expected to lead market share due to concentrated populations and economic activity. Addressing concerns regarding vehicle quality and fraudulent transactions through robust regulation and industry self-governance is paramount for fostering consumer confidence and ensuring sustained market development.

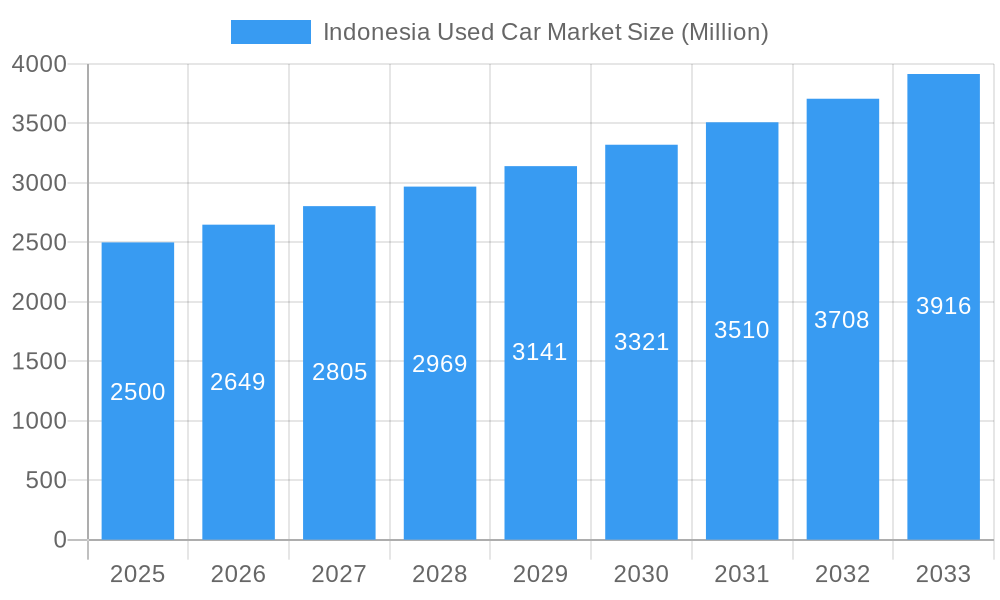

Indonesia Used Car Market Market Size (In Billion)

The competitive landscape features established automotive brands, including Toyota Astra Motor and Suzuki Auto Value, alongside prominent online platforms and independent dealerships. The growing emphasis on quality assurance is evident in certified pre-owned programs offered by premium brands like BMW Premium Selection and Mercedes Certified, appealing to consumers prioritizing reliability. Market evolution necessitates continuous adaptation and innovation. Dealerships are increasingly leveraging digital strategies for broader customer reach and enhanced engagement, while financing providers are optimizing their product portfolios to cater to a wider spectrum of buyer needs. Future market success will depend on the industry's capacity to effectively manage risks, guarantee vehicle quality, and deliver an integrated and trustworthy customer journey. The sustained expansion of the Indonesian economy and its middle class underpins a positive outlook for the used car market.

Indonesia Used Car Market Company Market Share

Indonesia Used Car Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia used car market, encompassing market dynamics, growth trends, regional performance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market. It leverages extensive data and analysis to provide actionable insights.

Indonesia Used Car Market Dynamics & Structure

The Indonesian used car market is characterized by a fragmented landscape with a mix of organized and unorganized players. Market concentration is relatively low, with no single dominant player controlling a significant share. Technological innovation, particularly in online platforms and financing solutions, is a key driver. Government regulations regarding vehicle inspections and emissions play a crucial role, influencing market practices. The availability of newer, more affordable cars acts as a competitive substitute, impacting the demand for used vehicles. The market is driven by a large and growing middle class with increasing purchasing power. Consolidation through mergers and acquisitions (M&A) is anticipated, though the volume in the historical period (2019-2024) remains at xx million deals.

- Market Concentration: Low, with top 5 players holding approximately xx% market share.

- Technological Innovation: Driven by online platforms, mobile apps (like Mobil88's Mo88i), and digital financing options.

- Regulatory Framework: Government regulations on vehicle inspections and emissions standards impact market dynamics.

- Competitive Substitutes: New cars, especially more affordable models, pose significant competition.

- End-User Demographics: Predominantly driven by the growing middle class in urban and semi-urban areas.

- M&A Trends: xx million deals in the historical period (2019-2024), with an expected increase in the forecast period. Innovation barriers include the integration of traditional dealerships with new technologies and consumer trust.

Indonesia Used Car Market Growth Trends & Insights

The Indonesian used car market exhibited strong growth during the historical period (2019-2024), registering a CAGR of xx%. Market size increased from xx million units in 2019 to xx million units in 2024. This growth is primarily attributed to increasing vehicle ownership, rising disposable incomes, and the expanding reach of online marketplaces. Technological disruptions, especially the rise of online platforms, are accelerating market penetration. Consumer behavior is shifting towards online research and transactions, favoring convenience and transparency. The forecast period (2025-2033) anticipates continued growth, projected at a CAGR of xx%, reaching xx million units by 2033. The adoption rate of online booking channels is increasing steadily, driven by convenience and a wider selection of vehicles. Challenges like used car quality, financing options and regulatory oversight remains.

Dominant Regions, Countries, or Segments in Indonesia Used Car Market

The Indonesian used car market shows regional variations in growth and dominance. Java (West Java, East Java, Central Java) accounts for the largest market share due to higher population density, economic activity and developed infrastructure. However, other regions like North Sumatra and Banten are demonstrating significant growth potential. In terms of vehicle types, SUVs and MPVs are the most popular segments, reflecting Indonesian consumer preferences for larger vehicles. Online booking channels are experiencing rapid adoption, outpacing traditional dealerships. While OEMs and banks dominate financing, non-banking financial companies are showing increasing market participation.

- Dominant Region: Java (West Java, East Java, Central Java) – xx% market share.

- Fastest Growing Region: North Sumatra – xx% CAGR.

- Dominant Vehicle Type: SUV and MPV – xx% combined market share.

- Fastest Growing Booking Channel: Online – xx% CAGR.

- Dominant Financing Provider: Banks – xx% market share.

Indonesia Used Car Market Product Landscape

The Indonesian used car market offers a wide range of vehicles, from hatchbacks and sedans to SUVs and MPVs, catering to diverse consumer needs and budgets. Technological advancements focus on online platforms that provide detailed vehicle information, virtual inspections, and streamlined financing options. Key differentiators for sellers include comprehensive vehicle history reports, warranties, and attractive financing packages.

Key Drivers, Barriers & Challenges in Indonesia Used Car Market

Key Drivers:

- Growing Middle Class: Increased disposable incomes fuel demand for personal vehicles.

- Technological Advancements: Online platforms enhance accessibility and transparency.

- Favorable Financing Options: Easier access to financing drives affordability.

Challenges & Restraints:

- Used Car Quality Concerns: Lack of standardization in vehicle inspections leads to uncertainty.

- Regulatory Hurdles: Complex regulations can hinder market efficiency and growth.

- Supply Chain Disruptions: Global chip shortages impacting new car production affect the used car market indirectly.

Emerging Opportunities in Indonesia Used Car Market

- Expansion into Tier 2 and 3 Cities: Untapped market potential in less developed regions.

- Subscription Models: Attracting younger demographics with flexible ownership options.

- Focus on Sustainability: Growing demand for environmentally friendly used vehicles.

Growth Accelerators in the Indonesia Used Car Market Industry

Strategic partnerships between online platforms and financing institutions are driving market growth. Investments in technology, data analytics, and customer experience are also vital. Expansion into underserved regions will play an essential role in driving long-term market expansion.

Key Players Shaping the Indonesia Used Car Market Market

- OLX Indonesia

- Suzuki Auto Value

- Carolin

- BMW Premium Selection

- Pt Tunas Ridean Tbk

- Mercedes Certified

- Diamond Smart Auto

- Cars

- Mobil

- Toyota Astra Motor (Toyota Trust)

Notable Milestones in Indonesia Used Car Market Sector

- September 2021: Mobil88 launches Mo88i app, revolutionizing the online used car buying/selling process.

- November 2021: Hyundai introduces Hyundai Smart Deal, a cost-effective financing solution.

- May 2022: Carsome collaborates with Bank Jago Tbk for automotive financing.

In-Depth Indonesia Used Car Market Market Outlook

The Indonesian used car market is poised for significant growth, driven by a young and expanding population, rising disposable incomes, and increasing penetration of online platforms. Strategic partnerships, technological innovations, and targeted expansion into underserved regions will shape future market dynamics, presenting lucrative opportunities for market participants. The market is expected to expand by xx million units over the next decade, indicating considerable potential for growth.

Indonesia Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicle (SUV)

- 1.4. Multi-purpose Vehicle (MPV)

-

2. Booking Channel

- 2.1. Online

- 2.2. OEM Certified/Authorized Dealerships

- 2.3. Multi Brand Dealerships

-

3. Financing Providers

- 3.1. OEMs

- 3.2. Banks

- 3.3. Non-Banking Financial Companies

-

4. Province

- 4.1. West Java

- 4.2. East Java

- 4.3. Central Java

- 4.4. North Sumatra

- 4.5. Banten

- 4.6. Other Provinces

Indonesia Used Car Market Segmentation By Geography

- 1. Indonesia

Indonesia Used Car Market Regional Market Share

Geographic Coverage of Indonesia Used Car Market

Indonesia Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Distribution Channels; Others

- 3.3. Market Restrains

- 3.3.1. Lack Of Trust And Transparency; Others

- 3.4. Market Trends

- 3.4.1. Growing Sport Utility Vehicle (SUV) Sales Aiding the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicle (SUV)

- 5.1.4. Multi-purpose Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Booking Channel

- 5.2.1. Online

- 5.2.2. OEM Certified/Authorized Dealerships

- 5.2.3. Multi Brand Dealerships

- 5.3. Market Analysis, Insights and Forecast - by Financing Providers

- 5.3.1. OEMs

- 5.3.2. Banks

- 5.3.3. Non-Banking Financial Companies

- 5.4. Market Analysis, Insights and Forecast - by Province

- 5.4.1. West Java

- 5.4.2. East Java

- 5.4.3. Central Java

- 5.4.4. North Sumatra

- 5.4.5. Banten

- 5.4.6. Other Provinces

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 OLX Indonesia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suzuki Auto Value

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carolin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW Premium Selection

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pt Tunas Ridean Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes Certified

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Diamond Smart Auto

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cars

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mobil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Astra Motor (Toyota Trust)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 OLX Indonesia

List of Figures

- Figure 1: Indonesia Used Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Indonesia Used Car Market Revenue billion Forecast, by Booking Channel 2020 & 2033

- Table 3: Indonesia Used Car Market Revenue billion Forecast, by Financing Providers 2020 & 2033

- Table 4: Indonesia Used Car Market Revenue billion Forecast, by Province 2020 & 2033

- Table 5: Indonesia Used Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Indonesia Used Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Indonesia Used Car Market Revenue billion Forecast, by Booking Channel 2020 & 2033

- Table 8: Indonesia Used Car Market Revenue billion Forecast, by Financing Providers 2020 & 2033

- Table 9: Indonesia Used Car Market Revenue billion Forecast, by Province 2020 & 2033

- Table 10: Indonesia Used Car Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Used Car Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Indonesia Used Car Market?

Key companies in the market include OLX Indonesia, Suzuki Auto Value, Carolin, BMW Premium Selection, Pt Tunas Ridean Tbk, Mercedes Certified, Diamond Smart Auto, Cars, Mobil, Toyota Astra Motor (Toyota Trust).

3. What are the main segments of the Indonesia Used Car Market?

The market segments include Vehicle Type, Booking Channel, Financing Providers, Province.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Distribution Channels; Others.

6. What are the notable trends driving market growth?

Growing Sport Utility Vehicle (SUV) Sales Aiding the Market.

7. Are there any restraints impacting market growth?

Lack Of Trust And Transparency; Others.

8. Can you provide examples of recent developments in the market?

May 2022: The Indonesian division of used automotive marketplace Carsome signed a collaboration agreement with Indonesian Bank Jago Tbk for automotive financing to support Carsome Indonesia's business, which focuses on buying and selling used cars online.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Used Car Market?

To stay informed about further developments, trends, and reports in the Indonesia Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence