Key Insights

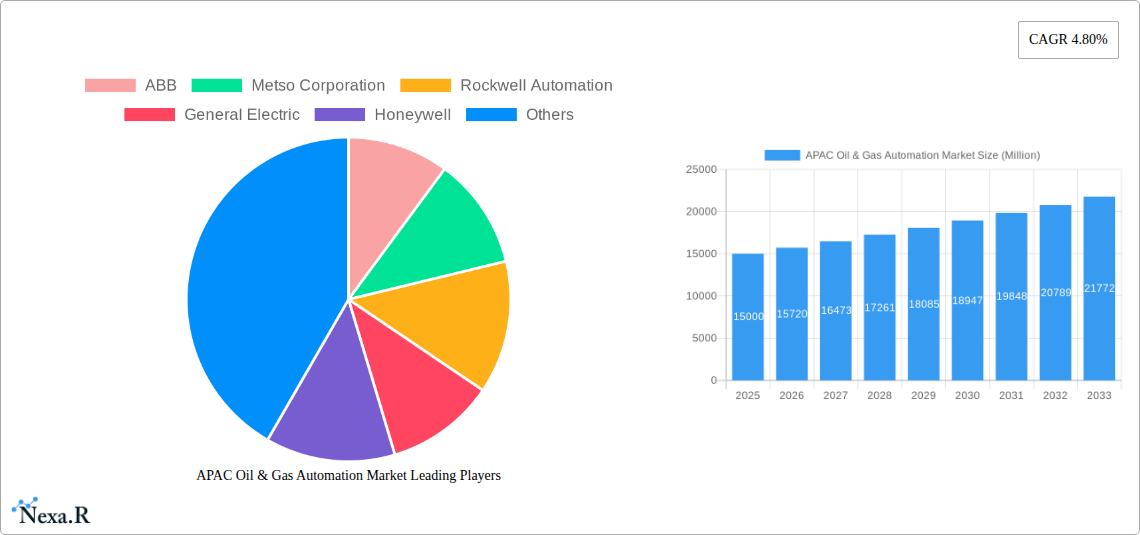

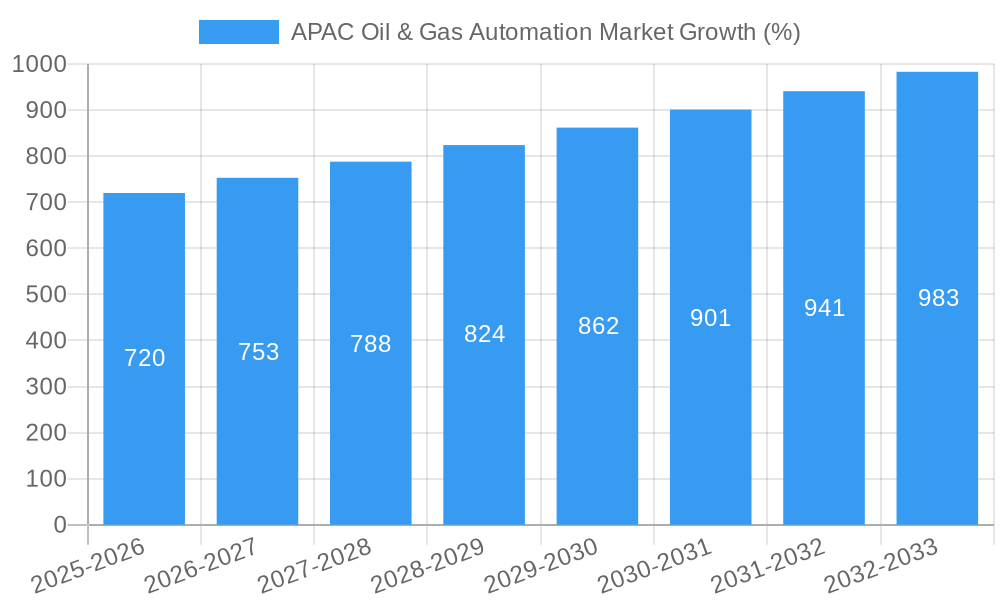

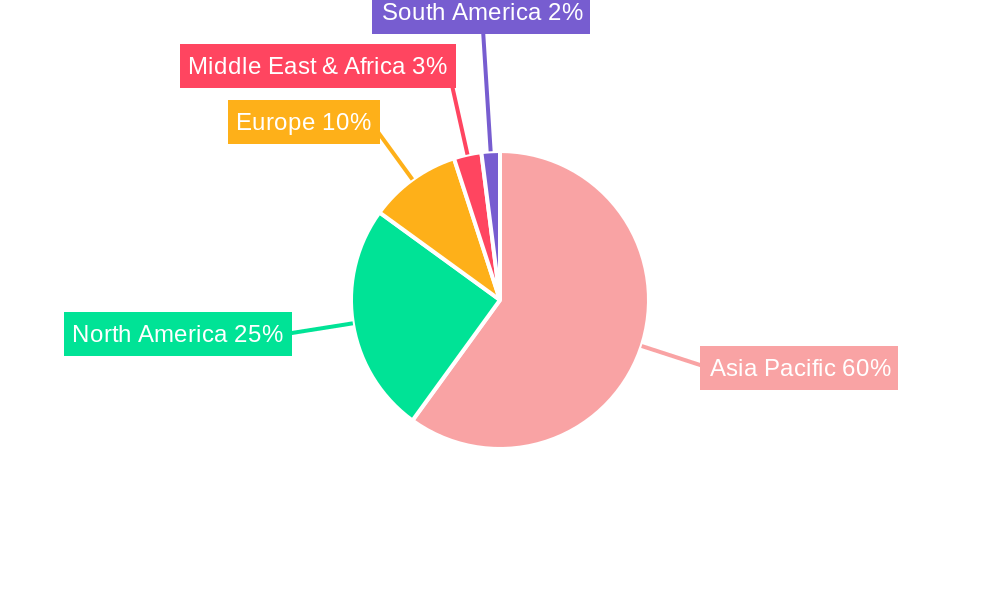

The Asia-Pacific (APAC) Oil & Gas Automation market is experiencing robust growth, driven by increasing demand for enhanced operational efficiency, safety, and reduced environmental impact within the region's extensive energy sector. A compound annual growth rate (CAGR) of 4.80% from 2019 to 2024 suggests a significant market expansion, projected to continue into the forecast period (2025-2033). Key drivers include the ongoing digital transformation within upstream, midstream, and downstream operations, a push for automation in resource-intensive processes like drilling, refining, and pipeline management, and the increasing adoption of advanced technologies such as Distributed Control Systems (DCS), Programmable Logic Controllers (PLCs), and Supervisory Control and Data Acquisition (SCADA) systems. Growth is particularly strong in countries like China, India, and other Southeast Asian nations experiencing rapid industrialization and energy consumption growth. While regulatory changes and cybersecurity concerns present some restraints, the long-term outlook remains positive, fueled by substantial investments in infrastructure modernization and a growing emphasis on sustainable energy practices. The market segmentation reveals strong demand for automation solutions across diverse petroleum derivative products (LPG, petrol, diesel, etc.) and various automation technologies. Major players, including ABB, Rockwell Automation, and Siemens, are strategically positioning themselves to capitalize on these opportunities through technological advancements, strategic partnerships, and regional expansion initiatives. The APAC market's significant size and growth potential make it a highly attractive investment destination for both established players and emerging technology providers in the oil and gas automation sector.

The significant investments being made in new oil and gas infrastructure projects across the APAC region, coupled with aging existing infrastructure requiring upgrades, are further bolstering market demand for automation solutions. This is particularly true in the upstream segment where automation enhances drilling efficiency and reduces operational costs. The midstream sector benefits from automation for optimizing pipeline operations and improving safety. The downstream segment sees benefits in refining processes and overall productivity. The rising adoption of Industry 4.0 principles and the Internet of Things (IoT) are contributing to the development of smarter, more interconnected oil and gas operations, driving demand for advanced analytics and real-time optimization capabilities. The increasing focus on environmental sustainability is also influencing market trends, with a growing interest in automation solutions that help reduce emissions and improve environmental performance. Competition is fierce, with established players leveraging their market presence and technological expertise while new entrants focus on innovative solutions and niche market segments.

APAC Oil & Gas Automation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) Oil & Gas Automation Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The base year for this report is 2025. The report segments the market by sector (Upstream, Midstream, Downstream), petroleum derivative products (Liquefied Petroleum Gas, Petrol, Diesel, Others), and automation technologies (Distributed Control Systems (DCS), Programmable Logic Controller (PLC), Human Machine Interface (HMI), Supervisory Control and Data Acquisition (SCADA), Real Time Optimization & Simulation (RTOS), Others). Key players analyzed include ABB, Metso Corporation, Rockwell Automation, General Electric, Honeywell, Mitsubishi Electric Corporation, Siemens, Schneider Electric, and Yokogawa Electric Corporation. The total market size is projected to reach xx Million by 2033.

APAC Oil & Gas Automation Market Dynamics & Structure

This section delves into the intricate structure of the APAC oil & gas automation market, analyzing market concentration, technological innovation, regulatory landscapes, competitive dynamics, and market trends. We examine the influence of mergers and acquisitions (M&A) activity and provide a comprehensive overview of the market's competitive landscape.

- Market Concentration: The APAC oil & gas automation market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share of the top 5 players is estimated at xx%.

- Technological Innovation: Continuous advancements in automation technologies, such as AI-powered solutions and IoT integration, are driving market growth. However, high initial investment costs and integration challenges pose barriers to widespread adoption.

- Regulatory Frameworks: Government regulations focusing on safety, environmental protection, and operational efficiency significantly influence market dynamics. Variations in regulatory frameworks across different APAC countries create complexities for market participants.

- Competitive Product Substitutes: The emergence of alternative technologies and solutions presents competitive challenges to traditional automation systems. This necessitates ongoing innovation and adaptation by market players.

- End-User Demographics: The market is driven by the increasing demand for enhanced operational efficiency, improved safety, and reduced environmental impact across all oil and gas sectors (Upstream, Midstream, and Downstream). The expanding energy demands in the region further fuel market growth.

- M&A Trends: The APAC oil & gas automation market has witnessed significant M&A activity in recent years, with companies seeking to expand their market reach and technological capabilities. The total deal volume between 2019 and 2024 was approximately xx deals.

APAC Oil & Gas Automation Market Growth Trends & Insights

This section leverages extensive market research data to analyze the market's growth trajectory, adoption rates, and technological disruptions. We explore the evolving consumer behavior and its impact on market dynamics, offering quantitative insights, including CAGR and market penetration rates. The APAC oil & gas automation market is projected to witness robust growth, driven by factors such as increasing investments in infrastructure development, rising energy demand, and stringent environmental regulations. The market is expected to exhibit a CAGR of xx% during the forecast period (2025-2033). The adoption rate of advanced automation technologies is gradually increasing, primarily driven by the need for improved operational efficiency, safety, and cost optimization.

Dominant Regions, Countries, or Segments in APAC Oil & Gas Automation Market

This section identifies the key regions, countries, and market segments driving the APAC oil & gas automation market growth. Analysis covers Upstream, Midstream, and Downstream sectors, and automation technologies such as DCS, PLC, HMI, SCADA, and RTOS.

- Dominant Sectors: The Upstream sector is currently the largest segment, driven by the need for enhanced oil and gas extraction efficiency and improved safety measures. However, the Downstream sector is projected to experience faster growth due to the rising demand for refined petroleum products.

- Dominant Technologies: DCS and PLC technologies hold significant market share, but the adoption of advanced technologies like SCADA and RTOS is gaining momentum.

- Dominant Countries: China and India are currently the largest markets, driven by significant oil & gas production and refining activities. However, other countries in Southeast Asia are expected to witness rapid growth in the coming years.

- Key Drivers: Government initiatives promoting energy efficiency and digitalization, expanding oil and gas infrastructure projects, and rising energy demand are key drivers.

APAC Oil & Gas Automation Market Product Landscape

The APAC oil & gas automation market showcases a diverse range of products, encompassing cutting-edge technologies aimed at improving efficiency, safety, and environmental performance. These products integrate advanced functionalities, such as predictive maintenance capabilities, real-time data analytics, and remote monitoring features. Continuous innovation drives the introduction of sophisticated automation systems capable of optimizing production processes and minimizing operational disruptions. The market is witnessing a growing trend towards cloud-based solutions, fostering enhanced data management and collaborative capabilities.

Key Drivers, Barriers & Challenges in APAC Oil & Gas Automation Market

Key Drivers: Increasing demand for enhanced operational efficiency, stringent safety regulations, growing focus on environmental sustainability, and advancements in automation technologies are key drivers for the market. Government initiatives promoting digital transformation in the energy sector further contribute to the market's expansion.

Challenges: High initial investment costs associated with implementing advanced automation systems, integration complexities across existing infrastructure, cybersecurity threats, and a shortage of skilled professionals pose significant challenges to market growth. Furthermore, geopolitical uncertainties and volatile oil prices can impact investment decisions. Supply chain disruptions caused by global events can impact project timelines and costs.

Emerging Opportunities in APAP Oil & Gas Automation Market

The APAP Oil & Gas Automation Market presents numerous emerging opportunities, driven by factors such as rising investments in renewable energy, growing adoption of smart technologies, increasing digitalization, and the growing demand for cost-effective solutions. Untapped markets in Southeast Asia, coupled with the increasing focus on enhancing operational efficiency and safety, offer substantial growth potential. The growing adoption of Industry 4.0 principles provides further impetus for market expansion.

Growth Accelerators in the APAC Oil & Gas Automation Market Industry

Technological breakthroughs, strategic partnerships between automation technology providers and oil & gas companies, and expanding market penetration into less developed regions of APAC are key catalysts for long-term growth. Government support for digitalization in the energy sector, coupled with rising investments in renewable energy sources, creates a favorable environment for sustained expansion.

Key Players Shaping the APAC Oil & Gas Automation Market Market

- ABB

- Metso Corporation

- Rockwell Automation

- General Electric

- Honeywell

- Mitsubishi Electric Corporation

- Siemens

- Schneider Electric

- Yokogawa Electric Corporation

Notable Milestones in APAC Oil & Gas Automation Market Sector

- November 2021: ABB showcased its NeoGear and PrimeGear switchgear solutions at ADIPEC 2021, emphasizing improved efficiency, reduced risk, and a smaller environmental footprint. NeoGear boasts a 25% smaller physical footprint, 20% improved energy efficiency, and 30% lower operating costs due to enhanced condition monitoring.

In-Depth APAC Oil & Gas Automation Market Outlook

The APAC oil & gas automation market is poised for sustained growth, driven by technological advancements, increasing investments in infrastructure development, and supportive government policies. Strategic partnerships and collaborations between technology providers and oil & gas companies are expected to accelerate market expansion. The market's future potential lies in the adoption of cutting-edge technologies such as AI, IoT, and cloud computing to enhance operational efficiency, safety, and sustainability across the entire oil and gas value chain. This presents significant opportunities for both established players and new entrants.

APAC Oil & Gas Automation Market Segmentation

-

1. Automation Technologies

- 1.1. Distributed Control Systems (DCS)

- 1.2. Programmable Logic Controller (PLC)

- 1.3. Human Machine Interface (HMI)

- 1.4. Supervisory Control and Data Acquisition (SCADA)

- 1.5. Real Time Optimization & Simulation (RTOS)

- 1.6. Others

-

2. Sectors

- 2.1. Upstream

- 2.2. Midstream

- 2.3. Downstream

-

3. Petroleum Derivative Products

- 3.1. Liquefied Petroleum Gas

- 3.2. Diesel

- 3.3. Others

-

4. Geography

-

4.1. Asia Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Others

-

4.1. Asia Pacific

APAC Oil & Gas Automation Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Others

APAC Oil & Gas Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. Relatively High Deployment Costs; Complex Design compared to Traditional Sensors

- 3.4. Market Trends

- 3.4.1. Digital Technologies to increase the production efficiency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Automation Technologies

- 5.1.1. Distributed Control Systems (DCS)

- 5.1.2. Programmable Logic Controller (PLC)

- 5.1.3. Human Machine Interface (HMI)

- 5.1.4. Supervisory Control and Data Acquisition (SCADA)

- 5.1.5. Real Time Optimization & Simulation (RTOS)

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Sectors

- 5.2.1. Upstream

- 5.2.2. Midstream

- 5.2.3. Downstream

- 5.3. Market Analysis, Insights and Forecast - by Petroleum Derivative Products

- 5.3.1. Liquefied Petroleum Gas

- 5.3.2. Diesel

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Others

- 5.4.1. Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Automation Technologies

- 6. China APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 8. India APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 12. Indonesia APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 13. Phillipes APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 14. Singapore APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 15. Thailandc APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Asia Pacific APAC Oil & Gas Automation Market Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 ABB

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Metso Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Rockwell Automation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 General Electric

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Honeywell

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Mitsubishi Electric Corporatio

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Siemens

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Schneider Electric

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Yokogawa Electric Corporation

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.1 ABB

List of Figures

- Figure 1: Global APAC Oil & Gas Automation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Automation Technologies 2024 & 2032

- Figure 5: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Automation Technologies 2024 & 2032

- Figure 6: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Sectors 2024 & 2032

- Figure 7: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Sectors 2024 & 2032

- Figure 8: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Petroleum Derivative Products 2024 & 2032

- Figure 9: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Petroleum Derivative Products 2024 & 2032

- Figure 10: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Geography 2024 & 2032

- Figure 11: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Geography 2024 & 2032

- Figure 12: Asia Pacific APAC Oil & Gas Automation Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Asia Pacific APAC Oil & Gas Automation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Automation Technologies 2019 & 2032

- Table 3: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Sectors 2019 & 2032

- Table 4: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Petroleum Derivative Products 2019 & 2032

- Table 5: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Southeast Asia APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Indonesia APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Phillipes APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Singapore APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Thailandc APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Automation Technologies 2019 & 2032

- Table 20: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Sectors 2019 & 2032

- Table 21: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Petroleum Derivative Products 2019 & 2032

- Table 22: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Global APAC Oil & Gas Automation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: China APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Japan APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Others APAC Oil & Gas Automation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Oil & Gas Automation Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the APAC Oil & Gas Automation Market?

Key companies in the market include ABB, Metso Corporation, Rockwell Automation, General Electric, Honeywell, Mitsubishi Electric Corporatio, Siemens, Schneider Electric, Yokogawa Electric Corporation.

3. What are the main segments of the APAC Oil & Gas Automation Market?

The market segments include Automation Technologies, Sectors, Petroleum Derivative Products, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector.

6. What are the notable trends driving market growth?

Digital Technologies to increase the production efficiency.

7. Are there any restraints impacting market growth?

Relatively High Deployment Costs; Complex Design compared to Traditional Sensors.

8. Can you provide examples of recent developments in the market?

November 2021 - ABB exhibited NeoGear and PrimeGear switchgear solutions for the oil and gas sector at ADIPEC 2021. It is designed to improve output efficiency while reducing risk and reducing the environmental footprint. ABB's NeoGear switchgear reduces physical footprint by up to 25% compared to comparable switchgear technology. Within this compact footprint, heat dissipation is reduced, resulting in up to 20% energy efficiency. In addition, new digital features offer up to 30% lower operating costs overall due to more efficient condition monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Oil & Gas Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Oil & Gas Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Oil & Gas Automation Market?

To stay informed about further developments, trends, and reports in the APAC Oil & Gas Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence