Key Insights

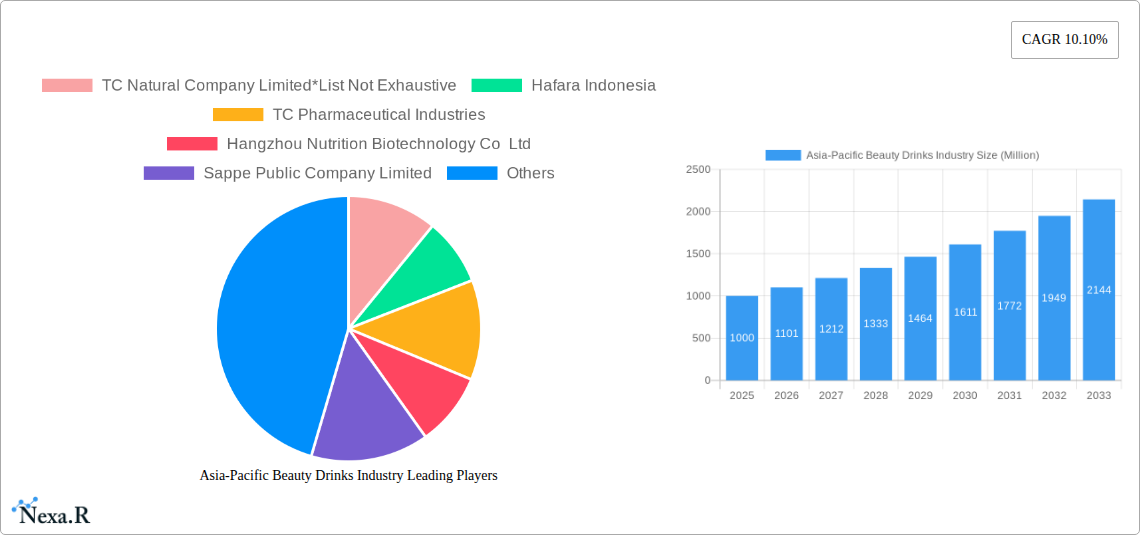

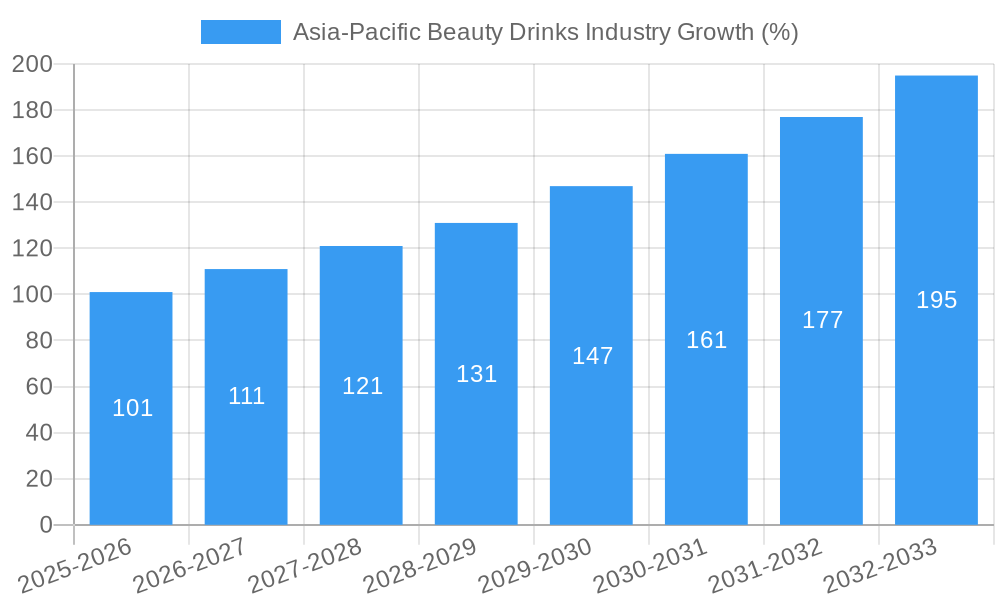

The Asia-Pacific beauty drinks market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10.10% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly in rapidly developing economies like China and India, are empowering consumers to invest more in beauty and wellness products. A growing awareness of the benefits of ingestible beauty solutions, such as improved skin hydration, collagen boosting, and enhanced nutrient intake, is further driving demand. The increasing prevalence of social media and influencer marketing significantly impacts consumer behavior, creating a strong desire for quick, convenient, and effective beauty solutions. Furthermore, the market is segmented by ingredient type (collagen, vitamins and minerals, others) and distribution channels (supermarkets/hypermarkets, pharmacies, specialty stores, online retail), offering various avenues for market penetration and growth. The dominance of specific ingredients like collagen reflects a strong consumer preference for visible, tangible results. The online retail channel is experiencing rapid growth, reflecting the increasing adoption of e-commerce in the region.

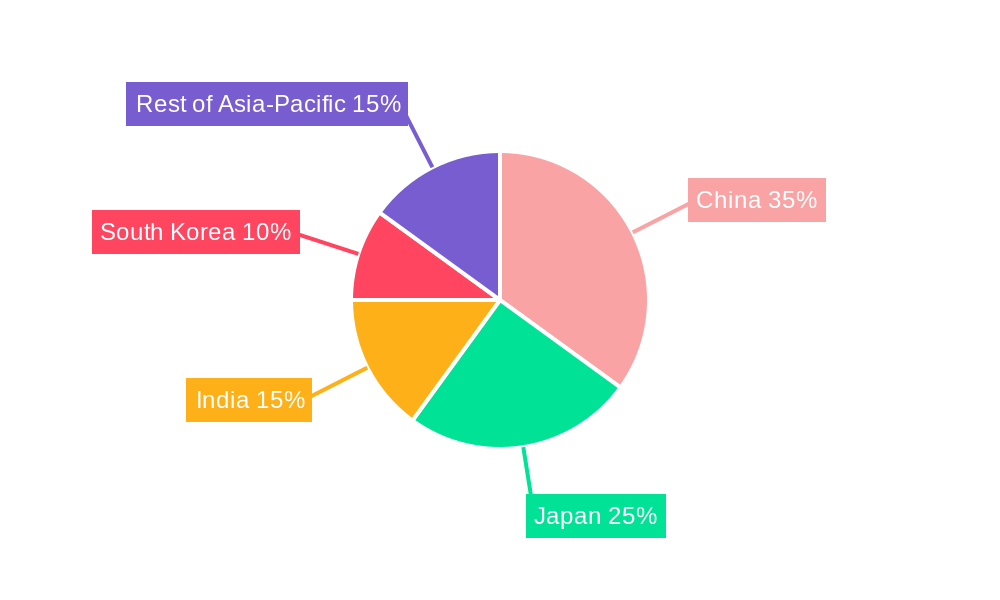

Significant regional variations exist within the Asia-Pacific market. China and Japan are currently major players, driven by established beauty and wellness cultures and high consumer spending. However, India and South Korea demonstrate immense growth potential due to expanding middle classes and a burgeoning interest in innovative beauty solutions. Market players like TC Natural Company Limited, Hafara Indonesia, and others are actively capitalizing on these trends through product innovation, strategic partnerships, and effective marketing campaigns. While the market faces challenges such as fluctuating raw material prices and the need to address consumer concerns regarding ingredient safety and efficacy, the overall outlook for the Asia-Pacific beauty drinks market remains exceptionally positive, presenting significant opportunities for both established and emerging players.

Asia-Pacific Beauty Drinks Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific beauty drinks market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report is an essential resource for industry professionals, investors, and anyone seeking a deep understanding of this burgeoning market. Value figures are presented in million units.

Asia-Pacific Beauty Drinks Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Asia-Pacific beauty drinks industry. We examine market concentration, revealing the market share held by major players and the overall level of competition. Technological innovation, including advancements in ingredient extraction and formulation, is assessed, along with its impact on product development and market growth. Regulatory frameworks governing food and beverage safety and labeling are analyzed for their influence on market access and product compliance. Furthermore, the report explores the presence and impact of competitive product substitutes, such as skincare products and dietary supplements. End-user demographics, including age, gender, and income levels, are examined to understand consumer preferences and purchasing behaviors. Finally, we investigate M&A trends, quantifying deal volumes and analyzing their implications for market consolidation and innovation.

- Market Concentration: xx% of the market is controlled by the top 5 players (estimated).

- Technological Innovation: Focus on natural ingredients, functional benefits, and sustainable packaging is driving innovation.

- Regulatory Landscape: Varying regulations across countries in the Asia-Pacific region influence product formulation and marketing claims.

- Competitive Substitutes: Skincare products and dietary supplements pose significant competitive pressure.

- M&A Activity: xx M&A deals were recorded in the historical period (2019-2024).

- End-User Demographics: High growth is driven by the millennial and Gen Z demographics with a strong focus on health and wellness.

Asia-Pacific Beauty Drinks Industry Growth Trends & Insights

This section provides a comprehensive analysis of the Asia-Pacific beauty drinks market's growth trajectory, leveraging extensive data and expert insights. We delve into the historical and projected market size, examining the compound annual growth rate (CAGR) and factors influencing market expansion. Adoption rates of beauty drinks across different segments and geographic locations are explored, revealing consumer preferences and regional variations. The impact of technological disruptions, such as the rise of e-commerce and personalized nutrition, on market dynamics is also examined. Finally, we analyze shifts in consumer behavior, focusing on the increasing demand for natural, functional, and convenient beauty solutions.

- Historical Market Size (2019-2024): Growth from xx million units to xx million units, CAGR of xx%.

- Estimated Market Size (2025): xx million units.

- Projected Market Size (2033): xx million units.

- Market Penetration: xx% penetration rate in major markets by 2033 (projected).

- Key Consumer Trends: Increasing focus on preventative health, personalized wellness, and natural ingredients.

Dominant Regions, Countries, or Segments in Asia-Pacific Beauty Drinks Industry

This section identifies the leading regions, countries, and segments within the Asia-Pacific beauty drinks market. We pinpoint the key drivers fueling market growth in these areas, examining economic factors, infrastructure development, and consumer preferences. A detailed analysis of market share and growth potential for each dominant segment (By Ingredient Type: Collagen, Vitamins and Minerals, Others; By Distribution Channel: Supermarket/Hypermarket, Pharmacies and Drug Stores, Specialty Stores, Online Retail, Other Distribution Channels) is provided.

- Leading Region: China, followed by South Korea and Japan.

- Dominant Ingredient Type: Collagen, driven by its anti-aging properties.

- Primary Distribution Channel: Supermarket/Hypermarket and online retail channels show strong growth.

- Key Growth Drivers: Rising disposable incomes, increasing health consciousness, and expanding e-commerce penetration.

Asia-Pacific Beauty Drinks Industry Product Landscape

This section provides an overview of the product landscape in the Asia-Pacific beauty drinks market. It details product innovations, encompassing new ingredient combinations, improved formulations, and advanced packaging technologies. We explore the applications of beauty drinks, highlighting their versatility and suitability for various consumer needs. Furthermore, we assess performance metrics, emphasizing key attributes such as efficacy, safety, and consumer satisfaction. Finally, we discuss unique selling propositions (USPs) that differentiate products in a competitive market.

The market features a diverse range of products catering to various beauty needs, from skin hydration to hair and nail health. Innovations include the incorporation of functional ingredients like probiotics and adaptogens, as well as sustainable and convenient packaging options. Key performance metrics include consumer reviews, sales data, and market share.

Key Drivers, Barriers & Challenges in Asia-Pacific Beauty Drinks Industry

This section outlines the key drivers and challenges shaping the Asia-Pacific beauty drinks market. Drivers include increasing consumer health awareness, rising disposable incomes, and technological advancements. Challenges encompass regulatory hurdles, fluctuating raw material prices, and intense competition.

Key Drivers:

- Growing health and wellness consciousness.

- Increasing disposable incomes, particularly in emerging economies.

- Technological advancements in product formulation and delivery.

Key Challenges:

- Stringent regulatory requirements for food and beverage products.

- Fluctuations in raw material costs, impacting product pricing.

- Intense competition among established and emerging players.

Emerging Opportunities in Asia-Pacific Beauty Drinks Industry

This section highlights emerging opportunities in the Asia-Pacific beauty drinks market, focusing on untapped market segments, innovative product applications, and evolving consumer preferences. These opportunities include the expansion into niche markets, the development of personalized beauty drinks, and the utilization of sustainable packaging.

Growth Accelerators in the Asia-Pacific Beauty Drinks Industry Industry

Long-term growth in the Asia-Pacific beauty drinks industry will be driven by continuous product innovation, strategic partnerships to expand market reach, and the penetration of emerging markets. Technological breakthroughs in ingredient extraction and formulation, coupled with effective marketing strategies, will further fuel growth.

Key Players Shaping the Asia-Pacific Beauty Drinks Industry Market

- TC Natural Company Limited List Not Exhaustive

- Hafara Indonesia

- TC Pharmaceutical Industries

- Hangzhou Nutrition Biotechnology Co Ltd

- Sappe Public Company Limited

- FUJIFILM Holdings Corporation

- Shiseido Co Ltd

- Kino Biotech

Notable Milestones in Asia-Pacific Beauty Drinks Industry Sector

- 2021-Q4: Launch of a new collagen-based beauty drink by a major player in Japan.

- 2022-Q2: Acquisition of a smaller beauty drink company by a multinational corporation.

- 2023-Q1: Introduction of a new line of sustainably packaged beauty drinks in South Korea.

In-Depth Asia-Pacific Beauty Drinks Industry Market Outlook

The Asia-Pacific beauty drinks market is poised for significant growth in the coming years. Continued innovation in product formulation, coupled with increasing consumer demand for health and wellness solutions, will be key drivers of this expansion. Strategic partnerships and market expansion into emerging economies will further fuel market growth. The market presents substantial opportunities for both established and emerging players, offering a promising outlook for the future.

Asia-Pacific Beauty Drinks Industry Segmentation

-

1. Ingredient Type

- 1.1. Collagen

- 1.2. Vitamins and Minerals

- 1.3. Others

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Pharmacies and Drug Stores

- 2.3. Specialty Stores

- 2.4. Online Retail

- 2.5. Other Distribution Channels

-

3. Geography

-

3.1. Asia Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Rest of Asia-Pacific

-

3.1. Asia Pacific

Asia-Pacific Beauty Drinks Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

Asia-Pacific Beauty Drinks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand For Collagen Based Beauty Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Collagen

- 5.1.2. Vitamins and Minerals

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Pharmacies and Drug Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Rest of Asia-Pacific

- 5.3.1. Asia Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. China Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Beauty Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 TC Natural Company Limited*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hafara Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 TC Pharmaceutical Industries

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hangzhou Nutrition Biotechnology Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sappe Public Company Limited

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 FUJIFILM Holdings Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Shiseido Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kino Biotech

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 TC Natural Company Limited*List Not Exhaustive

List of Figures

- Figure 1: Asia-Pacific Beauty Drinks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Beauty Drinks Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Ingredient Type 2019 & 2032

- Table 3: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Ingredient Type 2019 & 2032

- Table 15: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Beauty Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Beauty Drinks Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Beauty Drinks Industry?

The projected CAGR is approximately 10.10%.

2. Which companies are prominent players in the Asia-Pacific Beauty Drinks Industry?

Key companies in the market include TC Natural Company Limited*List Not Exhaustive, Hafara Indonesia, TC Pharmaceutical Industries, Hangzhou Nutrition Biotechnology Co Ltd, Sappe Public Company Limited, FUJIFILM Holdings Corporation, Shiseido Co Ltd, Kino Biotech.

3. What are the main segments of the Asia-Pacific Beauty Drinks Industry?

The market segments include Ingredient Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand For Collagen Based Beauty Drinks.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Beauty Drinks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Beauty Drinks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Beauty Drinks Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Beauty Drinks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence