Key Insights

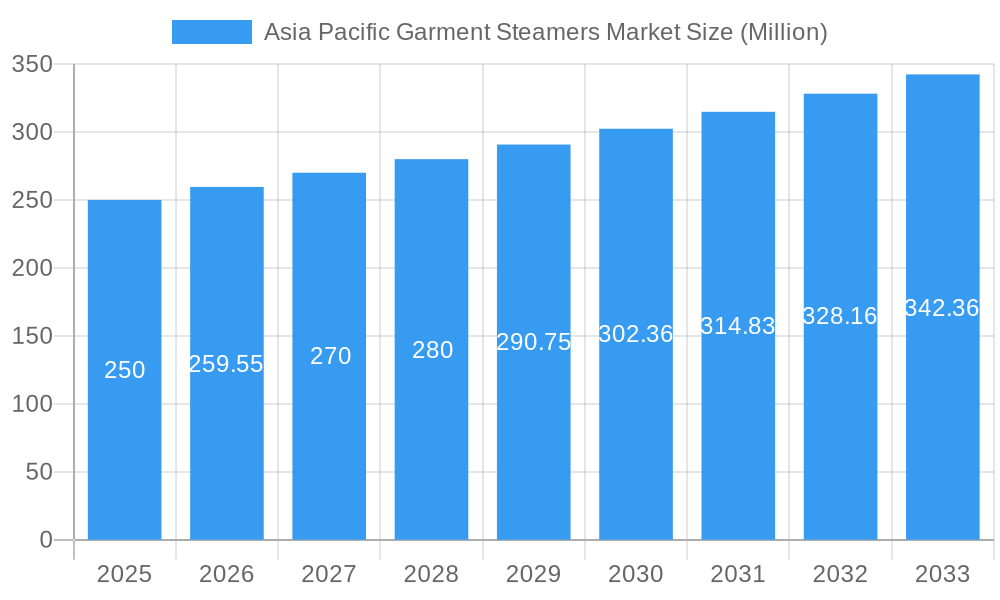

The Asia-Pacific garment steamers market, valued at approximately $XXX million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing awareness of hygiene and convenience, and a burgeoning fashion-conscious population across the region. The market's Compound Annual Growth Rate (CAGR) of 3.78% from 2019 to 2024 suggests a steady upward trajectory, which is expected to continue through 2033. Key growth drivers include the increasing preference for wrinkle-free clothing, especially among working professionals and those attending formal events. Furthermore, the market is witnessing a shift towards convenient and portable handheld and upright steamer types, replacing traditional ironing methods. The online distribution channel is witnessing significant expansion, benefiting from the increasing penetration of e-commerce in the region. While the market shows immense potential, challenges such as high initial investment costs for some models and the availability of affordable alternatives like traditional irons could act as potential restraints. Segmentation analysis reveals that China, India, and Japan are leading markets, while South Korea and Australia are displaying promising growth trajectories. The competitive landscape is diverse, with both established international players like Groupe SEB SA and Philips, and local brands like Pursteam and Maryant catering to varied consumer needs and preferences. The future growth will likely be fueled by innovation in steamer technology, focusing on energy efficiency and advanced features.

Asia Pacific Garment Steamers Market Market Size (In Million)

The market segmentation within the Asia-Pacific region reveals significant variations in growth potential across different countries. China, with its large population and rapidly growing middle class, is expected to dominate the market, followed by India due to its huge consumer base and increasing adoption of modern appliances. Japan and South Korea represent mature markets with consistent demand, whereas Australia shows substantial potential for future growth driven by its relatively high per capita income. The product type segmentation favors the increasing popularity of handheld steamers due to their portability and ease of use, although upright and tank-type steamers maintain a significant market share. The dominance of online retail channels is anticipated to continue, supported by the escalating popularity of e-commerce platforms and consumer preference for convenience. Future market developments will hinge upon manufacturers' ability to innovate, providing consumers with more energy-efficient, feature-rich, and affordable garment steamers while focusing on environmentally sustainable designs.

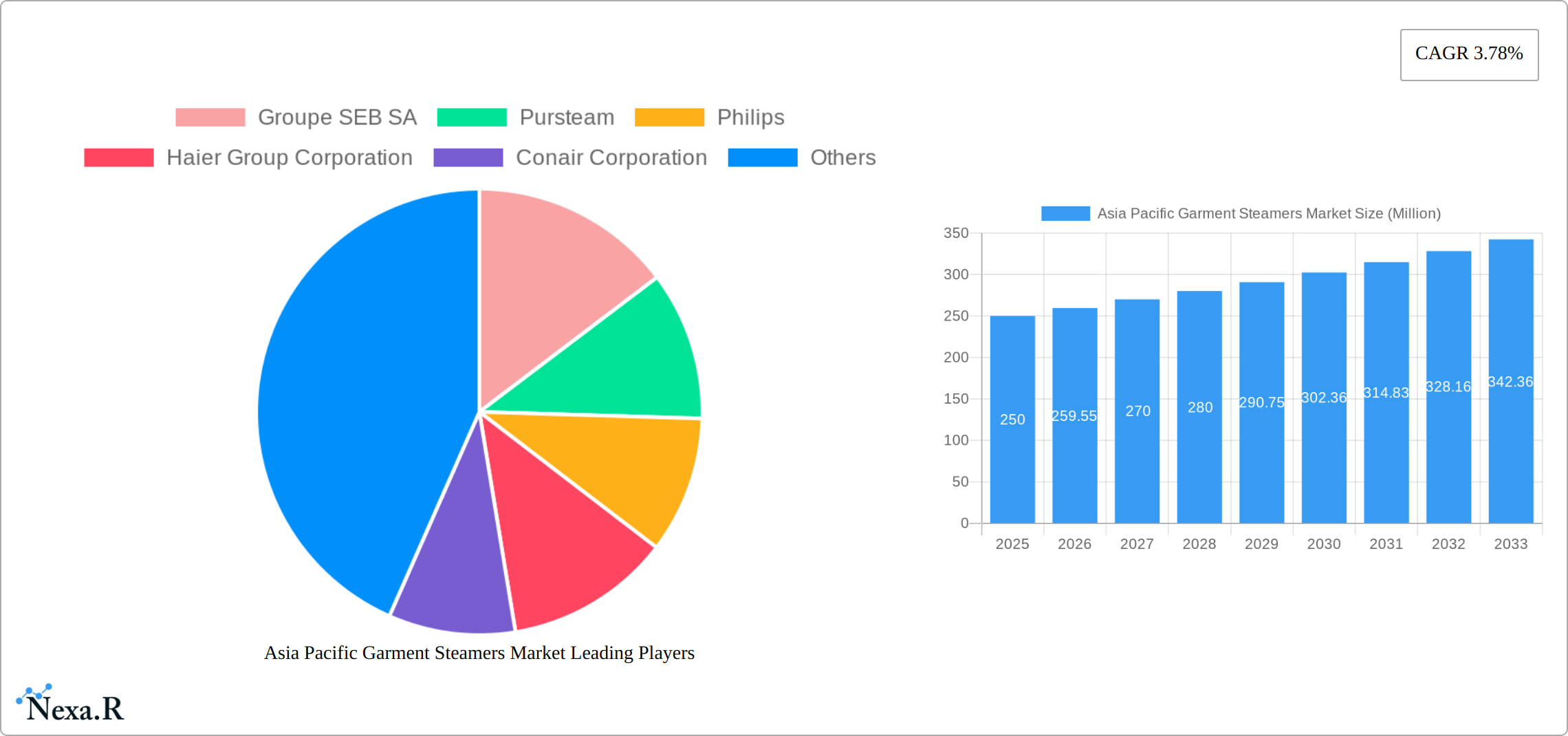

Asia Pacific Garment Steamers Market Company Market Share

This in-depth report provides a comprehensive analysis of the Asia Pacific garment steamers market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. This detailed analysis is crucial for businesses seeking to understand and capitalize on opportunities within this dynamic market.

Asia Pacific Garment Steamers Market Dynamics & Structure

The Asia Pacific garment steamers market is characterized by a moderately concentrated landscape, with key players like Groupe SEB SA, Pursteam, Philips, Haier Group Corporation, Conair Corporation, Reliable Corporation, Salav, Maryant, and Jiffy Steamer Company vying for market share. Technological innovation, driven by consumer demand for convenience and efficiency, is a significant growth driver. Stringent safety and energy efficiency regulations vary across countries, influencing product design and manufacturing. Competitive substitutes, such as traditional irons and dry cleaning services, continue to exert pressure, while the market witnesses increasing mergers and acquisitions (M&A) activity as companies aim to expand their market presence and product portfolios.

- Market Concentration: Moderate, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on portability, rapid heat-up times, and advanced steam technology.

- Regulatory Landscape: Varying regulations across countries regarding energy efficiency and safety standards.

- Competitive Substitutes: Traditional irons and dry cleaning services.

- M&A Activity: xx deals recorded between 2019 and 2024, predominantly focused on expanding geographical reach and product lines.

- End-User Demographics: Growing middle class and rising disposable incomes fuel demand, particularly in urban areas.

- Innovation Barriers: High initial investment costs for R&D and stringent safety certifications.

Asia Pacific Garment Steamers Market Growth Trends & Insights

The Asia Pacific garment steamers market experienced significant growth during the historical period (2019-2024), driven by increasing consumer awareness of the convenience and efficiency offered by garment steamers compared to traditional ironing. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. This growth is attributed to several factors: the rising disposable incomes in several key economies, changing consumer lifestyles favoring quick and easy clothing care solutions, and the growing influence of online retail channels. Technological advancements, such as the introduction of cordless and travel-friendly models, have also spurred adoption. The forecast period (2025-2033) anticipates continued growth, driven by the expanding middle class, increasing urbanization, and the launch of innovative products with enhanced features. The market is projected to reach xx million units by 2033, with a projected CAGR of xx%. Market penetration rates are expected to increase significantly in less developed regions of Asia Pacific.

Dominant Regions, Countries, or Segments in Asia Pacific Garment Steamers Market

China and India represent the most significant markets within the Asia Pacific garment steamer landscape, fueled by their substantial populations, burgeoning middle classes, and escalating consumer spending on home appliances. Handheld steamers currently command the largest market share due to their affordability and portability. However, removable tank steamers are experiencing a surge in popularity, driven by their enhanced convenience and ease of refilling. The online sales channel is exhibiting rapid expansion, mirroring the region's widespread e-commerce adoption. This dynamic market is further segmented by factors such as price point, features (e.g., vertical steamers, travel steamers), and brand recognition, influencing consumer purchasing decisions.

- Dominant Region: China, followed by India and subsequently other rapidly developing economies like South Korea, Australia, and Singapore.

- Key Country Drivers: China (high adoption rates, robust manufacturing base, strong domestic brands), India (expanding middle class, rising disposable incomes, increasing urbanization), South Korea (technological advancements and adoption of premium appliances).

- Leading Product Type: Handheld steamers (estimated xx% market share in 2024), with a growing segment of vertical and travel-sized models.

- Dominant Tank Type: Fixed tank (estimated xx% market share in 2024) remains prevalent due to cost-effectiveness. Removable tank steamers, however, are gaining traction due to convenience and user experience improvements.

- Fastest Growing Distribution Channel: Online (estimated xx% CAGR from 2024-2033), outpacing traditional retail channels due to increased accessibility and competitive pricing strategies.

- Growth Drivers: Rising disposable incomes, increasing urbanization, evolving lifestyles favoring convenience, heightened awareness of hygiene and wrinkle-free apparel.

Asia Pacific Garment Steamers Market Product Landscape

The Asia Pacific garment steamers market offers a diverse range of products catering to varied consumer needs and preferences. Handheld and upright steamers dominate the market, with innovations focusing on faster heat-up times, larger water tanks, and improved steam output. Features such as variable steam settings, automatic shutoff mechanisms, and ergonomic designs enhance user experience. Technological advancements are focused on improving steam penetration for wrinkle removal, energy efficiency, and safety features. Unique selling propositions include portability, ease of use, and specialized attachments for different fabric types.

Key Drivers, Barriers & Challenges in Asia Pacific Garment Steamers Market

Key Drivers:

- Rising disposable incomes and increased consumer spending on home convenience and personal care appliances.

- Growing preference for convenient and time-saving home cleaning and apparel care solutions.

- Technological advancements, leading to enhanced product features such as faster heat-up times, larger water tanks, and improved steam output, thus resulting in enhanced product performance and user experience.

- Expansion of e-commerce platforms and sophisticated logistics networks, facilitating easier access to a wider variety of garment steamers from both domestic and international brands.

- Increased awareness of hygiene and the desire for wrinkle-free apparel in both professional and casual settings.

Challenges & Restraints:

- Intense competition among established international and emerging domestic brands, leading to price wars and impacting profit margins.

- Fluctuations in raw material prices, particularly for plastics and metals, impacting production costs and potentially retail pricing.

- Varying safety and energy efficiency regulations across different countries, creating compliance complexities and adding to production costs.

- Supply chain disruptions, including geopolitical instability, raw material shortages, and transportation issues, impacting product availability and lead times.

- Consumer education and awareness regarding the advantages of garment steamers compared to traditional ironing methods.

Emerging Opportunities in Asia Pacific Garment Steamers Market

- Untapped potential in rural areas of high-population countries like India and Indonesia, through targeted marketing and distribution strategies.

- Growing demand for compact, travel-friendly garment steamers catering to the increasing frequency of both domestic and international travel.

- Increasing adoption of smart home technology, creating opportunities for integration with smart assistants and app-based controls for enhanced usability.

- Rise in eco-conscious consumers, creating demand for energy-efficient models with features like automatic shut-off and reduced water consumption.

- Development of specialized garment steamers for specific fabric types, such as delicate silks or heavy materials like wool.

Growth Accelerators in the Asia Pacific Garment Steamers Market Industry

Strategic partnerships between manufacturers and retailers are significantly accelerating market growth, enhancing distribution networks and improving brand visibility. Technological innovations, such as improved heating elements, advanced steam delivery systems, and ergonomic designs, contribute significantly to enhanced product performance and user experience. Market expansion into underpenetrated regions within the Asia Pacific region, particularly focusing on underserved rural markets and smaller cities, represents a key driver for future growth. The development of innovative financing options (e.g., installment plans) to make the product more accessible to a wider range of consumers could further boost market expansion.

Key Players Shaping the Asia Pacific Garment Steamers Market Market

- Groupe SEB SA

- Pursteam

- Philips

- Haier Group Corporation

- Conair Corporation

- Reliable Corporation

- Salav

- Maryant

- Jiffy Steamer Company

Notable Milestones in Asia Pacific Garment Steamers Market Sector

- August 2023: Haier launched a new space-saving garment steamer with integrated features like a clothes hanger and additional storage, highlighting a trend towards multi-functional home appliances.

- October 2022: Panasonic launched a new garment steamer with a rapid 30-second heat-up time and a 9-minute steam duration, showcasing advancements in heating technology and energy efficiency.

- [Add more recent milestones and company achievements as available]

In-Depth Asia Pacific Garment Steamers Market Market Outlook

The Asia Pacific garment steamers market is poised for robust growth throughout the forecast period (2025-2033). Continued innovation in product design and functionality, coupled with the expansion of e-commerce, will drive adoption. Strategic partnerships and effective marketing campaigns will play a crucial role in shaping future market dynamics. The rising middle class and increasing urbanization, particularly in South East Asia, present significant opportunities for market expansion.

Asia Pacific Garment Steamers Market Segmentation

-

1. Product Type

- 1.1. Handheld

- 1.2. Upright

-

2. Tank Type

- 2.1. Fixed

- 2.2. Removable

-

3. Distribution Channel

- 3.1. Multi brands store

- 3.2. Specialty Store

- 3.3. Online

- 3.4. Other Distribution Channel

Asia Pacific Garment Steamers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Garment Steamers Market Regional Market Share

Geographic Coverage of Asia Pacific Garment Steamers Market

Asia Pacific Garment Steamers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gentle and Safe on Fabrics

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Sales Through Online Channels

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Garment Steamers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Handheld

- 5.1.2. Upright

- 5.2. Market Analysis, Insights and Forecast - by Tank Type

- 5.2.1. Fixed

- 5.2.2. Removable

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi brands store

- 5.3.2. Specialty Store

- 5.3.3. Online

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Groupe SEB SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pursteam

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philips

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haier Group Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Conair Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Reliable Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pursteam

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Salav

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Maryant

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jiffy Steamer Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Groupe SEB SA

List of Figures

- Figure 1: Asia Pacific Garment Steamers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Garment Steamers Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Tank Type 2020 & 2033

- Table 4: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 5: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Tank Type 2020 & 2033

- Table 12: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Tank Type 2020 & 2033

- Table 13: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia Pacific Garment Steamers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Garment Steamers Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: China Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Pacific Garment Steamers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Pacific Garment Steamers Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Garment Steamers Market?

The projected CAGR is approximately 11.98%.

2. Which companies are prominent players in the Asia Pacific Garment Steamers Market?

Key companies in the market include Groupe SEB SA, Pursteam, Philips, Haier Group Corporation, Conair Corporation, Reliable Corporation, Pursteam, Salav, Maryant, Jiffy Steamer Company.

3. What are the main segments of the Asia Pacific Garment Steamers Market?

The market segments include Product Type, Tank Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Gentle and Safe on Fabrics.

6. What are the notable trends driving market growth?

Rising Sales Through Online Channels.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

August 2023: Haier launched a new garment steamer that focuses on saving space. The whole appliance can be folded into a small box. Wheels are equipped with a box to help move them. The handle on the top helps users twist or pull the steamer. The handle can also be used as a clothes hanger and has two width options for different clothes. There are additional hangers for clothes and a steam nozzle at the bottom of the ironing board for user convenience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Garment Steamers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Garment Steamers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Garment Steamers Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Garment Steamers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence