Key Insights

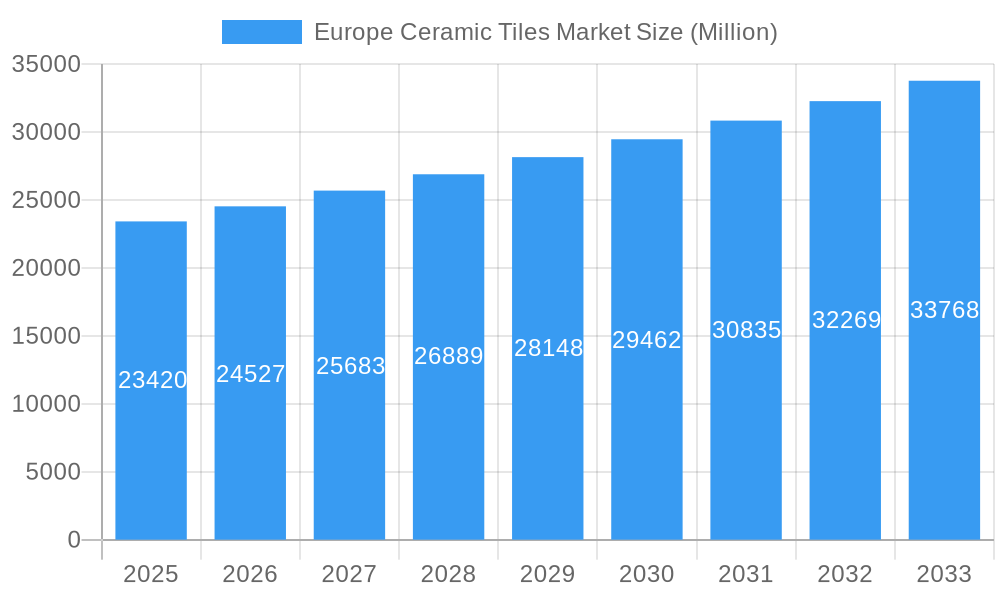

The European ceramic tile market, valued at €23.42 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by several key factors. The resurgence of renovation projects in existing residential and commercial spaces across major European economies like Germany, France, and the UK, coupled with sustained growth in new construction, particularly in the residential sector, significantly contributes to market demand. Increasing disposable incomes, coupled with a rising preference for aesthetically pleasing and durable flooring and wall solutions, further bolster market growth. The popularity of glazed and porcelain tiles, due to their ease of maintenance and stylish appeal, is driving product-specific demand segments. However, fluctuations in raw material prices and the increasing competition from alternative flooring materials, such as engineered wood and vinyl, pose some constraints on market expansion. Furthermore, stringent environmental regulations impacting manufacturing processes present a challenge for market players. The market is segmented by construction type (new construction and renovation), end-user (residential and commercial), product type (glazed, porcelain, scratch-free, and others), and application (floor tiles, wall tiles, and others). Key players like Crossville Inc., RAK Ceramics, and Porcelanosa Group are strategically investing in product innovation and expansion to maintain market share in this competitive landscape. Germany, France, Italy, and the UK constitute the major markets within Europe, reflecting high construction activity and consumer spending in these regions.

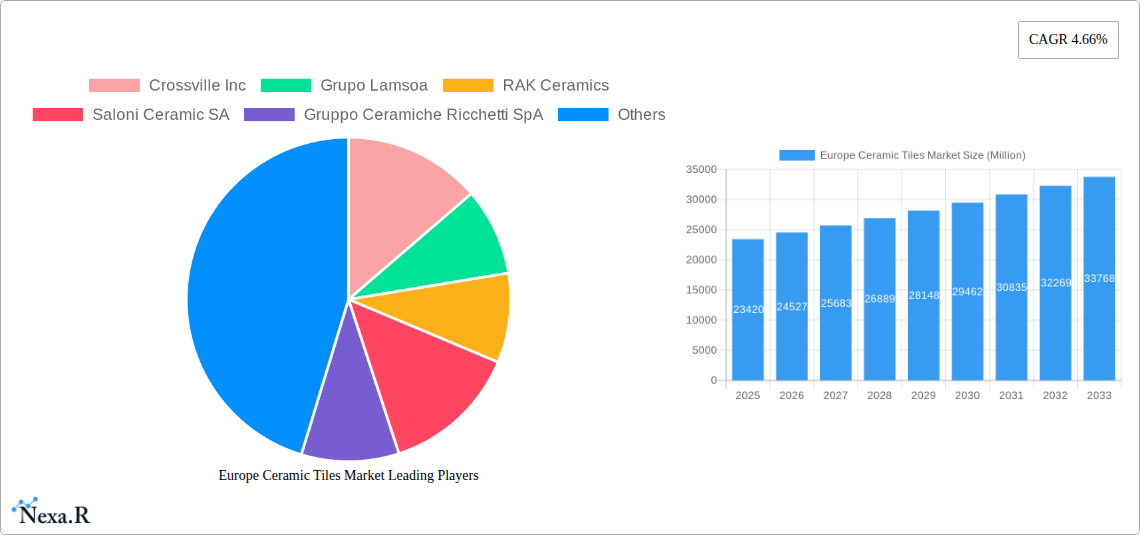

Europe Ceramic Tiles Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued growth, though the rate may slightly fluctuate year-on-year due to economic cycles and regional variations in construction activity. Successful players will be those that can balance affordability with superior product quality and design, while navigating fluctuating raw material costs and increasingly stringent environmental standards. The focus on sustainable manufacturing practices and eco-friendly product development is likely to become a crucial differentiator, attracting environmentally conscious consumers and enhancing brand reputation. Diversification into specialized niche markets, such as large-format tiles or tiles with specific technical properties, also presents opportunities for growth and enhanced profitability.

Europe Ceramic Tiles Market Company Market Share

Europe Ceramic Tiles Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe ceramic tiles market, covering market dynamics, growth trends, dominant segments, and key players. The report analyzes the market from 2019 to 2024 (historical period), with a focus on 2025 (base and estimated year), and provides forecasts until 2033 (forecast period). The market is segmented by construction type (new construction, replacement & renovation), end-user type (residential, commercial), product type (glazed, porcelain, scratch-free, other), and application (floor tiles, wall tiles, other tiles). The total market size is projected to reach xx Million units by 2033.

Europe Ceramic Tiles Market Dynamics & Structure

This section delves into the intricate structure and driving forces of the European ceramic tiles market. We analyze market concentration, revealing the market share held by key players like Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc, Blackstone Industrial (Foshan) Ltd, and China Ceramics Co Ltd (list not exhaustive). The report also examines technological innovation, regulatory landscapes influencing production and distribution, the impact of competitive substitute materials, evolving end-user demographics, and the frequency and impact of mergers and acquisitions (M&A) activities within the industry. Quantitative data, such as market share percentages and M&A deal volumes (xx deals in the last 5 years), are presented alongside qualitative factors, such as barriers to innovation stemming from high capital expenditure requirements for new production technologies.

- Market Concentration: Analysis of market share distribution among leading players.

- Technological Innovation: Assessment of R&D investments and the impact of new materials and production processes (e.g., large-format tiles, sustainable manufacturing).

- Regulatory Framework: Examination of EU regulations concerning material safety, environmental standards, and building codes.

- Competitive Substitutes: Evaluation of competing materials such as vinyl, wood, and stone, and their impact on market share.

- End-User Demographics: Analysis of shifting consumer preferences and their impact on demand for specific tile types and applications.

- M&A Trends: Assessment of recent M&A activity and its implications for market consolidation and innovation.

Europe Ceramic Tiles Market Growth Trends & Insights

This section provides a detailed analysis of the Europe ceramic tiles market's growth trajectory, leveraging extensive data to pinpoint key trends and drivers. The report examines market size evolution over the study period (2019-2033), quantifying growth rates (CAGR) and market penetration for different segments. The analysis encompasses technological disruptions, such as the introduction of innovative materials and manufacturing techniques, and shifts in consumer behavior, including growing preference for sustainable and eco-friendly options. Specific examples of these trends are detailed, providing a comprehensive picture of the market's evolution.

Dominant Regions, Countries, or Segments in Europe Ceramic Tiles Market

This section identifies the leading regions, countries, and segments within the European ceramic tile market that are driving its growth. It analyzes the market share and growth potential of different segments based on construction type (new construction vs. replacement & renovation), end-user type (residential vs. commercial), product type (glazed, porcelain, scratch-free, others), and application (floor tiles, wall tiles, other). The dominant segment is identified and key drivers in each segment are explored, including economic policies, infrastructure development, and building regulations.

- Key Drivers (Examples): Increased residential construction in Germany, renovation projects in Western Europe, government incentives for green building initiatives.

- Dominance Factors: Analysis of market share, growth rate, and competitive landscape within each dominant segment and region.

Europe Ceramic Tiles Market Product Landscape

This section offers a concise overview of the product innovations, applications, and performance metrics characterizing the European ceramic tile market. It highlights the unique selling propositions (USPs) of different tile types, such as durability, aesthetics, and ease of maintenance. The analysis incorporates technological advancements, such as the development of larger format tiles, improved printing technologies, and the use of sustainable materials.

Key Drivers, Barriers & Challenges in Europe Ceramic Tiles Market

This section identifies the primary drivers and impediments to growth within the European ceramic tiles market. Key drivers include technological advancements, economic growth in specific regions, and supportive government policies. Conversely, challenges include supply chain disruptions, regulatory hurdles (e.g., environmental regulations), and intense competitive pressures from alternative flooring materials. The analysis provides specific, quantifiable impacts of these challenges, such as estimated cost increases due to supply chain issues (xx%).

- Key Drivers: Technological innovations, economic growth in key regions, government incentives.

- Key Challenges: Supply chain disruptions (xx% increase in material costs), environmental regulations (impact on production costs), intense competition.

Emerging Opportunities in Europe Ceramic Tiles Market

This section explores promising emerging trends and opportunities in the European ceramic tile market. These opportunities include untapped markets (e.g., Eastern European countries), innovative applications (e.g., large-format tiles for commercial use), and evolving consumer preferences (e.g., demand for sustainable products).

Growth Accelerators in the Europe Ceramic Tiles Market Industry

This section highlights the factors that will propel long-term growth in the European ceramic tile market. These include technological breakthroughs in production and design, strategic partnerships among manufacturers and distributors, and expansion into new geographical markets.

Key Players Shaping the Europe Ceramic Tiles Market Market

- Crossville Inc

- Grupo Lamsoa

- RAK Ceramics

- Saloni Ceramic SA

- Gruppo Ceramiche Ricchetti SpA

- Porcelanosa Group

- NITCO

- Atlas Concorde S P A

- Johnson Tiles

- Mohawk Industries Inc

- Siam Cement Group

- Centura Tile Inc

- Blackstone Industrial (Foshan) Ltd

- China Ceramics Co Ltd

Notable Milestones in Europe Ceramic Tiles Market Sector

- February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, featuring a comprehensive product system and stylish surfaces for coordinated environments. This expands design options and boosts market competitiveness.

- March 2022: Johnson Tile's collaboration with the Material Lab for the Tile Trace Trend & Format Forum provided valuable insights into emerging design trends, translating into innovative tiling products for commercial spaces, enhancing market appeal and driving innovation.

In-Depth Europe Ceramic Tiles Market Market Outlook

The European ceramic tiles market is poised for continued growth driven by ongoing technological advancements, increasing construction activity, and growing demand for aesthetically pleasing and sustainable building materials. Strategic opportunities exist for manufacturers focused on innovation, sustainability, and expansion into new markets. The market’s projected growth, supported by favorable economic trends and increasing consumer spending, offers significant potential for industry stakeholders.

Europe Ceramic Tiles Market Segmentation

-

1. Product Type

- 1.1. Glazed

- 1.2. Porcelain

- 1.3. Scratch Free

- 1.4. Other Product Types

-

2. Application

- 2.1. Floor Tiles

- 2.2. Wall Tiles

- 2.3. Other Tiles

-

3. Construction Type

- 3.1. New Construction

- 3.2. Replacement & Renovation

-

4. End-User Type

- 4.1. Residential

- 4.2. Commercial

Europe Ceramic Tiles Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

- 5. Russia

- 6. Belgium

- 7. Poland

- 8. Rest of Europe

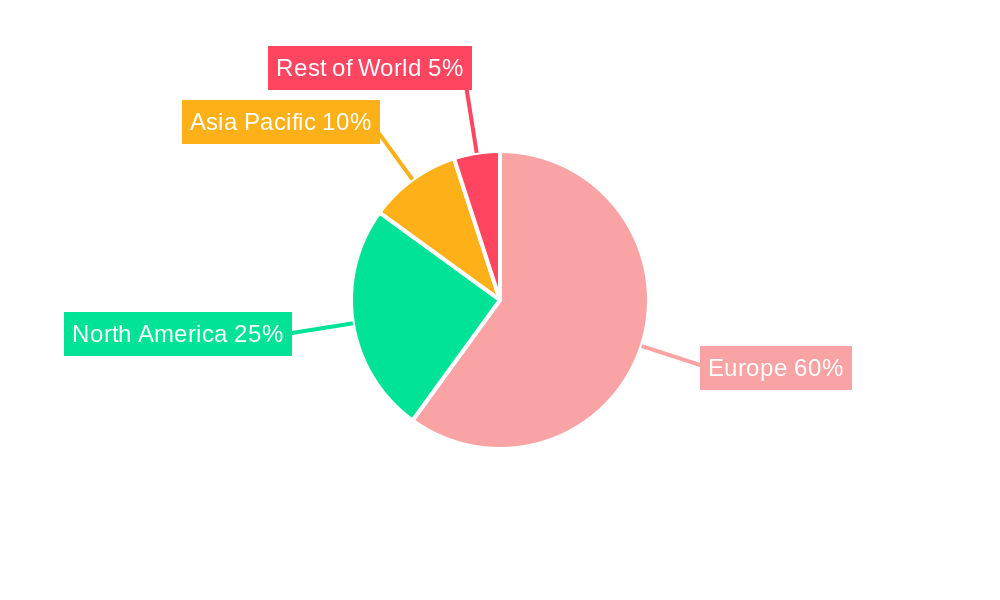

Europe Ceramic Tiles Market Regional Market Share

Geographic Coverage of Europe Ceramic Tiles Market

Europe Ceramic Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings

- 3.3. Market Restrains

- 3.3.1. Volatile Raw Material Prices; Increasing Regulations and Tariffs

- 3.4. Market Trends

- 3.4.1. Italy is the Major Exporter of Ceramic Tiles in Europe Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Glazed

- 5.1.2. Porcelain

- 5.1.3. Scratch Free

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Floor Tiles

- 5.2.2. Wall Tiles

- 5.2.3. Other Tiles

- 5.3. Market Analysis, Insights and Forecast - by Construction Type

- 5.3.1. New Construction

- 5.3.2. Replacement & Renovation

- 5.4. Market Analysis, Insights and Forecast - by End-User Type

- 5.4.1. Residential

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. Germany

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Russia

- 5.5.6. Belgium

- 5.5.7. Poland

- 5.5.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Glazed

- 6.1.2. Porcelain

- 6.1.3. Scratch Free

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Floor Tiles

- 6.2.2. Wall Tiles

- 6.2.3. Other Tiles

- 6.3. Market Analysis, Insights and Forecast - by Construction Type

- 6.3.1. New Construction

- 6.3.2. Replacement & Renovation

- 6.4. Market Analysis, Insights and Forecast - by End-User Type

- 6.4.1. Residential

- 6.4.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Glazed

- 7.1.2. Porcelain

- 7.1.3. Scratch Free

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Floor Tiles

- 7.2.2. Wall Tiles

- 7.2.3. Other Tiles

- 7.3. Market Analysis, Insights and Forecast - by Construction Type

- 7.3.1. New Construction

- 7.3.2. Replacement & Renovation

- 7.4. Market Analysis, Insights and Forecast - by End-User Type

- 7.4.1. Residential

- 7.4.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Glazed

- 8.1.2. Porcelain

- 8.1.3. Scratch Free

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Floor Tiles

- 8.2.2. Wall Tiles

- 8.2.3. Other Tiles

- 8.3. Market Analysis, Insights and Forecast - by Construction Type

- 8.3.1. New Construction

- 8.3.2. Replacement & Renovation

- 8.4. Market Analysis, Insights and Forecast - by End-User Type

- 8.4.1. Residential

- 8.4.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Glazed

- 9.1.2. Porcelain

- 9.1.3. Scratch Free

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Floor Tiles

- 9.2.2. Wall Tiles

- 9.2.3. Other Tiles

- 9.3. Market Analysis, Insights and Forecast - by Construction Type

- 9.3.1. New Construction

- 9.3.2. Replacement & Renovation

- 9.4. Market Analysis, Insights and Forecast - by End-User Type

- 9.4.1. Residential

- 9.4.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Glazed

- 10.1.2. Porcelain

- 10.1.3. Scratch Free

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Floor Tiles

- 10.2.2. Wall Tiles

- 10.2.3. Other Tiles

- 10.3. Market Analysis, Insights and Forecast - by Construction Type

- 10.3.1. New Construction

- 10.3.2. Replacement & Renovation

- 10.4. Market Analysis, Insights and Forecast - by End-User Type

- 10.4.1. Residential

- 10.4.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Belgium Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Glazed

- 11.1.2. Porcelain

- 11.1.3. Scratch Free

- 11.1.4. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Floor Tiles

- 11.2.2. Wall Tiles

- 11.2.3. Other Tiles

- 11.3. Market Analysis, Insights and Forecast - by Construction Type

- 11.3.1. New Construction

- 11.3.2. Replacement & Renovation

- 11.4. Market Analysis, Insights and Forecast - by End-User Type

- 11.4.1. Residential

- 11.4.2. Commercial

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Poland Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Glazed

- 12.1.2. Porcelain

- 12.1.3. Scratch Free

- 12.1.4. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Floor Tiles

- 12.2.2. Wall Tiles

- 12.2.3. Other Tiles

- 12.3. Market Analysis, Insights and Forecast - by Construction Type

- 12.3.1. New Construction

- 12.3.2. Replacement & Renovation

- 12.4. Market Analysis, Insights and Forecast - by End-User Type

- 12.4.1. Residential

- 12.4.2. Commercial

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Rest of Europe Europe Ceramic Tiles Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 13.1.1. Glazed

- 13.1.2. Porcelain

- 13.1.3. Scratch Free

- 13.1.4. Other Product Types

- 13.2. Market Analysis, Insights and Forecast - by Application

- 13.2.1. Floor Tiles

- 13.2.2. Wall Tiles

- 13.2.3. Other Tiles

- 13.3. Market Analysis, Insights and Forecast - by Construction Type

- 13.3.1. New Construction

- 13.3.2. Replacement & Renovation

- 13.4. Market Analysis, Insights and Forecast - by End-User Type

- 13.4.1. Residential

- 13.4.2. Commercial

- 13.1. Market Analysis, Insights and Forecast - by Product Type

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Crossville Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Grupo Lamsoa

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 RAK Ceramics

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Saloni Ceramic SA

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Gruppo Ceramiche Ricchetti SpA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Porcelanosa Group

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 NITCO

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Atlas Concorde S P A

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Johnson Tiles

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Mohawk Industries Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Siam Cement Group

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Centura Tile Inc **List Not Exhaustive

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Blackstone Industrial (Foshan) Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 China Ceramics Co Ltd

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Crossville Inc

List of Figures

- Figure 1: Europe Ceramic Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Ceramic Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 4: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 5: Europe Ceramic Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 9: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 10: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 14: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 15: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 19: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 20: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 24: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 25: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 29: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 30: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 34: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 35: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 37: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 40: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: Europe Ceramic Tiles Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Europe Ceramic Tiles Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Europe Ceramic Tiles Market Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 44: Europe Ceramic Tiles Market Revenue Million Forecast, by End-User Type 2020 & 2033

- Table 45: Europe Ceramic Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Ceramic Tiles Market?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Europe Ceramic Tiles Market?

Key companies in the market include Crossville Inc, Grupo Lamsoa, RAK Ceramics, Saloni Ceramic SA, Gruppo Ceramiche Ricchetti SpA, Porcelanosa Group, NITCO, Atlas Concorde S P A, Johnson Tiles, Mohawk Industries Inc, Siam Cement Group, Centura Tile Inc **List Not Exhaustive, Blackstone Industrial (Foshan) Ltd, China Ceramics Co Ltd.

3. What are the main segments of the Europe Ceramic Tiles Market?

The market segments include Product Type, Application, Construction Type, End-User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector; Adoption of Ceramic tiles for Sustainable Development of Buildings.

6. What are the notable trends driving market growth?

Italy is the Major Exporter of Ceramic Tiles in Europe Region.

7. Are there any restraints impacting market growth?

Volatile Raw Material Prices; Increasing Regulations and Tariffs.

8. Can you provide examples of recent developments in the market?

February 2023: Atlas Concorde launches its new 2023 general catalog of ceramic tiles, The Atlas Concorde product system and a stylish assortment of surfaces are both inside to help customers design finished coordinated environments. Large slabs, kitchen counters, tables, and accessories, as well as sinks and bathroom fixtures, are all design elements that can broaden the design options for any intended application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Ceramic Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Ceramic Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Ceramic Tiles Market?

To stay informed about further developments, trends, and reports in the Europe Ceramic Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence