Key Insights

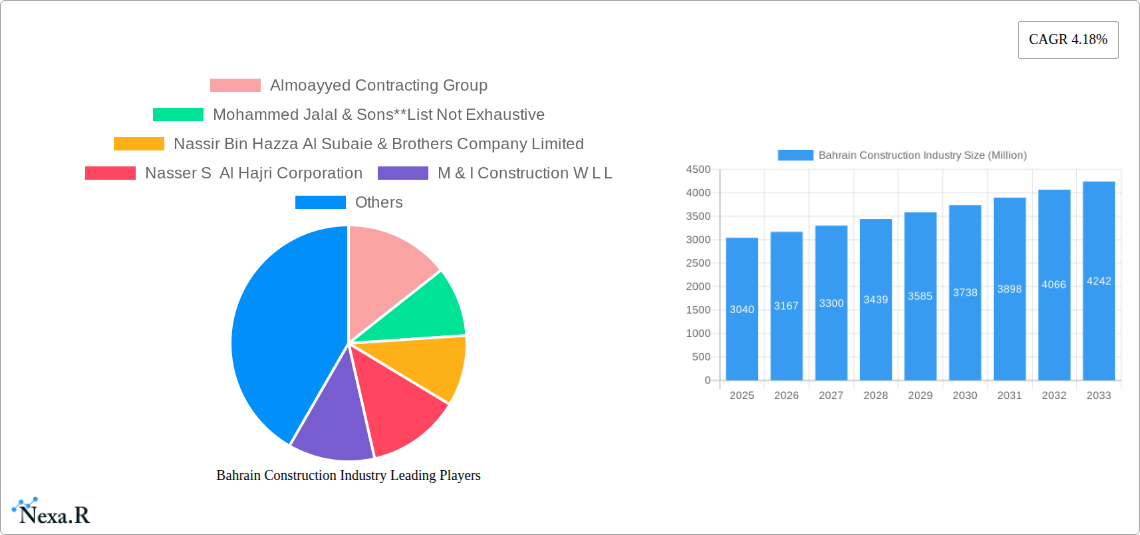

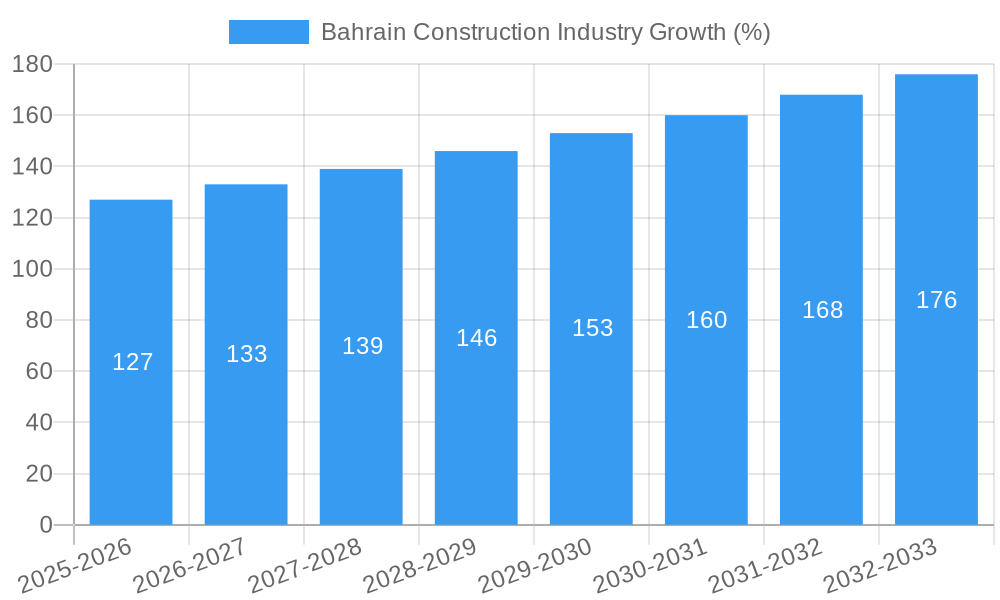

The Bahrain construction industry, valued at $3.04 billion in 2025, exhibits a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.18% from 2025 to 2033. This positive outlook is fueled by several key drivers. Government initiatives focused on infrastructure development, including transportation projects and upgrades to energy and utility systems, are significant contributors to this growth. Furthermore, a steady increase in both residential and commercial construction activities, driven by population growth and economic diversification efforts, further bolsters the market. While specific data on individual sector contributions isn't available, it's reasonable to assume that infrastructure and residential construction segments are leading the charge, given Bahrain's ongoing urbanization and need for improved connectivity. However, potential restraints such as global economic fluctuations and material price volatility could influence the market's trajectory. Major players such as Almoayyed Contracting Group, Mohammed Jalal & Sons, and Nass Corporation are well-positioned to capitalize on these opportunities, shaping the competitive landscape. The market's segmentation across commercial, residential, industrial, infrastructure, and energy & utilities construction offers diverse avenues for growth and investment.

The forecast period (2025-2033) promises continued expansion for the Bahraini construction industry. While challenges exist, the long-term outlook remains optimistic, especially with the government's commitment to large-scale infrastructure projects and the private sector's increasing involvement in real estate development. The industry’s resilience and adaptability will be key to navigating potential economic headwinds and maintaining sustainable growth throughout the forecast period. The market's dynamic nature necessitates continuous monitoring of key trends, technological advancements, and regulatory changes to accurately predict future performance. Further analysis of specific project pipelines and government spending plans would provide a more precise projection.

Bahrain Construction Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Bahrain construction industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report segments the market by sector, including Commercial, Residential, Industrial, Infrastructure (Transportation), and Energy & Utilities Construction, offering a granular view of market performance and future prospects.

Bahrain Construction Industry Market Dynamics & Structure

The Bahrain construction market, valued at xx Million in 2024, exhibits a moderately concentrated structure with several large players alongside numerous smaller firms. Market concentration is influenced by government projects and large-scale developments. Technological innovation, while present, faces challenges including a skilled labor shortage and a conservative adoption of advanced construction techniques. The regulatory framework, while generally supportive of development, can present bureaucratic hurdles. Substitute products (e.g., prefabricated structures) are gaining traction, but traditional construction methods still dominate. End-user demographics are diverse, encompassing residential, commercial, and industrial sectors, with government projects as significant drivers. M&A activity remains moderate, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Gradual adoption; challenges in skilled labor availability and conservative approach to new technologies.

- Regulatory Framework: Supportive but with bureaucratic complexities.

- Competitive Substitutes: Increasing use of prefabricated structures, but traditional methods remain prevalent.

- End-User Demographics: Diverse, including residential, commercial, industrial, and government sectors.

- M&A Trends: Moderate activity, with xx deals recorded from 2019-2024, indicating consolidation opportunities.

Bahrain Construction Industry Growth Trends & Insights

The Bahrain construction industry experienced a compound annual growth rate (CAGR) of xx% between 2019 and 2024. This growth was driven primarily by government investment in infrastructure projects, including transportation and utilities. Market size is projected to reach xx Million by 2025 and xx Million by 2033, driven by continued infrastructure development and a growing residential sector. While technological disruptions are gradually being adopted, their impact remains limited by the labor shortage. Consumer behavior shifts are influenced by rising construction costs and demand for sustainable building practices. Market penetration for green building techniques remains relatively low but is expected to increase over the forecast period.

Dominant Regions, Countries, or Segments in Bahrain Construction Industry

The Infrastructure (Transportation) Construction segment currently leads market growth, driven by significant government investments in transportation projects, such as the upcoming Bahrain Metro. The residential construction sector also demonstrates strong growth potential, fueled by a rising population and demand for new housing.

- Infrastructure (Transportation) Construction: Dominated by large-scale government projects, including the Bahrain Metro and airport expansion. High growth potential due to ongoing infrastructure development plans.

- Residential Construction: Driven by population growth and demand for housing. Growth potential influenced by affordability and access to financing.

- Commercial Construction: Moderate growth, driven by the private sector and tourism.

- Industrial Construction: Growth is tied to industrial diversification and economic growth initiatives.

- Energy and Utilities Construction: Growth is linked to the government's focus on energy security and sustainable energy sources.

Bahrain Construction Industry Product Landscape

The product landscape encompasses a wide range of construction materials and services, including traditional building materials and increasingly incorporating prefabricated components and sustainable building technologies. Innovation focuses on improving efficiency, reducing costs, and enhancing sustainability. Unique selling propositions often emphasize project management expertise, cost-effectiveness, and adherence to stringent quality standards.

Key Drivers, Barriers & Challenges in Bahrain Construction Industry

Key Drivers:

- Government investment in infrastructure projects (e.g., Bahrain Metro).

- Rising population and demand for housing.

- Growing tourism sector and associated infrastructure needs.

Challenges:

- Skilled labor shortages impact project timelines and costs.

- Fluctuations in material costs due to global supply chain issues.

- Bureaucratic processes and regulatory hurdles.

- Competition from international construction firms.

Emerging Opportunities in Bahrain Construction Industry

- Green building technologies and sustainable construction practices.

- Increased use of prefabricated structures and modular construction.

- Demand for specialized construction services, such as high-rise construction and complex infrastructure projects.

- Opportunities in the tourism and hospitality sectors.

Growth Accelerators in the Bahrain Construction Industry Industry

Technological advancements, strategic partnerships between local and international firms, and government initiatives promoting sustainable construction are key growth catalysts. The Bahrain Metro project, as well as other large-scale government infrastructure initiatives, will significantly drive market expansion in the coming years.

Key Players Shaping the Bahrain Construction Industry Market

- Almoayyed Contracting Group

- Mohammed Jalal & Sons

- Nassir Bin Hazza Al Subaie & Brothers Company Limited

- Nasser S Al Hajri Corporation

- M & I Construction W L L

- Nass Corporation

- Projects Holding Company W L L

- Mannai Holding

- Delta Construction Co W L L

- The Al Namal Group and the VKL

Notable Milestones in Bahrain Construction Industry Sector

- November 2022: Announcement of the Bahrain Metro project procurement process, signaling significant investment in infrastructure.

- May 2023: Award of a $1.437 million contract for the initial study of a new greenfield airport project, indicating long-term infrastructure plans.

In-Depth Bahrain Construction Industry Market Outlook

The Bahrain construction industry is poised for continued growth over the forecast period, driven by government investment, population growth, and private sector development. Opportunities exist in infrastructure, residential, and sustainable construction segments. Strategic partnerships and adoption of innovative technologies will be crucial for success in this dynamic market.

Bahrain Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Bahrain Construction Industry Segmentation By Geography

- 1. Bahrain

Bahrain Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Focus on green buildings4.; Increased investment in infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; High value of construction material

- 3.4. Market Trends

- 3.4.1. Increase in the number of Construction Projects driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Almoayyed Contracting Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mohammed Jalal & Sons**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nassir Bin Hazza Al Subaie & Brothers Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nasser S Al Hajri Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 M & I Construction W L L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nass Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Projects Holding Company W L L

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mannai Holding

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Delta Construction Co W L L

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Al Namal Group and the VKL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Almoayyed Contracting Group

List of Figures

- Figure 1: Bahrain Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Bahrain Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Bahrain Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Bahrain Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Bahrain Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Construction Industry?

The projected CAGR is approximately 4.18%.

2. Which companies are prominent players in the Bahrain Construction Industry?

Key companies in the market include Almoayyed Contracting Group, Mohammed Jalal & Sons**List Not Exhaustive, Nassir Bin Hazza Al Subaie & Brothers Company Limited, Nasser S Al Hajri Corporation, M & I Construction W L L, Nass Corporation, Projects Holding Company W L L, Mannai Holding, Delta Construction Co W L L, The Al Namal Group and the VKL.

3. What are the main segments of the Bahrain Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Focus on green buildings4.; Increased investment in infrastructure.

6. What are the notable trends driving market growth?

Increase in the number of Construction Projects driving the market.

7. Are there any restraints impacting market growth?

4.; High value of construction material.

8. Can you provide examples of recent developments in the market?

November 2022: According to the local publication Gulf Daily News, Bahrain will start a significant procurement for building a metro network in the first quarter of 2023. According to prior reports by Zawya Projects and others, 11 major global infrastructure companies are competing for a 29-kilometer Phase 1 of Bahrain Metro, which is being developed in a Public-Private Partnership (PPP) model. The 109 km, four transit line, the fully automated urban railway network will be built out in four stages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Construction Industry?

To stay informed about further developments, trends, and reports in the Bahrain Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence