Key Insights

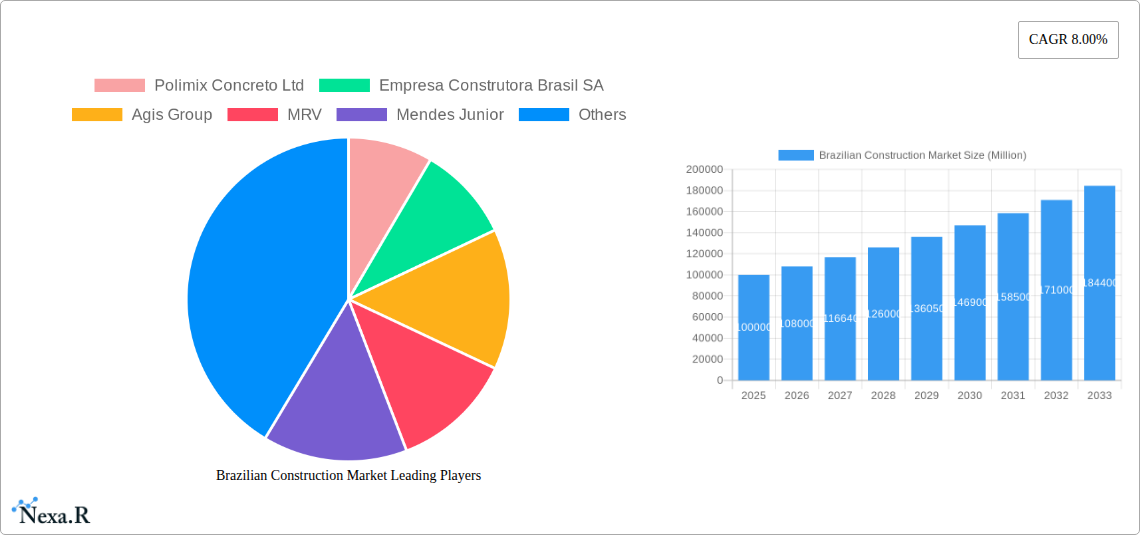

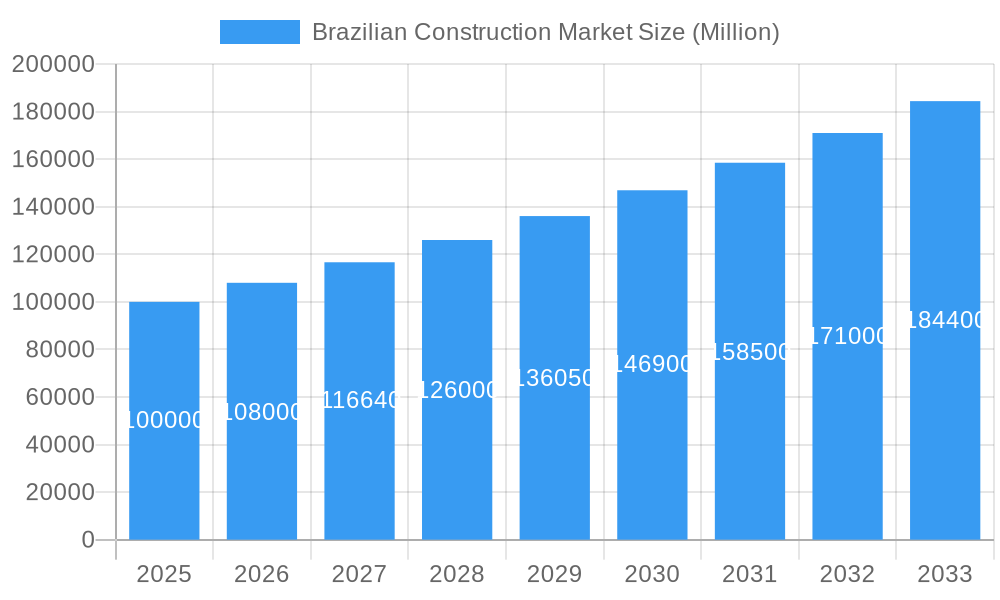

The Brazilian construction market, valued at approximately $100 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, significant government investments in infrastructure development, particularly in transportation networks and energy projects, are creating substantial demand. Secondly, a growing population and rising urbanization are driving increased residential construction activity, especially in major metropolitan areas. Further bolstering the market is a gradual improvement in the overall economic climate, leading to increased private sector investment in commercial and industrial projects. However, challenges remain. Inflationary pressures and fluctuations in raw material costs pose significant risks, impacting project profitability. Furthermore, bureaucratic complexities and regulatory hurdles can delay project timelines and increase overall costs. The market is segmented into commercial, residential, industrial, infrastructure (transportation), and energy & utility construction, each contributing to the overall growth trajectory, albeit at varying paces. Residential construction is likely to experience the most significant growth, fueled by population increases and government housing initiatives, closely followed by infrastructure projects due to government spending.

Brazilian Construction Market Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, regional players. Key players, including Polimix Concreto Ltd, Empresa Construtora Brasil SA, Agis Group, MRV, and others, are actively vying for market share. Their strategies encompass diversification across sectors, technological advancements in construction methodologies, and strategic partnerships to secure projects and manage risks. The forecast period (2025-2033) promises further expansion, albeit with potential volatility influenced by macroeconomic conditions and government policies. Strategic partnerships, innovative construction techniques, and effective risk management will be crucial for companies seeking sustainable growth within this dynamic market.

Brazilian Construction Market Company Market Share

This in-depth report provides a comprehensive analysis of the Brazilian construction market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market and its key child segments, this report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and navigate this dynamic market. The study period covers 2019-2033, with 2025 as the base and estimated year.

Brazilian Construction Market Dynamics & Structure

The Brazilian construction market is characterized by a moderately concentrated landscape, with a few large players dominating alongside numerous smaller firms. Technological innovation, while present, faces barriers such as high upfront investment costs and a lack of skilled labor. Regulatory frameworks, often complex and subject to change, significantly influence project timelines and costs. The market witnesses competitive pressure from substitute materials and construction methods, particularly in residential and commercial sectors. End-user demographics, driven by urbanization and a growing middle class, fuel demand, especially in residential construction. Mergers and acquisitions (M&A) activity is notable, reflecting consolidation and strategic expansion within the sector.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025 (estimated).

- M&A Activity (2019-2024): xx billion USD in total deal volume.

- Technological Innovation Barriers: High initial investment, skilled labor shortage, and regulatory uncertainty.

- Key Substitutes: Prefabricated building components, sustainable materials.

Brazilian Construction Market Growth Trends & Insights

The Brazilian construction market experienced significant fluctuation during the historical period (2019-2024), influenced by economic cycles and policy changes. However, a positive outlook is projected for the forecast period (2025-2033), driven by infrastructure investments, rising urbanization, and government initiatives. The market size is estimated at xx million USD in 2025 and is projected to reach xx million USD by 2033, exhibiting a CAGR of xx%. Technological disruptions, such as Building Information Modeling (BIM) and the adoption of prefabricated components, are gradually increasing efficiency and productivity. Consumer behavior is shifting towards sustainable and technologically advanced construction solutions.

Dominant Regions, Countries, or Segments in Brazilian Construction Market

The residential construction segment dominates the Brazilian construction market, driven by a growing population and increasing urbanization. Infrastructure (transportation) construction also represents a significant segment, fueled by government investment in roads, railways, and airports. Specific regions like São Paulo and Rio de Janeiro show consistently high activity levels.

- Residential Construction: xx million USD in 2025 (estimated), driven by affordable housing programs and population growth.

- Infrastructure (Transportation) Construction: xx million USD in 2025 (estimated), fueled by government investments in PPPs (Public-Private Partnerships).

- Key Drivers: Government infrastructure projects, economic growth, urbanization, and supportive government policies.

- Dominance Factors: Strong population growth, significant government spending on infrastructure projects, and increasing private investment.

Brazilian Construction Market Product Landscape

The Brazilian construction market utilizes a diverse range of products, including cement, steel, aggregates, and various building materials. Recent innovations include the adoption of sustainable materials (e.g., bamboo, recycled materials) and advanced construction techniques like 3D printing. These innovations contribute to improved efficiency, reduced environmental impact, and enhanced structural integrity. Key selling points increasingly focus on sustainability, cost-effectiveness, and enhanced performance features.

Key Drivers, Barriers & Challenges in Brazilian Construction Market

Key Drivers:

- Government investment in infrastructure projects.

- Growing urbanization and population growth.

- Rising demand for affordable housing.

Challenges:

- Bureaucracy and regulatory hurdles causing delays.

- Supply chain disruptions impacting material costs and availability.

- Fluctuations in the Brazilian economy affecting investment decisions.

- Intense competition among construction firms.

Emerging Opportunities in Brazilian Construction Market

Emerging opportunities exist in the sustainable construction sector, leveraging green building materials and technologies. The demand for smart buildings and IoT integration in construction projects offers significant potential. Furthermore, expanding into less developed regions with growing infrastructure needs presents considerable untapped market potential.

Growth Accelerators in the Brazilian Construction Market Industry

Long-term growth will be accelerated by continued government investment in infrastructure, technological advancements like BIM and 3D printing, and the growing adoption of sustainable construction practices. Strategic partnerships between construction firms and technology providers are expected to drive innovation and efficiency gains, leading to stronger market growth and expansion.

Key Players Shaping the Brazilian Construction Market Market

- Polimix Concreto Ltd

- Empresa Construtora Brasil SA

- Agis Group

- MRV

- Mendes Junior

- Teixeira Duarte

- Construtora OAS SA

- Constran Internacional

- Andrade Gutierrez Engenharia SA

- ARG Group

Notable Milestones in Brazilian Construction Market Sector

- August 2022: CADE approves the USD 1.025 billion sale of Holcim AG's Brazilian cement division to CSN, signifying industry consolidation.

- July 2022: ArcelorMittal's USD 2.2 billion acquisition of Companhia Siderúrgica do Pecém (CSP) is announced, pending regulatory approval, which potentially increases steel production capacity within the country.

In-Depth Brazilian Construction Market Market Outlook

The Brazilian construction market shows strong potential for growth over the forecast period, driven by sustained government investment in infrastructure, a growing population, and increasing urbanization. Strategic partnerships and technological advancements will further enhance this positive outlook, creating numerous opportunities for market participants. The focus on sustainable and technologically advanced solutions will continue to shape the market landscape.

Brazilian Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utility Construction

Brazilian Construction Market Segmentation By Geography

- 1. Brazil

Brazilian Construction Market Regional Market Share

Geographic Coverage of Brazilian Construction Market

Brazilian Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Government Initiatives for Infrastructural Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polimix Concreto Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empresa Construtora Brasil SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agis Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MRV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mendes Junior

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teixeira Duarte

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Constran Internacional

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Andrade Gutierrez Engenharia SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ARG Group**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Construtora Oas SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Polimix Concreto Ltd

List of Figures

- Figure 1: Brazilian Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazilian Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Brazilian Construction Market Revenue undefined Forecast, by Sector 2020 & 2033

- Table 2: Brazilian Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Brazilian Construction Market Revenue undefined Forecast, by Sector 2020 & 2033

- Table 4: Brazilian Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Construction Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Brazilian Construction Market?

Key companies in the market include Polimix Concreto Ltd, Empresa Construtora Brasil SA, Agis Group, MRV, Mendes Junior, Teixeira Duarte, Constran Internacional, Andrade Gutierrez Engenharia SA, ARG Group**List Not Exhaustive, Construtora Oas SA.

3. What are the main segments of the Brazilian Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Government Initiatives for Infrastructural Development.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

August 2022: Brazilian antitrust watchdog CADE gave the go-ahead for the USD 1.025 billion transactions and cleared Holcim AG's local cement division to be sold to steelmaker Cia Siderurgica Nacional. Holcim, the largest cement manufacturer in the world with headquarters in Switzerland attempts to diversify away from its core industry, CSN initially announced the acquisition of LafargeHolcim Brasil in September 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Construction Market?

To stay informed about further developments, trends, and reports in the Brazilian Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence