Key Insights

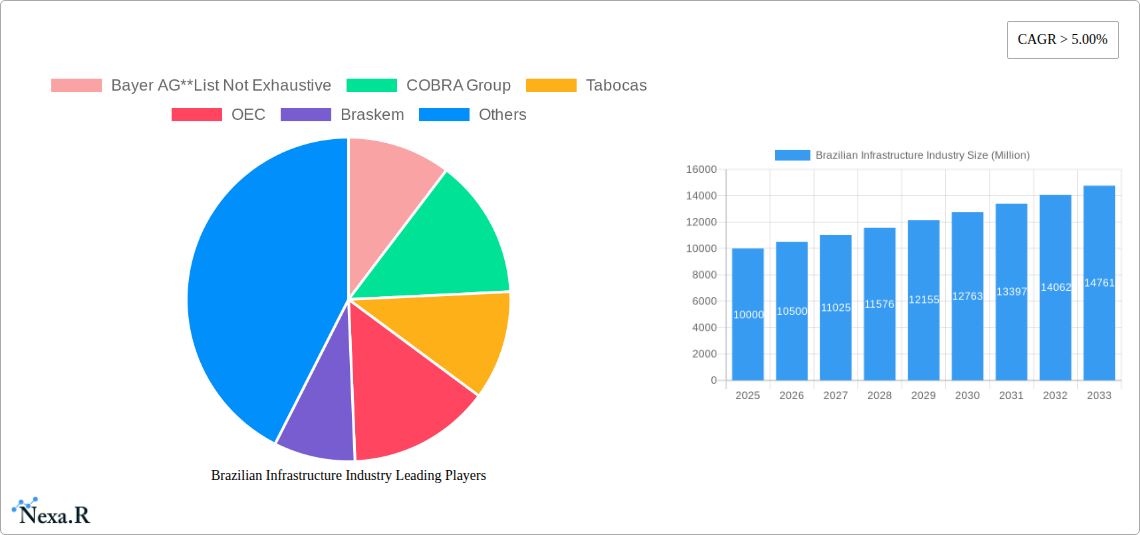

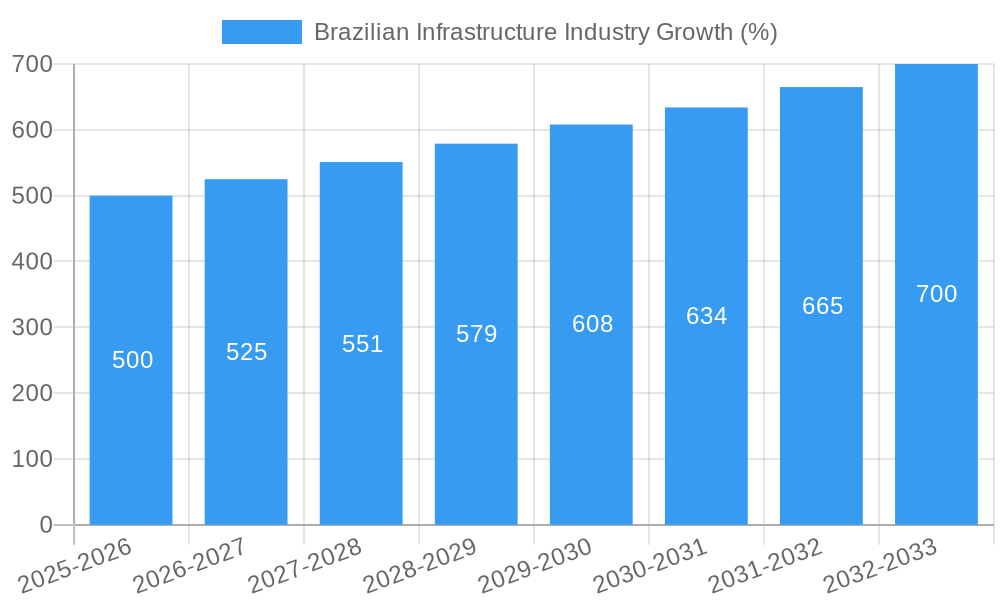

The Brazilian infrastructure market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by significant investments in social infrastructure, including transportation (particularly waterways), telecommunications, and energy. The substantial development of key cities like Sao Paulo, Rio de Janeiro, and Salvador fuels this growth, demanding substantial upgrades and expansion of existing infrastructure. Government initiatives focused on improving logistics, enhancing connectivity, and supporting sustainable development are also key drivers. While the sector faces challenges such as economic volatility and bureaucratic hurdles, the long-term outlook remains positive, fueled by Brazil's large and growing economy and increasing urbanization. Major players like Bayer AG, COBRA Group, Braskem, and Andrade Gutierrez are actively shaping the market landscape, through large scale projects and technological innovation.

The segmentation reveals a strong emphasis on social infrastructure projects, with transportation and waterways infrastructure showing particularly promising growth trajectories. The concentration of activity in major metropolitan areas indicates a need for targeted investments in urban renewal and sustainable infrastructure development. Future growth will likely be influenced by factors like the success of ongoing privatization efforts, the efficiency of government regulations and the overall economic climate. The market’s potential is further enhanced by the increasing adoption of technological advancements, like smart city initiatives and advanced construction techniques, which aim to increase efficiency and sustainability across infrastructure projects. This convergence of economic necessity, governmental policy, and technological innovation indicates that the Brazilian infrastructure market will continue its upward trend in the coming years.

This comprehensive report provides an in-depth analysis of the Brazilian infrastructure industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report utilizes a parent and child market approach, offering granular insights into various segments and key cities.

Brazilian Infrastructure Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Brazilian infrastructure industry, encompassing market concentration, technological innovation, regulatory frameworks, and M&A activity. The market is characterized by a mix of large multinational corporations and smaller, specialized firms. The total market size in 2025 is estimated at xx Million.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Adoption of Building Information Modeling (BIM) and digital technologies is increasing, driven by government initiatives and efficiency demands. However, barriers include a skills gap and high initial investment costs.

- Regulatory Framework: Government regulations concerning environmental impact assessments and public procurement significantly impact project timelines and costs. Recent reforms aim to streamline processes but challenges remain.

- Competitive Product Substitutes: Limited direct substitutes exist, but cost-effective alternatives and technological advancements are continually emerging within specific segments.

- End-User Demographics: The primary end-users include government agencies at federal, state, and municipal levels, alongside private sector developers and concessionaires.

- M&A Trends: The number of M&A deals in the period 2019-2024 averaged xx per year, with a total deal value of xx Million. Consolidation is expected to continue, driven by economies of scale and access to capital.

Brazilian Infrastructure Industry Growth Trends & Insights

The Brazilian infrastructure industry experienced a period of slower growth between 2019 and 2024, primarily due to macroeconomic challenges and political instability. However, the market is projected to rebound strongly, driven by increased government investment and privatization initiatives. The CAGR is forecast to reach xx% during the 2025-2033 forecast period. Market penetration rates vary significantly across segments.

- Market Size Evolution: The total market size is estimated at xx Million in 2025 and projected to reach xx Million by 2033.

- Adoption Rates: Adoption of new technologies such as smart city solutions and advanced materials is gradually increasing but faces obstacles related to cost and integration.

- Technological Disruptions: Digital technologies and innovative construction materials are reshaping the industry, leading to increased efficiency and sustainability.

- Consumer Behavior Shifts: Increasing demand for sustainable and resilient infrastructure is influencing project designs and procurement decisions.

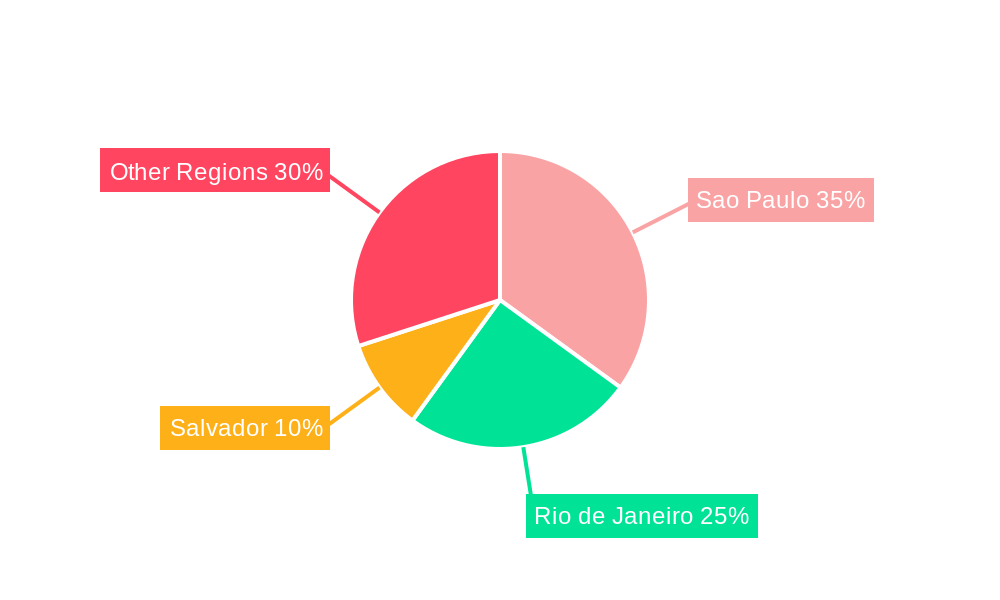

Dominant Regions, Countries, or Segments in Brazilian Infrastructure Industry

Sao Paulo continues to be the dominant region, accounting for xx% of the market in 2025, driven by its robust economy and extensive infrastructure projects. Within segments, Transportation Infrastructure is the largest, representing xx% of the total market, followed by Social Infrastructure at xx%.

- Sao Paulo: High concentration of projects, strong economic activity, and a well-established construction industry fuel its dominance.

- Transportation Infrastructure: Government investment in road, rail, and airport expansion is a key growth driver.

- Social Infrastructure: Increasing demand for healthcare, education, and sanitation facilities is driving growth in this segment.

- Rio de Janeiro: Significant investments in infrastructure related to tourism and large-scale events contribute to its considerable market share.

- Salvador: Ongoing urbanization and improvements to port infrastructure contribute to its moderate market share.

Brazilian Infrastructure Industry Product Landscape

The product landscape encompasses a wide range of construction materials, technologies, and services. Recent innovations include the use of advanced concrete mixes, prefabricated components, and digital construction management tools, boosting efficiency and reducing construction times. These advancements offer enhanced durability, sustainability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Brazilian Infrastructure Industry

Key Drivers:

- Increased government investment in infrastructure development

- Privatization initiatives and public-private partnerships (PPPs)

- Growing urbanization and population expansion

- Demand for improved transportation networks and logistics

- Investments in renewable energy infrastructure

Key Challenges:

- Bureaucracy and regulatory hurdles slowing down project approvals

- Corruption and lack of transparency

- Inflation and currency fluctuations impacting project costs

- Skilled labor shortages

- Environmental concerns and sustainability requirements

Emerging Opportunities in Brazilian Infrastructure Industry

- Expansion of 5G networks and digital infrastructure

- Growth of renewable energy projects

- Development of smart city solutions

- Investments in resilient infrastructure to withstand climate change impacts

- Increasing adoption of sustainable construction practices

Growth Accelerators in the Brazilian Infrastructure Industry Industry

Long-term growth will be fueled by continued government investments, advancements in technology, and the increasing adoption of sustainable practices. Strategic partnerships between public and private sectors, along with the development of robust supply chains, will further accelerate growth.

Key Players Shaping the Brazilian Infrastructure Industry Market

- Bayer AG

- COBRA Group

- Tabocas

- OEC

- Braskem

- Telemont

- Andrade Gutierrez

- Construcap

- Construtora Queiroz Galvao

- U&M Mineracao e Construcao

- Camargo Correa Infra Construcoes

- Novonor

Notable Milestones in Brazilian Infrastructure Industry Sector

- 2020: Launch of the National Infrastructure Plan by the Brazilian government.

- 2021: Significant increase in PPP projects awarded across various sectors.

- 2022: Introduction of new regulations aimed at streamlining the environmental licensing process.

- 2023: Several major infrastructure projects commenced in major cities.

- 2024: Merger between two leading construction firms.

In-Depth Brazilian Infrastructure Industry Market Outlook

The Brazilian infrastructure industry is poised for significant growth over the next decade. Continued government support, technological innovation, and a focus on sustainable development will drive market expansion, creating numerous opportunities for both domestic and international players. The market is expected to become increasingly competitive, with a focus on efficiency, innovation, and sustainability.

Brazilian Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other Social Infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Distribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other Manufacturing Infrastructures

-

1.1. Social Infrastructure

-

2. Key Cities

- 2.1. Sao Paulo

- 2.2. Rio de Janeiro

- 2.3. Salvador

Brazilian Infrastructure Industry Segmentation By Geography

- 1. Brazil

Brazilian Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continued Expansion of Higher Education; The Surge in the Number of International Students

- 3.3. Market Restrains

- 3.3.1. Affordability and Shortage of Supply; High Cost for International Students

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Infrastructure Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other Social Infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Distribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other Manufacturing Infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Sao Paulo

- 5.2.2. Rio de Janeiro

- 5.2.3. Salvador

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 COBRA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tabocas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OEC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Braskem

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telemont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andrade Gutierrez

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Construcap

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Construtora Queiroz Galvao

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 U&M Mineracao e Construcao

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Camargo Correa Infra Construcoes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novonor

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayer AG**List Not Exhaustive

List of Figures

- Figure 1: Brazilian Infrastructure Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Infrastructure Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Infrastructure Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Brazilian Infrastructure Industry?

Key companies in the market include Bayer AG**List Not Exhaustive, COBRA Group, Tabocas, OEC, Braskem, Telemont, Andrade Gutierrez, Construcap, Construtora Queiroz Galvao, U&M Mineracao e Construcao, Camargo Correa Infra Construcoes, Novonor.

3. What are the main segments of the Brazilian Infrastructure Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continued Expansion of Higher Education; The Surge in the Number of International Students.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Affordability and Shortage of Supply; High Cost for International Students.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Brazilian Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence