Key Insights

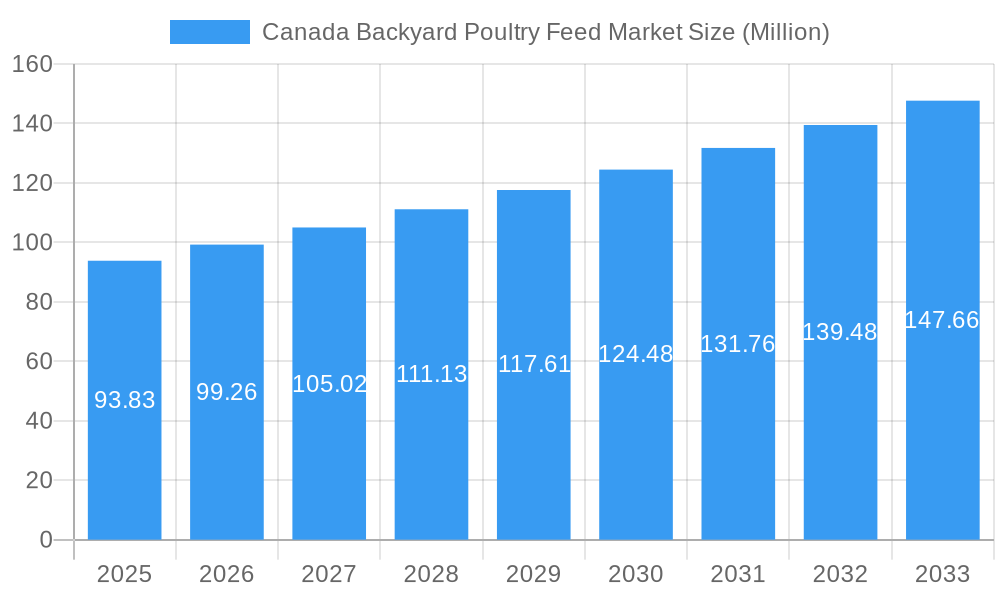

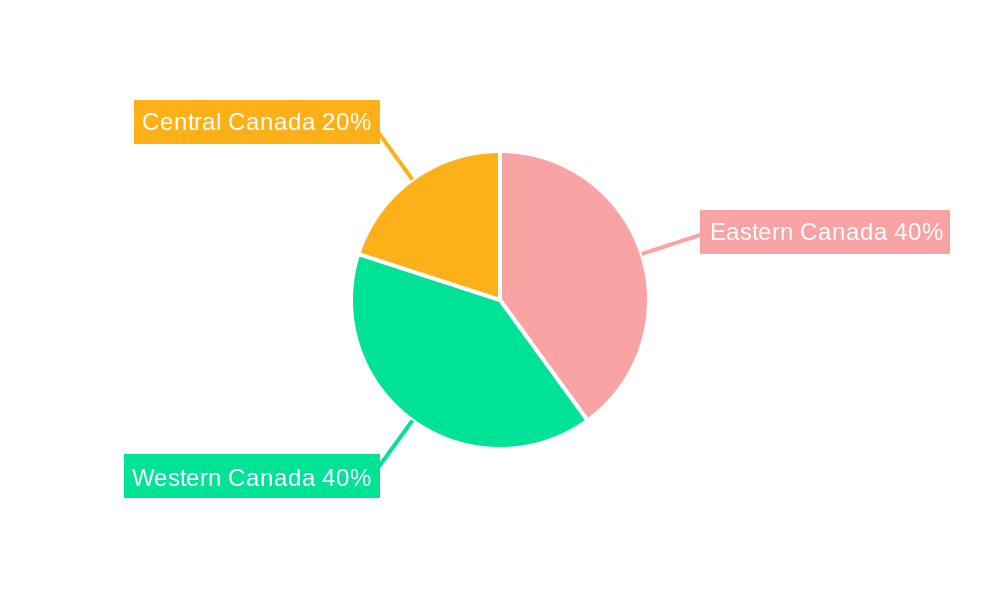

The Canadian backyard poultry feed market, valued at $93.83 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.50% from 2025 to 2033. This expansion is driven by several key factors. The rising popularity of backyard poultry farming, fueled by increasing consumer demand for fresh, locally-sourced eggs and meat, is a significant driver. Consumers are increasingly seeking sustainable and ethical food sources, leading to a preference for homegrown poultry. Furthermore, the growing awareness of the benefits of keeping chickens, such as reducing food waste through composting and providing a therapeutic experience, contributes to market growth. The market segmentation reveals a diverse landscape. Layer feed dominates due to the high demand for egg production. Broiler feed follows, catering to meat production needs. Ingredient-wise, cereal grains form a substantial portion, followed by oilseed meals, offering cost-effective protein sources. The increasing use of specialized supplements, aimed at optimizing poultry health and productivity, contributes to market value. Geographic distribution sees variations, with Eastern and Western Canada exhibiting potentially higher demand compared to Central Canada, reflecting population density and farming practices. Competitively, the market comprises established players such as Cargill Inc. and ADM Animal Nutrition alongside regional feed mills, highlighting opportunities for both large-scale and niche players. However, potential restraints include fluctuating feed prices due to global commodity market volatility and potential regulatory changes impacting backyard poultry farming.

Canada Backyard Poultry Feed Market Market Size (In Million)

The forecast period of 2025-2033 presents significant opportunities for growth. Strategic partnerships between feed manufacturers and backyard poultry farming associations can foster market expansion. Innovation in feed formulations, particularly those focused on improving poultry health and reducing environmental impact, will be crucial. Expanding distribution channels, including e-commerce platforms and direct-to-consumer sales, will enhance market accessibility. Furthermore, educational initiatives aimed at promoting responsible backyard poultry farming practices can contribute to sustained market growth. Understanding regional variations in consumer preferences and tailoring product offerings accordingly will also be crucial for success in the Canadian backyard poultry feed market. The market's future trajectory strongly hinges on maintaining the momentum of the current trends and proactively addressing potential challenges.

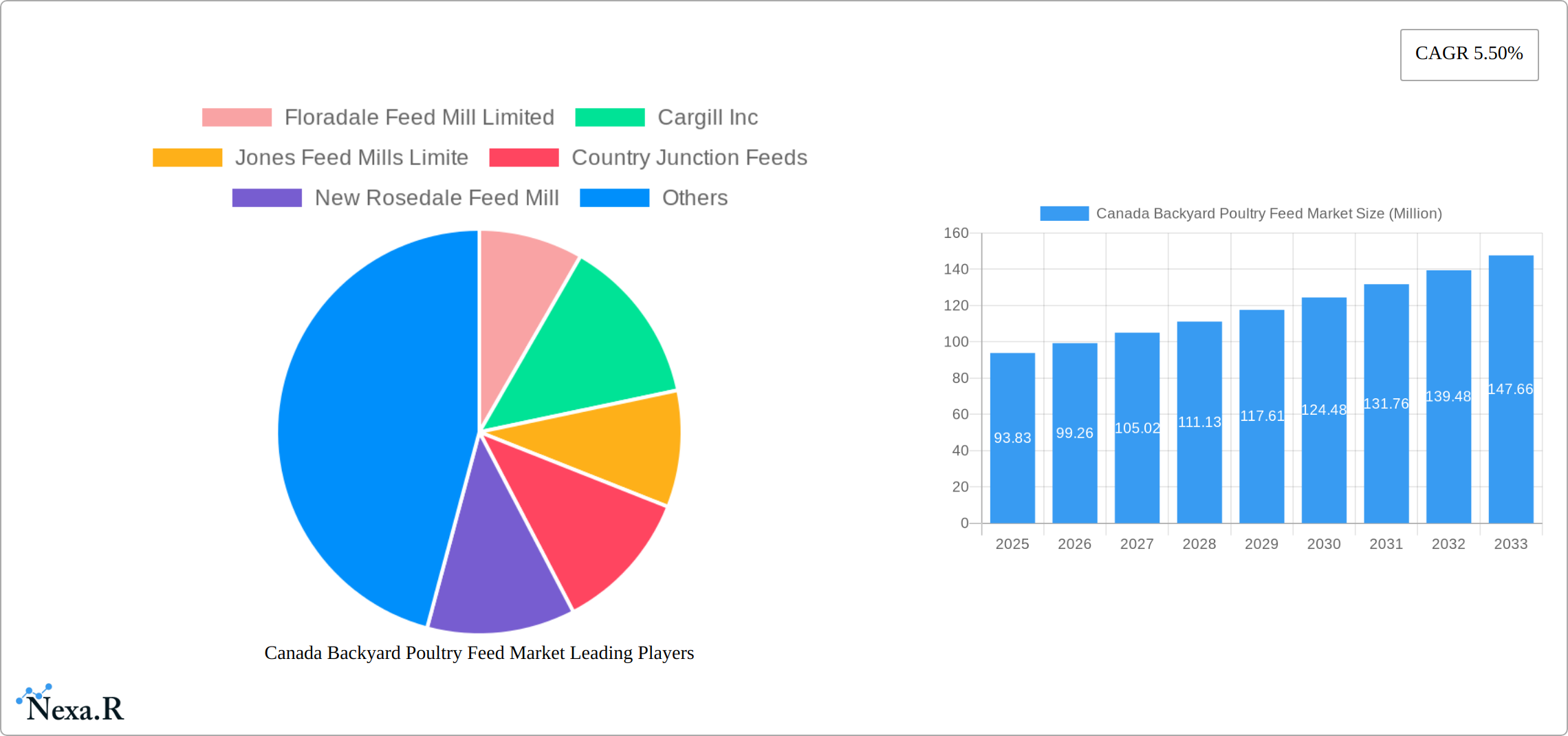

Canada Backyard Poultry Feed Market Company Market Share

Canada Backyard Poultry Feed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Backyard Poultry Feed market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by Type (Layer, Broiler, Other Animal Types) and Ingredient Type (Cereal, Oilseed Meal, Molasses, Fish Oil and Fish Meal, Supplements, Other Ingredient Types), providing a granular understanding of market segments and their growth trajectories. The total market value in 2025 is estimated at XX Million units, expected to reach XX Million units by 2033.

Canada Backyard Poultry Feed Market Market Dynamics & Structure

The Canadian backyard poultry feed market is characterized by a dynamic interplay of structural forces, technological advancements, and evolving consumer preferences. While the market exhibits a moderately fragmented structure, it is experiencing a gradual shift towards consolidation as larger entities recognize the growth potential. Key drivers include heightened consumer awareness regarding animal welfare, food safety, and the desire for locally sourced, high-quality poultry products. Technological innovation is a significant catalyst, with a growing emphasis on developing feed formulations that not only enhance poultry health and productivity but also minimize environmental impact. The regulatory landscape, particularly concerning feed safety standards and antibiotic usage, plays a crucial role in shaping production practices and market access. Competitive substitutes, such as commercially produced poultry products, continue to exert influence, but the distinct value proposition of backyard-raised poultry—often linked to superior taste, ethical sourcing, and a connection to food production—is gaining traction.

- Market Concentration: The market is moderately fragmented, with a trend towards increasing concentration as key players expand their reach. The top 5 players are estimated to hold a combined market share of approximately 40-45% in 2025, with potential for further consolidation.

- Technological Innovation: Innovations are primarily focused on enhancing feed efficiency through optimized nutrient profiles, developing feed additives that promote gut health and reduce the need for antibiotics, and exploring sustainable ingredient sourcing. Precision feeding technologies are also gaining traction, enabling more tailored nutrition for different flock needs.

- Regulatory Framework: Stringent federal and provincial regulations governing feed safety, ingredient traceability, and animal welfare are paramount. Recent regulatory shifts, particularly concerning the reduction of antibiotic use, are driving demand for alternative feed solutions and promoting enhanced biosecurity measures.

- Competitive Substitutes: While conventional commercial poultry products offer price competitiveness, the growing segment of consumers seeking niche, ethically produced, and backyard-raised poultry creates a distinct market space. Imported poultry products also represent a competitive factor, though local production often garners a preference for freshness and traceability.

- End-User Demographics: The primary end-users are hobbyists, small-scale farmers, and urban dwellers embracing the "farm-to-table" movement. This demographic is characterized by a high degree of engagement with their flocks, a keen interest in the nutritional quality of feed, and a strong preference for natural, organic, and sustainably produced options.

- M&A Trends: The historical period (2019-2024) saw a moderate level of M&A activity, with an estimated 15-20 significant deals. This activity is expected to continue as larger companies seek to acquire regional expertise, expand their product portfolios, and gain a stronger foothold in this growing niche market.

Canada Backyard Poultry Feed Market Growth Trends & Insights

This section details the growth trajectory of the Canada Backyard Poultry Feed market from 2019 to 2033. Market size experienced steady growth during the historical period (2019-2024), driven by factors such as the rising popularity of backyard poultry keeping, increased consumer awareness of food safety and traceability, and government initiatives promoting sustainable agricultural practices. Adoption rates for specialized poultry feeds, particularly those formulated to enhance animal health and productivity, have increased significantly. Technological disruptions, such as the adoption of smart farming technologies, further enhance efficiency and contribute to market expansion. Consumer preferences are shifting towards higher-quality, sustainable, and locally sourced poultry feeds, boosting demand for premium products. The market is projected to experience a CAGR of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in Canada Backyard Poultry Feed Market

Ontario and British Columbia represent the dominant regions within the Canadian backyard poultry feed market, primarily due to higher concentrations of backyard poultry owners and favorable climate conditions for poultry farming. Within the segment types, the Layer segment holds the largest market share, driven by the high demand for eggs. Similarly, the Cereal ingredient type accounts for a substantial portion of the market, owing to its affordability and nutritional value for poultry.

- Key Drivers (Ontario & British Columbia):

- Higher density of backyard poultry farms.

- Favorable climate conditions for poultry farming.

- Strong consumer demand for locally sourced poultry products.

- Segment Dominance:

- Type: Layer segment leads due to high egg consumption.

- Ingredient Type: Cereal dominates due to cost-effectiveness and nutritional value.

Canada Backyard Poultry Feed Market Product Landscape

The Canadian backyard poultry feed market boasts a diverse and expanding product landscape designed to meet the specific nutritional requirements of various poultry breeds and life stages, from starter feeds for chicks to layer feeds for adult hens and grower feeds for meat birds. There's a pronounced trend towards the development of specialized formulations that prioritize natural, non-GMO, and organic ingredients, reflecting a growing consumer demand for healthier and more sustainable poultry products. Innovations include the incorporation of probiotics and prebiotics to bolster immune systems, improve gut health, and reduce the reliance on synthetic additives and antibiotics. Furthermore, advancements in feed processing and delivery systems are enabling more precise nutrient availability and customized feed solutions. Key selling propositions often revolve around enhanced animal welfare, the use of locally sourced ingredients, sustainable production practices, and demonstrable improvements in feed conversion ratios and overall flock vitality.

Key Drivers, Barriers & Challenges in Canada Backyard Poultry Feed Market

Key Drivers: Increasing consumer interest in backyard poultry farming, growing demand for locally sourced and organic poultry products, and government support for sustainable agriculture. Technological advancements in feed formulation and delivery systems also play a crucial role.

Challenges and Restraints: Fluctuations in raw material prices, stringent regulatory compliance requirements, and competition from larger commercial feed producers pose significant challenges. Supply chain disruptions can significantly impact feed availability and pricing, creating volatility in the market.

Emerging Opportunities in Canada Backyard Poultry Feed Market

The Canadian backyard poultry feed market is ripe with emerging opportunities, primarily driven by evolving consumer values and market trends. The escalating consumer preference for organic, non-GMO, and sustainably sourced poultry feed presents a significant growth avenue for manufacturers who can cater to these demands. Furthermore, the burgeoning interest in environmentally conscious farming practices is creating a strong market for specialized feed products formulated to minimize ecological footprints, such as those utilizing alternative protein sources or reducing nutrient runoff. The expansion of urban farming initiatives and community-supported agriculture (CSA) models also opens up new and direct distribution channels for specialized poultry feeds, allowing producers to connect directly with a highly engaged consumer base seeking transparency and local sourcing.

Growth Accelerators in the Canada Backyard Poultry Feed Market Industry

Technological advancements such as precision feeding systems and the development of novel feed ingredients will propel market growth. Strategic partnerships between feed manufacturers and poultry producers will drive innovation and improve market efficiency. Expansion of the urban farming sector will create new market opportunities and increase overall market size.

Key Players Shaping the Canada Backyard Poultry Feed Market Market

- Cargill Inc

- ADM Animal Nutrition

- Floradale Feed Mill Limited

- Jones Feed Mills Limite

- Country Junction Feeds

- New Rosedale Feed Mill

- Hi Pro Feeds

- Enterra Feed Corporation

Notable Milestones in Canada Backyard Poultry Feed Market Sector

- 2022: [Company Name] successfully launched a comprehensive new line of certified organic poultry feeds, responding to increasing consumer demand for natural products.

- 2023: The Canadian Food Inspection Agency (CFIA) implemented stricter regulations and guidelines regarding the responsible use of antibiotics in poultry feed, prompting a surge in research and development for antibiotic alternatives.

- 2024: [Company Name] introduced an innovative precision feeding system for backyard poultry, significantly enhancing feed efficiency and allowing for customized nutritional plans based on flock size and breed.

- 2024: A leading Canadian feed manufacturer partnered with an agricultural research institute to explore the development of novel, plant-based protein sources for sustainable poultry feed formulations.

In-Depth Canada Backyard Poultry Feed Market Market Outlook

The Canadian backyard poultry feed market is projected to experience robust and sustained growth in the coming years, underpinned by a confluence of favorable trends. The enduring popularity of backyard poultry keeping, fueled by a desire for fresh, home-raised eggs and meat, coupled with a growing consumer consciousness towards ethical sourcing and the health benefits of natural feed ingredients, will continue to be primary growth engines. Technological advancements in feed formulation, ingredient sourcing, and delivery systems will not only improve the nutritional value and sustainability of feed but also contribute to operational efficiencies for both manufacturers and end-users. Strategic collaborations between feed producers, agricultural researchers, and distributors are expected to further catalyze market expansion and foster innovation. The market's trajectory suggests substantial opportunities for businesses to capitalize on the increasing demand for high-quality, specialized, and environmentally responsible poultry feed solutions.

Canada Backyard Poultry Feed Market Segmentation

-

1. Type

- 1.1. Layer

- 1.2. Broiler

- 1.3. Other Animal Types

-

2. Ingredient Type

- 2.1. Cereal

- 2.2. Oilseed Meal

- 2.3. Molasses

- 2.4. Fish Oil and Fish Meal

- 2.5. Supplements

- 2.6. Other Ingredient Types

Canada Backyard Poultry Feed Market Segmentation By Geography

- 1. Canada

Canada Backyard Poultry Feed Market Regional Market Share

Geographic Coverage of Canada Backyard Poultry Feed Market

Canada Backyard Poultry Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Poultry Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Backyard Poultry Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Layer

- 5.1.2. Broiler

- 5.1.3. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.2.1. Cereal

- 5.2.2. Oilseed Meal

- 5.2.3. Molasses

- 5.2.4. Fish Oil and Fish Meal

- 5.2.5. Supplements

- 5.2.6. Other Ingredient Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Floradale Feed Mill Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jones Feed Mills Limite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Country Junction Feeds

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 New Rosedale Feed Mill

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hi Pro Feeds

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enterra Feed Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ADM Animal Nutrition

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Floradale Feed Mill Limited

List of Figures

- Figure 1: Canada Backyard Poultry Feed Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Backyard Poultry Feed Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 3: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Ingredient Type 2020 & 2033

- Table 6: Canada Backyard Poultry Feed Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Backyard Poultry Feed Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Canada Backyard Poultry Feed Market?

Key companies in the market include Floradale Feed Mill Limited, Cargill Inc, Jones Feed Mills Limite, Country Junction Feeds, New Rosedale Feed Mill, Hi Pro Feeds, Enterra Feed Corporation, ADM Animal Nutrition.

3. What are the main segments of the Canada Backyard Poultry Feed Market?

The market segments include Type, Ingredient Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 93.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Poultry Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Backyard Poultry Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Backyard Poultry Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Backyard Poultry Feed Market?

To stay informed about further developments, trends, and reports in the Canada Backyard Poultry Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence