Key Insights

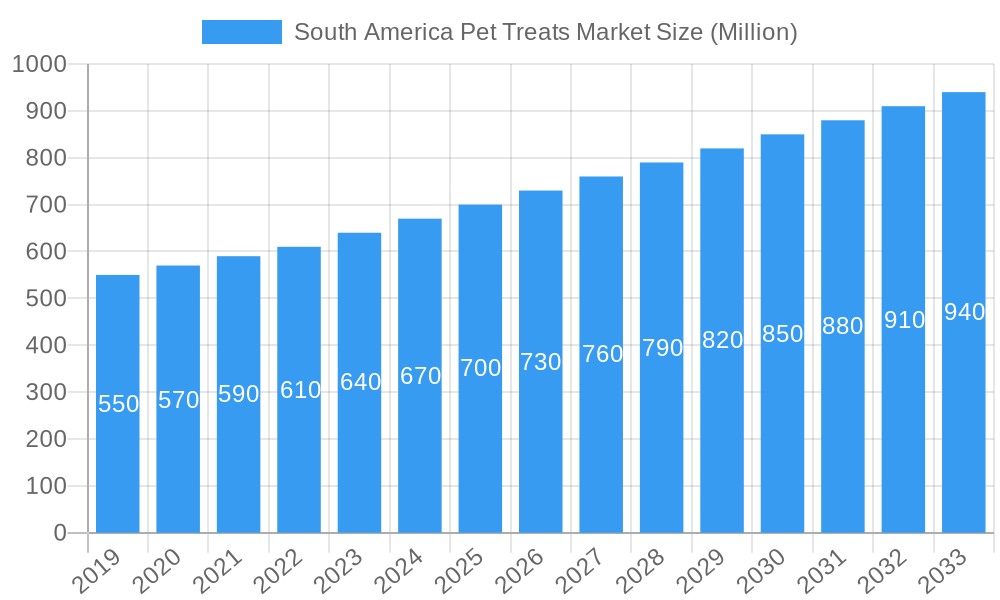

The South America pet treats market is projected for significant expansion, anticipated to reach $1.71 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.82% through 2033. This robust growth is propelled by the increasing humanization of pets, leading owners to invest more in premium and specialized treat options. Rising disposable incomes across South America, particularly in key markets like Brazil and Argentina, further fuel consumer spending on pet care. Growing owner awareness of the health benefits of functional treats, such as dental and specialized formulations, also serves as a significant growth catalyst. The market is further influenced by a surge in demand for natural and organic pet treats, aligning with consumer preferences for healthier, sustainable products.

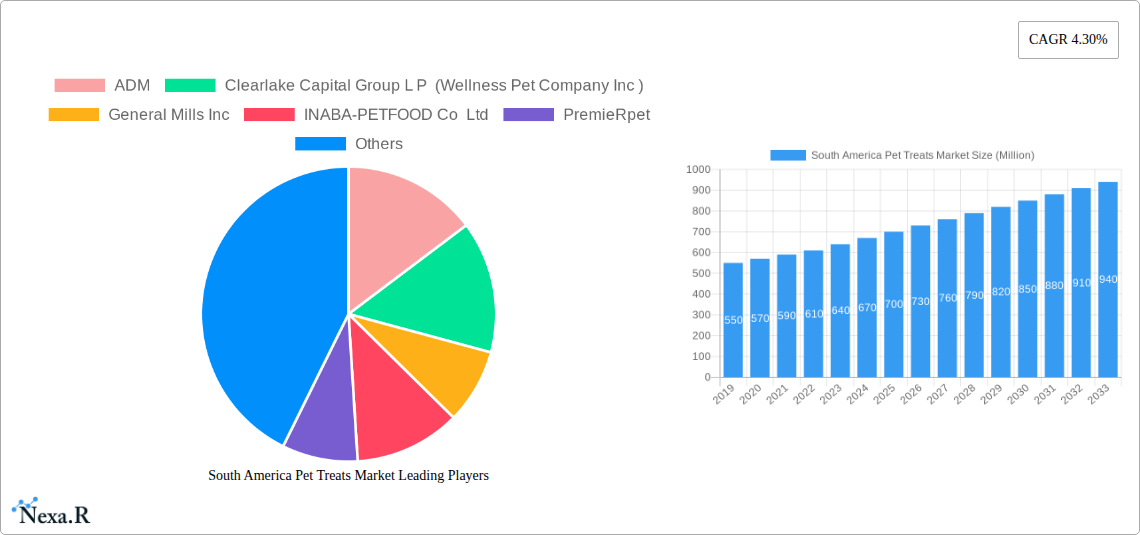

South America Pet Treats Market Market Size (In Billion)

The competitive environment is dynamic, featuring global leaders such as Mars Incorporated, Nestle (Purina), and General Mills Inc., alongside influential regional players like PremieRpet and INABA-PETFOOD Co Ltd. Distribution channels are evolving, with a marked increase in online sales and a growing reliance on specialty pet stores for convenience and wider product selection. While the market is poised for continued growth, potential price sensitivities in certain segments and the ongoing need for consumer education on advanced treat benefits present minor challenges. Nevertheless, the primary trend of pet owners prioritizing their pets' well-being, coupled with continuous product innovation, ensures a promising outlook for the South America pet treats market.

South America Pet Treats Market Company Market Share

South America Pet Treats Market Analysis & Forecast 2025–2033: Size, Share, Trends, Drivers, and Key Players

Explore the dynamic growth of the South America Pet Treats Market, a key segment within the global pet care industry. This comprehensive report analyzes the market from 2019 to 2033, focusing on the Base Year 2025 and a detailed Forecast Period of 2025–2033. Gain critical insights into market size, share, emerging trends, and the strategic factors shaping the future of dog treats, cat treats, and other pet treats across the region.

Analyze the market structure, including segments like Crunchy Treats, Dental Treats, Freeze-dried and Jerky Treats, and Soft & Chewy Treats. Understand evolving consumer demands for premium and functional pet treats. This report examines the influence of the online channel, expanding reach of specialty stores, and the established presence of supermarkets/hypermarkets on distribution strategies. Gain granular insights into the pet treats market within key South American economies, identifying major countries and regions driving market expansion.

This report is an essential resource for pet food manufacturers, treat suppliers, ingredient providers, distributors, retailers, and industry investors seeking to capitalize on the burgeoning South America pet industry. Analyze the competitive landscape featuring global leaders like ADM, General Mills Inc, Mars Incorporated, Nestle (Purina), and Colgate-Palmolive Company (Hill's Pet Nutrition Inc), alongside prominent regional players such as PremieRpet and Empresas Carozzi SA. Evaluate their strategic initiatives, product innovations, and market penetration strategies.

Utilize quantitative data and qualitative insights to identify key market drivers, navigate potential barriers, and pinpoint emerging opportunities. The report highlights significant industry developments, including recent product launches from Nestle Purina and PremieRpet, and strategic collaborations like Mars Incorporated's genome initiative.

South America Pet Treats Market Market Dynamics & Structure

The South America Pet Treats Market exhibits a moderately concentrated structure, with a blend of multinational corporations and burgeoning regional players vying for market share. Innovation remains a key driver, with companies investing in developing novel formulations, functional ingredients, and sustainable packaging solutions to cater to evolving pet owner demands. Regulatory frameworks, while generally supportive of the pet food industry, can vary by country, influencing product approval processes and ingredient standards. Competitive product substitutes, ranging from home-prepared treats to alternative pet food categories, pose a constant challenge. End-user demographics are shifting, with an increasing pet humanization trend and a growing middle class in many South American nations, leading to a greater willingness to spend on premium pet products. Mergers and acquisitions (M&A) are becoming more prevalent as larger companies seek to expand their regional footprint and product portfolios. For instance, the acquisition of smaller, innovative treat brands by established players is a recurring theme. The market share of top players, like Mars Incorporated and Nestle Purina, is substantial, but niche players are gaining traction through specialization. Barriers to innovation include the high cost of research and development, stringent quality control requirements, and the need for extensive market testing.

- Market Concentration: Moderate, with a mix of global and regional leaders.

- Technological Innovation Drivers: Demand for functional ingredients (e.g., joint support, calming), natural and organic formulations, and novel delivery formats.

- Regulatory Frameworks: Varying national standards for pet food safety, labeling, and ingredient sourcing.

- Competitive Product Substitutes: Homemade treats, other pet food categories, and even human food items perceived as safe for pets.

- End-User Demographics: Growing pet humanization, increasing disposable incomes, and a rising number of households with pets, particularly in urban centers.

- M&A Trends: Consolidation by larger entities acquiring specialized or innovative smaller companies to enhance market presence and product diversity.

- Quantitative Insights: Top 5 players are estimated to hold approximately 45-55% of the market share in million units. M&A deal volumes have seen a steady increase of 5-8% annually over the historical period.

South America Pet Treats Market Growth Trends & Insights

The South America Pet Treats Market is poised for substantial growth, driven by several interconnected trends and insights that are redefining consumer behavior and industry strategies. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) expected to be in the range of 7.5% to 9.0% during the forecast period. This growth is fueled by a fundamental shift in pet ownership, moving beyond basic care to a more holistic approach that includes specialized nutrition and indulgence. The increasing humanization of pets, where animals are viewed as integral family members, directly translates into a greater willingness among owners to invest in high-quality, beneficial, and flavorful treats. Adoption rates for premium and super-premium treats are particularly high, indicating a discerning consumer base actively seeking products that offer specific health benefits, such as dental care, digestive health, or stress relief. Technological disruptions, while more nascent in the treats segment compared to pharmaceuticals, are beginning to emerge, with advancements in freeze-drying, extrusion, and innovative ingredient processing enabling the creation of more nutritious and palatable options. Consumer behavior is also evolving, with a pronounced preference for natural, organic, and ethically sourced ingredients. Transparency in sourcing and production is becoming a key purchasing factor. The growing awareness of pet well-being, coupled with an expanding middle class across South America, particularly in countries like Brazil, Argentina, and Colombia, is creating a fertile ground for market expansion. Online channels have become crucial for accessibility and discovery, allowing consumers to easily compare products and access a wider variety of niche brands. The penetration of specialized pet treat products designed for specific life stages, breeds, or health conditions is also on the rise, reflecting a demand for tailored solutions. The overall market penetration of pet treats as a distinct category within pet spending continues to climb, indicating its increasing importance in the pet care budget.

Dominant Regions, Countries, or Segments in South America Pet Treats Market

The South America Pet Treats Market is experiencing robust growth, with specific regions, countries, and segments exhibiting particularly strong performance. Among the sub-products, Soft & Chewy Treats and Crunchy Treats consistently lead the market in terms of volume and value, accounting for a significant portion of sales. This dominance is attributed to their widespread appeal, versatility in application (training, rewarding, everyday indulgence), and established presence in the market. However, Dental Treats are witnessing accelerated growth due to increasing owner awareness of pet oral hygiene and the associated long-term health benefits.

Dogs remain the dominant pet category within the market, representing the largest consumer base for pet treats. This is a global trend that holds true for South America as well, given the widespread ownership of dogs and their high engagement with treat-based training and bonding activities. While the Cats segment is also growing, driven by an increasing number of feline companions and the introduction of specialized cat treats, it still trails behind the dog segment in overall market share.

Geographically, Brazil emerges as the leading country within the South American pet treats market. Its large population, significant pet ownership rates, and a burgeoning economy with a growing middle class contribute to its dominant position. The increasing adoption of a pet humanization mindset in Brazil, similar to more developed markets, translates into higher consumer spending on premium and specialized pet products, including treats. Following Brazil, Argentina and Colombia are identified as other significant markets demonstrating considerable growth potential, supported by expanding pet populations and increasing disposable incomes.

Distribution channel analysis reveals that Supermarkets/Hypermarkets continue to hold a substantial share, offering convenience and accessibility to a broad consumer base. However, the Online Channel is experiencing the most rapid growth, driven by the convenience of e-commerce, the availability of a wider product selection, and the increasing comfort of South American consumers with online shopping. Specialty Stores also play a crucial role, catering to discerning pet owners seeking premium, niche, or veterinarian-recommended treats, often offering expert advice and a curated selection.

- Dominant Sub-Product: Soft & Chewy Treats and Crunchy Treats, driven by widespread appeal and training applications.

- Growth Sub-Product: Dental Treats, fueled by rising pet oral health awareness.

- Dominant Pet Category: Dogs, owing to higher ownership and engagement with treats.

- Leading Country: Brazil, owing to its large population, pet ownership, and economic growth.

- High-Growth Countries: Argentina and Colombia, supported by increasing disposable incomes and pet humanization.

- Dominant Distribution Channel: Supermarkets/Hypermarkets for accessibility, with Online Channels showing the fastest growth due to convenience and product variety.

- Key Drivers: Pet humanization, rising disposable incomes, increased awareness of pet health benefits, and the expansion of e-commerce platforms.

South America Pet Treats Market Product Landscape

The South America Pet Treats Market is characterized by a dynamic product landscape focused on innovation and catering to evolving pet owner demands. Manufacturers are actively introducing a diverse range of treats, from single-ingredient, all-natural options to functional treats designed for specific health needs like digestive support and joint mobility. The rise of freeze-dried and jerky treats signifies a consumer preference for highly palatable, protein-rich, and minimally processed options. Advances in manufacturing technologies enable the creation of treats with enhanced textures, flavors, and nutritional profiles, further differentiating offerings. Unique selling propositions often revolve around ingredient transparency, ethical sourcing, and the absence of artificial additives, colors, and preservatives. Technological advancements are also seen in the development of long-lasting chews and interactive treats that provide mental stimulation, alongside specialized formulations for puppies, seniors, and pets with dietary sensitivities.

Key Drivers, Barriers & Challenges in South America Pet Treats Market

Key Drivers:

- Pet Humanization: The growing trend of pets being considered family members significantly increases spending on premium and specialized treats.

- Rising Disposable Incomes: A burgeoning middle class in key South American economies can afford to spend more on their pets' well-being and enjoyment.

- Increased Awareness of Pet Health and Nutrition: Owners are increasingly educated about the role of treats in training, socialization, and overall health, driving demand for functional and beneficial products.

- Product Innovation: Continuous introduction of new flavors, textures, ingredients, and health-focused formulations by manufacturers keeps consumers engaged and encourages purchasing.

Barriers & Challenges:

- Economic Volatility: Fluctuations in regional economies can impact consumer discretionary spending on non-essential pet items like treats.

- Supply Chain Disruptions: Sourcing of specific ingredients and efficient distribution across vast geographical areas can be challenging, leading to potential cost increases and availability issues.

- Regulatory Hurdles: Varying import/export regulations and differing pet food safety standards across South American countries can create complexities for market entry and expansion.

- Price Sensitivity: While premiumization is a trend, a significant portion of the market remains price-sensitive, requiring a balance between quality and affordability.

- Competition: Intense competition from both global and local brands necessitates continuous differentiation and marketing efforts to capture and retain market share.

Emerging Opportunities in South America Pet Treats Market

Emerging opportunities in the South America Pet Treats Market lie in the increasing demand for functional treats that address specific pet health concerns, such as anxiety, joint health, and digestive issues. The growing popularity of natural and organic ingredients, coupled with a preference for sustainably sourced products, presents a significant avenue for differentiation and premiumization. Untapped markets within smaller South American countries offer substantial growth potential as pet ownership and disposable incomes rise. Furthermore, the expansion of e-commerce platforms and the development of direct-to-consumer (DTC) models create new channels for reaching a wider customer base and building brand loyalty. Innovative treat formats, such as edible dental chews with added vitamins or limited-edition seasonal flavors, can also capture consumer attention and drive incremental sales.

Growth Accelerators in the South America Pet Treats Market Industry

Several key catalysts are accelerating the growth of the South America Pet Treats Market. Technological breakthroughs in ingredient processing and formulation are enabling the creation of more nutritious, palatable, and beneficial treats, catering to the demand for functional products. Strategic partnerships between ingredient suppliers and treat manufacturers, as well as collaborations with veterinary professionals, are fostering innovation and product credibility. Market expansion strategies by key players, including increased investment in marketing and distribution networks in underserved regions, are driving penetration. The consistent rise in pet ownership rates across the continent, coupled with the deepening humanization trend, provides a stable and growing consumer base for treat products. Moreover, the increasing availability of online purchasing options simplifies access for consumers and facilitates impulse buys, further contributing to market expansion.

Key Players Shaping the South America Pet Treats Market Market

ADM Clearlake Capital Group L P (Wellness Pet Company Inc) General Mills Inc INABA-PETFOOD Co Ltd PremieRpet Mars Incorporated Nestle (Purina) Empresas Carozzi SA Colgate-Palmolive Company (Hill's Pet Nutrition Inc) Virbac

Notable Milestones in South America Pet Treats Market Sector

- May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats, expanding their feline treat offerings.

- March 2023: PremieRpet launched a line of superpremium, "Protein-packed" meal toppers/treats for dogs and cats under the brand Natoo. These treats, produced at PremieRpet's facility in Brazil, highlight the growing demand for high-quality, protein-rich pet nutrition.

- January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. This initiative, aimed at developing more effective precision medicines and diets, signifies a long-term commitment to the scientific advancement of pet health and well-being, potentially influencing future treat formulations.

In-Depth South America Pet Treats Market Market Outlook

The South America Pet Treats Market is projected for sustained and robust growth, driven by an intensifying pet humanization trend and increasing consumer willingness to invest in their pets' health and happiness. Future market potential is significant, particularly in emerging economies within the region where pet ownership is on the rise. Strategic opportunities abound in the development of specialized, functional treats catering to specific health needs, the expansion of online retail channels, and the adoption of sustainable sourcing practices that resonate with environmentally conscious consumers. The market is expected to witness continued innovation in product formulations, ingredients, and delivery formats, with a growing emphasis on natural, organic, and scientifically backed offerings. Key players will likely focus on expanding their product portfolios, enhancing their distribution networks, and leveraging digital platforms to connect with pet owners. The overall outlook indicates a dynamic and evolving market, presenting lucrative avenues for stakeholders poised to adapt to consumer preferences and technological advancements.

South America Pet Treats Market Segmentation

-

1. Sub Product

- 1.1. Crunchy Treats

- 1.2. Dental Treats

- 1.3. Freeze-dried and Jerky Treats

- 1.4. Soft & Chewy Treats

- 1.5. Other Treats

-

2. Pets

- 2.1. Cats

- 2.2. Dogs

- 2.3. Other Pets

-

3. Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Channel

- 3.3. Specialty Stores

- 3.4. Supermarkets/Hypermarkets

- 3.5. Other Channels

South America Pet Treats Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Pet Treats Market Regional Market Share

Geographic Coverage of South America Pet Treats Market

South America Pet Treats Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Pet Treats Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 5.1.1. Crunchy Treats

- 5.1.2. Dental Treats

- 5.1.3. Freeze-dried and Jerky Treats

- 5.1.4. Soft & Chewy Treats

- 5.1.5. Other Treats

- 5.2. Market Analysis, Insights and Forecast - by Pets

- 5.2.1. Cats

- 5.2.2. Dogs

- 5.2.3. Other Pets

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Channel

- 5.3.3. Specialty Stores

- 5.3.4. Supermarkets/Hypermarkets

- 5.3.5. Other Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Sub Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearlake Capital Group L P (Wellness Pet Company Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 INABA-PETFOOD Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PremieRpet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mars Incorporated

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle (Purina)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Empresas Carozzi SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virba

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: South America Pet Treats Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Pet Treats Market Share (%) by Company 2025

List of Tables

- Table 1: South America Pet Treats Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 2: South America Pet Treats Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 3: South America Pet Treats Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: South America Pet Treats Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: South America Pet Treats Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 6: South America Pet Treats Market Revenue billion Forecast, by Pets 2020 & 2033

- Table 7: South America Pet Treats Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: South America Pet Treats Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Peru South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Venezuela South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Ecuador South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Bolivia South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Paraguay South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Uruguay South America Pet Treats Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Pet Treats Market?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the South America Pet Treats Market?

Key companies in the market include ADM, Clearlake Capital Group L P (Wellness Pet Company Inc ), General Mills Inc, INABA-PETFOOD Co Ltd, PremieRpet, Mars Incorporated, Nestle (Purina), Empresas Carozzi SA, Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), Virba.

3. What are the main segments of the South America Pet Treats Market?

The market segments include Sub Product, Pets, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.March 2023: PremieRpet launched a line of superpremium, "Protein-packed" meal toppers/treats for dogs and cats under the brand Natoo. These are produced at PremieRpet's facility in Brazil.January 2023: Mars Incorporated partnered with the Broad Institute to create an open-access database of dog and cat genomes to advance preventive pet care. It is aimed at developing more effective precision medicines and diets that lead to scientific breakthroughs for the future of pet health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Pet Treats Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Pet Treats Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Pet Treats Market?

To stay informed about further developments, trends, and reports in the South America Pet Treats Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence