Key Insights

The China two-wheeler market, exhibiting a robust CAGR of over 4%, presents a significant investment opportunity. From 2019 to 2024, the market demonstrated consistent growth, driven primarily by increasing urbanization, rising disposable incomes, and the expanding middle class, all fueling demand for personal transportation. Key players like Wuyang-Honda, Loncin, and Jiangsu Xinri have capitalized on this, offering diverse models catering to varying needs and budgets. The market is segmented by propulsion type, with both Internal Combustion Engine (ICE) and Electric Vehicles (EVs) / Hybrids contributing significantly. While ICE vehicles currently dominate, the government's push towards electrification, coupled with improving EV technology and decreasing prices, is expected to accelerate the adoption of electric two-wheelers in the coming years. This shift presents both challenges and opportunities for manufacturers, demanding strategic adaptation and investment in R&D to meet evolving consumer preferences and environmental regulations. Furthermore, the expansion of rural infrastructure and improved connectivity in less-developed regions are expected to further boost market growth.

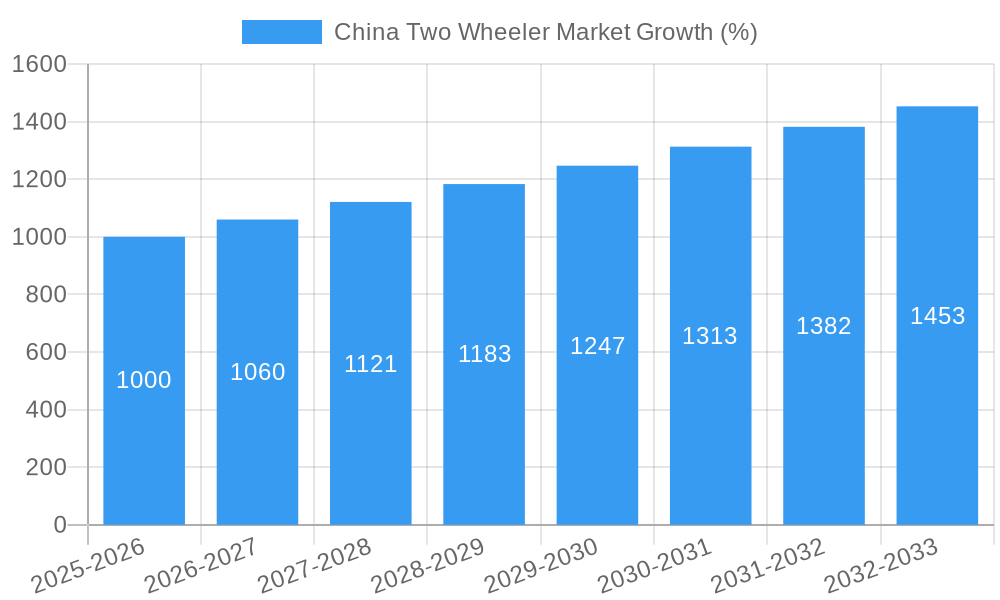

Looking ahead to 2033, the market is projected to continue its expansion, though the CAGR may fluctuate slightly depending on economic conditions and government policies. The ongoing competition among established manufacturers and the emergence of new entrants will intensify, leading to price pressures and innovation in product design and features. Challenges include navigating fluctuating raw material costs, stringent emission standards, and the potential for supply chain disruptions. However, the long-term outlook remains positive, driven by the inherent affordability and practicality of two-wheelers as a primary mode of transportation in China. The market's success will hinge on the ability of manufacturers to successfully balance cost-effectiveness with technological advancement and sustainability, catering to a diverse customer base with varying needs and preferences across different regions.

China Two Wheeler Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China two-wheeler market, encompassing its dynamics, growth trends, key players, and future outlook. The report covers both the parent market (two-wheelers) and child markets (Internal Combustion Engine (ICE) and Electric/Hybrid vehicles), offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year.

China Two Wheeler Market Market Dynamics & Structure

The China two-wheeler market, valued at xx million units in 2024, exhibits a complex interplay of factors influencing its structure and growth. Market concentration is moderately high, with a few dominant players and a multitude of smaller companies. Technological innovation, particularly in electric and hybrid vehicles, is a significant driver, alongside government regulations promoting cleaner transportation. Competitive substitutes include cars and public transportation, although the affordability and convenience of two-wheelers maintain their strong market presence. End-user demographics are diverse, encompassing urban commuters, rural residents, and delivery services. M&A activity in the sector has been moderate, with strategic acquisitions aimed at expanding product portfolios and technological capabilities.

- Market Concentration: Moderately high, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on electric, hybrid, and connected technologies.

- Regulatory Framework: Government incentives for EVs and emission standards for ICE vehicles.

- Competitive Substitutes: Cars, public transport, and ride-sharing services.

- End-User Demographics: Diverse, spanning urban and rural populations, various age groups, and income levels.

- M&A Activity: Moderate, driven by strategic expansion and technology acquisition.

China Two Wheeler Market Growth Trends & Insights

The China two-wheeler market witnessed robust growth during the historical period (2019-2024), driven by increasing urbanization, rising disposable incomes, and government support for the electric vehicle (EV) segment. The market size is projected to reach xx million units by 2025 and further expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, including the development of more efficient and affordable EVs and the integration of smart features. Consumer behavior is shifting towards eco-friendly and technologically advanced vehicles, while government initiatives continue to incentivize the adoption of EVs. Market penetration of electric two-wheelers is expected to significantly increase, surpassing xx% by 2033. Specific technological disruptions, such as the introduction of battery swapping technology and advancements in battery chemistry, will further propel market growth.

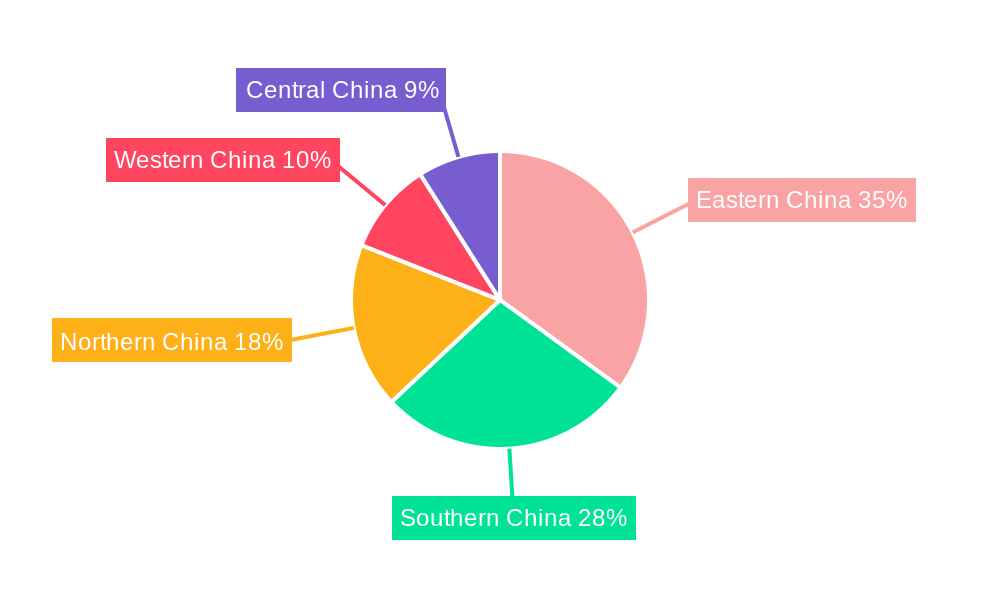

Dominant Regions, Countries, or Segments in China Two Wheeler Market

The coastal regions of China, particularly those encompassing major metropolitan areas and industrial hubs, dominate the two-wheeler market. These regions benefit from robust infrastructure, higher disposable incomes, and a larger concentration of businesses reliant on two-wheeler delivery services. The electric and hybrid vehicle (EV/HEV) segment is experiencing the most rapid growth, driven by government subsidies, environmental concerns, and technological advancements in battery technology and charging infrastructure.

- Key Drivers in Coastal Regions: Developed infrastructure, higher disposable incomes, and strong demand from businesses.

- EV/HEV Segment Drivers: Government incentives, environmental awareness, and battery technology advancements.

- Market Share: Coastal regions hold approximately xx% of the market, with EV/HEV segment projected to reach xx% by 2033.

- Growth Potential: Significant growth potential remains in less developed regions as infrastructure improves and affordability increases.

China Two Wheeler Market Product Landscape

The Chinese two-wheeler market offers a diverse range of products, including scooters, motorcycles, and electric bicycles. Innovations focus on enhanced performance, fuel efficiency (for ICE vehicles), battery technology (for EVs), safety features, and connectivity. Unique selling propositions include advanced features like smartphone integration, GPS navigation, and anti-theft systems. Technological advancements are pushing towards lighter, more powerful electric motors, longer-lasting batteries, and improved battery management systems. The increasing integration of smart technologies is transforming the user experience.

Key Drivers, Barriers & Challenges in China Two Wheeler Market

Key Drivers:

- Government incentives for EV adoption.

- Growing urbanization and rising disposable incomes.

- Increased demand for last-mile delivery services.

- Technological advancements in electric vehicle technology.

Key Challenges & Restraints:

- Supply chain disruptions impacting component availability and pricing.

- Stringent emission regulations for ICE vehicles.

- Intense competition among domestic and international manufacturers.

- Fluctuations in raw material prices (particularly for batteries).

- Impact: xx% increase in production cost in 2024 due to raw material price volatility.

Emerging Opportunities in China Two Wheeler Market

- Expansion into rural markets with affordable and durable models.

- Development of specialized two-wheelers for niche applications (e.g., cargo delivery, tourism).

- Growth in shared mobility services utilizing electric two-wheelers.

- Integration of advanced safety features, such as advanced driver-assistance systems (ADAS).

Growth Accelerators in the China Two Wheeler Market Industry

Technological breakthroughs in battery technology, particularly solid-state batteries, hold the key to unlocking wider EV adoption. Strategic partnerships between established manufacturers and technology companies are fostering innovation and driving market expansion. Government policies promoting green transportation and infrastructure development for charging stations are crucial accelerators. Expanding into underserved rural markets with cost-effective solutions will also fuel significant growth.

Key Players Shaping the China Two Wheeler Market Market

- Wuyang-Honda Motors (Guangzhou) Co Ltd

- Loncin Motor Co Ltd

- Jiangsu Xinri E-Vehicle Co Ltd

- Zhejiang Luyuan Electric Vehicle Co Ltd

- Sundiro Honda Motorcycle Co Ltd

- Zongshen Industrial Group Co Ltd

- Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd)

- Luoyang Northern Enterprises Group Co Ltd

- Lifan Technology (Group) Co Ltd

- JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd)

- Guangzhou Dayun Motorcycle Co Ltd

Notable Milestones in China Two Wheeler Market Sector

- July 2023: Sunra launches mass-produced two-wheeled EV with sodium-ion batteries. This signifies a significant step towards more affordable and accessible electric mobility.

- August 2023: Loncin GM and Lingyun Intelligent collaborate on intelligent self-balancing motorcycle products. This highlights the growing integration of technology in the two-wheeler sector.

- August 2023: SUNRA's multi-matrix publicity activities deepen global deployment of electric vehicles, indicating increased global competitiveness.

In-Depth China Two Wheeler Market Market Outlook

The future of the China two-wheeler market is bright, driven by continued technological advancements, supportive government policies, and evolving consumer preferences. The market's long-term growth will be propelled by the increasing adoption of electric vehicles, the development of innovative features and functionalities, and the expansion into untapped markets. Strategic partnerships and investments in research and development will further enhance the sector's competitiveness on a global scale, creating significant opportunities for both established players and new entrants.

China Two Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

China Two Wheeler Market Segmentation By Geography

- 1. China

China Two Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Loncin Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jiangsu Xinri E-Vehicle Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zhejiang Luyuan Electric Vehicle Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sundiro Honda Motorcycle Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zongshen Industrial Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Luoyang Northern Enterprises Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lifan Technology (Group) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guangzhou Dayun Motorcycle Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

List of Figures

- Figure 1: China Two Wheeler Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Two Wheeler Market Share (%) by Company 2024

List of Tables

- Table 1: China Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: China Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: China Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Two Wheeler Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the China Two Wheeler Market?

Key companies in the market include Wuyang-Honda Motors (Guangzhou) Co Ltd, Loncin Motor Co Ltd, Jiangsu Xinri E-Vehicle Co Ltd, Zhejiang Luyuan Electric Vehicle Co Ltd, Sundiro Honda Motorcycle Co Ltd, Zongshen Industrial Group Co Ltd, Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd ), Luoyang Northern Enterprises Group Co Ltd, Lifan Technology (Group) Co Ltd, JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd ), Guangzhou Dayun Motorcycle Co Ltd.

3. What are the main segments of the China Two Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

August 2023: Multi-matrix Publicity Activities Deepen the Global Deployment of SUNRA Electric VehiclesAugust 2023: Win-win cooperation丨Loncin GM and Lingyun Intelligent jointly create intelligent self-balancing motorcycle products.July 2023: Recently, Sunra, a Chinese electric vehicle manufacturer, launched the mass-produced two-wheeled EV with sodium-ion batteries, bringing the concept to reality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Two Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Two Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Two Wheeler Market?

To stay informed about further developments, trends, and reports in the China Two Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence