Key Insights

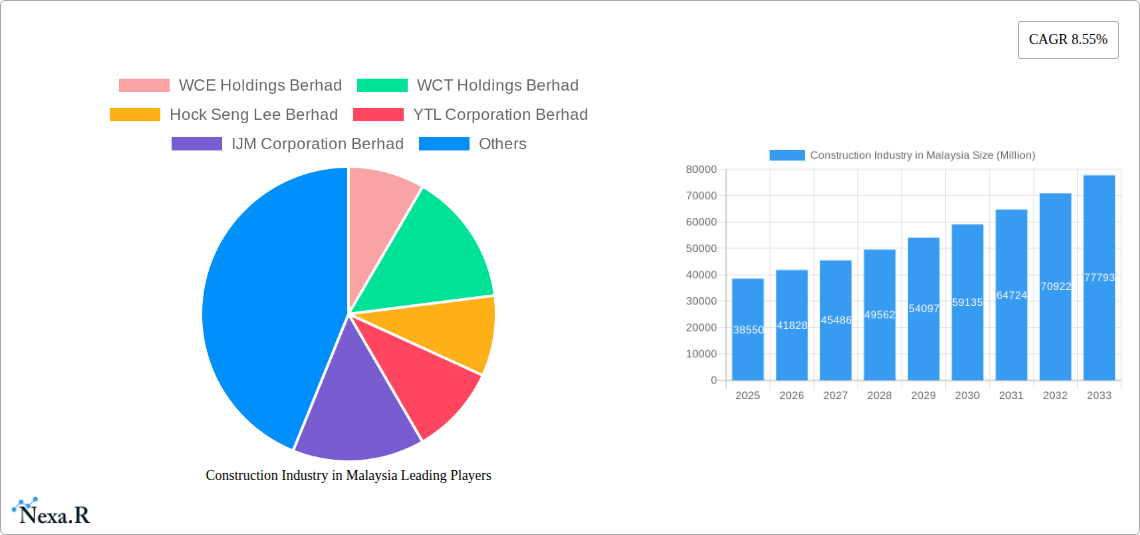

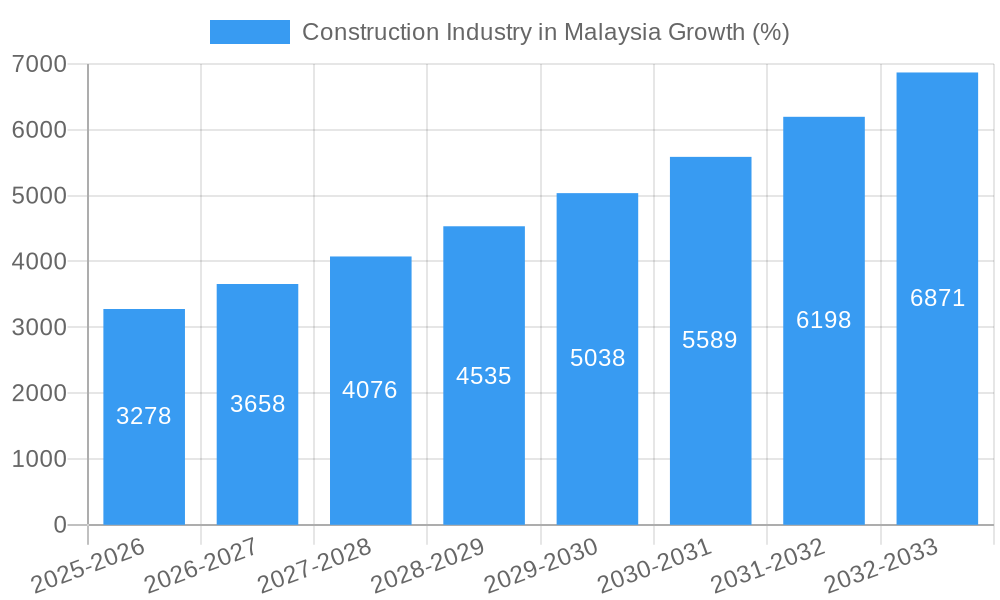

The Malaysian construction industry, valued at RM 38.55 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.55% from 2025 to 2033. This expansion is driven by several key factors. Government initiatives focused on infrastructure development, such as the ongoing expansion of transportation networks and the development of sustainable energy projects, significantly contribute to this growth. Furthermore, a growing population and increasing urbanization are fueling demand for residential and commercial construction. The rising middle class is also driving demand for better housing and commercial spaces. While challenges remain, such as fluctuations in material costs and the availability of skilled labor, the long-term outlook remains positive due to continuous government investment and a growing economy. The industry is segmented into commercial, residential, industrial, infrastructure (transportation), and energy and utilities construction, with further segmentation based on construction type: additions, demolition, and new construction. Major players like WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, and IJM Corporation Berhad are well-positioned to capitalize on this growth, although competition remains fierce. The forecast period from 2025-2033 indicates consistent expansion, promising significant opportunities for both established players and new entrants in the market.

The diversification of the construction sector into various segments offers resilience against economic shocks. While specific challenges like material sourcing and labor shortages need strategic management, the positive long-term outlook driven by strong government spending on infrastructure and a rising population makes the Malaysian construction industry an attractive investment prospect. Further growth is likely to be stimulated by the government's focus on sustainable development projects, encouraging environmentally friendly construction practices and technologies. This shift towards sustainability is expected to influence future investments and project selection, driving innovation and creating new market opportunities. Continued monitoring of economic indicators and government policies will be crucial in accurately forecasting future market trends and identifying potential investment risks.

Construction Industry in Malaysia: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Malaysian construction industry, encompassing market dynamics, growth trends, key players, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for industry professionals, investors, and stakeholders seeking a deep understanding of this dynamic sector. The report segments the market by sector (Commercial, Residential, Industrial, Infrastructure, Energy & Utilities) and construction type (Additions, Demolition, New Construction), providing granular insights into the various sub-markets.

Construction Industry in Malaysia Market Dynamics & Structure

The Malaysian construction industry is characterized by a moderately concentrated market, with a few large players dominating alongside numerous smaller firms. Technological innovation, while present, faces barriers such as limited adoption rates amongst smaller companies and a lack of skilled labor to implement new technologies. The regulatory framework, while generally supportive of growth, necessitates strict compliance, potentially slowing down project timelines. Substitute products are minimal, primarily involving alternative building materials with limited market penetration. End-user demographics are diverse, including both public and private sectors, impacting project types and funding sources. Mergers and acquisitions (M&A) activity remains moderate; in the period 2020-2024 we estimate xx M&A deals valued at approximately xx Million.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabrication technologies remains relatively low (estimated xx% in 2024).

- Regulatory Framework: Stringent regulations related to safety, sustainability, and procurement processes.

- Competitive Substitutes: Limited viable substitutes except for emerging sustainable building materials.

- End-User Demographics: Public sector projects (Infrastructure) represent a significant portion of the market, followed by private sector residential and commercial development.

- M&A Trends: Consolidation is expected to increase, driven by larger firms seeking to expand their market share.

Construction Industry in Malaysia Growth Trends & Insights

The Malaysian construction industry experienced fluctuating growth during the historical period (2019-2024), influenced by economic cycles and government spending patterns. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by government initiatives to improve infrastructure, increase affordable housing, and meet the demands of a growing population and economic activity. Technological disruptions, such as the adoption of advanced construction technologies and sustainable building practices, are slowly increasing, influencing market efficiencies and project timelines. Consumer behavior shifts are evident in increased demand for sustainable and smart buildings.

Dominant Regions, Countries, or Segments in Construction Industry in Malaysia

The Klang Valley region remains the dominant market, driven by high population density and significant infrastructure development projects. Within sectors, Infrastructure (Transportation) Construction displays strong growth potential, fueled by ongoing government investments in transportation networks. Residential construction, particularly affordable housing projects, also contributes significantly.

- Key Growth Drivers:

- Government infrastructure spending (e.g., MRT, LRT extensions).

- Increasing urbanization and population growth.

- Private sector investment in commercial and residential real estate.

- Government initiatives promoting sustainable building practices.

- Dominant Segments:

- Infrastructure (Transportation) Construction holds the largest market share, approximately xx% in 2024.

- Residential construction constitutes approximately xx% of the market.

- Commercial construction displays steady growth but smaller market share at xx%.

Construction Industry in Malaysia Product Landscape

The Malaysian construction industry is witnessing an increasing adoption of prefabricated building components, modular construction, and Building Information Modeling (BIM) technologies. These innovations improve efficiency, reduce construction time, and enhance quality control. Sustainable building materials and practices, including green building certifications like Green Building Index (GBI), are gaining popularity driven by government incentives and heightened environmental awareness. The unique selling propositions revolve around cost savings, improved sustainability, and enhanced project delivery times.

Key Drivers, Barriers & Challenges in Construction Industry in Malaysia

Key Drivers: Government investment in infrastructure projects, robust economic growth (prior to recent fluctuations), and supportive policies promoting sustainable development.

Key Challenges: Labor shortages, particularly skilled workers, rising material costs, and supply chain disruptions, impacting project timelines and costs. Stringent regulations and bureaucratic processes can also create delays. The impact of these challenges translates to approximately xx Million in lost revenue annually (estimated).

Emerging Opportunities in Construction Industry in Malaysia

Growing demand for sustainable and green buildings, coupled with government incentives, presents significant opportunities. The adoption of advanced technologies like BIM, prefabrication, and automation offers efficiency gains and cost reductions. Untapped markets exist in rural areas requiring improved infrastructure and housing.

Growth Accelerators in the Construction Industry in Malaysia Industry

Technological advancements, particularly in construction management software and automation, are significantly improving efficiency. Strategic partnerships between public and private entities, attracting both domestic and foreign investment, are catalyzing growth. Government initiatives focused on skills development and infrastructure development are crucial drivers for long-term growth.

Key Players Shaping the Construction Industry in Malaysia Market

- WCE Holdings Berhad

- WCT Holdings Berhad

- Hock Seng Lee Berhad

- YTL Corporation Berhad

- IJM Corporation Berhad

- Muhibbah Engineering (M) Bhd

- Malaysian Resources Corporation Berhad

- Gamuda Berhad

- Mudajaya Group Berhad

- UEM Group Berhad

Notable Milestones in Construction Industry in Malaysia Sector

- October 2023: Gamuda Bhd's joint venture secures a MYR 4 billion hydroelectric power plant project in Sabah, demonstrating the growing involvement of private sector investment in energy infrastructure.

- July 2023: IJM Corporation's foray into industrial property development marks diversification efforts and expansion into new market segments.

In-Depth Construction Industry in Malaysia Market Outlook

The Malaysian construction industry is poised for continued growth, driven by ongoing government investments and private sector participation. Strategic investments in technology, skills development, and sustainable practices will be crucial in realizing the sector's full potential. Opportunities abound in infrastructure development, affordable housing, and the growing demand for sustainable buildings. The long-term outlook remains positive, although challenges related to labor supply and material costs need to be actively addressed.

Construction Industry in Malaysia Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Construction

Construction Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition and New Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition and New Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition and New Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition and New Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition and New Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 WCE Holdings Berhad

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WCT Holdings Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hock Seng Lee Berhad

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 YTL Corporation Berhad

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IJM Corporation Berhad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Muhibbah Engineering (M) Bhd**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malaysian Resources Corporation Berhad

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gamuda Berhad

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mudajaya Group Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UEM Group Berhad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WCE Holdings Berhad

List of Figures

- Figure 1: Global Construction Industry in Malaysia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Malaysia Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 3: Malaysia Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 5: North America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 6: North America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 7: North America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 8: North America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 11: South America Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 12: South America Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 13: South America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 14: South America Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 17: Europe Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 18: Europe Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 19: Europe Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 20: Europe Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 23: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 24: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 25: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 26: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Sector 2024 & 2032

- Figure 29: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Sector 2024 & 2032

- Figure 30: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Construction Type 2024 & 2032

- Figure 31: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Construction Type 2024 & 2032

- Figure 32: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 4: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 7: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 8: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 13: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 14: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 19: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 20: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 31: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 32: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2019 & 2032

- Table 40: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 41: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Malaysia?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Construction Industry in Malaysia?

Key companies in the market include WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, YTL Corporation Berhad, IJM Corporation Berhad, Muhibbah Engineering (M) Bhd**List Not Exhaustive, Malaysian Resources Corporation Berhad, Gamuda Berhad, Mudajaya Group Berhad, UEM Group Berhad.

3. What are the main segments of the Construction Industry in Malaysia?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects.

6. What are the notable trends driving market growth?

Residential Construction Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023: Gamuda Bhd entered into a joint-venture agreement with Sabah Energy Corp Sdn Bhd (SEC) and Kerjaya Kagum Hitech JV Sdn Bhd (KKHJV) to undertake a private finance initiative for the development of the MYR 4 billion (USD 0.86 billion) 187.5 MW hydroelectric power plant in Tenom, Sabah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Construction Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence