Key Insights

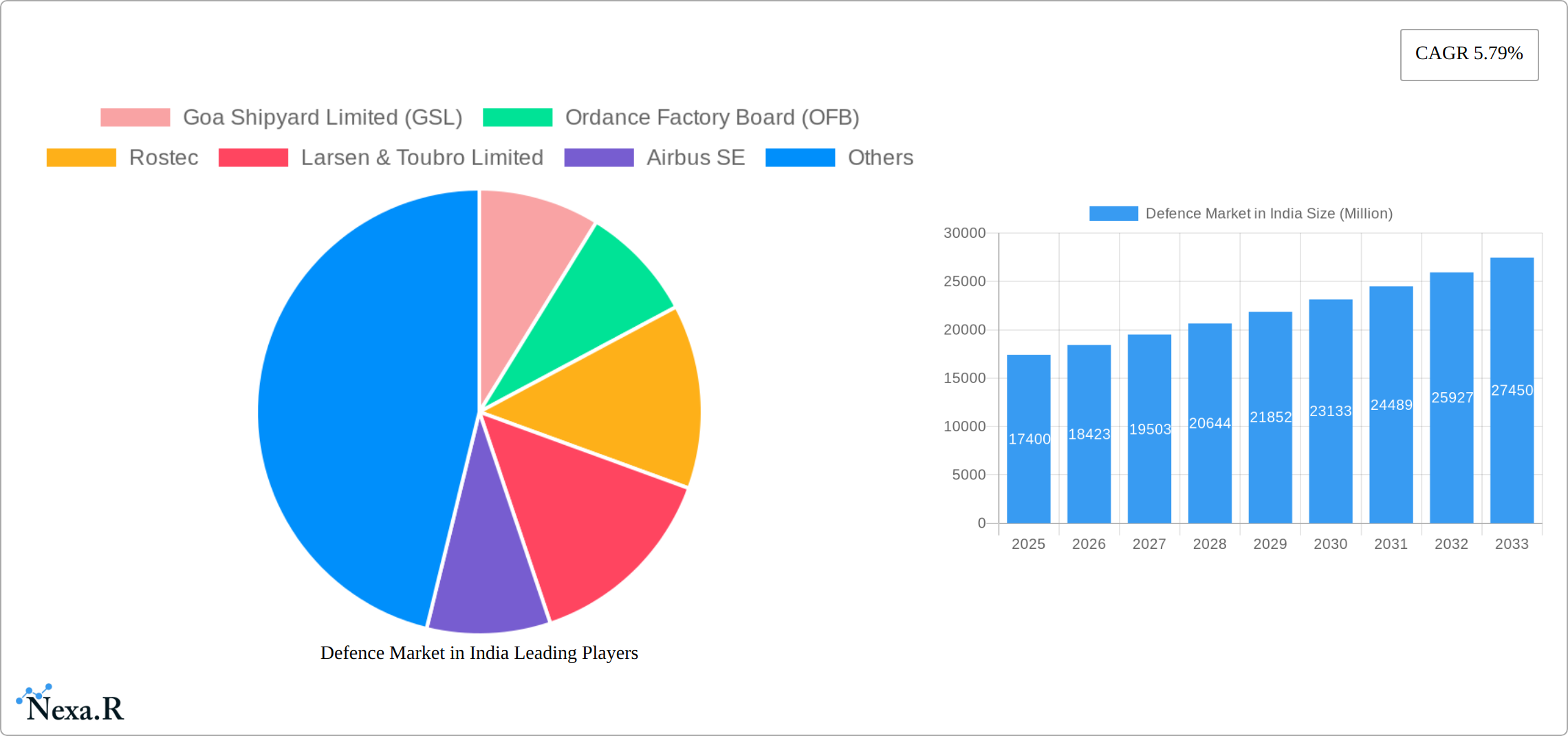

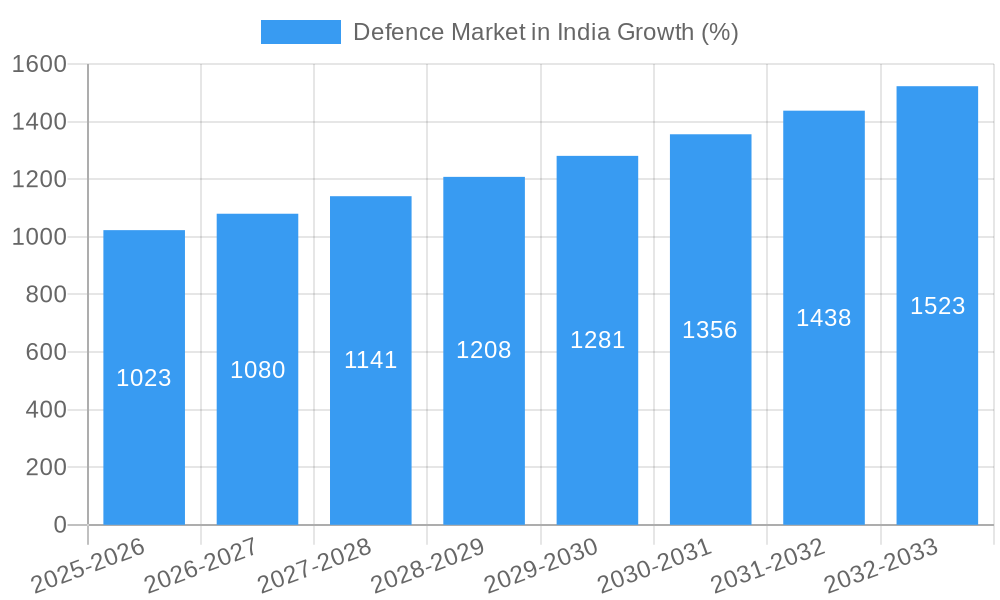

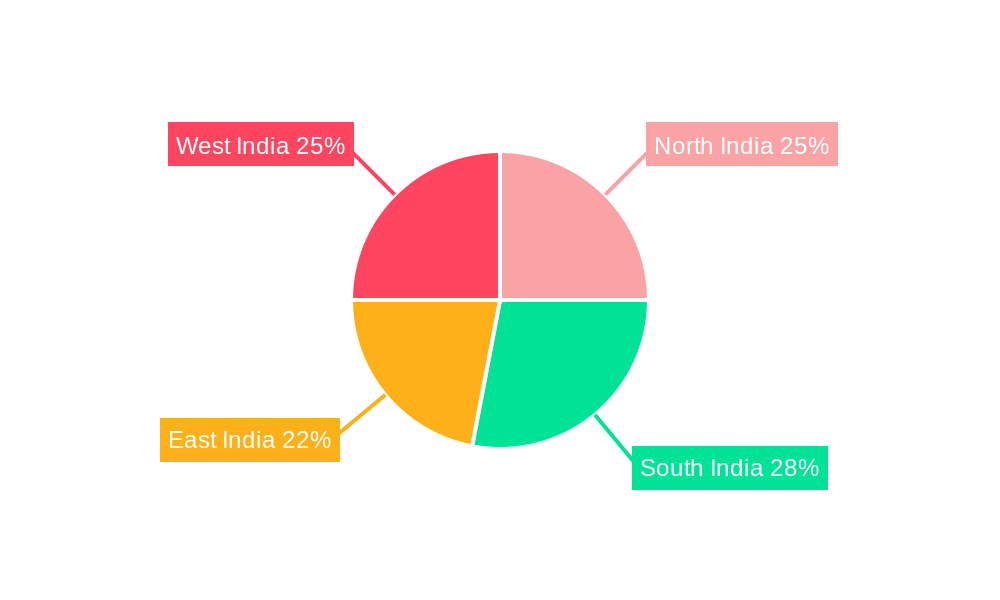

The Indian defense market, valued at approximately $17.4 billion in 2025, is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of 5.79% from 2025 to 2033. This expansion is driven by several key factors. Firstly, escalating geopolitical tensions and the need to modernize aging equipment are prompting significant investments in defense capabilities. Secondly, the government's emphasis on "Make in India" initiatives is stimulating domestic manufacturing and attracting foreign direct investment, fostering innovation and technological advancements within the sector. Thirdly, growing internal security concerns and cross-border threats are further fueling demand for advanced weaponry, surveillance systems, and protective equipment. The market is segmented across various product categories, including fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR systems, weapons and ammunition, protection and training equipment, and unmanned systems. Key players like HAL, BEL, Tata Sons, Larsen & Toubro, and foreign giants like Boeing and Airbus, alongside numerous domestic MSMEs, are actively competing in this dynamic landscape. Regional variations exist, with potential for uneven growth across North, South, East, and West India, reflecting varying levels of infrastructure development and defense requirements. Challenges include maintaining technological parity with global leaders, ensuring efficient resource allocation, and navigating complex regulatory frameworks.

The forecast period (2025-2033) presents opportunities for both domestic and international companies. Strategic partnerships, technological collaborations, and a focus on indigenization will be vital for success. The Indian government's commitment to enhancing defense capabilities, coupled with private sector investment and innovation, will continue to shape the market's trajectory. The expanding role of unmanned systems and the integration of advanced technologies like AI and cyber security solutions are particularly noteworthy trends influencing growth. The market is expected to witness a gradual shift towards increased procurement of technologically advanced, indigenous defense products, further solidifying India's self-reliance in the defense sector.

Defence Market in India: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indian defence market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and policymakers seeking to understand this dynamic sector. The report leverages extensive primary and secondary research to deliver actionable insights across various segments, including Armed Forces (Army, Navy, Air Force) and product types (Fixed-wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems). The total market size in 2025 is estimated at XX Million units.

Defence Market in India Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Indian defence industry. The market is characterized by a mix of domestic and international players, with varying degrees of market concentration across different segments. Government policies, indigenous development initiatives, and technological advancements significantly influence the market structure.

- Market Concentration: The Indian defence market exhibits moderate concentration, with a few dominant players alongside numerous smaller, specialized firms. The market share of the top 5 players is estimated at XX% in 2025.

- Technological Innovation: Technological advancements, particularly in areas like unmanned systems, C4ISR, and advanced weaponry, are key drivers. However, barriers to innovation include technology transfer restrictions, intellectual property concerns, and a need for greater R&D investment.

- Regulatory Framework: Stringent regulatory frameworks, including licensing requirements and import restrictions, shape the market dynamics and incentivize domestic production.

- Competitive Product Substitutes: Limited substitutability exists for many defence products due to their specialized nature and stringent quality requirements.

- End-User Demographics: The primary end-users are the Indian Armed Forces (Army, Navy, and Air Force), with their procurement strategies and budgetary allocations influencing market demand.

- M&A Trends: Consolidation through mergers and acquisitions is expected to increase, driven by the need for enhanced capabilities and economies of scale. The volume of M&A deals in the historical period (2019-2024) was approximately XX deals, with an estimated value of XX Million units.

Defence Market in India Growth Trends & Insights

The Indian defence market is experiencing robust growth fueled by increasing geopolitical tensions, modernization efforts by the armed forces, and government initiatives promoting indigenous defence manufacturing. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at XX%, driven by significant investments in upgrading military capabilities and enhancing technological preparedness. Market penetration for advanced technologies like Unmanned Aerial Vehicles (UAVs) and precision-guided munitions is steadily increasing, impacting overall market growth. Furthermore, evolving consumer behavior – a shift towards technologically superior and domestically produced systems – significantly affects the market landscape. This section explores the market size evolution, adoption rates of new technologies, and changing consumer preferences driving this growth. Specific details on CAGR, market penetration rates for key segments are detailed within the report.

Dominant Regions, Countries, or Segments in Defence Market in India

The Indian defence market's growth is not uniform across all regions and segments. Specific regions may experience higher growth rates due to increased military infrastructure development or focused government investment. Similarly, certain segments, such as C4ISR and unmanned systems, are experiencing faster growth than others.

- Key Drivers: Government spending on defence modernization, geopolitical factors, infrastructure development in specific regions, and policy support for domestic manufacturing are key drivers of regional dominance.

- Dominant Segments: The Air Force segment is anticipated to witness significant growth due to planned upgrades of its fighter fleet and investments in advanced technologies. Similarly, the Weapons and Ammunition segment will likely experience substantial growth due to increasing demand for modern weaponry and ammunition.

- Market Share and Growth Potential: Detailed market share and growth potential are analyzed for each segment, providing a clear picture of the market leaders and areas with high growth potential. The report provides a granular analysis of market share across regions and Armed Force branches.

Defence Market in India Product Landscape

The Indian defence product landscape is characterized by a diverse range of products, including fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR systems, weapons and ammunition, protection and training equipment, and unmanned systems. Significant innovations are evident in areas such as indigenous development of advanced fighter jets, the integration of AI in defence systems, and the introduction of advanced precision-guided munitions. The products are differentiated based on factors such as performance metrics, technological capabilities, and cost-effectiveness. The focus is increasingly on developing domestically produced systems with enhanced capabilities and greater technological sophistication.

Key Drivers, Barriers & Challenges in Defence Market in India

Key Drivers:

- Increased defence budget allocation by the Indian government.

- Growing geopolitical tensions and regional security concerns.

- Modernization and upgradation of the armed forces' capabilities.

- Government initiatives promoting domestic defence manufacturing ('Make in India').

Challenges and Restraints:

- Technology dependence on foreign suppliers.

- Supply chain vulnerabilities.

- Stringent regulatory hurdles and bureaucratic processes.

- Intense competition from both domestic and international players.

- The estimated cost of overcoming these challenges is XX Million units.

Emerging Opportunities in Defence Market in India

Emerging opportunities abound in the Indian defence market, particularly in areas such as:

- Growth in the private sector participation in defence manufacturing.

- Expansion of the unmanned systems market.

- Increased adoption of advanced technologies like AI and machine learning.

- Focus on cyber security and information warfare capabilities.

- Development of indigenous defence technologies and export potential.

Growth Accelerators in the Defence Market in India Industry

Long-term growth in the Indian defence market is driven by several factors: sustained government investment in defence modernization, strategic partnerships between domestic and international players, technological breakthroughs in areas such as hypersonics and AI-powered systems, and a push towards self-reliance in defence production.

Key Players Shaping the Defence Market in India Market

- Goa Shipyard Limited (GSL)

- Ordnance Factory Board (OFB)

- Rostec

- Larsen & Toubro Limited

- Airbus SE

- Kalyani Group

- The Boeing Company

- Tata Sons Private Limited

- Rafael Advanced Defense Systems Ltd

- Hindustan Aeronautics Limited (HAL)

- Hinduja Group

- Defence Research and Development Organisation (DRDO)

- IAI Group

- Mahindra & Mahindra Ltd

- Reliance Group

- Bharat Electronics Limited (BEL)

Notable Milestones in Defence Market in India Sector

- 2020: Launch of the indigenous LCA Tejas fighter jet.

- 2021: Signing of major defence deals with foreign partners.

- 2022: Increased focus on domestic manufacturing of key defence platforms.

- 2023: Successful testing of indigenous defence technologies.

- (Further milestones will be detailed in the full report)

In-Depth Defence Market in India Market Outlook

The future of the Indian defence market is bright, with strong growth potential driven by continued government investment, technological advancements, and a strategic focus on self-reliance. Opportunities exist across various segments, particularly in areas such as unmanned systems, C4ISR, and advanced weaponry. Strategic partnerships and collaborations will play a crucial role in driving innovation and shaping the future of the Indian defence industry. The market is poised for significant expansion over the forecast period, with substantial potential for both domestic and international players.

Defence Market in India Segmentation

-

1. Armed Forces

- 1.1. Army

- 1.2. Navy

- 1.3. Air Force

-

2. Type

- 2.1. Fixed-wing Aircraft

- 2.2. Rotorcraft

- 2.3. Ground Vehicles

- 2.4. Naval Vessels

- 2.5. C4ISR

- 2.6. Weapons and Ammunition

- 2.7. Protection and Training Equipment

- 2.8. Unmanned Systems

Defence Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Defence Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.79% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Army

- 5.1.2. Navy

- 5.1.3. Air Force

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed-wing Aircraft

- 5.2.2. Rotorcraft

- 5.2.3. Ground Vehicles

- 5.2.4. Naval Vessels

- 5.2.5. C4ISR

- 5.2.6. Weapons and Ammunition

- 5.2.7. Protection and Training Equipment

- 5.2.8. Unmanned Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. North America Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6.1.1. Army

- 6.1.2. Navy

- 6.1.3. Air Force

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fixed-wing Aircraft

- 6.2.2. Rotorcraft

- 6.2.3. Ground Vehicles

- 6.2.4. Naval Vessels

- 6.2.5. C4ISR

- 6.2.6. Weapons and Ammunition

- 6.2.7. Protection and Training Equipment

- 6.2.8. Unmanned Systems

- 6.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7. South America Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 7.1.1. Army

- 7.1.2. Navy

- 7.1.3. Air Force

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fixed-wing Aircraft

- 7.2.2. Rotorcraft

- 7.2.3. Ground Vehicles

- 7.2.4. Naval Vessels

- 7.2.5. C4ISR

- 7.2.6. Weapons and Ammunition

- 7.2.7. Protection and Training Equipment

- 7.2.8. Unmanned Systems

- 7.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8. Europe Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 8.1.1. Army

- 8.1.2. Navy

- 8.1.3. Air Force

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fixed-wing Aircraft

- 8.2.2. Rotorcraft

- 8.2.3. Ground Vehicles

- 8.2.4. Naval Vessels

- 8.2.5. C4ISR

- 8.2.6. Weapons and Ammunition

- 8.2.7. Protection and Training Equipment

- 8.2.8. Unmanned Systems

- 8.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9. Middle East & Africa Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 9.1.1. Army

- 9.1.2. Navy

- 9.1.3. Air Force

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fixed-wing Aircraft

- 9.2.2. Rotorcraft

- 9.2.3. Ground Vehicles

- 9.2.4. Naval Vessels

- 9.2.5. C4ISR

- 9.2.6. Weapons and Ammunition

- 9.2.7. Protection and Training Equipment

- 9.2.8. Unmanned Systems

- 9.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10. Asia Pacific Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 10.1.1. Army

- 10.1.2. Navy

- 10.1.3. Air Force

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fixed-wing Aircraft

- 10.2.2. Rotorcraft

- 10.2.3. Ground Vehicles

- 10.2.4. Naval Vessels

- 10.2.5. C4ISR

- 10.2.6. Weapons and Ammunition

- 10.2.7. Protection and Training Equipment

- 10.2.8. Unmanned Systems

- 10.1. Market Analysis, Insights and Forecast - by Armed Forces

- 11. North India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 12. South India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 13. East India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 14. West India Defence Market in India Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Goa Shipyard Limited (GSL)

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Ordance Factory Board (OFB)

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Rostec

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Larsen & Toubro Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Airbus SE

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Kalyani Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 The Boeing Compan

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Tata Sons Private Limited

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Rafael Advanced Defense Systems Ltd

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Hindustan Aeronautics Limited (HAL)

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Hinduja Group

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Defense Research and Development Organisation (DRDO)

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 IAI Group

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Mahindra & Mahindra Ltd

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Reliance Group

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.16 Bharat Electronics Limited (BEL)

- 15.2.16.1. Overview

- 15.2.16.2. Products

- 15.2.16.3. SWOT Analysis

- 15.2.16.4. Recent Developments

- 15.2.16.5. Financials (Based on Availability)

- 15.2.1 Goa Shipyard Limited (GSL)

List of Figures

- Figure 1: Global Defence Market in India Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 3: India Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 5: North America Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 6: North America Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 11: South America Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 12: South America Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 13: South America Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 17: Europe Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 18: Europe Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 23: Middle East & Africa Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 24: Middle East & Africa Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Defence Market in India Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Defence Market in India Revenue (Million), by Armed Forces 2024 & 2032

- Figure 29: Asia Pacific Defence Market in India Revenue Share (%), by Armed Forces 2024 & 2032

- Figure 30: Asia Pacific Defence Market in India Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Defence Market in India Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Defence Market in India Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Defence Market in India Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Defence Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Defence Market in India Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 11: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 17: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of South America Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 23: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 35: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Defence Market in India Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 44: Global Defence Market in India Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global Defence Market in India Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: ASEAN Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Oceania Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Asia Pacific Defence Market in India Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Defence Market in India?

The projected CAGR is approximately 5.79%.

2. Which companies are prominent players in the Defence Market in India?

Key companies in the market include Goa Shipyard Limited (GSL), Ordance Factory Board (OFB), Rostec, Larsen & Toubro Limited, Airbus SE, Kalyani Group, The Boeing Compan, Tata Sons Private Limited, Rafael Advanced Defense Systems Ltd, Hindustan Aeronautics Limited (HAL), Hinduja Group, Defense Research and Development Organisation (DRDO), IAI Group, Mahindra & Mahindra Ltd, Reliance Group, Bharat Electronics Limited (BEL).

3. What are the main segments of the Defence Market in India?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.40 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Defence Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Defence Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Defence Market in India?

To stay informed about further developments, trends, and reports in the Defence Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence