Key Insights

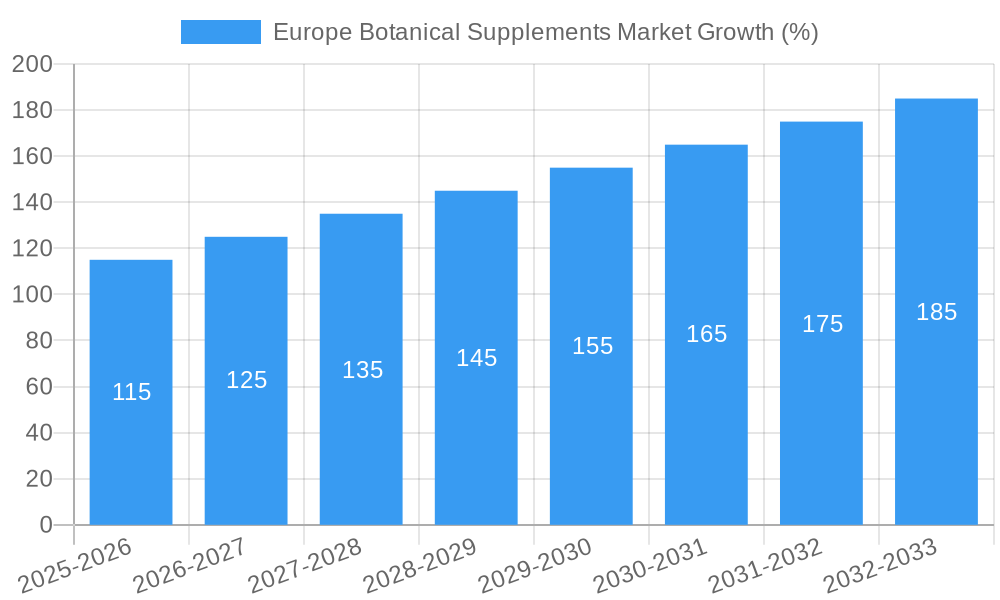

The European botanical supplements market, valued at approximately €XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 7.70% from 2025 to 2033. This growth is fueled by several key drivers. Increasing consumer awareness of the health benefits associated with natural and plant-based remedies is a significant factor, coupled with a rising preference for holistic and preventative healthcare approaches. The market is also benefiting from a growing number of health-conscious consumers seeking alternatives to synthetic pharmaceuticals. Furthermore, the expanding online retail sector facilitates easy access to a wide variety of botanical supplements, broadening market reach and driving sales. Key segments within the market include powder, capsules, and tablets, with online stores and pharmacies/drug stores as leading distribution channels. Germany, France, the UK, and Italy represent major markets within Europe, reflecting established consumer bases and healthcare infrastructure. However, regulatory hurdles and concerns surrounding product efficacy and standardization remain potential restraints to market expansion. Competition amongst established players like Whitewall GmbH, Himalaya Wellness Latvia SIA, and NOW Foods, along with emerging brands, is shaping market dynamics and driving innovation.

The forecast period (2025-2033) anticipates continued growth, driven by innovation in product formulations and delivery systems (e.g., functional foods incorporating botanical extracts). Companies are increasingly focusing on research and development to support the efficacy claims of their products, fostering consumer trust and market legitimacy. The market's future trajectory will be influenced by evolving consumer preferences, technological advancements, and the ongoing development of regulatory frameworks that balance innovation with consumer safety. Specific growth strategies within the market are likely to focus on targeted marketing campaigns to specific demographic groups interested in preventative health and wellness, strategic partnerships to expand distribution networks, and the development of innovative product lines that cater to specific health concerns. Regional variations in consumer preferences and regulatory landscapes will likely continue to influence the market's regional performance, with Germany and the UK remaining key growth areas.

Europe Botanical Supplements Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Botanical Supplements Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by form (powder, capsules, tablets, other forms) and distribution channel (supermarkets/hypermarkets, pharmacies/drug stores, online stores, other channels), providing a granular understanding of market dynamics. The total market size is projected to reach xx Million units by 2033.

Europe Botanical Supplements Market Dynamics & Structure

The European botanical supplements market is characterized by a moderately fragmented landscape, with a multitude of players ranging from large multinational corporations to smaller, specialized brands. Market concentration is relatively low, with no single dominant player commanding a significant majority share. Technological innovation plays a crucial role, driving the development of new extraction methods, formulation technologies, and delivery systems. Stringent regulatory frameworks, particularly concerning labeling, safety, and efficacy, influence market practices. The market witnesses considerable competitive pressure from synthetic vitamin and mineral supplements. End-user demographics are shifting towards an increasingly health-conscious and aging population, creating significant demand for botanical supplements with various health benefits. The market also experiences regular mergers and acquisitions (M&A) activity, with larger players strategically acquiring smaller companies to expand their product portfolios and market reach. Recent M&A activity has been characterized by xx deals in the last five years, resulting in a xx% increase in market consolidation.

- Market Concentration: Moderately fragmented

- Technological Innovation: Significant driver, focusing on extraction, formulation, and delivery.

- Regulatory Framework: Stringent, impacting labeling, safety, and efficacy.

- Competitive Substitutes: Synthetic vitamins and minerals.

- End-User Demographics: Aging population and increased health consciousness are key drivers.

- M&A Trends: Moderate activity, xx deals over the past 5 years leading to xx% increased consolidation.

- Innovation Barriers: High regulatory hurdles and cost of research and development.

Europe Botanical Supplements Market Growth Trends & Insights

The European botanical supplements market experienced significant growth during the historical period (2019-2024), driven by increasing consumer awareness of the benefits of natural health solutions. The market size in 2024 reached xx Million units. The adoption rate of botanical supplements has been steadily rising, particularly among health-conscious consumers and those seeking alternative or complementary therapies. Technological disruptions, such as advancements in extraction techniques and personalized supplement formulations, are further fueling market expansion. Consumer behavior shifts towards greater online purchasing and a preference for organic and sustainably sourced products are impacting market dynamics. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching a projected market size of xx Million units by 2033. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Europe Botanical Supplements Market

The German market currently holds the largest share of the European botanical supplements market, driven by high consumer spending on health and wellness products, strong regulatory frameworks, and a well-established distribution network. The United Kingdom and France also represent substantial markets, with significant growth potential in both regions. Within segments, capsules represent the largest form, owing to their convenience and ease of consumption, followed by tablets. Online stores are experiencing rapid growth as a distribution channel, driven by increased e-commerce adoption and convenience.

- Key Drivers (Germany): High consumer spending on health and wellness, robust regulatory environment, extensive distribution network.

- Key Drivers (UK & France): Growing health consciousness, increasing e-commerce adoption.

- Dominant Form: Capsules

- Fastest-Growing Channel: Online Stores

Europe Botanical Supplements Market Product Landscape

Product innovation in the European botanical supplements market is focused on enhancing efficacy, improving bioavailability, and developing novel delivery systems. Products are increasingly formulated with targeted health benefits, such as improved cognitive function, enhanced immune support, or stress reduction. The emphasis on natural and organic ingredients, sustainable sourcing, and transparency in labeling are key selling points. Technological advancements in extraction methods, such as supercritical CO2 extraction, are leading to higher-quality and more potent products. Unique selling propositions include patented formulations, clinically proven efficacy, and superior bioavailability.

Key Drivers, Barriers & Challenges in Europe Botanical Supplements Market

Key Drivers: Growing health awareness, increasing preference for natural health solutions, rise in chronic diseases, increasing demand for personalized health solutions, and advancements in extraction technologies.

Challenges: Stringent regulatory requirements, fluctuating raw material prices, counterfeiting concerns, and intense competition from established players and generic products. Supply chain disruptions due to geopolitical events can cause significant price volatility.

Emerging Opportunities in Europe Botanical Supplements Market

Emerging opportunities include the development of personalized botanical supplement formulations based on individual genetic and health needs, an increased focus on functional foods and beverages incorporating botanical extracts, and expanding into untapped markets within Eastern Europe. The growth of the vegan and vegetarian population is also creating new opportunities for plant-based supplement products. Furthermore, the development of novel delivery systems, such as liposomal encapsulation or sublingual sprays, offers significant potential.

Growth Accelerators in the Europe Botanical Supplements Market Industry

Long-term growth in the European botanical supplements market will be driven by technological advancements, strategic partnerships between supplement manufacturers and healthcare providers, and expansion into new markets. The increasing integration of technology into the supplement industry, such as AI-driven personalized recommendations and telemedicine platforms, will drive innovation and increase market penetration. Strategic collaborations with research institutions and clinical trials to further validate the efficacy and safety of botanical supplements will solidify market credibility. Expansion into underpenetrated Eastern European markets will open up significant growth opportunities.

Key Players Shaping the Europe Botanical Supplements Market Market

- Whitewall GmbH

- Hawlik

- Himalaya Wellness Latvia SIA

- NOW Foods

- Natures plus

- GNC Holdings

- Gaia Herbs Farm

- Zein Pharma

- Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC)

- KLAIRE LABS

Notable Milestones in Europe Botanical Supplements Market Sector

- August 2022: Stada's Natures Aid launches children's supplement range in the UK.

- May 2022: FutureCeuticals launches FruiteX-B mineral complex for joint health.

- March 2022: Cymbiotika launches e-commerce store in the UK.

In-Depth Europe Botanical Supplements Market Market Outlook

The future of the European botanical supplements market looks promising, driven by sustained growth in health awareness and the increasing adoption of natural health solutions. Strategic opportunities lie in developing personalized supplements, expanding into new markets, and leveraging technological advancements for enhanced product development and delivery. Continued innovation, strategic partnerships, and robust regulatory frameworks will be crucial in shaping the market’s future trajectory, unlocking significant growth potential in the coming years.

Europe Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powder

- 1.2. Capsules

- 1.3. Tablets

- 1.4. Other Forms

-

2. Distibution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Pharmacies/ Drug Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Europe Botanical Supplements Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Escalating Consumer Investment In Preventive Healthcare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powder

- 5.1.2. Capsules

- 5.1.3. Tablets

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Pharmacies/ Drug Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United Kingdom Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powder

- 6.1.2. Capsules

- 6.1.3. Tablets

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Pharmacies/ Drug Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Germany Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powder

- 7.1.2. Capsules

- 7.1.3. Tablets

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Pharmacies/ Drug Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Spain Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powder

- 8.1.2. Capsules

- 8.1.3. Tablets

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Pharmacies/ Drug Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. France Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Powder

- 9.1.2. Capsules

- 9.1.3. Tablets

- 9.1.4. Other Forms

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Pharmacies/ Drug Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Italy Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Powder

- 10.1.2. Capsules

- 10.1.3. Tablets

- 10.1.4. Other Forms

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Supermarkets and Hypermarkets

- 10.2.2. Pharmacies/ Drug Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Russia Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Powder

- 11.1.2. Capsules

- 11.1.3. Tablets

- 11.1.4. Other Forms

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. Supermarkets and Hypermarkets

- 11.2.2. Pharmacies/ Drug Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Rest of Europe Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Form

- 12.1.1. Powder

- 12.1.2. Capsules

- 12.1.3. Tablets

- 12.1.4. Other Forms

- 12.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 12.2.1. Supermarkets and Hypermarkets

- 12.2.2. Pharmacies/ Drug Stores

- 12.2.3. Online Stores

- 12.2.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Form

- 13. Germany Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Botanical Supplements Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Whitewall GmbH

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Hawlik

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Himalaya Wellness Latvia SIA

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 NOW Foods

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Natures plus

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 GNC Holdings

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Gaia Herbs Farm

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Zein Pharma

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )*List Not Exhaustive

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 KLAIRE LABS

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Whitewall GmbH

List of Figures

- Figure 1: Europe Botanical Supplements Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Botanical Supplements Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Botanical Supplements Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Europe Botanical Supplements Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Botanical Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 15: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 17: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 18: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 20: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 21: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 23: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 24: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 26: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 27: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 29: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 30: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Botanical Supplements Market Revenue Million Forecast, by Form 2019 & 2032

- Table 32: Europe Botanical Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 33: Europe Botanical Supplements Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Botanical Supplements Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the Europe Botanical Supplements Market?

Key companies in the market include Whitewall GmbH, Hawlik, Himalaya Wellness Latvia SIA, NOW Foods, Natures plus, GNC Holdings, Gaia Herbs Farm, Zein Pharma, Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )*List Not Exhaustive, KLAIRE LABS.

3. What are the main segments of the Europe Botanical Supplements Market?

The market segments include Form, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Escalating Consumer Investment In Preventive Healthcare Products.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In August 2022, Stada's Natures Aid subsidiary launched the children's supplement range in the United Kingdom. It adds a new, fun line of children's vitamin/mineral supplement (VMS) products to its portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the Europe Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence