Key Insights

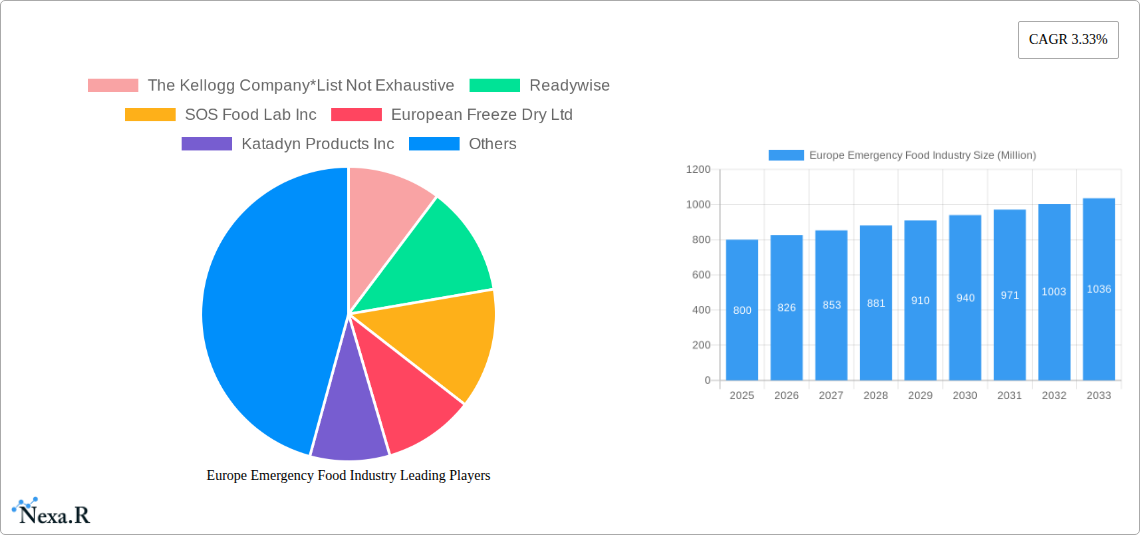

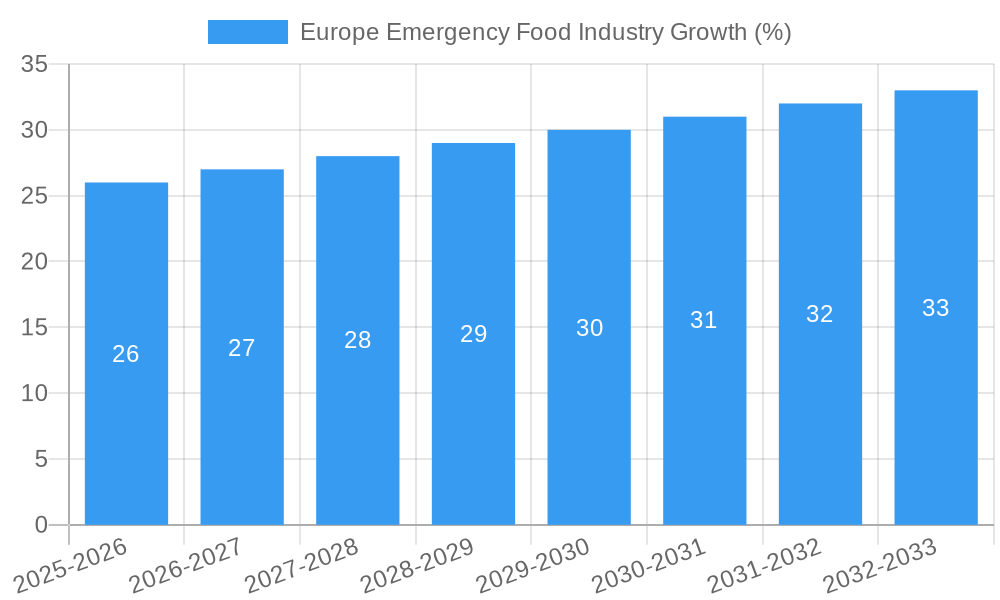

The European emergency food market, valued at approximately €800 million in 2025, is projected to experience steady growth, driven by increasing concerns about natural disasters, geopolitical instability, and the desire for enhanced preparedness among both consumers and governments. A compound annual growth rate (CAGR) of 3.33% from 2025 to 2033 indicates a market expansion fueled by several key factors. Rising consumer awareness of food security issues and the increasing popularity of long-shelf-life, nutritious emergency food supplies are major contributors. Furthermore, the growing popularity of outdoor activities, such as camping and hiking, and the increasing demand for convenient and ready-to-eat emergency meals are bolstering market growth. The market is segmented by product type, encompassing freeze-dried fruits and vegetables, freeze-dried ready meals, snack bars, canned juice, freeze-dried dairy, and freeze-dried meat. Freeze-dried ready meals and snack bars are anticipated to witness particularly robust growth due to their convenience and nutritional value. While the market faces some restraints, such as price sensitivity and potential challenges related to supply chain disruptions, the overall outlook remains positive, driven by a growing recognition of the importance of emergency preparedness.

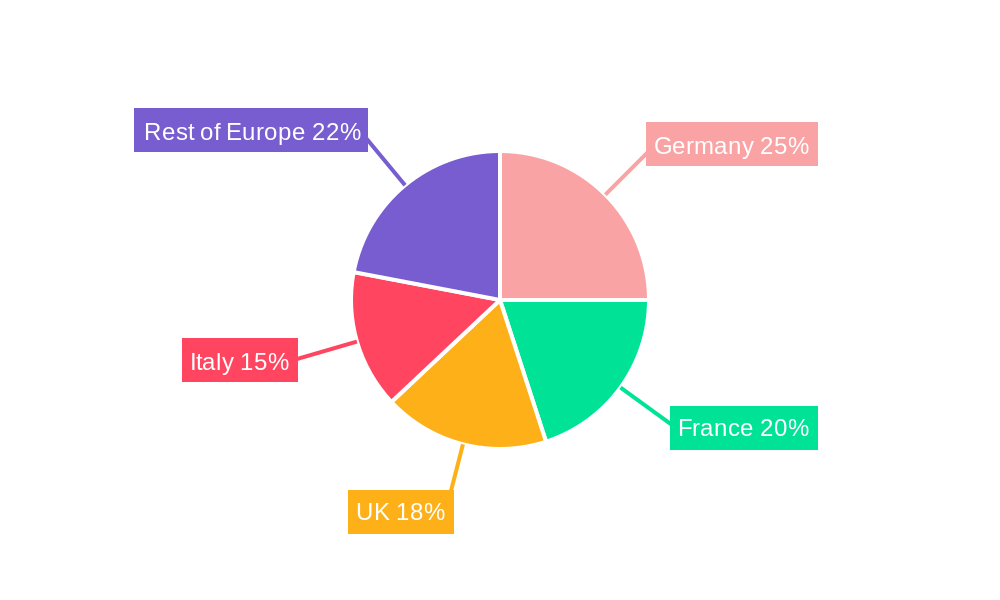

The key players in the European market, including established food companies like Kellogg’s and specialized providers such as Readywise and SOS Food Lab Inc., are continuously innovating to meet evolving consumer demands. The European market, particularly in countries like Germany, France, the United Kingdom, and Italy, shows significant potential. These countries are characterized by high levels of disposable income and a relatively high awareness of emergency preparedness. Future growth is expected to be further influenced by advancements in food preservation technologies, expanding distribution channels, and governmental initiatives promoting food security. The market's segment-wise growth will vary, with freeze-dried products potentially outpacing canned options due to their lighter weight and longer shelf life, aligning well with the demands of emergency situations. Government regulations and safety standards will continue to shape the industry's trajectory, driving demand for high-quality, safe, and reliable emergency food supplies across the region.

Europe Emergency Food Industry Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the Europe emergency food industry, providing critical insights for businesses, investors, and policymakers. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market dynamics, growth trends, key players, and future opportunities within this vital sector. The report segments the market by product type (Freeze-dried/Canned Fruits and Vegetables, Freeze-dried Ready Meals, Snack Bars, Canned Juice, Freeze-dried Dairy, Freeze-dried Meat), offering granular analysis to identify high-growth segments and lucrative investment prospects.

Keywords: Europe Emergency Food, Emergency Food Market, Freeze-dried Food Europe, Canned Food Europe, Survival Food, Disaster Relief Food, Ready-to-Eat Meals, Food Security, European Food Industry, Market Size, Market Share, Market Growth, CAGR, Market Analysis, Market Forecast, Competitive Landscape, Industry Trends.

Europe Emergency Food Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the European emergency food market, encompassing market concentration, technological advancements, regulatory environments, and key market trends. The analysis incorporates quantitative data on market share, mergers and acquisitions (M&A) activity, and qualitative insights regarding innovation barriers and competitive dynamics. We project a xx% market concentration in 2025, driven by the dominance of a few large players and regional variations.

- Market Concentration: xx% in 2025, with a predicted increase to xx% by 2033. This is influenced by consolidation through M&A activity and the emergence of specialized niche players.

- Technological Innovation: Focus on lightweight packaging, extended shelf life technologies (e.g., freeze-drying advancements), and improved nutritional content drives innovation. Barriers include high R&D costs and regulatory approvals.

- Regulatory Frameworks: EU food safety regulations and labeling requirements significantly impact product development and market access. Harmonization efforts across member states are influencing market consolidation.

- Competitive Product Substitutes: Traditional food preservation methods and alternative emergency food sources present competition. The market is increasingly differentiated by product quality, nutritional value, and convenience.

- End-User Demographics: The target demographic extends beyond disaster relief to encompass outdoor enthusiasts, military personnel, and preparedness-minded consumers. Changing lifestyles and increasing awareness of food security are key drivers.

- M&A Trends: The past five years have seen xx M&A deals in this sector, indicating a trend towards consolidation among key players. Strategic acquisitions target enhanced production capabilities, expanded product portfolios, and broadened distribution networks.

Europe Emergency Food Industry Growth Trends & Insights

This section presents a detailed analysis of the market size, adoption rates, technological disruptions, and shifts in consumer behavior within the European emergency food market. The analysis will leverage both primary and secondary research sources and will provide insights into historical performance (2019-2024), current market estimations (2025), and future projections (2025-2033). The market exhibited a CAGR of xx% during 2019-2024, and we forecast a CAGR of xx% from 2025 to 2033, with the market reaching a value of xx Million units by 2033. Key factors influencing growth include increasing consumer awareness of preparedness and changing consumer preferences favoring convenient, nutritious options. Technological innovation, particularly in shelf-life extension, plays a crucial role in driving market expansion.

Dominant Regions, Countries, or Segments in Europe Emergency Food Industry

This section pinpoints the leading regions, countries, and product segments driving market growth. Germany and France are predicted to represent the largest market share in 2025, driven by strong consumer demand and established distribution networks. The freeze-dried ready meals segment is expected to dominate the market in terms of value, fueled by convenience and longer shelf life.

Key Drivers:

- Strong Consumer Demand: Growing awareness of food security and emergency preparedness fuels demand.

- Established Distribution Networks: Well-established retail channels, including supermarkets and online retailers, facilitate market penetration.

- Government Initiatives: Government support for disaster preparedness programs encourages market growth.

Dominant Segments:

- Freeze-dried Ready Meals: Convenience and extended shelf life contribute to its high growth potential.

- Freeze-dried Fruits and Vegetables: High nutritional value and prolonged shelf life appeal to health-conscious consumers.

Europe Emergency Food Industry Product Landscape

The European emergency food market offers a diverse range of products, encompassing freeze-dried meals, canned goods, energy bars, and specialized survival kits. Product innovation focuses on enhancing nutritional value, improving taste and texture, and extending shelf life. Key trends include the development of lightweight, shelf-stable products suitable for various applications. Competition centers around delivering superior taste, nutrition, and convenience.

Key Drivers, Barriers & Challenges in Europe Emergency Food Industry

Key Drivers: Increasing consumer awareness of emergency preparedness, technological advancements in food preservation (e.g., improved freeze-drying methods), and government initiatives promoting food security.

Key Challenges and Restraints: Supply chain disruptions, fluctuating raw material prices, stringent regulatory hurdles for food safety and labeling, and intense competition among established players. The impact of these challenges is estimated to reduce the overall market growth by xx% in 2025.

Emerging Opportunities in Europe Emergency Food Industry

Emerging opportunities lie in the development of specialized products catering to niche markets (e.g., vegan options, allergen-free products). Expanding into online distribution channels and leveraging personalized marketing strategies can also open new avenues for growth. Furthermore, collaborations with disaster relief organizations can create mutually beneficial partnerships.

Growth Accelerators in the Europe Emergency Food Industry Industry

Long-term growth will be fueled by technological advancements in food preservation, strategic partnerships between food manufacturers and disaster relief organizations, and expansion into new geographical markets with emerging needs. Government investment in food security programs is also poised to significantly boost market growth.

Key Players Shaping the Europe Emergency Food Industry Market

- The Kellogg Company

- Readywise

- SOS Food Lab Inc

- European Freeze Dry Ltd

- Katadyn Products Inc

- Expedition Foods Limited

- Malton Foods Limited

- Melograno SRL

- Lyofood SP Z O O

Notable Milestones in Europe Emergency Food Industry Sector

- 2021: Introduction of a new freeze-drying technology by [Company Name], resulting in extended shelf life for emergency food products.

- 2022: A major merger between two key players [Company Name 1] and [Company Name 2] leads to increased market share.

- 2023: The EU implements stricter regulations on food labeling impacting the market.

In-Depth Europe Emergency Food Industry Market Outlook

The Europe emergency food industry is poised for significant growth over the forecast period (2025-2033), driven by escalating consumer awareness, technological breakthroughs, and a supportive regulatory environment. Strategic partnerships and innovations in product development will play a crucial role in shaping the industry's trajectory, creating exciting opportunities for industry stakeholders. The market is expected to reach xx Million units by 2033.

Europe Emergency Food Industry Segmentation

-

1. Product Type

- 1.1. Freeze-dried/Canned Fruits and Vegetables

- 1.2. Freeze-dried Ready Meals

- 1.3. Snack Bars

- 1.4. Canned Juice

- 1.5. Freeze-dried Dairy

- 1.6. Freeze-dried Meat

Europe Emergency Food Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe Emergency Food Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1. Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Freeze-dried/Canned Fruits and Vegetables

- 5.1.2. Freeze-dried Ready Meals

- 5.1.3. Snack Bars

- 5.1.4. Canned Juice

- 5.1.5. Freeze-dried Dairy

- 5.1.6. Freeze-dried Meat

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Russia

- 5.2.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Freeze-dried/Canned Fruits and Vegetables

- 6.1.2. Freeze-dried Ready Meals

- 6.1.3. Snack Bars

- 6.1.4. Canned Juice

- 6.1.5. Freeze-dried Dairy

- 6.1.6. Freeze-dried Meat

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Freeze-dried/Canned Fruits and Vegetables

- 7.1.2. Freeze-dried Ready Meals

- 7.1.3. Snack Bars

- 7.1.4. Canned Juice

- 7.1.5. Freeze-dried Dairy

- 7.1.6. Freeze-dried Meat

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Freeze-dried/Canned Fruits and Vegetables

- 8.1.2. Freeze-dried Ready Meals

- 8.1.3. Snack Bars

- 8.1.4. Canned Juice

- 8.1.5. Freeze-dried Dairy

- 8.1.6. Freeze-dried Meat

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Freeze-dried/Canned Fruits and Vegetables

- 9.1.2. Freeze-dried Ready Meals

- 9.1.3. Snack Bars

- 9.1.4. Canned Juice

- 9.1.5. Freeze-dried Dairy

- 9.1.6. Freeze-dried Meat

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Freeze-dried/Canned Fruits and Vegetables

- 10.1.2. Freeze-dried Ready Meals

- 10.1.3. Snack Bars

- 10.1.4. Canned Juice

- 10.1.5. Freeze-dried Dairy

- 10.1.6. Freeze-dried Meat

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Freeze-dried/Canned Fruits and Vegetables

- 11.1.2. Freeze-dried Ready Meals

- 11.1.3. Snack Bars

- 11.1.4. Canned Juice

- 11.1.5. Freeze-dried Dairy

- 11.1.6. Freeze-dried Meat

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Freeze-dried/Canned Fruits and Vegetables

- 12.1.2. Freeze-dried Ready Meals

- 12.1.3. Snack Bars

- 12.1.4. Canned Juice

- 12.1.5. Freeze-dried Dairy

- 12.1.6. Freeze-dried Meat

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Germany Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Emergency Food Industry Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 The Kellogg Company*List Not Exhaustive

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Readywise

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 SOS Food Lab Inc

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 European Freeze Dry Ltd

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Katadyn Products Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Expedition Foods Limited

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Malton Foods Limited

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Melograno SRL

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 Lyofood SP Z O O

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.1 The Kellogg Company*List Not Exhaustive

List of Figures

- Figure 1: Europe Emergency Food Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Emergency Food Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Emergency Food Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Emergency Food Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Europe Emergency Food Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Europe Emergency Food Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Emergency Food Industry?

The projected CAGR is approximately 3.33%.

2. Which companies are prominent players in the Europe Emergency Food Industry?

Key companies in the market include The Kellogg Company*List Not Exhaustive, Readywise, SOS Food Lab Inc, European Freeze Dry Ltd, Katadyn Products Inc, Expedition Foods Limited, Malton Foods Limited, Melograno SRL, Lyofood SP Z O O.

3. What are the main segments of the Europe Emergency Food Industry?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

Freeze-dried/Canned Fruits and Vegetables Holds the Largest Share in the Market.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Emergency Food Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Emergency Food Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Emergency Food Industry?

To stay informed about further developments, trends, and reports in the Europe Emergency Food Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence