Key Insights

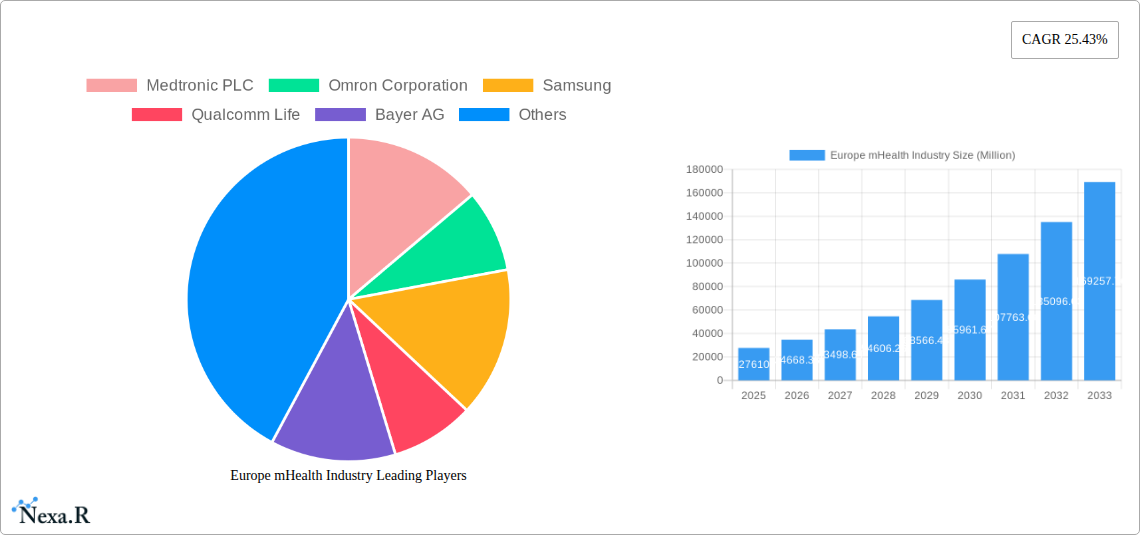

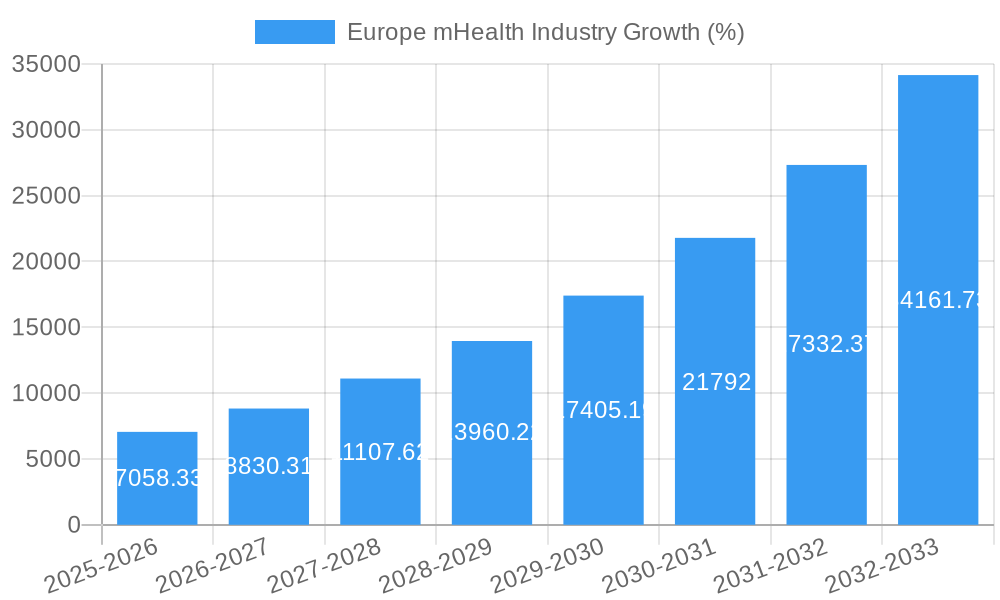

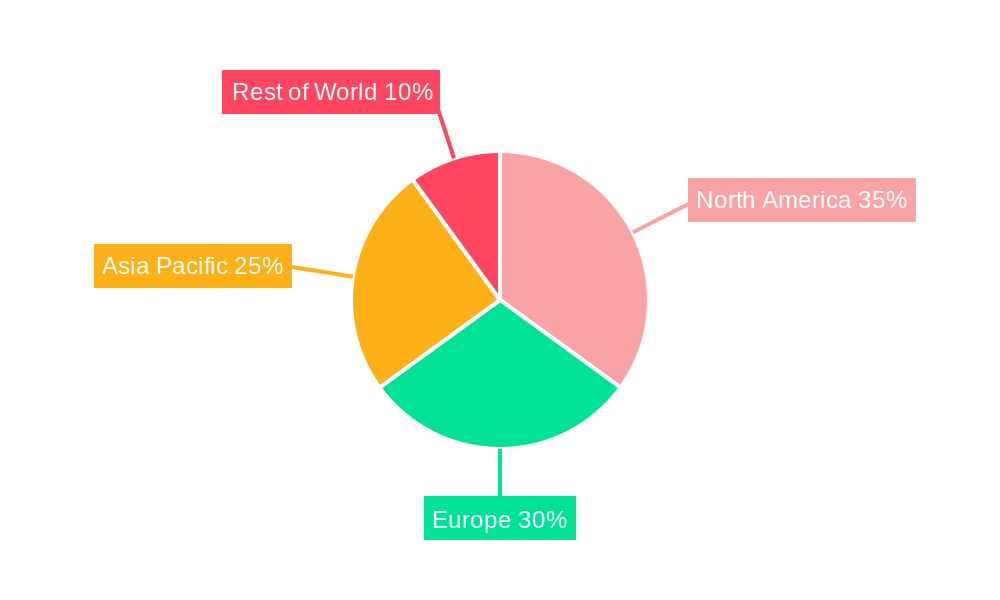

The European mHealth market, valued at €27.61 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 25.43% from 2025 to 2033. This surge is driven by several key factors. Increasing prevalence of chronic diseases like diabetes and heart conditions necessitates remote patient monitoring, fueling demand for mHealth devices and services. The rising adoption of smartphones and improved mobile internet penetration across Europe significantly contributes to market expansion, enabling wider access to telehealth platforms and applications. Furthermore, supportive government initiatives promoting digital healthcare and favorable reimbursement policies for telehealth services are accelerating market growth. The market is segmented by device type (blood glucose monitors, cardiac monitors, etc.), stakeholder (healthcare providers, mobile operators), and service type (monitoring, post-acute care, teleconsultation). Major players like Medtronic, Omron, Samsung, and Philips are actively shaping the market landscape through technological advancements and strategic partnerships. Germany, France, the UK, and Italy represent significant regional markets within Europe, collectively driving a substantial portion of the overall market value. While data privacy concerns and the need for robust cybersecurity infrastructure present challenges, the overall market trajectory indicates substantial growth potential throughout the forecast period.

The competitive landscape is characterized by a mix of established medical device manufacturers and technology companies. The integration of artificial intelligence (AI) and machine learning (ML) in mHealth applications is anticipated to enhance diagnostic accuracy and personalized treatment plans, further bolstering market growth. The increasing focus on preventative healthcare and the growing adoption of wearable health trackers contribute to the expanding market. However, challenges such as interoperability issues between different devices and platforms, along with concerns regarding data security and patient privacy, require careful consideration. The market's future growth will depend on addressing these challenges, fostering collaboration across the healthcare ecosystem, and ensuring widespread adoption of standardized mHealth solutions.

Europe mHealth Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European mHealth industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by device type, stakeholder, and service type, providing granular insights into this rapidly evolving sector. Expected market value in 2025 is estimated at xx Million.

Europe mHealth Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the European mHealth industry. The market is characterized by a moderate level of concentration, with key players like Medtronic PLC, Omron Corporation, and Philips constantly innovating. The report delves into the impact of regulatory frameworks like GDPR and CE marking on market growth and outlines the competitive dynamics of various mHealth solutions.

- Market Concentration: xx% market share held by the top 5 players in 2025.

- Technological Innovation: Significant advancements in AI, IoT, and data analytics are driving innovation. Barriers include data security concerns and interoperability challenges.

- Regulatory Frameworks: Stringent data privacy regulations and device approvals influence market access.

- Competitive Substitutes: Traditional healthcare services pose competition, but mHealth solutions offer convenience and cost-effectiveness.

- End-User Demographics: Aging population and rising chronic disease prevalence are key drivers.

- M&A Trends: An estimated xx M&A deals in the mHealth sector were observed between 2019-2024. Consolidation is expected to continue.

Europe mHealth Industry Growth Trends & Insights

The European mHealth market is experiencing robust growth, driven by increasing smartphone penetration, rising healthcare costs, and growing preference for remote patient monitoring. This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and shifts in consumer behavior. The report leverages proprietary data and industry insights to project a CAGR of xx% during the forecast period (2025-2033). Market penetration is expected to reach xx% by 2033. Key factors driving growth include increased telehealth adoption, government initiatives supporting digital health, and the development of sophisticated mobile health applications.

Dominant Regions, Countries, or Segments in Europe mHealth Industry

This section identifies the leading regions, countries, and segments within the European mHealth market. Germany, UK, and France are expected to dominate the market due to robust healthcare infrastructure and higher adoption rates. Within the segment breakdown:

By Device Type:

- Remote Patient Monitoring (RPM) Devices: This segment is expected to witness the highest growth, driven by increasing demand for chronic disease management.

- Blood Glucose Monitors: A mature segment with steady growth, benefiting from continuous technological advancements.

By Stakeholder:

- Healthcare Providers: This group is the largest stakeholder, driving adoption and investment in mHealth solutions.

- Mobile Operators: Significant players in providing network infrastructure and enabling connectivity.

By Service Type:

- Monitoring Services: A leading segment due to high demand for remote patient monitoring and chronic disease management.

- Teleconsultation: This segment is poised for significant growth, fueled by increasing patient preference and advancements in video conferencing technology.

Driving factors include government policies promoting digital health, strong investments from private equity firms, and the presence of a skilled workforce. Market share and growth potential are analyzed for each segment.

Europe mHealth Industry Product Landscape

The European mHealth market is characterized by a diverse range of innovative products, including advanced wearable sensors, sophisticated mobile apps, and cloud-based platforms for data analysis and remote patient management. These solutions offer features like real-time data monitoring, personalized health insights, and seamless integration with Electronic Health Records (EHRs). Technological advancements such as AI-powered diagnostics and improved data security are key features driving product differentiation. Unique selling propositions include ease of use, cost-effectiveness, and improved patient engagement.

Key Drivers, Barriers & Challenges in Europe mHealth Industry

Key Drivers:

- Increasing prevalence of chronic diseases.

- Growing demand for cost-effective healthcare solutions.

- Government initiatives promoting digital health.

- Technological advancements such as AI and IoT.

Key Barriers and Challenges:

- Data security and privacy concerns.

- Interoperability issues between different mHealth devices and platforms.

- Regulatory hurdles and varying approval processes across different European countries.

- Lack of widespread broadband access in certain regions. This impacts the usage of remote monitoring services. Estimated impact on market growth: xx% by 2033.

Emerging Opportunities in Europe mHealth Industry

- Expansion into underserved rural areas: Leveraging telehealth to improve access to healthcare in remote locations.

- Development of AI-powered diagnostic tools: Improving accuracy and efficiency of disease detection and management.

- Integration of mHealth with wearable technology: Providing more personalized and proactive healthcare solutions.

- Focus on mental health applications: Addressing the growing need for accessible mental health support.

Growth Accelerators in the Europe mHealth Industry

Strategic partnerships between healthcare providers, technology companies, and insurers are vital growth catalysts. Technological advancements, particularly in AI-powered diagnostics and personalized medicine, will drive innovation and market expansion. Government support through funding initiatives and regulatory reforms will play a crucial role in fostering growth. The expansion into new therapeutic areas and the integration of mHealth solutions into existing healthcare workflows will further accelerate market expansion.

Key Players Shaping the Europe mHealth Industry Market

- Medtronic PLC

- Omron Corporation

- Samsung

- Qualcomm Life

- Bayer AG

- Johnson & Johnson

- AT&T Inc

- Koninklijke Philips N V

- Cisco Systems Inc

Notable Milestones in Europe mHealth Industry Sector

- 2021-Q3: Launch of a new AI-powered diabetes management app by a leading mHealth company.

- 2022-Q1: Acquisition of a smaller telehealth company by a major pharmaceutical firm.

- 2023-Q2: Approval of a new remote patient monitoring device by a European regulatory body. (Further milestones can be added as they become available)

In-Depth Europe mHealth Industry Market Outlook

The European mHealth market holds significant long-term growth potential, driven by an aging population, rising healthcare costs, and continuous technological advancements. Strategic partnerships and further integration with existing healthcare systems will create new opportunities for market expansion. Focus on personalized medicine, preventative care, and improved data security will be crucial for sustainable growth. The market is expected to witness significant consolidation in the coming years, driven by acquisitions and mergers.

Europe mHealth Industry Segmentation

-

1. Service Type

- 1.1. Monitoring Services

- 1.2. Diagnostic Services

- 1.3. Treatment Services

- 1.4. Wellness and Fitness Solutions

- 1.5. Other Services

-

2. Device Type

- 2.1. Blood Glucose Monitors

- 2.2. Cardiac Monitors

- 2.3. Hemodynamic Monitors

- 2.4. Neurological Monitors

- 2.5. Respiratory Monitors

- 2.6. Body and Temperature Monitors

- 2.7. Remote Patient Monitoring Devices

- 2.8. Other Device Types

-

3. Stake Holder

- 3.1. Mobile Operators

- 3.2. Healthcare Providers

- 3.3. Application/Content Players

- 3.4. Other Stake Holders

Europe mHealth Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe mHealth Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in Use of Smartphones

- 3.2.2 Tablets; Increasing Focus on Personalized Medicine and Patient-Centered Approach; Increased Need of Point of Care Diagnosis and Treatment

- 3.3. Market Restrains

- 3.3.1. Data Security Issues; Stringent Regulatory Policies for mHealth Applications

- 3.4. Market Trends

- 3.4.1. Blood Glucose Monitors are Expected to Have the Largest Share in Device Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Monitoring Services

- 5.1.2. Diagnostic Services

- 5.1.3. Treatment Services

- 5.1.4. Wellness and Fitness Solutions

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Blood Glucose Monitors

- 5.2.2. Cardiac Monitors

- 5.2.3. Hemodynamic Monitors

- 5.2.4. Neurological Monitors

- 5.2.5. Respiratory Monitors

- 5.2.6. Body and Temperature Monitors

- 5.2.7. Remote Patient Monitoring Devices

- 5.2.8. Other Device Types

- 5.3. Market Analysis, Insights and Forecast - by Stake Holder

- 5.3.1. Mobile Operators

- 5.3.2. Healthcare Providers

- 5.3.3. Application/Content Players

- 5.3.4. Other Stake Holders

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Germany Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe mHealth Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Medtronic PLC

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Omron Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Qualcomm Life

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bayer AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Johnson & Johnson

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AT&T Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Koninklijke Philips N V

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cisco Systems Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Medtronic PLC

List of Figures

- Figure 1: Europe mHealth Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe mHealth Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe mHealth Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe mHealth Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe mHealth Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Europe mHealth Industry Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 5: Europe mHealth Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 6: Europe mHealth Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 7: Europe mHealth Industry Revenue Million Forecast, by Stake Holder 2019 & 2032

- Table 8: Europe mHealth Industry Volume K Unit Forecast, by Stake Holder 2019 & 2032

- Table 9: Europe mHealth Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe mHealth Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe mHealth Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe mHealth Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe mHealth Industry Revenue Million Forecast, by Service Type 2019 & 2032

- Table 28: Europe mHealth Industry Volume K Unit Forecast, by Service Type 2019 & 2032

- Table 29: Europe mHealth Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 30: Europe mHealth Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 31: Europe mHealth Industry Revenue Million Forecast, by Stake Holder 2019 & 2032

- Table 32: Europe mHealth Industry Volume K Unit Forecast, by Stake Holder 2019 & 2032

- Table 33: Europe mHealth Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe mHealth Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Germany Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Germany Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: United Kingdom Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: France Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Italy Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Italy Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Spain Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Europe mHealth Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Europe mHealth Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe mHealth Industry?

The projected CAGR is approximately 25.43%.

2. Which companies are prominent players in the Europe mHealth Industry?

Key companies in the market include Medtronic PLC, Omron Corporation, Samsung, Qualcomm Life, Bayer AG, Johnson & Johnson, AT&T Inc, Koninklijke Philips N V, Cisco Systems Inc.

3. What are the main segments of the Europe mHealth Industry?

The market segments include Service Type, Device Type, Stake Holder.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.61 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Use of Smartphones. Tablets; Increasing Focus on Personalized Medicine and Patient-Centered Approach; Increased Need of Point of Care Diagnosis and Treatment.

6. What are the notable trends driving market growth?

Blood Glucose Monitors are Expected to Have the Largest Share in Device Type Segment.

7. Are there any restraints impacting market growth?

Data Security Issues; Stringent Regulatory Policies for mHealth Applications.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe mHealth Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe mHealth Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe mHealth Industry?

To stay informed about further developments, trends, and reports in the Europe mHealth Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence