Key Insights

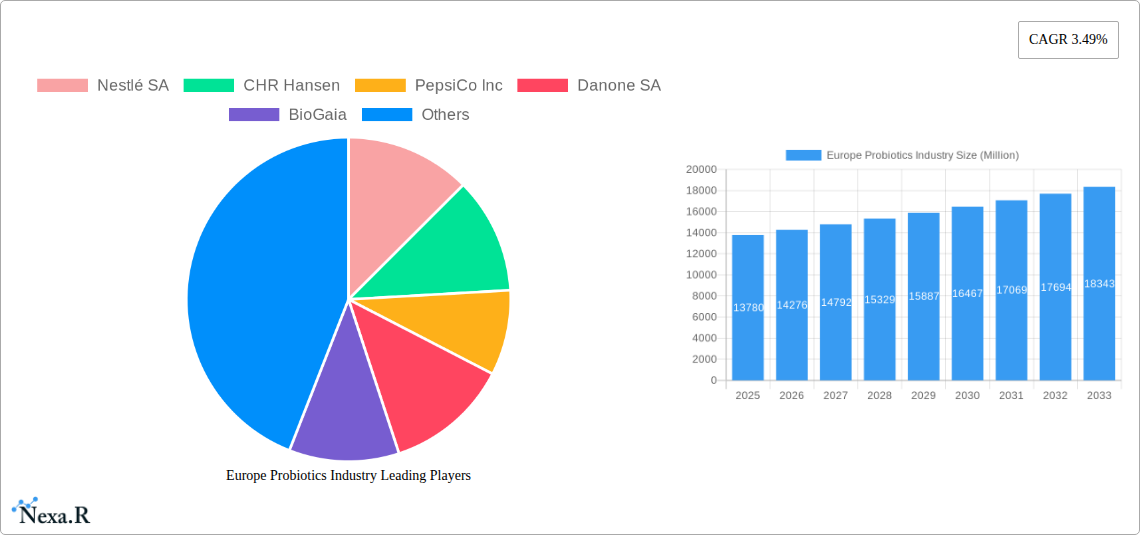

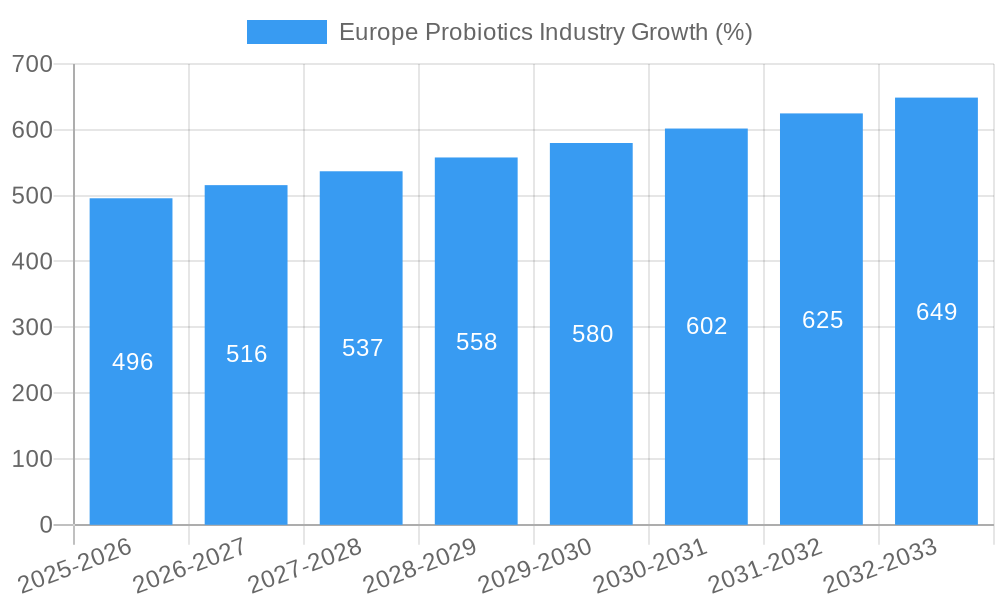

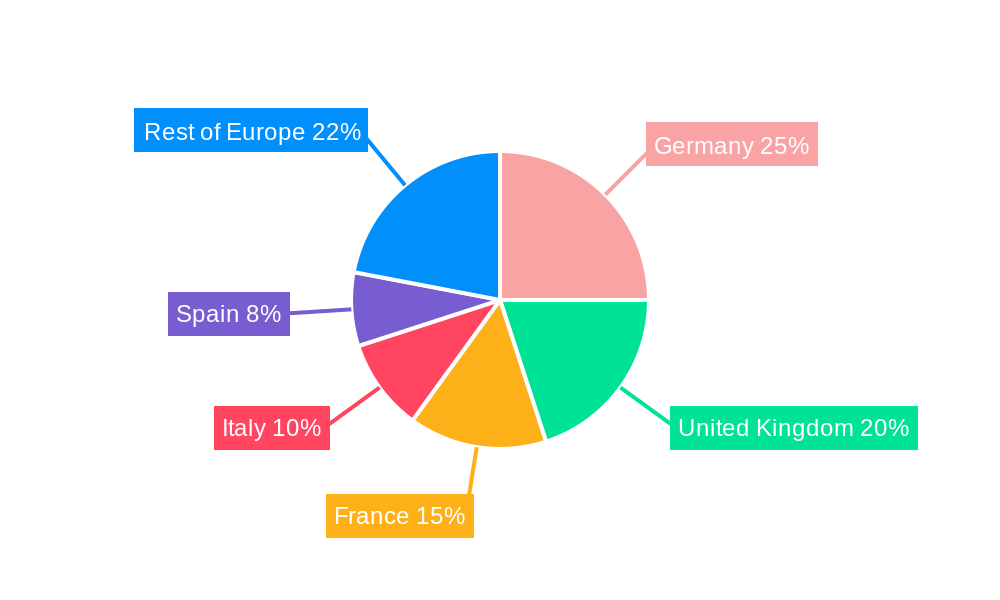

The European probiotics market, valued at €13.78 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.49% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of gut health and its connection to overall well-being is a significant factor, driving demand for probiotic-rich functional foods, dietary supplements, and even animal feed. The rising prevalence of digestive disorders and the growing adoption of preventative healthcare measures further contribute to market growth. Furthermore, the increasing availability of probiotics through diverse distribution channels, including supermarkets, pharmacies, and online retailers, enhances accessibility and market penetration. Germany, the United Kingdom, and France represent the largest national markets within Europe, benefiting from higher consumer spending power and a greater awareness of health and wellness trends. While the market faces potential restraints like stringent regulatory requirements and concerns about product efficacy and standardization, innovation in product formulations and delivery systems, along with a focus on scientifically-backed claims, are expected to mitigate these challenges and sustain market momentum.

The market segmentation reveals a diverse landscape. Functional foods and beverages dominate the product type segment, reflecting the growing integration of probiotics into everyday diets. Dietary supplements maintain a strong presence, catering to consumers seeking targeted gut health benefits. The distribution channel analysis indicates the dominance of supermarkets and hypermarkets, reflecting the convenience and accessibility of these channels. However, pharmacies and health stores continue to play a crucial role, leveraging their expertise in health and wellness advice to drive sales of high-quality probiotic products. The consistent CAGR suggests a stable and predictable growth trajectory, likely driven by consistent consumer demand and incremental advancements within the industry. Future growth will likely be supported by continued research highlighting the numerous benefits of probiotics, leading to increased consumer confidence and broader adoption. The competitive landscape features established multinational corporations alongside smaller, specialized companies, fostering innovation and expanding product offerings.

Europe Probiotics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe probiotics market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report utilizes data from 2019-2024 as the historical period, 2025 as the base year and estimated year, and 2025-2033 as the forecast period. Market values are presented in million units.

Europe Probiotics Industry Market Dynamics & Structure

The European probiotics market is a dynamic landscape shaped by factors such as increasing consumer health awareness, technological advancements in strain development, and stringent regulatory frameworks. Market concentration is moderate, with several key players holding significant shares, but also allowing room for smaller, specialized companies. Technological innovation, particularly in strain identification, formulation, and delivery systems, is a major driver. Regulatory changes impacting labeling, claims substantiation, and food safety standards significantly influence market activities. The market witnesses competitive pressure from substitute products like prebiotics and synbiotics. End-user demographics reveal a growing demand from health-conscious consumers across various age groups. M&A activity has been relatively frequent, with larger companies acquiring smaller firms to expand their product portfolios and geographic reach.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on personalized probiotics, targeted strain development, and enhanced stability.

- Regulatory Framework: Stringent regulations regarding labeling, claims, and safety standards vary across European countries.

- Competitive Substitutes: Prebiotics, synbiotics, and other functional foods pose competitive challenges.

- End-User Demographics: Growing demand from health-conscious consumers, particularly in the 25-55 age group.

- M&A Trends: Average of xx M&A deals annually in the historical period, driven by portfolio expansion and market consolidation.

Europe Probiotics Industry Growth Trends & Insights

The European probiotics market exhibited robust growth during the historical period (2019-2024), driven by rising health consciousness and increasing adoption of functional foods and dietary supplements. The market size expanded from xx million units in 2019 to xx million units in 2024, recording a CAGR of xx%. This growth is projected to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%, reaching xx million units by 2033. Technological disruptions, such as advancements in microencapsulation and targeted delivery systems, are accelerating market expansion. Changing consumer behaviour, including increasing demand for personalized nutrition and convenient formats, fuels this growth. Market penetration remains relatively low in certain segments and countries, presenting significant future growth opportunities.

Dominant Regions, Countries, or Segments in Europe Probiotics Industry

Germany, the United Kingdom, and France constitute the largest national markets within Europe, driven by high consumer awareness, robust healthcare infrastructure, and significant market penetration by key players. Within product types, functional food and beverages dominate, followed by dietary supplements. Supermarkets/hypermarkets are the primary distribution channel, offering broad consumer reach.

- Leading Region: Western Europe (Germany, UK, France) accounts for xx% of the total market value in 2024.

- Leading Country: Germany holds the largest market share due to high per capita consumption and a well-established health and wellness sector.

- Leading Product Type: Functional food and beverage segment accounts for xx% of the total market in 2024.

- Leading Distribution Channel: Supermarkets/hypermarkets capture the largest market share in 2024.

- Growth Drivers: High disposable incomes, increased health awareness, and supportive regulatory environment.

Europe Probiotics Industry Product Landscape

The European probiotics market offers a diverse range of products catering to various health needs. Products are differentiated based on bacterial strains, targeted health benefits (digestive health, immune support, skin health), and delivery formats (capsules, powders, drinks). Innovation focuses on improving strain stability, enhancing bioavailability, and developing personalized probiotic solutions using advanced technologies like microbiome profiling and AI-driven strain selection. Unique selling propositions include clinically validated efficacy, specific strain combinations, and sustainable production methods.

Key Drivers, Barriers & Challenges in Europe Probiotics Industry

Key Drivers: Rising consumer awareness regarding gut health, increasing demand for natural health solutions, and the growing prevalence of chronic diseases contribute to market growth. Technological advancements in strain development and delivery systems also fuel innovation. Favorable government regulations supporting the functional food industry contribute positively to the market.

Key Barriers & Challenges: Stringent regulatory approvals for novel strains, price sensitivity among consumers, and the need for robust clinical evidence to support health claims pose challenges. Supply chain disruptions, particularly related to raw materials and manufacturing, have caused occasional market instability. Intense competition among established and emerging players also influences market dynamics.

Emerging Opportunities in Europe Probiotics Industry

Untapped markets in Eastern Europe, personalized probiotic solutions tailored to specific individual needs and microbiome profiles, and the increasing integration of probiotics into various food and beverage categories present substantial opportunities. The development of novel probiotic strains with targeted health benefits, including skin and mental health applications, is opening new growth avenues. Evolving consumer preferences toward sustainable and ethically sourced products are also shaping market trends.

Growth Accelerators in the Europe Probiotics Industry

Technological advancements in strain engineering, formulation, and delivery systems are driving long-term growth. Strategic partnerships between probiotics manufacturers and food and beverage companies are accelerating market penetration. Expansion into new geographic markets, especially in Eastern Europe and developing countries, will significantly contribute to future market growth.

Key Players Shaping the Europe Probiotics Industry Market

- Nestlé SA

- CHR Hansen

- PepsiCo Inc

- Danone SA

- BioGaia

- Lifeway Foods Inc

- Archer Daniels Midland

- Yakult Honsha

- Daflorn MLM5 Ltd

- Bio-K Plus International Inc

Notable Milestones in Europe Probiotics Industry Sector

- September 2022: BioGaia partners with Skinome to develop a skin health probiotic concentrate.

- August 2022: BioGaia expands its product line with new bacterial strains and opens a fermentation pilot plant.

- February 2021: Perrigo and Probi launch a pan-European agreement for premium probiotic products.

In-Depth Europe Probiotics Industry Market Outlook

The European probiotics market is poised for significant growth driven by escalating consumer health awareness, technological innovation, and strategic collaborations. The expanding product portfolio, coupled with increased market penetration in untapped regions, presents substantial opportunities for growth. Strategic investments in R&D, targeted marketing, and robust regulatory compliance will be crucial for success in this dynamic and competitive market.

Europe Probiotics Industry Segmentation

-

1. Product Type

- 1.1. Functional Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

Europe Probiotics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Probiotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CHR Hansen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danone SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BioGaia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lifeway Foods Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yakult Honsha

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Daflorn MLM5 Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bio-K Plus International Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Europe Probiotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Probiotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Probiotics Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Europe Probiotics Industry?

Key companies in the market include Nestlé SA, CHR Hansen, PepsiCo Inc, Danone SA, BioGaia, Lifeway Foods Inc *List Not Exhaustive, Archer Daniels Midland, Yakult Honsha, Daflorn MLM5 Ltd, Bio-K Plus International Inc.

3. What are the main segments of the Europe Probiotics Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Probiotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Probiotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Probiotics Industry?

To stay informed about further developments, trends, and reports in the Europe Probiotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence