Key Insights

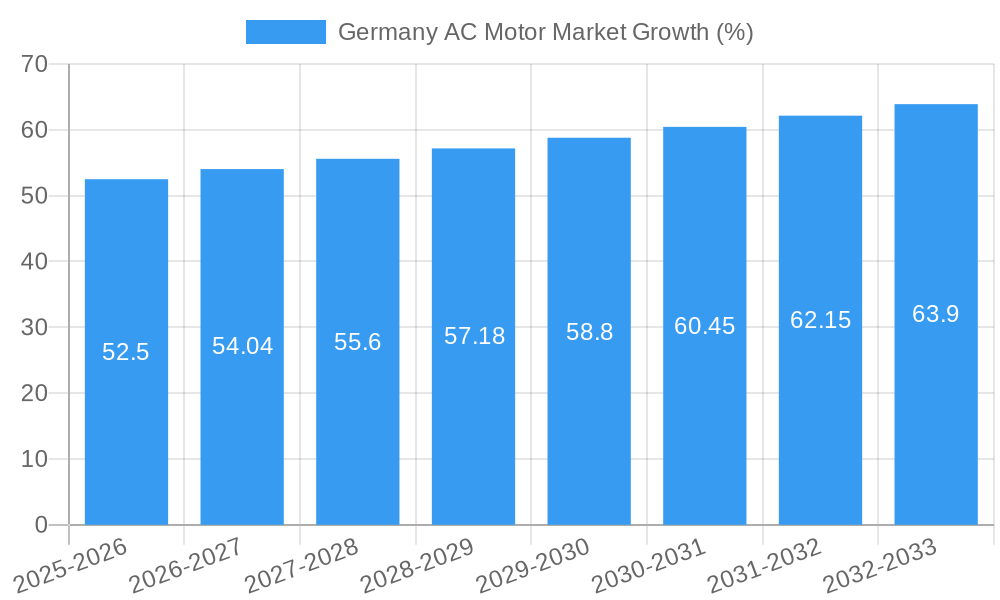

The German AC motor market, valued at approximately €1.5 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 3.50% from 2025 to 2033. This growth is fueled by several key drivers. The increasing automation across various industries, particularly manufacturing and automotive, necessitates a high demand for efficient and reliable AC motors. Furthermore, government initiatives promoting energy efficiency and the adoption of renewable energy sources are stimulating the demand for high-performance, energy-saving AC motors. Technological advancements in motor design, incorporating features like improved power density and enhanced control systems, further contribute to market expansion. However, the market faces some restraints, including fluctuating raw material prices and potential supply chain disruptions. Despite these challenges, the ongoing trend towards Industry 4.0 and smart manufacturing will continue to drive market growth. The market segmentation is likely diverse, encompassing various motor types (e.g., induction motors, synchronous motors, servo motors) and power ratings, catering to a broad range of applications. Key players like ABB, Siemens, and Nidec are expected to maintain their market leadership through continuous innovation and strategic partnerships.

The forecast period (2025-2033) suggests a significant expansion of the German AC motor market. Growth will be particularly driven by the increasing integration of AC motors in electric vehicles, robotics, and industrial machinery. The presence of established manufacturing giants in Germany, coupled with ongoing investment in research and development, ensures a competitive landscape and continuous innovation within the sector. While challenges related to raw material costs and global economic uncertainty exist, the long-term outlook for the German AC motor market remains positive, indicating sustained growth and opportunities for market participants.

Germany AC Motor Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany AC motor market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period extending to 2033. The market size is presented in million units.

Germany AC Motor Market Dynamics & Structure

The German AC motor market, a vital component of the broader European industrial automation sector, exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is relatively high, with several major players dominating the landscape. Technological innovation, particularly in energy efficiency and smart motor technologies, is a key driver, fueled by stringent environmental regulations and the growing adoption of Industry 4.0 principles. The regulatory framework, encompassing energy efficiency standards and safety regulations, significantly impacts market development. Competitive pressures from alternative technologies, such as servo motors and brushless DC motors, pose ongoing challenges. End-user demographics, predominantly concentrated in the automotive, manufacturing, and renewable energy sectors, shape market demand. The market has witnessed a moderate level of M&A activity in recent years, with strategic acquisitions aiming to enhance technological capabilities and expand market reach.

- Market Concentration: High, with top 5 players holding xx% market share (2024).

- Technological Innovation: Strong focus on energy-efficient motors, smart motors, and digitalization.

- Regulatory Framework: Stringent energy efficiency standards and safety regulations drive market development.

- Competitive Substitutes: Servo motors and brushless DC motors present competition.

- End-User Demographics: Primarily automotive, manufacturing, and renewable energy sectors.

- M&A Activity: Moderate activity focused on technological advancement and market expansion. xx M&A deals recorded in the last 5 years.

Germany AC Motor Market Growth Trends & Insights

The German AC motor market experienced steady growth during the historical period (2019-2024), driven by robust industrial activity and investments in infrastructure modernization. The market size reached xx million units in 2024. Adoption rates for energy-efficient motors and smart motor technologies are increasing, spurred by rising energy costs and the need for improved operational efficiency. Technological disruptions, including the emergence of advanced control systems and the integration of IoT capabilities, are transforming the market landscape. Consumer behavior shifts, focused on sustainability and operational efficiency, are further influencing demand. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by continued industrialization, government support for renewable energy, and technological advancements. Market penetration of high-efficiency motors is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Germany AC Motor Market

The German AC motor market demonstrates relatively even distribution across its major regions. However, the automotive manufacturing hub in Southern Germany exhibits strong demand, driven by high production volumes and automation investments in the automotive industry. The robust manufacturing sector across the country contributes significantly to overall demand. The renewable energy sector, particularly in areas with high wind and solar capacity, also fuels significant demand for specific AC motor types.

- Key Drivers: Strong automotive manufacturing sector, robust industrial base, and expanding renewable energy infrastructure.

- Dominance Factors: High industrial output, government incentives for energy efficiency, and technological advancements.

- Growth Potential: Continued growth driven by automation within various sectors and the rise of renewable energy.

Germany AC Motor Market Product Landscape

The German AC motor market offers a diverse product range, encompassing induction motors, synchronous motors, and specialized motors for various applications. Recent innovations focus on improved energy efficiency, compact designs, and advanced control capabilities. Key performance metrics include efficiency ratings, power output, operating temperature, and lifespan. Unique selling propositions include enhanced reliability, reduced maintenance requirements, and seamless integration with smart factory systems. Technological advancements encompass the adoption of high-performance materials, advanced cooling techniques, and integrated sensor technology.

Key Drivers, Barriers & Challenges in Germany AC Motor Market

Key Drivers:

- Increasing automation across various industrial sectors.

- Government initiatives promoting energy efficiency and renewable energy.

- Growing demand for high-performance and specialized AC motors.

Challenges & Restraints:

- Supply chain disruptions impacting the availability of raw materials and components. Estimated impact on production: xx% in 2023.

- Intense competition from both domestic and international manufacturers.

- Rising costs of raw materials and energy impacting production costs.

Emerging Opportunities in Germany AC Motor Market

- Growing adoption of electric vehicles (EVs) is creating new opportunities for specialized AC motors.

- Expanding renewable energy sector offers opportunities for high-efficiency motors in wind turbines and solar power systems.

- Increased demand for smart motors and IoT-enabled solutions presents significant growth prospects.

Growth Accelerators in the Germany AC Motor Market Industry

Technological breakthroughs, particularly in energy efficiency and smart motor technologies, are key growth catalysts. Strategic partnerships between motor manufacturers and automation providers are enhancing market reach and product integration. Expansion into new applications, such as robotics and autonomous systems, is widening the market potential.

Key Players Shaping the Germany AC Motor Market Market

- ABB Ltd

- Siemens AG

- Nidec Corporation

- WEG Germany GmbH

- Johnson Electric Holdings Limited

- Fuji Electric Co Ltd

- TECO Electric Europe Ltd

- MENZEL Elektromotoren GmbH

- Dunkermotoren

Notable Milestones in Germany AC Motor Market Sector

- July 2023: Siemens AG launched Innomotics, combining its geared motors, converters, and motor spindles businesses, enhancing its market position.

- June 2023: ABB Ltd introduced the AMI 5800 NEMA modular induction motor, boosting its offerings in energy-efficient motor solutions.

In-Depth Germany AC Motor Market Outlook

The German AC motor market is poised for continued growth, driven by advancements in energy efficiency, smart technologies, and the expansion of key end-user sectors. Strategic collaborations, investments in R&D, and focus on sustainable solutions will play crucial roles in shaping the future market landscape. The market presents significant opportunities for manufacturers who can leverage technological innovations, cater to evolving customer needs, and navigate supply chain challenges effectively.

Germany AC Motor Market Segmentation

-

1. Induction AC Motors

- 1.1. Single Phase

- 1.2. Poly Phase

-

2. Synchronous AC Motors

- 2.1. DC Excited Rotor

- 2.2. Permanent Magnet

- 2.3. Hysteresis Motor

- 2.4. Reluctance Motor

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical and Petrochemical

- 3.3. Power Generation

- 3.4. Water and Wastewater

- 3.5. Metal and Mining

- 3.6. Food and Beverage

- 3.7. Discrete Industries

- 3.8. Other End-user Industries

Germany AC Motor Market Segmentation By Geography

- 1. Germany

Germany AC Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Manufacturing Sector in Germany Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations

- 3.3. Market Restrains

- 3.3.1. The Growing Manufacturing Sector in Germany Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations

- 3.4. Market Trends

- 3.4.1. Induction Motors Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany AC Motor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Induction AC Motors

- 5.1.1. Single Phase

- 5.1.2. Poly Phase

- 5.2. Market Analysis, Insights and Forecast - by Synchronous AC Motors

- 5.2.1. DC Excited Rotor

- 5.2.2. Permanent Magnet

- 5.2.3. Hysteresis Motor

- 5.2.4. Reluctance Motor

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Power Generation

- 5.3.4. Water and Wastewater

- 5.3.5. Metal and Mining

- 5.3.6. Food and Beverage

- 5.3.7. Discrete Industries

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Induction AC Motors

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siemens AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nidec Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WEG Germany GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fuji Electric Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TECO Electric Europe Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MENZEL Elektromotoren GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dunkermotoren*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Germany AC Motor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany AC Motor Market Share (%) by Company 2024

List of Tables

- Table 1: Germany AC Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany AC Motor Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany AC Motor Market Revenue Million Forecast, by Induction AC Motors 2019 & 2032

- Table 4: Germany AC Motor Market Volume Billion Forecast, by Induction AC Motors 2019 & 2032

- Table 5: Germany AC Motor Market Revenue Million Forecast, by Synchronous AC Motors 2019 & 2032

- Table 6: Germany AC Motor Market Volume Billion Forecast, by Synchronous AC Motors 2019 & 2032

- Table 7: Germany AC Motor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Germany AC Motor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Germany AC Motor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Germany AC Motor Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Germany AC Motor Market Revenue Million Forecast, by Induction AC Motors 2019 & 2032

- Table 12: Germany AC Motor Market Volume Billion Forecast, by Induction AC Motors 2019 & 2032

- Table 13: Germany AC Motor Market Revenue Million Forecast, by Synchronous AC Motors 2019 & 2032

- Table 14: Germany AC Motor Market Volume Billion Forecast, by Synchronous AC Motors 2019 & 2032

- Table 15: Germany AC Motor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Germany AC Motor Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Germany AC Motor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany AC Motor Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany AC Motor Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Germany AC Motor Market?

Key companies in the market include ABB Ltd, Siemens AG, Nidec Corporation, WEG Germany GmbH, Johnson Electric Holdings Limited, Fuji Electric Co Ltd, TECO Electric Europe Ltd, MENZEL Elektromotoren GmbH, Dunkermotoren*List Not Exhaustive.

3. What are the main segments of the Germany AC Motor Market?

The market segments include Induction AC Motors, Synchronous AC Motors, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Manufacturing Sector in Germany Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations.

6. What are the notable trends driving market growth?

Induction Motors Hold Significant Market Share.

7. Are there any restraints impacting market growth?

The Growing Manufacturing Sector in Germany Will Drive the Market Growth; Demand for Energy Efficiency Owning to Government Regulations.

8. Can you provide examples of recent developments in the market?

July 2023: Siemens AG announced the launch of Innomotics, a new leading motors and large drives company. Under this brand, the company will combine its business activities in geared motors, medium-voltage converters, low- to high-voltage motors, and motor spindles. The portfolio includes a digitalization portfolio, innovative solutions, and broad service offerings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany AC Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany AC Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany AC Motor Market?

To stay informed about further developments, trends, and reports in the Germany AC Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence