Key Insights

The Hungary Crop Protection Chemicals market, valued at approximately €150 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.70% from 2025 to 2033. This expansion is fueled by several key factors. Increasing pest and disease pressure on crops due to climate change necessitates greater reliance on chemical protection. Simultaneously, the rising demand for higher agricultural yields to meet the food requirements of a growing population drives market expansion. The prevalent use of grains and cereals, pulses and oilseeds, and fruits and vegetables in Hungary's agricultural landscape contributes significantly to the market's size. Furthermore, the increasing adoption of advanced agricultural techniques and precision farming, coupled with government initiatives supporting sustainable agricultural practices, is further stimulating growth. However, stringent regulations regarding the use of certain chemicals, environmental concerns about pesticide residues, and the increasing popularity of bio-based alternatives pose potential challenges to market growth. The market is segmented by mode of action (herbicides, fungicides, insecticides, etc.), origin (synthetic vs. bio-based), and application (grains & cereals, pulses & oilseeds, etc.). Key players like Bayer AG, UPL Ltd, and Belchim Crop Protection are competing in this dynamic market, constantly innovating to meet evolving farmer needs and regulatory standards. The market's growth trajectory indicates a promising future for crop protection chemical providers in Hungary, particularly those focused on sustainable and effective solutions.

The continued growth is expected to be driven by innovation within the industry, with companies focusing on developing more targeted and effective chemicals with reduced environmental impact. The increasing adoption of integrated pest management (IPM) strategies, combining chemical and biological control methods, presents both a challenge and an opportunity for market players. Companies that can effectively integrate their products within IPM frameworks will likely gain a competitive edge. The bio-based segment is anticipated to witness considerable growth as consumers and regulatory bodies show increasing preference for environmentally friendly solutions. Regional variations in crop patterns and pest pressures within Hungary may also influence specific product demand. Nevertheless, the overall outlook for the Hungarian crop protection chemicals market remains positive, driven by the interplay of agricultural necessities, technological advancements, and evolving environmental concerns.

Hungary Crop Protection Chemicals Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Hungary Crop Protection Chemicals Market, offering invaluable insights for industry professionals, investors, and stakeholders. The report covers the period from 2019 to 2033, with 2025 serving as the base year and the forecast period extending from 2025 to 2033. The market is segmented by mode of action (herbicide, fungicide, insecticide, nematicide, molluscicide, others), origin (synthetic, bio-based), and application (grains and cereals, pulses and oilseeds, fruits and vegetables, commercial crops, turf and ornamentals). Key players such as Bayer AG, UPL Ltd, Belchim Crop Protection, Oro Agri, Bold agro, Agrokemia, and Nufarm Ltd are analyzed, though this list is not exhaustive. The report's value is measured in Million units.

Hungary Crop Protection Chemicals Market Dynamics & Structure

This section delves into the intricate dynamics shaping the Hungarian crop protection chemicals market. We analyze market concentration, revealing the market share held by dominant players and the level of competition. Technological innovation drivers, such as the development of more effective and environmentally friendly pesticides, are scrutinized, alongside the impact of regulatory frameworks and compliance standards. The influence of competitive product substitutes, including biopesticides and integrated pest management strategies, is assessed. Furthermore, the report examines end-user demographics, focusing on the farming community's size, structure, and adoption patterns of modern agricultural techniques. Finally, we explore M&A trends within the industry, analyzing the volume and value of deals over the study period (2019-2024), and predicting future trends for the forecast period (2025-2033).

- Market Concentration: xx% of the market is controlled by the top 5 players in 2025.

- Technological Innovation: Significant investment in R&D focuses on biopesticides and precision application technologies.

- Regulatory Framework: EU regulations heavily influence pesticide approvals and usage, impacting market growth.

- M&A Activity: An estimated xx M&A deals occurred between 2019-2024, with a projected xx deals for 2025-2033.

- Innovation Barriers: High R&D costs and lengthy regulatory approval processes hinder innovation.

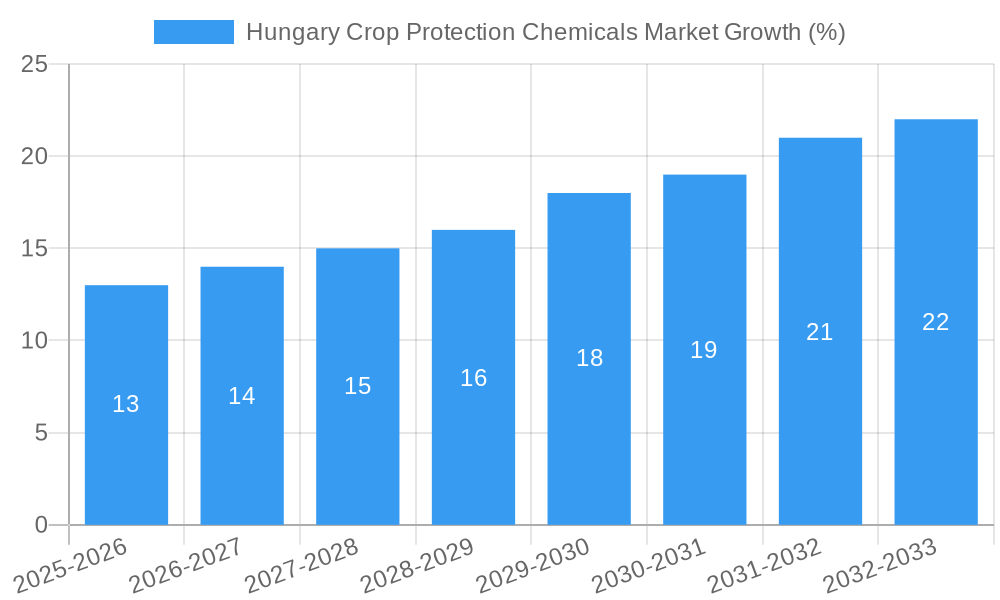

Hungary Crop Protection Chemicals Market Growth Trends & Insights

This section provides a comprehensive analysis of the Hungary Crop Protection Chemicals Market's growth trajectory from 2019 to 2033. The analysis leverages various data sources and methodologies to provide a robust understanding of market size evolution, adoption rates of different crop protection chemicals, and the impact of technological disruptions. We examine shifts in consumer behavior among farmers, considering factors like increasing awareness of environmental sustainability and the adoption of precision farming techniques. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates are presented to illustrate the growth dynamics. The forecast for market size in 2033 is estimated at xx Million units.

- Market Size: The market size reached xx Million units in 2024, and is projected to reach xx Million units in 2033.

- CAGR: The CAGR for the forecast period (2025-2033) is estimated at xx%.

- Market Penetration: Penetration rates for biopesticides are expected to increase from xx% in 2024 to xx% in 2033.

Dominant Regions, Countries, or Segments in Hungary Crop Protection Chemicals Market

This section identifies the leading regions, countries, and market segments within the Hungarian crop protection chemicals market. Dominance is analyzed across the key segments: Mode of Action (Herbicide, Fungicide, Insecticide, Nematicide, Molluscicide, Others), Origin (Synthetic, Bio-based), and Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Commercial Crops, Turf and Ornamentals). We examine the factors driving growth within these leading segments, considering economic policies, infrastructure development, and agricultural practices. Market share and growth potential are quantified for each leading segment, offering a detailed picture of market dominance and future prospects.

- Leading Segment by Mode of Action: Herbicides, holding approximately xx% market share in 2025.

- Leading Segment by Origin: Synthetic pesticides, dominating with xx% market share in 2025.

- Leading Segment by Application: Grains and cereals, accounting for xx% of the market in 2025.

- Key Drivers: Government support for sustainable agriculture, increasing yield requirements, and favorable climatic conditions for crop cultivation.

Hungary Crop Protection Chemicals Market Product Landscape

This section provides a concise overview of product innovations, applications, and performance metrics within the Hungarian crop protection chemical market. It highlights unique selling propositions (USPs) of different products and technological advancements that have improved efficacy, reduced environmental impact, and enhanced user-friendliness.

The market is witnessing the introduction of more targeted and efficient formulations, along with a rising demand for bio-based alternatives. Innovative application technologies, such as drones and precision spraying systems, are gaining traction, contributing to improved efficacy and reduced chemical usage. Performance metrics, such as crop yield improvement and reduction in pest and disease damage, are crucial factors in determining market success.

Key Drivers, Barriers & Challenges in Hungary Crop Protection Chemicals Market

Key Drivers:

- Increasing agricultural output demands driven by population growth.

- Government initiatives supporting agricultural modernization.

- Technological advancements in pesticide formulation and application.

Challenges and Restraints:

- Stringent environmental regulations and limitations on the use of certain chemicals.

- Price volatility of raw materials impacting production costs.

- Intense competition from both domestic and international players.

- The market faces a xx% reduction in growth due to regulatory hurdles, based on industry reports.

Emerging Opportunities in Hungary Crop Protection Chemicals Market

- Growing demand for biopesticides and other sustainable solutions.

- Opportunities in precision agriculture and targeted pesticide application.

- Potential for market expansion through the adoption of innovative technologies.

Growth Accelerators in the Hungary Crop Protection Chemicals Market Industry

Technological innovation, strategic partnerships between pesticide manufacturers and agricultural companies, and expansion into untapped market segments will drive long-term growth in the Hungary Crop Protection Chemicals Market. The adoption of precision agriculture techniques, including sensor-based monitoring and data-driven decision-making, will enhance the efficiency and sustainability of pesticide use.

Key Players Shaping the Hungary Crop Protection Chemicals Market Market

- Bayer AG

- UPL Ltd

- Belchim Crop Protection

- Oro Agri

- Bold agro

- Agrokemia

- Nufarm Ltd

Notable Milestones in Hungary Crop Protection Chemicals Market Sector

- 2022: Introduction of a new biopesticide by Bayer AG.

- 2023: Agrokemia expands its distribution network across the country.

- 2024: New regulations impacting the use of certain synthetic pesticides come into effect.

In-Depth Hungary Crop Protection Chemicals Market Market Outlook

The Hungarian crop protection chemicals market is poised for sustained growth over the next decade. Technological advancements in biopesticides, precision agriculture, and sustainable farming practices will be key drivers. The market presents attractive opportunities for both established players and new entrants, particularly those focusing on innovative solutions and environmentally friendly alternatives. The projected market value in 2033 indicates significant potential for expansion and increased market share among key players.

Hungary Crop Protection Chemicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Hungary Crop Protection Chemicals Market Segmentation By Geography

- 1. Hungary

Hungary Crop Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Escalated Adaptation of Biopesticides

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Crop Protection Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPL Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Belchim Crop Protection

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oro Agri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bold agro *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrokemia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nufarm Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Hungary Crop Protection Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hungary Crop Protection Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Hungary Crop Protection Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Crop Protection Chemicals Market?

The projected CAGR is approximately 8.70%.

2. Which companies are prominent players in the Hungary Crop Protection Chemicals Market?

Key companies in the market include Bayer AG, UPL Ltd, Belchim Crop Protection, Oro Agri, Bold agro *List Not Exhaustive, Agrokemia, Nufarm Ltd.

3. What are the main segments of the Hungary Crop Protection Chemicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Escalated Adaptation of Biopesticides.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Crop Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Crop Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Crop Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the Hungary Crop Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence