Key Insights

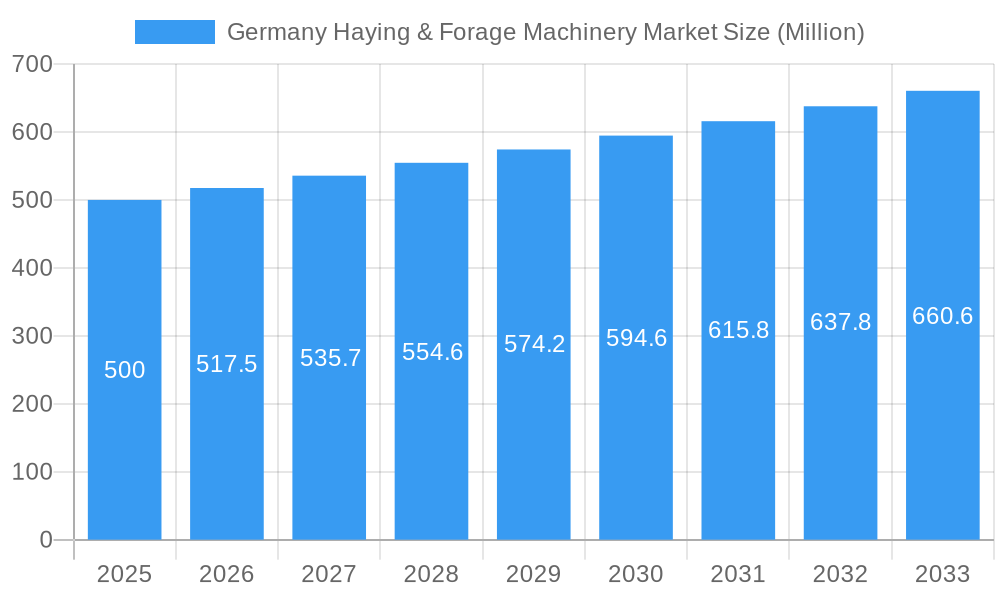

The German Haying & Forage Machinery market, valued at approximately €6.07 billion in 2025, is projected for robust expansion. This market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 3.7% from 2025 to 2033. Key growth drivers include the escalating demand for premium animal feed, particularly within the dairy and livestock industries, which necessitates advanced haying and forage equipment. The increasing integration of precision agriculture technologies, such as GPS-guided machinery and automation, is also significantly boosting operational efficiency and crop yields, thereby stimulating market growth. Furthermore, government initiatives focused on promoting sustainable farming practices and investments in agricultural infrastructure modernization are positively influencing the market's upward trajectory. Major market segments comprise mowers, balers, and forage harvesters, each exhibiting unique growth dynamics influenced by farm size, livestock type, and technological innovation. Prominent industry players, including Deere & Company, CLAAS, and Krone, are actively pursuing technological advancements and strategic collaborations to secure their market positions. Future growth will be contingent on optimizing harvesting efficiency, reducing labor expenses, and enhancing feed quality.

Germany Haying & Forage Machinery Market Market Size (In Billion)

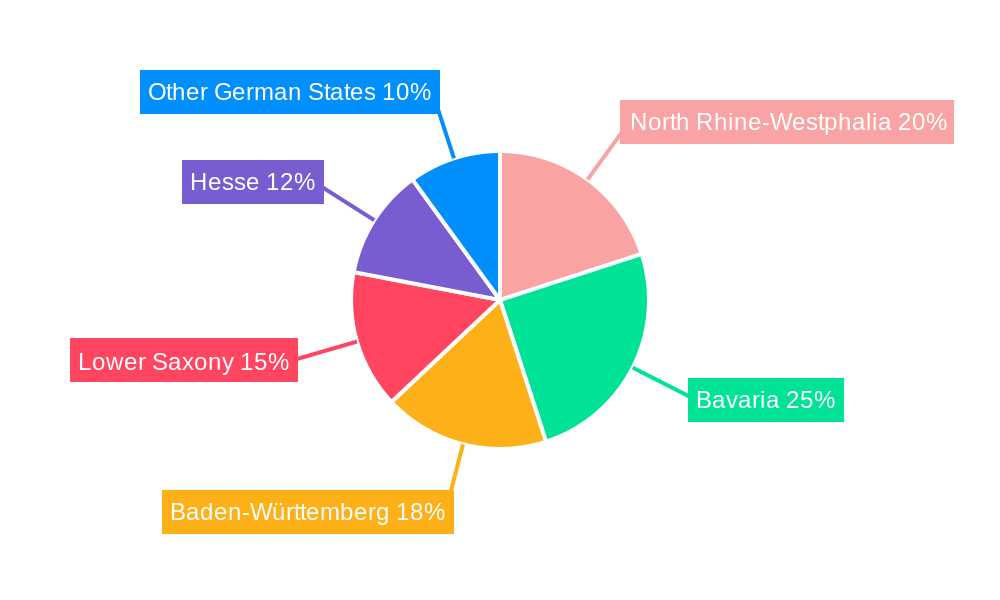

A regional analysis highlights North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse as principal contributors to the market's volume, attributed to their substantial agricultural output. Regional growth rates are expected to vary based on specific farming methodologies and local government support for technological upgrades. While potential challenges such as volatile commodity prices and rising input costs exist, the overall market outlook remains favorable. This optimism is underpinned by the persistent need for enhanced efficiency and productivity in German agriculture. The sustained demand for sophisticated machinery, coupled with supportive government policies, indicates continued market growth over the forecast period. In-depth research into specific technological advancements and their adoption rates across diverse market segments will offer more granular insights.

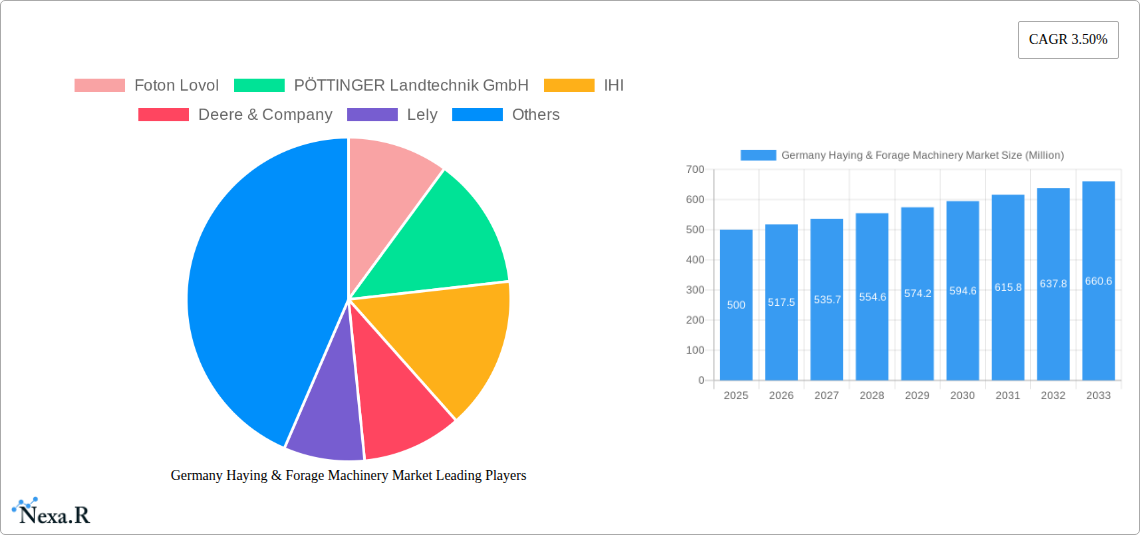

Germany Haying & Forage Machinery Market Company Market Share

Germany Haying & Forage Machinery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Haying & Forage Machinery Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by type (Mowers, Balers, Forage Harvesters, Others) and offers valuable insights for industry professionals, investors, and stakeholders. Market size is presented in Million units.

Germany Haying & Forage Machinery Market Market Dynamics & Structure

This section delves into the intricate structure of the German Haying & Forage Machinery market, examining its concentration levels, technological advancements, regulatory landscape, and competitive dynamics. The analysis incorporates both qualitative and quantitative insights, including market share data and M&A activity trends.

- Market Concentration: The German market exhibits a moderately concentrated structure, with a few major players holding significant market share (xx%). Smaller, specialized firms cater to niche segments.

- Technological Innovation: Technological advancements, such as precision farming technologies, automated systems, and improved machine efficiency, are driving market growth. However, high initial investment costs present a barrier to adoption for some farmers.

- Regulatory Framework: EU and German regulations concerning emissions, safety, and machinery standards significantly influence market dynamics. Compliance costs can impact the competitiveness of certain manufacturers.

- Competitive Product Substitutes: The primary substitutes are older, less efficient machinery, potentially leading to a slower replacement cycle. However, increasing labor costs and productivity demands are pushing farmers to adopt more advanced technologies.

- End-User Demographics: The market primarily comprises large-scale commercial farms and agricultural cooperatives, alongside a significant number of smaller, family-run farms.

- M&A Trends: The past five years have witnessed xx M&A deals in the German hay and forage machinery sector, predominantly driven by consolidation among smaller players and expansion strategies of larger companies. This activity is anticipated to continue in the coming years. The total value of these deals is estimated at xx Million units.

Germany Haying & Forage Machinery Market Growth Trends & Insights

This section provides a detailed analysis of the Germany Haying & Forage Machinery Market's growth trajectory, considering factors like market size, adoption rates, technological disruptions, and evolving consumer behavior. The analysis incorporates specific metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rate.

The German Haying & Forage Machinery market experienced a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. Driven by factors such as increasing agricultural productivity demands, technological advancements in machinery, and government support for modern farming practices, the market is projected to continue its growth trajectory, reaching xx Million units by 2033, with a forecasted CAGR of xx% during 2025-2033. Market penetration remains relatively high amongst larger farms, but untapped potential exists in the smaller farm segment. The adoption of precision farming technologies is also accelerating, contributing to the growth of the higher-end market segment. Consumer behavior shifts toward sustainable farming practices also influence the demand for efficient and environmentally-friendly machinery.

Dominant Regions, Countries, or Segments in Germany Haying & Forage Machinery Market

This section pinpoints the leading regions, countries, or market segments (Mowers, Balers, Forage Harvesters, Others) within the German Haying & Forage Machinery Market that are exhibiting strong growth.

The Northern German plains, characterized by extensive arable land and large-scale farming operations, represent the dominant region, holding a market share of xx%. This dominance is primarily attributed to:

- High Agricultural Output: The region's favorable climate and fertile soils contribute to high agricultural productivity, necessitating the use of efficient harvesting and forage machinery.

- Economies of Scale: Large-scale farming operations within this region benefit significantly from the economies of scale offered by advanced machinery, leading to high adoption rates.

- Government Subsidies: Government support for technological upgrades in agriculture further incentivizes the adoption of advanced machinery.

Amongst the market segments, Forage Harvesters constitutes the largest segment, capturing xx% of the market share, due to increasing demand for efficient silage production for livestock feed. The Mowers segment also presents significant growth potential, driven by increased demand for high-precision cutting for improved yields.

Germany Haying & Forage Machinery Market Product Landscape

The German Haying & Forage Machinery market features a diverse range of products, with continuous innovation in areas like automated guidance systems, improved cutting mechanisms, and enhanced baling technology. These advancements aim to maximize efficiency, minimize labor costs, and improve crop quality. Key innovations include GPS-guided mowers and self-propelled forage harvesters. These machines offer features like increased cutting widths, higher throughput rates, and improved crop preservation.

Key Drivers, Barriers & Challenges in Germany Haying & Forage Machinery Market

Key Drivers: The market is primarily driven by increasing demand for improved agricultural efficiency, technological advancements leading to more productive and efficient machinery, and government subsidies promoting modernization of agricultural practices. Furthermore, growing awareness of environmental sustainability and precision agriculture is shaping demand.

Key Barriers & Challenges: High initial investment costs associated with new technologies can hinder adoption, particularly among smaller farms. Fluctuating commodity prices can impact farm profitability and investment decisions. Supply chain disruptions and increasing raw material costs pose significant challenges to the industry. The intense competition from both domestic and international players further intensifies the challenges faced. These factors collectively have a quantifiable impact, estimated to constrain market growth by xx% in the next 5 years.

Emerging Opportunities in Germany Haying & Forage Machinery Market

Significant opportunities exist in developing and deploying automation technologies to further improve efficiency and reduce labor costs. The increasing focus on sustainable agriculture presents an opportunity to introduce environmentally friendly machinery. Expanding into niche markets, such as organic farming, offers further growth potential. Finally, leveraging digitalization through precision agriculture technologies, such as data analytics and remote monitoring, provides exciting prospects for the industry.

Growth Accelerators in the Germany Haying & Forage Machinery Market Industry

Long-term growth will be accelerated by technological advancements leading to increased machine autonomy and precision, strategic collaborations amongst manufacturers and agricultural technology companies, and expansion into international markets. These factors, coupled with government support for agricultural modernization and the growing demand for sustainable agricultural practices, will significantly boost market growth in the coming decade.

Key Players Shaping the Germany Haying & Forage Machinery Market Market

- Foton Lovol

- PÖTTINGER Landtechnik GmbH

- IHI

- Deere & Company

- Lely

- CLAAS KGaA mbH

- Buhler Industries

- Vermee

- Kverneland Group

- CNH Industrial

- Krone North America Inc

- KUHN Group

- AGCO Corporation

- Kubota

Notable Milestones in Germany Haying & Forage Machinery Market Sector

- 2021: CLAAS launched a new generation of forage harvesters with improved efficiency and automation features.

- 2022: Pöttinger Landtechnik GmbH announced a strategic partnership with a precision agriculture technology provider.

- 2023: A significant merger occurred between two smaller hay machinery manufacturers. (Specific details unavailable - xx)

In-Depth Germany Haying & Forage Machinery Market Market Outlook

The German Haying & Forage Machinery Market presents a robust outlook for the coming decade, driven by ongoing technological innovation, a focus on sustainable farming practices, and a healthy agricultural sector. Strategic partnerships, expansion into new market segments, and targeted product development will be key to capitalizing on the considerable growth opportunities within this dynamic market. The market is expected to exhibit continued growth, exceeding xx Million units by 2033, presenting lucrative opportunities for both established and emerging players.

Germany Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Forage Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Forage Harvesters

- 2.4. Others

Germany Haying & Forage Machinery Market Segmentation By Geography

- 1. Germany

Germany Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of Germany Haying & Forage Machinery Market

Germany Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Demand for Forage Feed from Animal Production Industries Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Forage Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Forage Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Foton Lovol

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PÖTTINGER Landtechnik GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IHI

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere & Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lely

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CLAAS KGaA mbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Buhler Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vermee

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kverneland Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CNH Industrial

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Krone North America Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 KUHN Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AGCO Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kubota

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Foton Lovol

List of Figures

- Figure 1: Germany Haying & Forage Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Germany Haying & Forage Machinery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Haying & Forage Machinery Market?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Germany Haying & Forage Machinery Market?

Key companies in the market include Foton Lovol, PÖTTINGER Landtechnik GmbH, IHI, Deere & Company, Lely, CLAAS KGaA mbH, Buhler Industries, Vermee, Kverneland Group, CNH Industrial, Krone North America Inc, KUHN Group, AGCO Corporation, Kubota.

3. What are the main segments of the Germany Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Demand for Forage Feed from Animal Production Industries Drives the Market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the Germany Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence