Key Insights

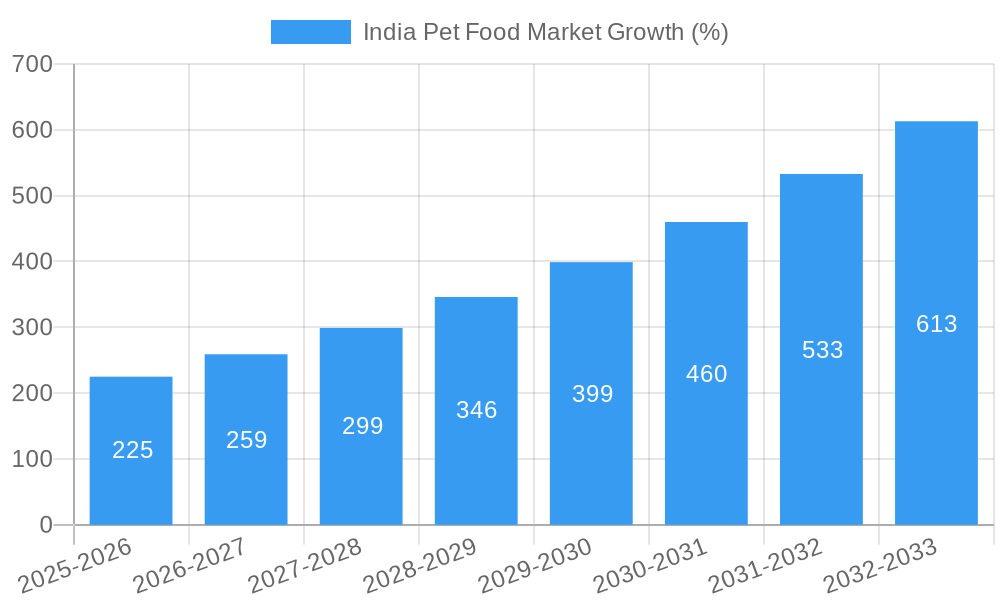

The Indian pet food market is experiencing robust growth, driven by increasing pet ownership, rising disposable incomes, and a shift towards premium pet food products. The market, while exhibiting a significant size (let's assume a 2025 market size of $1.5 Billion based on global trends and projected CAGR), is characterized by a considerable Compound Annual Growth Rate (CAGR) of, let's say, 15% during the forecast period (2025-2033). This rapid expansion is fueled by several key factors. The burgeoning middle class is increasingly willing to spend on their pets' well-being, opting for specialized diets and premium brands. Furthermore, a growing awareness of pet nutrition and health, coupled with readily available information online and through veterinary services, is driving demand for higher-quality pet food. This preference for premiumization is pushing up the average selling price of pet food. The market is further segmented by pet type (dogs and cats dominating), food type (dry, wet, treats), and price point (economy, premium, super-premium). Key players like Nestle Purina, Mars, and local brands are actively competing to capture market share through innovation and brand building.

However, challenges remain. Price sensitivity among a significant portion of the consumer base and the presence of unorganized players offering cheaper alternatives pose some restraints. Furthermore, addressing concerns around ingredient sourcing and quality control is crucial for sustained growth and consumer trust. Despite these challenges, the long-term outlook for the Indian pet food market remains extremely positive. The continued growth of the pet ownership base, changing consumer lifestyles, and increasing product innovation are poised to drive substantial expansion in the coming years. Companies are expected to capitalize on these trends through strategic product development, targeted marketing campaigns, and expansion into new geographic markets. The focus on health and wellness within pet food will only continue to elevate demand.

India Pet Food Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning India Pet Food Market, offering invaluable insights for industry professionals, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, and future prospects. The report leverages extensive data analysis to deliver precise market sizing and forecasting, encompassing both the parent market (pet food) and its key segments (dog food, cat food, etc.). This report is crucial for navigating the complexities of this rapidly evolving market and making informed strategic decisions. Expected Market Size in 2025: xx Million Units.

India Pet Food Market Dynamics & Structure

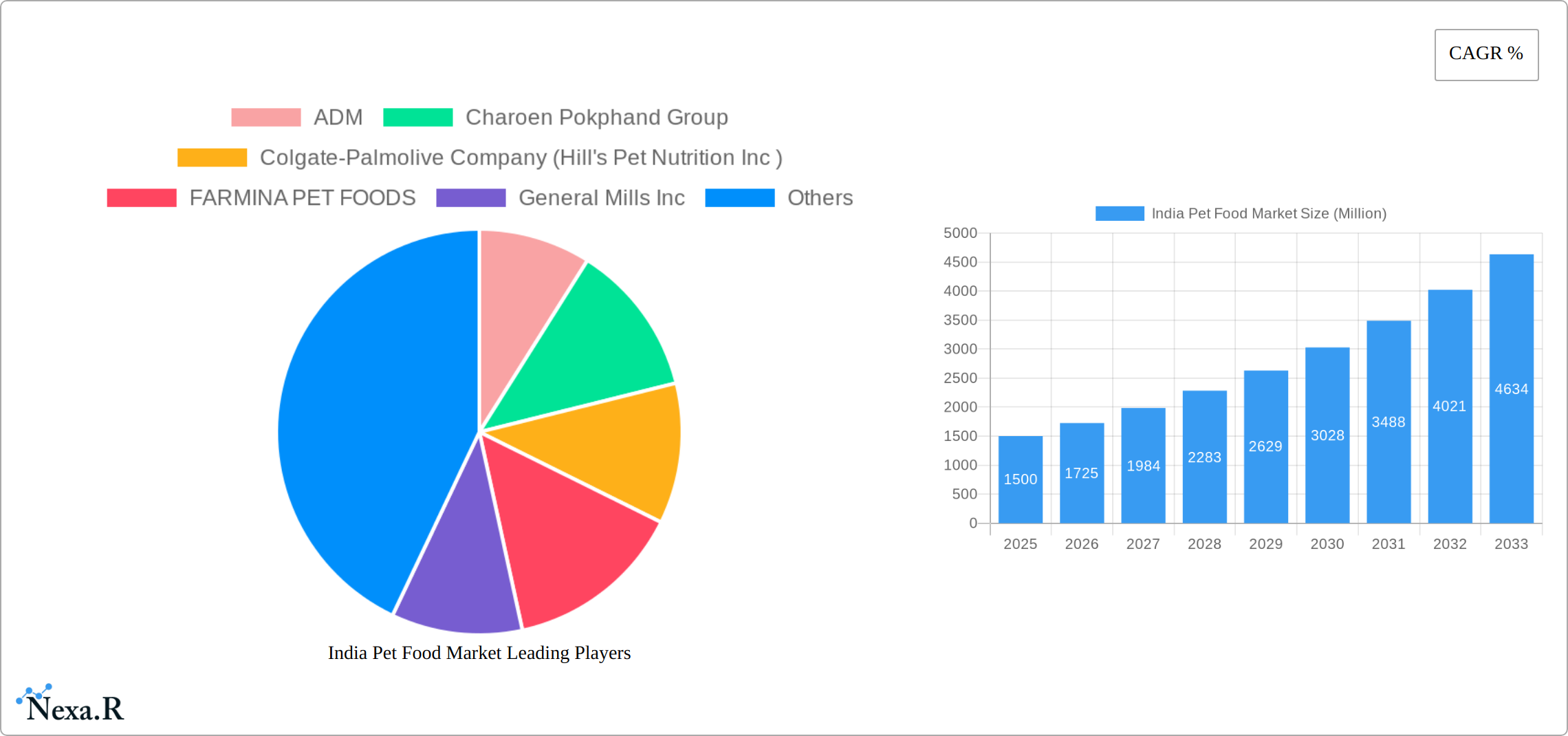

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the Indian pet food market. The market exhibits a moderately concentrated structure, with key players holding significant shares but also offering room for smaller players to thrive.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025 (estimated). This indicates a competitive yet not overly saturated environment.

- Technological Innovation: Innovations in pet food formulations (e.g., functional foods, organic options) are key drivers. The adoption of advanced manufacturing techniques and supply chain technologies contributes to efficiency and quality. However, barriers such as high R&D costs and regulatory approvals limit the pace of innovation for some smaller players.

- Regulatory Framework: Government regulations regarding pet food safety, labeling, and ingredients play a crucial role. Compliance costs and evolving regulations present both challenges and opportunities for adaptation.

- Competitive Product Substitutes: Homemade pet food and unbranded options offer some competition, but the convenience and nutritional benefits of branded pet food remain a strong draw.

- End-User Demographics: Rising disposable incomes, increasing pet ownership (particularly in urban areas), and evolving pet-owner preferences are driving demand. The growing middle class is significantly contributing to market growth.

- M&A Trends: The Indian pet food market has witnessed xx M&A deals in the historical period (2019-2024). Strategic acquisitions are expected to continue, consolidating market share and driving further growth.

India Pet Food Market Growth Trends & Insights

The Indian pet food market demonstrates robust growth driven by a confluence of factors. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

[Insert 600 words of analysis here focusing on market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Include specific metrics (e.g., CAGR, market penetration) for deeper insights.]

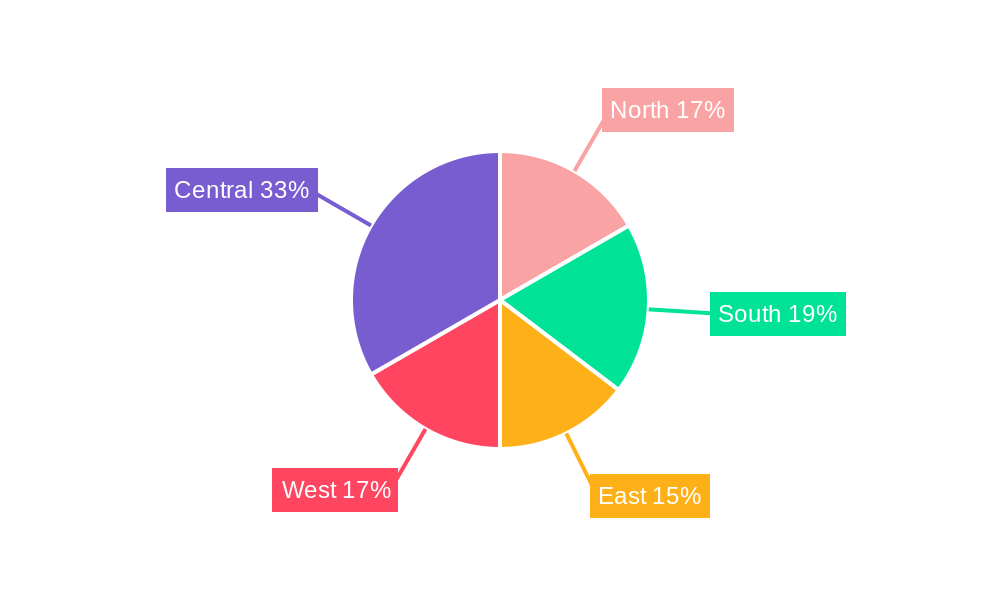

Dominant Regions, Countries, or Segments in India Pet Food Market

The Indian pet food market is experiencing rapid growth, with specific regions and segments emerging as key drivers of this expansion. While the entire nation shows burgeoning interest, the **urban and metropolitan areas** of India, particularly in the southern and western regions, currently dominate the market. Cities like Mumbai, Delhi, Bengaluru, Chennai, and Pune represent the epicenters of pet ownership and consequently, pet food consumption. This dominance is fueled by a confluence of factors:

- Higher Disposable Incomes: Urban populations generally possess higher disposable incomes, allowing for greater expenditure on pet care, including premium and specialized pet food.

- Increased Pet Ownership: Modern Indian families, especially in urban settings, are increasingly viewing pets as integral family members. This shift in perception leads to a greater desire to provide the best for their companions, including high-quality food.

- Awareness and Access to Information: Metropolitan areas benefit from greater access to information through the internet, social media, and veterinary professionals. This heightened awareness about pet nutrition and the benefits of branded pet food directly translates into higher demand.

- Availability of Premium Products: The urban retail landscape, including supermarkets, pet specialty stores, and e-commerce platforms, offers a wider variety and higher accessibility to premium and imported pet food brands. This availability caters to the evolving preferences of discerning pet owners.

- Westernization of Lifestyles: The adoption of Western lifestyles and cultural norms in urban India has also contributed to the increased acceptance and demand for commercially prepared pet food, mirroring trends observed in developed countries.

Beyond geographical regions, the **dog food segment** stands out as the most dominant. Dogs, being the most popular pet companion across India, naturally command the largest share of the pet food market. The sub-segments within dog food, such as dry kibble, wet food, and treats, are all experiencing significant growth. The increasing focus on specific dietary needs for dogs, including puppy, adult, senior, and breed-specific formulations, further solidifies this segment's leadership. The rising awareness about the importance of balanced nutrition for canine health, disease prevention, and longevity is a primary catalyst. Moreover, the emotional connection owners share with their dogs drives a willingness to invest in products that promise optimal health and well-being. While cat food and food for other pets are growing segments, the sheer volume of dog ownership and the associated expenditure ensure that dog food remains the undisputed leader in the Indian pet food market for the foreseeable future.

India Pet Food Market Product Landscape

The Indian pet food market showcases a diverse and rapidly evolving range of products meticulously designed to cater to the specific needs of various pet types, including dogs, cats, birds, and small animals. The current landscape is characterized by a strong trend towards **premiumization**, with consumers actively seeking out higher-quality ingredients and more sophisticated formulations for their beloved companions. This includes a significant surge in demand for **specialized diets**, such as grain-free options for pets with sensitivities, hypoallergenic formulations for those with allergies, and breed-specific foods tailored to unique nutritional requirements. Furthermore, the market is witnessing an increasing incorporation of **functional ingredients** aimed at enhancing specific aspects of pet health. These can include omega-3 fatty acids for coat health, probiotics for digestive well-being, antioxidants for immune support, and joint-supporting supplements. Technological advancements are playing a crucial role in ensuring the superior quality, safety, and extended shelf life of pet food products through sophisticated processing techniques like extrusion and advanced packaging solutions that preserve freshness and nutritional integrity. Brands are increasingly differentiating themselves by emphasizing their use of **superior, natural, or organic ingredients**, their commitment to **advanced, science-backed formulations**, and the demonstrable **specific health benefits** their products offer, moving beyond basic sustenance to a proactive approach to pet wellness.

Key Drivers, Barriers & Challenges in India Pet Food Market

Key Drivers:

- Rising pet ownership and changing lifestyles.

- Increasing disposable incomes among urban middle class.

- Growing awareness of pet nutrition and health.

- Entry of international brands and increased competition.

Challenges and Restraints:

- High import costs of raw materials.

- Stringent regulatory framework and compliance costs.

- Competition from cheaper, unbranded alternatives.

- Limited supply chain infrastructure in some regions.

Emerging Opportunities in India Pet Food Market

The India Pet Food Market presents significant opportunities for growth. Untapped markets in rural areas, growing demand for premium and specialized pet food, and the potential for online retail expansion are key areas of opportunity. Innovation in areas such as sustainable sourcing of ingredients and eco-friendly packaging will also create niche opportunities. The increasing adoption of pet insurance and veterinary services presents further linked opportunities for synergistic growth.

Growth Accelerators in the India Pet Food Market Industry

The long-term trajectory of the Indian pet food market is powerfully propelled by several interconnected and compounding growth accelerators. **Technological innovations** are at the forefront, leading not only to demonstrably improved product quality, nutritional efficacy, and palatability but also to enhanced manufacturing efficiencies and cost-effectiveness. These advancements enable brands to meet evolving consumer expectations for healthier, safer, and more appealing pet food options. **Strategic partnerships and collaborations** between pet food brands, veterinarians, and retailers are proving to be crucial for expanding distribution networks and increasing market penetration, especially in Tier 2 and Tier 3 cities. These alliances facilitate broader reach and more effective marketing. Furthermore, the concerted effort to **expand into untapped and emerging markets** within India, coupled with localized product development that addresses specific regional preferences and pet demographics, represents a significant avenue for sustained growth. The unwavering and intensifying **focus on pet health and wellness** by a growing segment of pet owners, driven by increased education and a deeper emotional bond with their pets, is a fundamental catalyst. This is complemented by a significant **rise in consumer awareness** regarding the importance of balanced nutrition, the risks associated with poor-quality food, and the availability of specialized dietary solutions. This heightened awareness, fueled by readily available information, empowers consumers to make informed purchasing decisions, thereby further fueling market expansion.

Key Players Shaping the India Pet Food Market Market

- ADM

- Charoen Pokphand Group

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc)

- FARMINA PET FOODS

- General Mills Inc

- IB Group (Drools Pet Food Pvt Ltd)

- Mars Incorporated

- Nestle (Purina)

- Schell & Kampeter Inc (Diamond Pet Foods)

- Virba

Notable Milestones in India Pet Food Market Sector

- July 2023: Hill's Pet Nutrition launched MSC-certified pollock and insect protein products for pets with sensitive skin and stomachs.

- May 2023: Nestle Purina introduced new Friskies Playfuls cat treats.

- April 2023: Mars Incorporated opened its first pet food R&D center in Asia-Pacific.

In-Depth India Pet Food Market Market Outlook

The outlook for the Indian pet food market is exceptionally bright and poised for substantial and sustained expansion in the coming years. The foundational driver remains the continued upward trend in **pet ownership**, a phenomenon bolstered by evolving societal norms and a growing appreciation for the companionship and emotional benefits pets provide. This is further amplified by the steady increase in **rising disposable incomes** across various segments of the Indian population, empowering more households to allocate a larger portion of their budget towards pet care. A particularly significant trend shaping the future is the increasing **preference for premium and specialized pet food**. Consumers are no longer content with generic options; they are actively seeking out high-quality, nutritionally superior, and health-focused products for their pets, mirroring global trends in human food consumption. To capitalize on these burgeoning opportunities, **strategic investments in research and development (R&D)** will be paramount. This will enable manufacturers to innovate with novel ingredients, develop advanced formulations targeting specific health concerns, and create more palatable and digestible products. Concurrently, the **expansion of robust and efficient distribution networks**, encompassing both traditional retail channels and the rapidly growing e-commerce sector, will be critical for ensuring widespread product availability. Targeted and effective **marketing campaigns** that educate consumers about the benefits of quality pet food and highlight unique selling propositions will further stimulate demand. Looking ahead, the growing emphasis on **sustainable and ethical sourcing practices** within the industry is poised to play an increasingly pivotal role in shaping consumer choices and brand loyalty. Companies that demonstrate a commitment to environmental responsibility and ethical ingredient sourcing will likely gain a competitive edge and resonate deeply with a conscientious consumer base, further cementing the positive and dynamic future of the Indian pet food market.

India Pet Food Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Pet Food Market Segmentation By Geography

- 1. India

India Pet Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of % from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Pet Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Charoen Pokphand Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colgate-Palmolive Company (Hill's Pet Nutrition Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FARMINA PET FOODS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Mills Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IB Group (Drools Pet Food Pvt Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nestle (Purina)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schell & Kampeter Inc (Diamond Pet Foods)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virba

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: India Pet Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Pet Food Market Share (%) by Company 2024

List of Tables

- Table 1: India Pet Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Pet Food Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: India Pet Food Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: India Pet Food Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: India Pet Food Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: India Pet Food Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: India Pet Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Pet Food Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 9: India Pet Food Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 10: India Pet Food Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 11: India Pet Food Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 12: India Pet Food Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: India Pet Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Pet Food Market?

The projected CAGR is approximately N/A%.

2. Which companies are prominent players in the India Pet Food Market?

Key companies in the market include ADM, Charoen Pokphand Group, Colgate-Palmolive Company (Hill's Pet Nutrition Inc ), FARMINA PET FOODS, General Mills Inc, IB Group (Drools Pet Food Pvt Ltd ), Mars Incorporated, Nestle (Purina), Schell & Kampeter Inc (Diamond Pet Foods), Virba.

3. What are the main segments of the India Pet Food Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2023: Hill's Pet Nutrition introduced its new MSC (Marine Stewardship Council) certified pollock and insect protein products for pets with sensitive stomachs and skin lines. They contain vitamins, omega-3 fatty acids, and antioxidants.May 2023: Nestle Purina launched new cat treats under the Friskies "Friskies Playfuls - treats" brand. These treats are round in shape and are available in chicken and liver and salmon and shrimp flavors for adult cats.April 2023: Mars Incorporated opened its first pet food research and development center in Asia-Pacific. This new facility, called the APAC pet center, will support the company's product development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Pet Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Pet Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Pet Food Market?

To stay informed about further developments, trends, and reports in the India Pet Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence