Key Insights

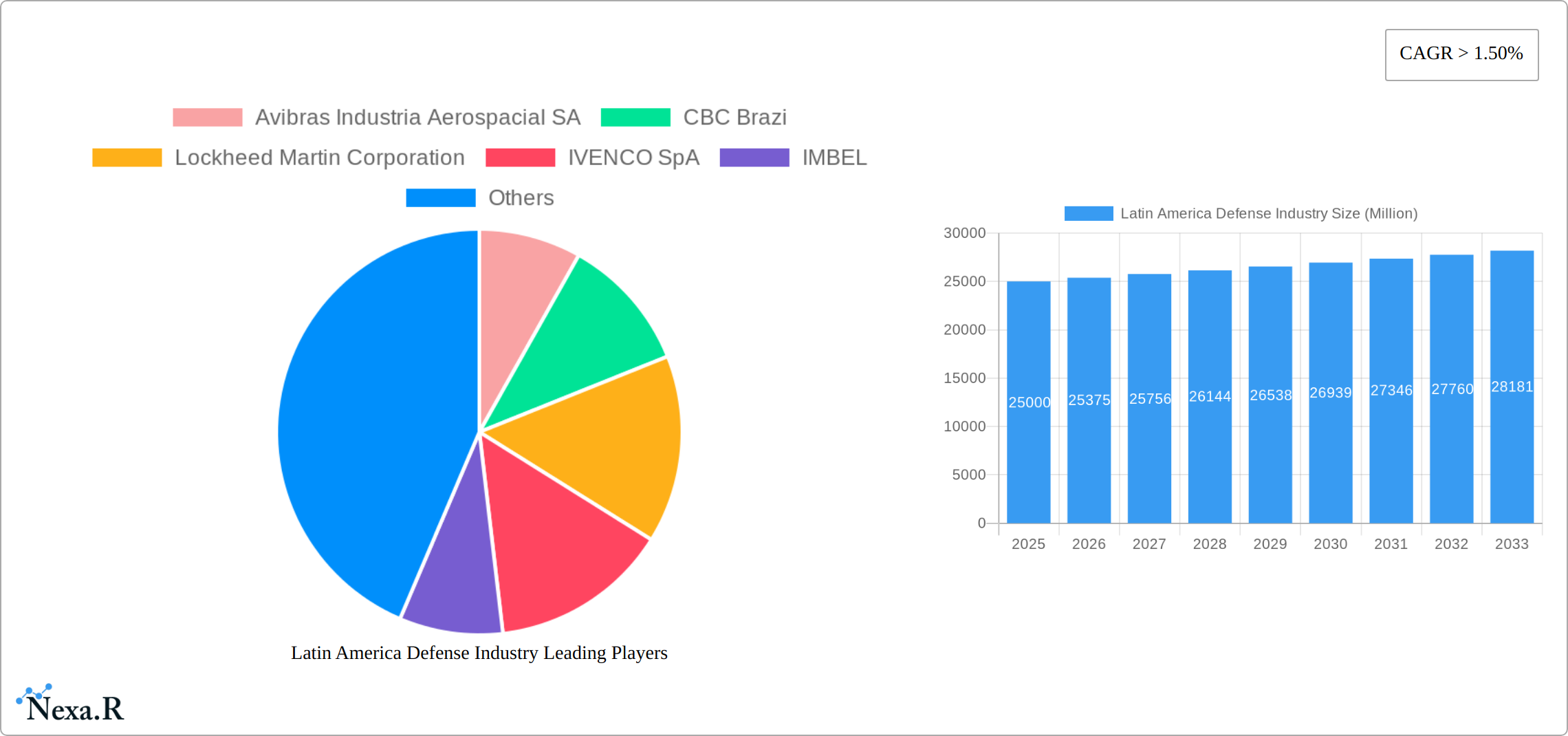

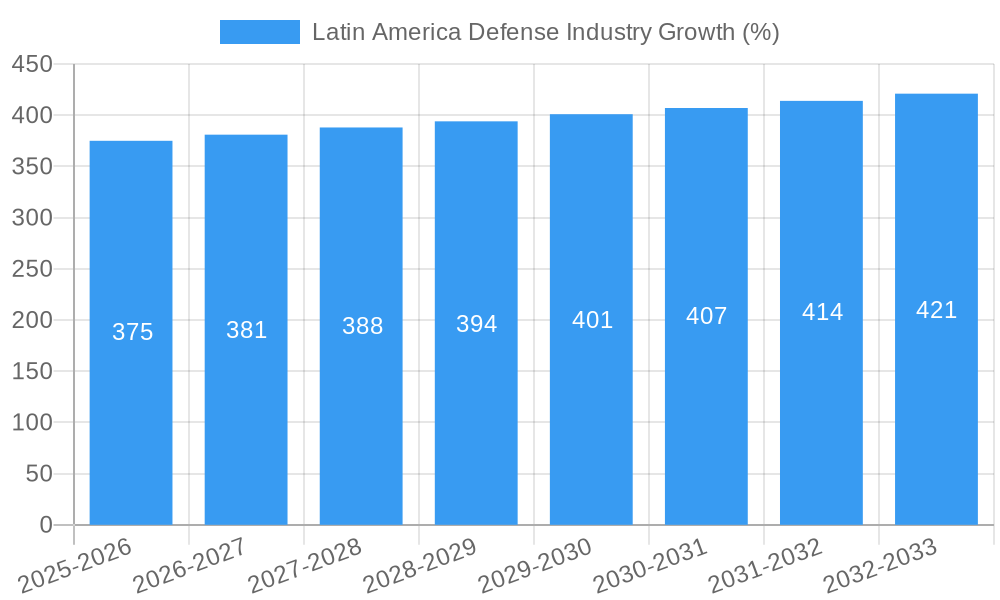

The Latin American defense industry, currently valued at approximately $XX million (assuming a reasonable market size based on regional geopolitical factors and global defense spending trends), is experiencing steady growth, projected to maintain a compound annual growth rate (CAGR) exceeding 1.50% from 2025 to 2033. This growth is fueled by several key drivers. Increased cross-border tensions and internal security concerns within several Latin American nations necessitate significant investment in defense modernization. This includes upgrading aging military equipment, enhancing cybersecurity infrastructure, and bolstering border security measures. Furthermore, the region's growing economic strength in select countries enables increased defense budgets. Government procurement plays a crucial role, encompassing personnel training and protection, sophisticated communication systems, advanced weaponry and ammunition, and a diverse range of military vehicles. The Maintenance, Repair, and Operations (MRO) segment also contributes significantly, requiring continuous investment in maintaining operational readiness across all procured assets. Key players like Avibras Industria Aerospacial SA, Embraer SA, and international giants such as Lockheed Martin Corporation and Thales Group, are actively involved in supplying and servicing this market.

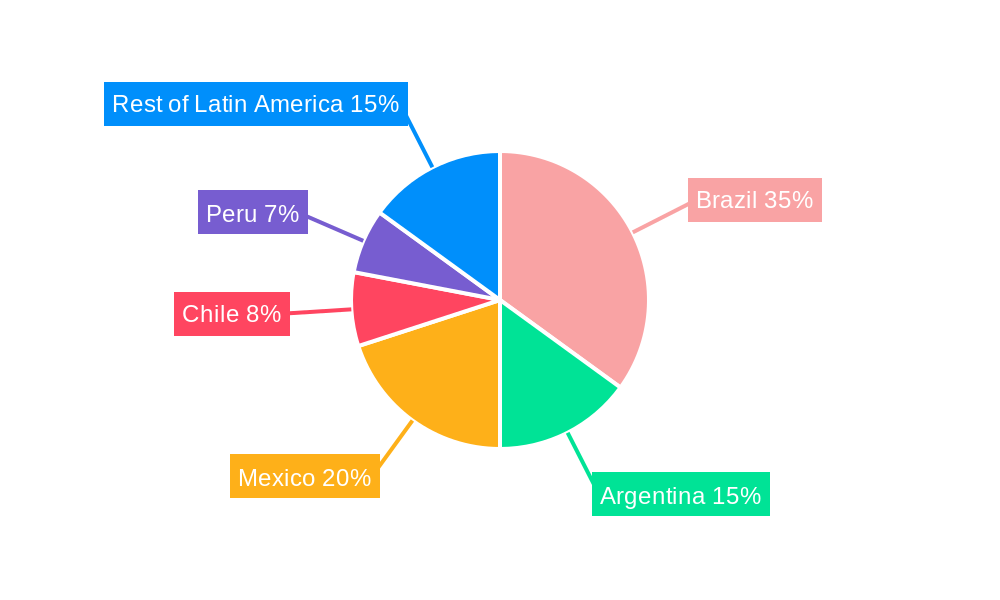

However, the Latin American defense industry faces certain restraints. Budgetary constraints in several countries, particularly those facing economic challenges, can limit defense spending. Political instability and corruption in some regions can also impact procurement processes and overall investment. Furthermore, reliance on foreign technology and equipment can create vulnerabilities and dependencies, necessitating a shift towards domestic manufacturing and technological advancement. Segmentation analysis reveals strong demand across procurement and MRO services for communication systems, weapons and ammunition, and military vehicles. Brazil, Argentina, Mexico, and Chile are significant contributors to the regional market. Future growth is largely contingent upon continued economic growth in key nations, successful implementation of national defense strategies, and a reduction of political and economic instability across the region. This balanced approach – considering both opportunities and challenges – suggests continued growth, although perhaps at a rate slightly moderated by the inherent risks present in the Latin American geopolitical landscape.

Latin America Defense Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America defense industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on procurement and MRO segments, this report is essential for industry professionals, investors, and policymakers seeking a complete understanding of this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in millions.

Latin America Defense Industry Market Dynamics & Structure

The Latin American defense industry is characterized by a moderately concentrated market with significant variations across nations. Technological innovation, driven by both internal development and external partnerships, is a key driver, albeit facing challenges like funding constraints and technology transfer restrictions. Regulatory frameworks vary significantly across countries, impacting procurement processes and investment decisions. The industry witnesses competition from both domestic and international players, with varying degrees of substitution based on specific product categories. End-user demographics primarily comprise national armed forces and law enforcement agencies, while M&A activity remains relatively limited compared to other regions, although strategic partnerships are gaining traction.

- Market Concentration: Moderately concentrated, with a few dominant players holding significant market share in specific segments. xx% market share held by top 5 players in 2024.

- Technological Innovation: Driven by modernization efforts and external collaborations, but constrained by budget limitations and technological dependence.

- Regulatory Framework: Varies widely across countries, impacting procurement procedures and investment attractiveness.

- Competitive Landscape: Mix of domestic and international companies, creating both competition and collaboration opportunities.

- M&A Activity: Relatively low compared to other regions, but strategic partnerships and joint ventures are increasing.

Latin America Defense Industry Growth Trends & Insights

The Latin American defense industry exhibits a steady growth trajectory, driven by increasing geopolitical instability, modernization needs, and evolving defense strategies across the region. The market is witnessing increasing adoption of advanced technologies, such as AI, unmanned systems, and cyber defense solutions. Consumer behavior shifts toward greater emphasis on technological sophistication and cost-effectiveness. The historical period (2019-2024) saw a CAGR of xx%, while the forecast period (2025-2033) projects a CAGR of xx%, reaching a market size of xx million by 2033. This growth is fueled by increased government spending, modernization programs, and rising security concerns. Market penetration of advanced technologies remains relatively low, offering significant growth opportunities. Specific regional variations exist, reflecting unique political and economic contexts.

Dominant Regions, Countries, or Segments in Latin America Defense Industry

Brazil and Mexico dominate the Latin American defense market, representing a combined xx% of the total market in 2024. Within procurement, the "Weapons and Ammunition" segment holds the largest share, followed by "Vehicles". In the MRO segment, "Weapons and Ammunition" also leads, indicating a significant need for maintenance and upgrades. Growth is driven by various factors:

- Brazil: Strong domestic industry base, significant investment in modernization, and a large armed force contribute to its leading position.

- Mexico: Growing defense budget and strategic partnerships with international companies are driving market growth.

- Weapons and Ammunition: High demand for replacement and upgrades of existing inventories fuels this segment's dominance.

- Vehicles: Need for modernization and fleet replacement drives substantial growth in this segment.

Further regional nuances exist, reflecting specific geopolitical concerns and economic capabilities.

Latin America Defense Industry Product Landscape

The Latin American defense industry showcases a mix of domestically produced and imported products. Innovation focuses on cost-effective solutions, addressing specific regional needs, and integrating advanced technologies where feasible. Recent advancements include improved communication systems with enhanced cybersecurity features, more resilient and versatile vehicles, and precision-guided munitions. The unique selling propositions frequently center on adaptability to diverse operational environments and affordability.

Key Drivers, Barriers & Challenges in Latin America Defense Industry

Key Drivers:

- Increasing geopolitical tensions and regional conflicts.

- Rising internal security concerns and counter-insurgency operations.

- Government initiatives aimed at modernizing armed forces.

- Technological advancements offering enhanced capabilities.

Challenges & Restraints:

- Budgetary constraints limiting large-scale procurement programs.

- Dependence on foreign technology and potential supply chain disruptions.

- Complex procurement processes and bureaucratic hurdles.

- Competition from established international defense contractors.

Emerging Opportunities in Latin America Defense Industry

- Growth in the cybersecurity sector due to rising cyber threats.

- Increasing demand for unmanned aerial vehicles (UAVs) and other autonomous systems.

- Opportunities in the development and integration of indigenous defense technologies.

- Expanding market for defense-related services, such as training and maintenance.

Growth Accelerators in the Latin America Defense Industry Industry

Long-term growth is driven by a combination of factors including regional geopolitical instability fostering increased defense spending, modernization efforts across the region, and partnerships between domestic and international companies fostering technology transfer and capability development. Technological breakthroughs in areas such as AI and cybersecurity will continue to shape market expansion.

Key Players Shaping the Latin America Defense Industry Market

- Avibras Industria Aerospacial SA

- CBC Brazil (Website unavailable)

- Lockheed Martin Corporation

- IVENCO SpA (Website unavailable)

- IMBEL (Website unavailable)

- FAMAE (Website unavailable)

- Thales Group

- Embraer SA

- INDUMIL (Website unavailable)

- Northrop Grumman Corporation

- Saab AB

- The Boeing Company

Notable Milestones in Latin America Defense Industry Sector

- 2021: Brazil launches a new national defense strategy focusing on technological independence.

- 2022: Mexico signs a significant contract for the procurement of new military vehicles.

- 2023: A major joint venture is formed between a Brazilian and a European defense company to develop advanced weapon systems. (Specific details unavailable)

In-Depth Latin America Defense Industry Market Outlook

The Latin American defense industry is poised for sustained growth over the next decade, driven by modernization initiatives, regional security concerns, and technological advancements. Strategic partnerships, focusing on technology transfer and capacity building, will play a crucial role in shaping the market landscape. Significant opportunities exist for companies offering advanced technologies, cost-effective solutions, and tailored services catering to the specific needs of the region. Continued focus on regional cooperation and integration will further stimulate market expansion.

Latin America Defense Industry Segmentation

-

1. Procurement

- 1.1. Personnel Training and Protection

- 1.2. Communication Systems

- 1.3. Weapons and Ammunition

-

1.4. Vehicles

- 1.4.1. Land-based Vehicles

- 1.4.2. Sea-based Vehicles

- 1.4.3. Air-based Vehicles

-

2. MRO

- 2.1. Communication Systems

- 2.2. Weapons and Ammunition

- 2.3. Vehicles

-

3. Geography

- 3.1. Brazil

- 3.2. Colombia

- 3.3. Mexico

- 3.4. Chile

- 3.5. Rest of Latin America

Latin America Defense Industry Segmentation By Geography

- 1. Brazil

- 2. Colombia

- 3. Mexico

- 4. Chile

- 5. Rest of Latin America

Latin America Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Vehicles Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 5.1.1. Personnel Training and Protection

- 5.1.2. Communication Systems

- 5.1.3. Weapons and Ammunition

- 5.1.4. Vehicles

- 5.1.4.1. Land-based Vehicles

- 5.1.4.2. Sea-based Vehicles

- 5.1.4.3. Air-based Vehicles

- 5.2. Market Analysis, Insights and Forecast - by MRO

- 5.2.1. Communication Systems

- 5.2.2. Weapons and Ammunition

- 5.2.3. Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Colombia

- 5.3.3. Mexico

- 5.3.4. Chile

- 5.3.5. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Colombia

- 5.4.3. Mexico

- 5.4.4. Chile

- 5.4.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Procurement

- 6. Brazil Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 6.1.1. Personnel Training and Protection

- 6.1.2. Communication Systems

- 6.1.3. Weapons and Ammunition

- 6.1.4. Vehicles

- 6.1.4.1. Land-based Vehicles

- 6.1.4.2. Sea-based Vehicles

- 6.1.4.3. Air-based Vehicles

- 6.2. Market Analysis, Insights and Forecast - by MRO

- 6.2.1. Communication Systems

- 6.2.2. Weapons and Ammunition

- 6.2.3. Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Colombia

- 6.3.3. Mexico

- 6.3.4. Chile

- 6.3.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Procurement

- 7. Colombia Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 7.1.1. Personnel Training and Protection

- 7.1.2. Communication Systems

- 7.1.3. Weapons and Ammunition

- 7.1.4. Vehicles

- 7.1.4.1. Land-based Vehicles

- 7.1.4.2. Sea-based Vehicles

- 7.1.4.3. Air-based Vehicles

- 7.2. Market Analysis, Insights and Forecast - by MRO

- 7.2.1. Communication Systems

- 7.2.2. Weapons and Ammunition

- 7.2.3. Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Colombia

- 7.3.3. Mexico

- 7.3.4. Chile

- 7.3.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Procurement

- 8. Mexico Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 8.1.1. Personnel Training and Protection

- 8.1.2. Communication Systems

- 8.1.3. Weapons and Ammunition

- 8.1.4. Vehicles

- 8.1.4.1. Land-based Vehicles

- 8.1.4.2. Sea-based Vehicles

- 8.1.4.3. Air-based Vehicles

- 8.2. Market Analysis, Insights and Forecast - by MRO

- 8.2.1. Communication Systems

- 8.2.2. Weapons and Ammunition

- 8.2.3. Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Colombia

- 8.3.3. Mexico

- 8.3.4. Chile

- 8.3.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Procurement

- 9. Chile Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 9.1.1. Personnel Training and Protection

- 9.1.2. Communication Systems

- 9.1.3. Weapons and Ammunition

- 9.1.4. Vehicles

- 9.1.4.1. Land-based Vehicles

- 9.1.4.2. Sea-based Vehicles

- 9.1.4.3. Air-based Vehicles

- 9.2. Market Analysis, Insights and Forecast - by MRO

- 9.2.1. Communication Systems

- 9.2.2. Weapons and Ammunition

- 9.2.3. Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Colombia

- 9.3.3. Mexico

- 9.3.4. Chile

- 9.3.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Procurement

- 10. Rest of Latin America Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 10.1.1. Personnel Training and Protection

- 10.1.2. Communication Systems

- 10.1.3. Weapons and Ammunition

- 10.1.4. Vehicles

- 10.1.4.1. Land-based Vehicles

- 10.1.4.2. Sea-based Vehicles

- 10.1.4.3. Air-based Vehicles

- 10.2. Market Analysis, Insights and Forecast - by MRO

- 10.2.1. Communication Systems

- 10.2.2. Weapons and Ammunition

- 10.2.3. Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Colombia

- 10.3.3. Mexico

- 10.3.4. Chile

- 10.3.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Procurement

- 11. Brazil Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 14. Peru Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 15. Chile Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America Latin America Defense Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Avibras Industria Aerospacial SA

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 CBC Brazi

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Lockheed Martin Corporation

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 IVENCO SpA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 IMBEL

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 FAMAE

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Thales Group

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Embraer SA

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 INDUMIL

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Northrop Grumman Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Saab AB

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 The Boeing Company

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Avibras Industria Aerospacial SA

List of Figures

- Figure 1: Latin America Defense Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Defense Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 3: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 4: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Latin America Defense Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Defense Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 14: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 15: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 18: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 19: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 22: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 23: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 26: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 27: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Latin America Defense Industry Revenue Million Forecast, by Procurement 2019 & 2032

- Table 30: Latin America Defense Industry Revenue Million Forecast, by MRO 2019 & 2032

- Table 31: Latin America Defense Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Latin America Defense Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Defense Industry?

The projected CAGR is approximately > 1.50%.

2. Which companies are prominent players in the Latin America Defense Industry?

Key companies in the market include Avibras Industria Aerospacial SA, CBC Brazi, Lockheed Martin Corporation, IVENCO SpA, IMBEL, FAMAE, Thales Group, Embraer SA, INDUMIL, Northrop Grumman Corporation, Saab AB, The Boeing Company.

3. What are the main segments of the Latin America Defense Industry?

The market segments include Procurement, MRO, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Vehicles Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Defense Industry?

To stay informed about further developments, trends, and reports in the Latin America Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence