Key Insights

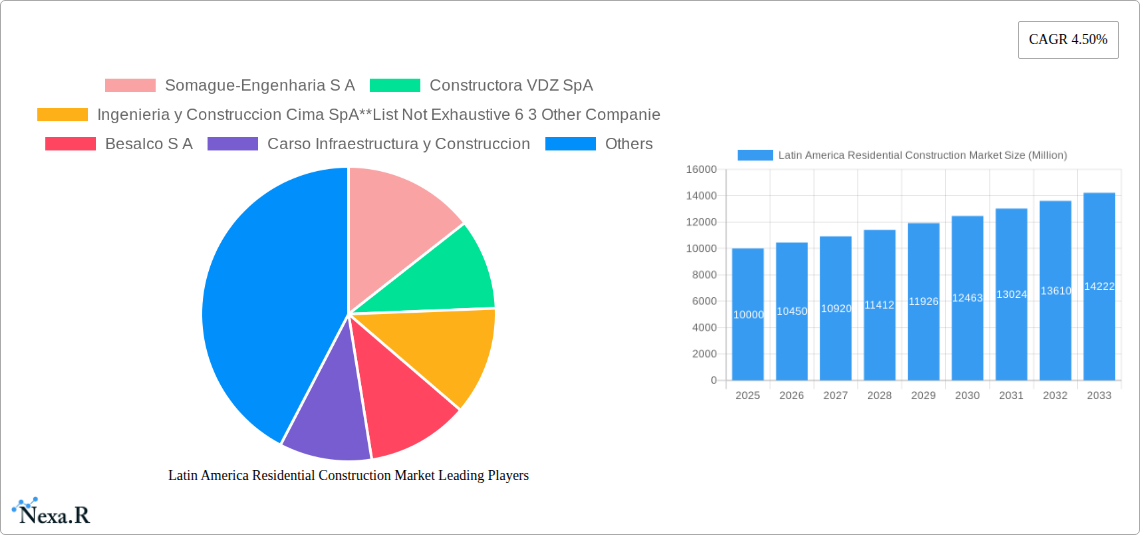

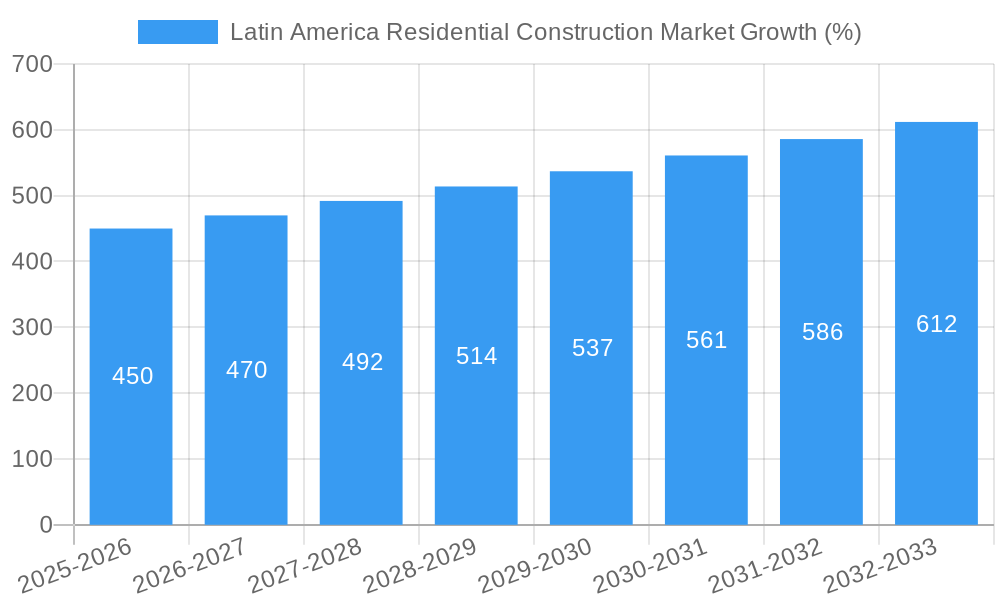

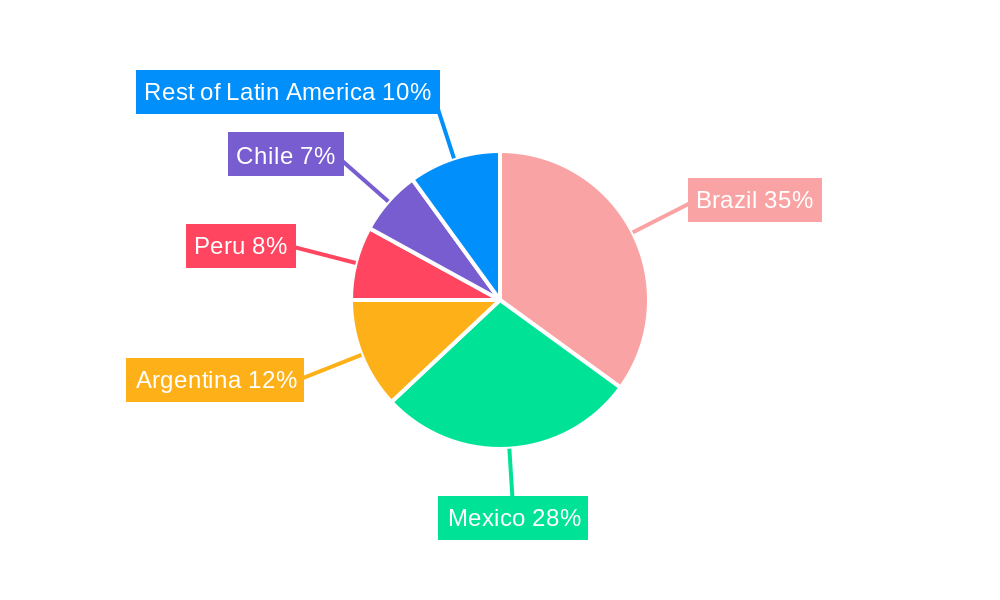

The Latin American residential construction market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. A rising population, particularly in urban centers, fuels increased demand for housing. Furthermore, improving economic conditions in several key countries like Brazil and Mexico are stimulating investment in residential projects, particularly in the condominium/apartment segment which often caters to a growing middle class. Government initiatives aimed at affordable housing and infrastructure development also contribute positively to market expansion. While the prefabricated homes segment presents a growing opportunity, driven by cost-effectiveness and faster construction times, challenges remain. These include inconsistent regulatory frameworks across different Latin American nations, fluctuations in material costs due to global supply chain issues, and infrastructural limitations in some regions, potentially hindering project timelines and increasing overall costs. The market is segmented by dwelling type (villas/landed houses, condominiums/apartments, prefabricated homes) and geography (Mexico, Brazil, Argentina, Peru, Chile, Uruguay, and Rest of Latin America). Brazil and Mexico are expected to dominate the market due to their larger populations and economies. Competition is relatively high, with both large multinational construction firms and regional players vying for market share. The forecast period of 2025-2033 anticipates continued growth, albeit potentially at a slightly moderated pace compared to previous years, with a projected CAGR of 4.5%.

The sustained growth forecast hinges on the continued economic stability and improvement across the region. Factors such as political stability, inflation control, and access to financing will play a crucial role. Furthermore, the successful implementation of sustainable construction practices and the adoption of innovative building technologies could further enhance the market's trajectory. The ongoing shift towards urbanization, coupled with rising disposable incomes within certain demographic segments, is expected to drive demand for higher-quality and more sophisticated housing options. Understanding the nuances of individual country markets within Latin America is critical for effective market penetration and strategic investment. Analyzing regional variations in regulatory environments, consumer preferences, and economic indicators will allow stakeholders to effectively navigate the opportunities and challenges presented by this dynamic market.

Latin America Residential Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America residential construction market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by type (Villas/Landed Houses, Condominiums/Apartments, Prefabricated Homes) and country (Mexico, Brazil, Argentina, Peru, Chile, Uruguay, Rest of Latin America), providing granular insights into market performance across various regions and segments. The total market size is estimated at xx Million units in 2025.

Latin America Residential Construction Market Dynamics & Structure

The Latin American residential construction market is characterized by a moderately concentrated landscape, with a few large players and numerous smaller regional firms competing for market share. Market concentration is highest in Brazil and Mexico, while smaller countries display more fragmented structures. Technological innovation is uneven across the region, with advanced construction techniques more prevalent in larger cities. Regulatory frameworks vary significantly between countries, impacting construction timelines and costs. The main competitive substitutes are existing housing stock and alternative housing solutions. The end-user demographic is diverse, encompassing a broad range of income levels and housing preferences.

- Market Concentration: Brazil and Mexico account for approximately xx% of the total market, while the remaining countries share the remaining xx%.

- Technological Innovation: Adoption of Building Information Modeling (BIM) and prefabrication technologies is gradually increasing, primarily in larger projects.

- Regulatory Frameworks: Varying building codes and permitting processes across Latin American countries introduce significant complexities and influence construction costs and timelines.

- M&A Activity: The number of M&A deals in the sector has averaged xx deals annually between 2019 and 2024, with a majority focusing on consolidation within national markets.

Latin America Residential Construction Market Growth Trends & Insights

The Latin American residential construction market has experienced fluctuating growth over the historical period (2019-2024), influenced by economic cycles, government policies, and infrastructural developments. However, a steady recovery is projected for the forecast period (2025-2033), driven by factors such as increasing urbanization, rising disposable incomes in several countries, and government initiatives aimed at improving housing affordability. Technological disruptions, like modular construction and the application of BIM, are accelerating efficiency and sustainability. Changing consumer preferences towards modern designs and eco-friendly features are also influencing market trends. The CAGR for the market is estimated at xx% during the forecast period. Market penetration of prefabricated homes is projected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Latin America Residential Construction Market

Brazil and Mexico are the dominant countries in the Latin American residential construction market, accounting for the largest share of total units constructed. This dominance is attributed to factors including a large and growing population, robust economic growth (although fluctuating), and significant investments in infrastructure. Within the segments, condominiums/apartments represent the largest share due to urbanization and the increasing preference for high-density living.

- Brazil: Strong economic growth (albeit volatile) and a large population drive high demand.

- Mexico: Significant urbanization and government initiatives supporting housing development contribute to market leadership.

- Condominiums/Apartments: This segment dominates due to urbanization and space constraints in major cities.

- Villas/Landed Houses: This segment retains substantial demand particularly in suburban and rural areas.

Latin America Residential Construction Market Product Landscape

The Latin American residential construction market displays a diverse product landscape, ranging from basic affordable housing units to luxury villas. Innovations focus on cost-effectiveness, sustainability, and improved quality. Prefabricated homes are gaining traction, offering faster construction times and reduced labor costs. Technological advancements include the wider adoption of BIM for design and construction management, contributing to better project coordination and cost control. Unique selling propositions include designs tailored to local climates and preferences, incorporating energy-efficient technologies and smart home features.

Key Drivers, Barriers & Challenges in Latin America Residential Construction Market

Key Drivers:

- Increasing urbanization and population growth.

- Rising middle-class incomes driving housing demand.

- Government initiatives aimed at improving housing affordability.

- Adoption of innovative construction technologies.

Challenges & Restraints:

- Economic volatility impacting investment and construction activity.

- Bureaucracy and complex permitting processes creating delays.

- Supply chain disruptions affecting material costs and availability.

- Skills gap in the construction workforce hindering project completion.

Emerging Opportunities in Latin America Residential Construction Market

- Growth in eco-friendly and sustainable housing construction.

- Increasing demand for smart homes and technology integration.

- Expansion into rural and underserved markets.

- Development of modular and prefabricated housing solutions to meet growing demand efficiently.

Growth Accelerators in the Latin America Residential Construction Market Industry

The long-term growth of the Latin American residential construction market will be accelerated by the continued urbanization trend, rising disposable incomes, and supportive government policies. Technological advancements, strategic partnerships between construction firms and technology providers, and innovative financing models will further catalyze market expansion. Government initiatives to improve infrastructure and reduce bureaucratic hurdles will also play a crucial role in unlocking growth potential.

Key Players Shaping the Latin America Residential Construction Market Market

- Somague-Engenharia S A

- Constructora VDZ SpA

- Ingenieria y Construccion Cima SpA

- Besalco S A

- Carso Infraestructura y Construccion

- Socovesa S A

- Fluor Corporation

- Hogares Eden S A de C V

- ACS Servicios Comunicaciones Y Energa Mexico S A De C V

- Cyrela Brazil Realty S A

- 63 Other Companies

Notable Milestones in Latin America Residential Construction Market Sector

- September 2022: A new Las Colinas housing community, comprising six dozen high-end homes, is planned near Fluor Corp.'s headquarters, indicating a strong demand for luxury housing.

- January 2023: Modularis initiates construction of a mixed-use development in Sao Paulo, showcasing the increasing adoption of modular construction techniques.

In-Depth Latin America Residential Construction Market Market Outlook

The Latin American residential construction market presents substantial growth potential driven by strong demographic and economic trends. Strategic opportunities exist for companies that can effectively navigate the regulatory landscape, adopt innovative technologies, and cater to the evolving needs of a diverse consumer base. The focus on sustainable and affordable housing solutions will be crucial for long-term success in this dynamic market.

Latin America Residential Construction Market Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

- 1.3. Prefabricated Homes

Latin America Residential Construction Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Residential Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Social Rental Drive

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.1.3. Prefabricated Homes

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Residential Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Somague-Engenharia S A

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Constructora VDZ SpA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Ingenieria y Construccion Cima SpA**List Not Exhaustive 6 3 Other Companie

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Besalco S A

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Carso Infraestructura y Construccion

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Socovesa S A

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fluor Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hogares Eden S A de C V

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 ACS Servicios Comunicaciones Y Energa Mexico S A De C V

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cyrela Brazil Realty S A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Somague-Engenharia S A

List of Figures

- Figure 1: Latin America Residential Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Residential Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Residential Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Latin America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazil Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Argentina Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Peru Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chile Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Latin America Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Latin America Residential Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Latin America Residential Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Chile Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Colombia Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Venezuela Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ecuador Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bolivia Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Paraguay Latin America Residential Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Residential Construction Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Latin America Residential Construction Market?

Key companies in the market include Somague-Engenharia S A, Constructora VDZ SpA, Ingenieria y Construccion Cima SpA**List Not Exhaustive 6 3 Other Companie, Besalco S A, Carso Infraestructura y Construccion, Socovesa S A, Fluor Corporation, Hogares Eden S A de C V, ACS Servicios Comunicaciones Y Energa Mexico S A De C V, Cyrela Brazil Realty S A.

3. What are the main segments of the Latin America Residential Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Social Rental Drive.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

January 2023: Modularis is set to break ground in May of 2023 for new residential development in Sao Paulo, Brazil, made possible by modular construction and will be comprised of two concrete floors with commercial spaces and 11 floors of modular apartments and is set to be complete by the end of the 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Residential Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Residential Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Residential Construction Market?

To stay informed about further developments, trends, and reports in the Latin America Residential Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence