Key Insights

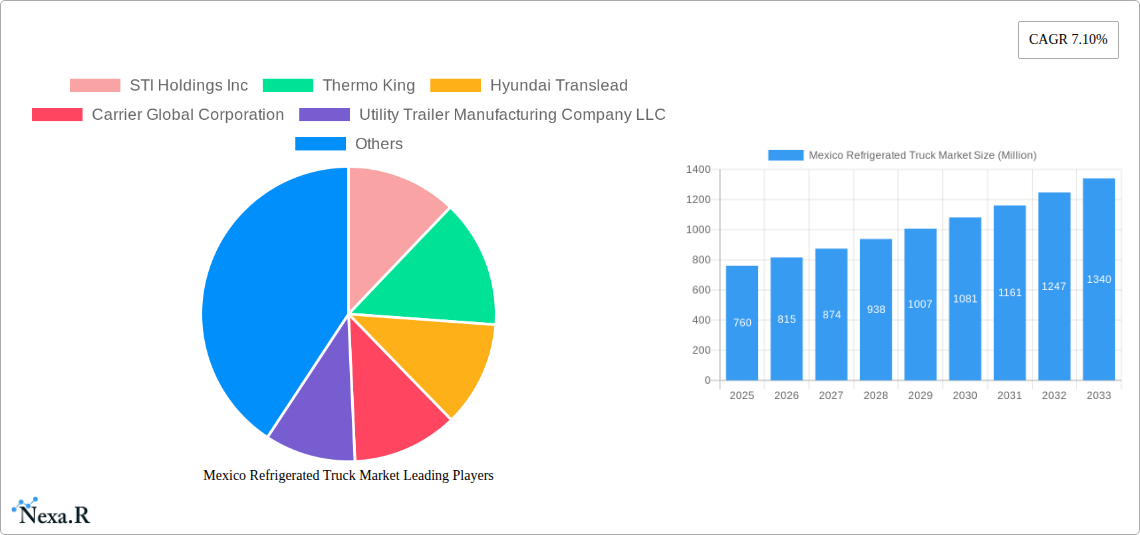

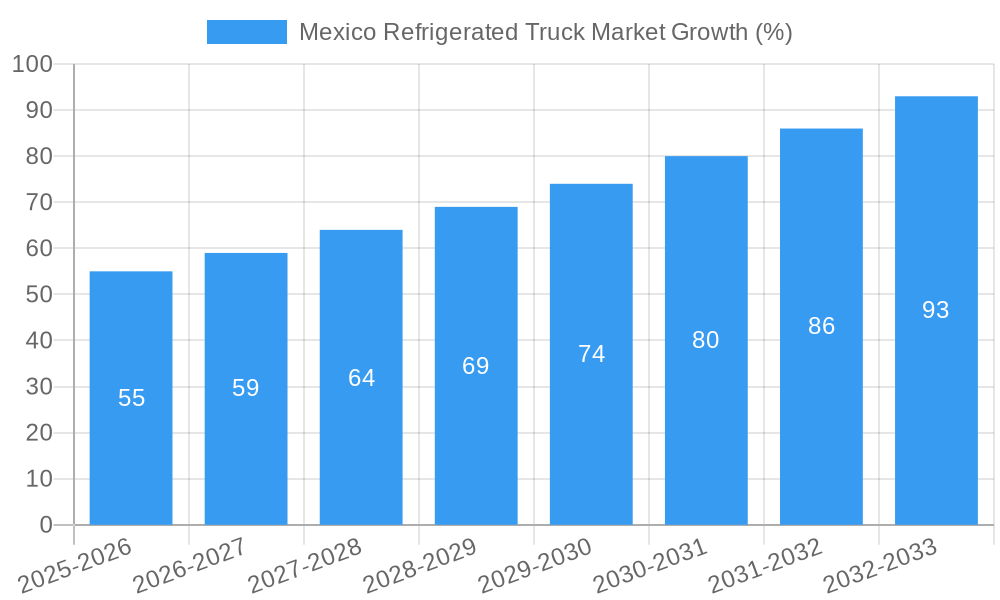

The Mexico refrigerated truck market, valued at $0.76 billion in 2025, is projected to experience robust growth, driven by a burgeoning food and beverage sector, expanding e-commerce logistics requiring temperature-sensitive deliveries, and increasing pharmaceutical production and distribution within the healthcare sector. The market's Compound Annual Growth Rate (CAGR) of 7.10% from 2025 to 2033 indicates a significant expansion over the forecast period. This growth is further fueled by advancements in refrigeration technology, leading to more fuel-efficient and reliable units. The preference for multi-temperature range trucks offers flexibility for diverse cargo needs, further stimulating market demand. While challenges such as fluctuating fuel prices and stringent emission regulations might act as restraints, the overall market outlook remains positive due to Mexico's growing economy and increased investment in its cold chain infrastructure. The dominance of the food and beverage sector, coupled with the increasing adoption of light-duty trucks for last-mile delivery, shapes the market's segmental landscape. Key players, including STI Holdings Inc., Thermo King, and Carrier Global Corporation, are strategically investing in research and development to enhance their product offerings and capture a larger market share. The expanding middle class and increasing urbanization within Mexico are anticipated to further propel demand for refrigerated transportation solutions in the coming years.

The market segmentation reveals a significant share held by the food and beverage sector, followed by the healthcare sector. Within truck types, the light-duty segment is experiencing rapid growth driven by the rise of e-commerce and the need for efficient last-mile deliveries. The ongoing investments in cold chain infrastructure, especially in border regions facilitating trade with the US, are crucial for sustaining market growth. This continuous improvement in infrastructure is vital for reducing transit times and maintaining the quality of temperature-sensitive goods. The increasing adoption of telematics and other advanced technologies for real-time monitoring and improved fleet management contributes to enhanced operational efficiency and reduces spoilage, further driving market expansion. The strategic alliances and collaborations between truck manufacturers, refrigeration technology providers, and logistics companies are also pivotal in driving market innovation and growth.

Mexico Refrigerated Truck Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico Refrigerated Truck Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within the Mexican refrigerated trucking landscape. With a focus on both parent and child markets, this report delivers a granular understanding of market segments such as By Temperature Range (Multi-temperature Range, Single Temperature Range), By Type (Chiller, Freezer), By End User (Healthcare Sector, Food and Beverages Sector, Chemicals, Others), and By Truck Type (Light-Duty Truck, Medium and Heavy-Duty Truck). The market size is presented in Million units.

Mexico Refrigerated Truck Market Dynamics & Structure

This section delves into the intricate structure of the Mexican refrigerated truck market, examining its concentration, technological advancements, regulatory environment, and competitive dynamics. We analyze the impact of mergers and acquisitions (M&A) activity and explore the influence of substitute products. The analysis considers the demographic profile of end-users and their evolving needs.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share (xx%). However, smaller players are also actively participating, creating a dynamic competitive landscape.

- Technological Innovation: Technological advancements, such as the adoption of telematics, fuel-efficient engines, and advanced refrigeration systems, are driving market growth. However, high initial investment costs and a lack of skilled labor present challenges to widespread adoption.

- Regulatory Framework: Government regulations concerning emissions, fuel efficiency, and safety standards directly impact the market. Ongoing policy changes and their influence on market dynamics are assessed.

- Competitive Product Substitutes: While direct substitutes are limited, the market faces indirect competition from other modes of transportation, particularly for shorter distances.

- End-User Demographics: The growing food and beverage sector, coupled with the expansion of the e-commerce industry, is a major driver of demand for refrigerated trucks.

- M&A Trends: The past five years have seen xx M&A deals in the Mexican refrigerated truck market, reflecting strategic consolidation and expansion efforts by major players.

Mexico Refrigerated Truck Market Growth Trends & Insights

This section analyzes the historical and projected growth trajectories of the Mexican refrigerated truck market, offering a comprehensive view of its evolution. The analysis uses proprietary data and industry benchmarks to predict future market size and penetration rates. We examine factors like technological disruptions and shifting consumer behavior to forecast future trends.

The Mexican refrigerated truck market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. This growth is driven primarily by the increasing demand for temperature-sensitive goods and the expansion of the cold chain logistics infrastructure in Mexico. Technological advancements, particularly the adoption of advanced refrigeration technologies and telematics, are also contributing to market growth.

Dominant Regions, Countries, or Segments in Mexico Refrigerated Truck Market

This section pinpoints the leading regions, countries, or market segments that significantly contribute to the overall market growth. The analysis assesses the factors driving dominance, such as economic policies, infrastructure development, and regional market characteristics. Market share and growth potential are analyzed for each segment.

- By Temperature Range: The multi-temperature range segment holds the largest market share (xx%), driven by its versatility in handling diverse temperature-sensitive goods.

- By Type: The reefer segment dominates the market (xx%), reflecting the high demand for refrigerated transportation of perishable goods.

- By End User: The food and beverage sector accounts for the largest market share (xx%), owing to the significant volume of temperature-sensitive products requiring refrigerated transportation. The healthcare sector displays significant growth potential (xx%).

- By Truck Type: The medium and heavy-duty truck segment dominates, reflecting the need for higher cargo capacity for long-haul transportation.

The northern region of Mexico demonstrates the highest growth potential due to its proximity to the US market and the thriving agricultural and manufacturing sectors.

Mexico Refrigerated Truck Market Product Landscape

The Mexican refrigerated truck market is characterized by a diverse range of products offering varying temperature control capabilities, fuel efficiency, and technological features. Innovation is focused on enhancing fuel efficiency, improving temperature control precision, and integrating advanced telematics for enhanced tracking and monitoring. Manufacturers are increasingly incorporating features like improved insulation, advanced refrigeration units, and remote monitoring capabilities to meet evolving customer needs. The adoption of electric and alternative fuel-powered refrigerated trucks is gaining traction, driven by environmental concerns and government incentives.

Key Drivers, Barriers & Challenges in Mexico Refrigerated Truck Market

Key Drivers:

- Growing demand from the food and beverage industry.

- Expansion of e-commerce and cold chain logistics.

- Government initiatives promoting infrastructure development.

- Technological advancements in refrigeration and telematics.

Key Challenges & Restraints:

- High initial investment costs for advanced technology.

- Fluctuations in fuel prices impacting operating costs.

- Stringent emission regulations potentially restricting older truck models.

- Supply chain disruptions and logistics bottlenecks.

Emerging Opportunities in Mexico Refrigerated Truck Market

- Untapped Markets: Expansion into rural areas with limited cold chain infrastructure presents significant opportunities.

- Innovative Applications: The use of refrigerated trucks in the pharmaceutical and healthcare sectors is growing.

- Evolving Consumer Preferences: Increasing demand for fresh and organic produce is driving the need for efficient temperature-controlled transportation.

Growth Accelerators in the Mexico Refrigerated Truck Market Industry

Several factors are poised to accelerate the long-term growth of the Mexican refrigerated truck market. Technological breakthroughs in refrigeration technology, such as more energy-efficient units and improved temperature control, will play a significant role. Strategic partnerships between truck manufacturers, logistics providers, and technology companies will foster innovation and expand market reach. Government initiatives to improve infrastructure and support the cold chain logistics sector will further stimulate market growth.

Key Players Shaping the Mexico Refrigerated Truck Market Market

- STI Holdings Inc

- Thermo King

- Hyundai Translead

- Carrier Global Corporation

- Utility Trailer Manufacturing Company LLC

- Vanguard National Trailer Corp

- Great Dane Trailers Inc

- Wabash National Corp

- Cimc Vehicles Group Co Ltd

- Ford Motor Company

Notable Milestones in Mexico Refrigerated Truck Market Sector

- September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit for cargo rail and intermodal applications. This signifies a move towards more efficient and specialized refrigerated transport solutions.

- May 2023: Canadian Pacific Kansas City (CPKC) expanded its Mexican network by adding 1,000 new temperature-controlled intermodal containers, significantly boosting capacity for perishable goods transport between Mexico and the United States. This strengthens the cold chain infrastructure and supports increased trade volumes.

In-Depth Mexico Refrigerated Truck Market Market Outlook

The Mexican refrigerated truck market is poised for sustained growth driven by several factors, including increasing demand from the food and beverage and healthcare sectors, expansion of cold chain logistics, and ongoing technological advancements. Strategic investments in infrastructure and partnerships across the supply chain will further accelerate this growth. The market presents significant opportunities for both established players and new entrants, particularly in the adoption of sustainable and efficient transportation solutions. The market is expected to continue its expansion and offer attractive returns for investors in the coming years.

Mexico Refrigerated Truck Market Segmentation

-

1. Truck Type

- 1.1. Light-Duty Truck

- 1.2. Medium and Heavy-Duty Truck

-

2. Temperature Range

- 2.1. Multi-temperature Range

- 2.2. Single Temperature Range

-

3. Type

- 3.1. Chiller

- 3.2. Freezer

-

4. End User

- 4.1. Healthcare Sector

- 4.2. Food and Beverages Sector

- 4.3. Chemicals

- 4.4. Others

Mexico Refrigerated Truck Market Segmentation By Geography

- 1. Mexico

Mexico Refrigerated Truck Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Transportation of Perishable Goods Across the Country

- 3.3. Market Restrains

- 3.3.1. High Maintenance Cost of Refrigerated Trucks

- 3.4. Market Trends

- 3.4.1. Medium and Heavy-Duty Trucks Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Refrigerated Truck Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Truck Type

- 5.1.1. Light-Duty Truck

- 5.1.2. Medium and Heavy-Duty Truck

- 5.2. Market Analysis, Insights and Forecast - by Temperature Range

- 5.2.1. Multi-temperature Range

- 5.2.2. Single Temperature Range

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Chiller

- 5.3.2. Freezer

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Healthcare Sector

- 5.4.2. Food and Beverages Sector

- 5.4.3. Chemicals

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Truck Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 STI Holdings Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermo King

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Translead

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carrier Global Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Utility Trailer Manufacturing Company LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vanguard National Trailer Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Great Dane Trailers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wabash National Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cimc Vehicles Group Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ford Motor Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 STI Holdings Inc

List of Figures

- Figure 1: Mexico Refrigerated Truck Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Refrigerated Truck Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Refrigerated Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Refrigerated Truck Market Revenue Million Forecast, by Truck Type 2019 & 2032

- Table 3: Mexico Refrigerated Truck Market Revenue Million Forecast, by Temperature Range 2019 & 2032

- Table 4: Mexico Refrigerated Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Mexico Refrigerated Truck Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Mexico Refrigerated Truck Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Mexico Refrigerated Truck Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Mexico Refrigerated Truck Market Revenue Million Forecast, by Truck Type 2019 & 2032

- Table 9: Mexico Refrigerated Truck Market Revenue Million Forecast, by Temperature Range 2019 & 2032

- Table 10: Mexico Refrigerated Truck Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Mexico Refrigerated Truck Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Mexico Refrigerated Truck Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Refrigerated Truck Market?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Mexico Refrigerated Truck Market?

Key companies in the market include STI Holdings Inc, Thermo King, Hyundai Translead, Carrier Global Corporation, Utility Trailer Manufacturing Company LLC, Vanguard National Trailer Corp, Great Dane Trailers Inc, Wabash National Corp, Cimc Vehicles Group Co Ltd, Ford Motor Company.

3. What are the main segments of the Mexico Refrigerated Truck Market?

The market segments include Truck Type, Temperature Range, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Transportation of Perishable Goods Across the Country.

6. What are the notable trends driving market growth?

Medium and Heavy-Duty Trucks Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Maintenance Cost of Refrigerated Trucks.

8. Can you provide examples of recent developments in the market?

September 2023: Thermo King introduced the Advancer S-DRC slimline rail unit. The unit is suitable for cargo rail and intermodal applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Refrigerated Truck Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Refrigerated Truck Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Refrigerated Truck Market?

To stay informed about further developments, trends, and reports in the Mexico Refrigerated Truck Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence