Key Insights

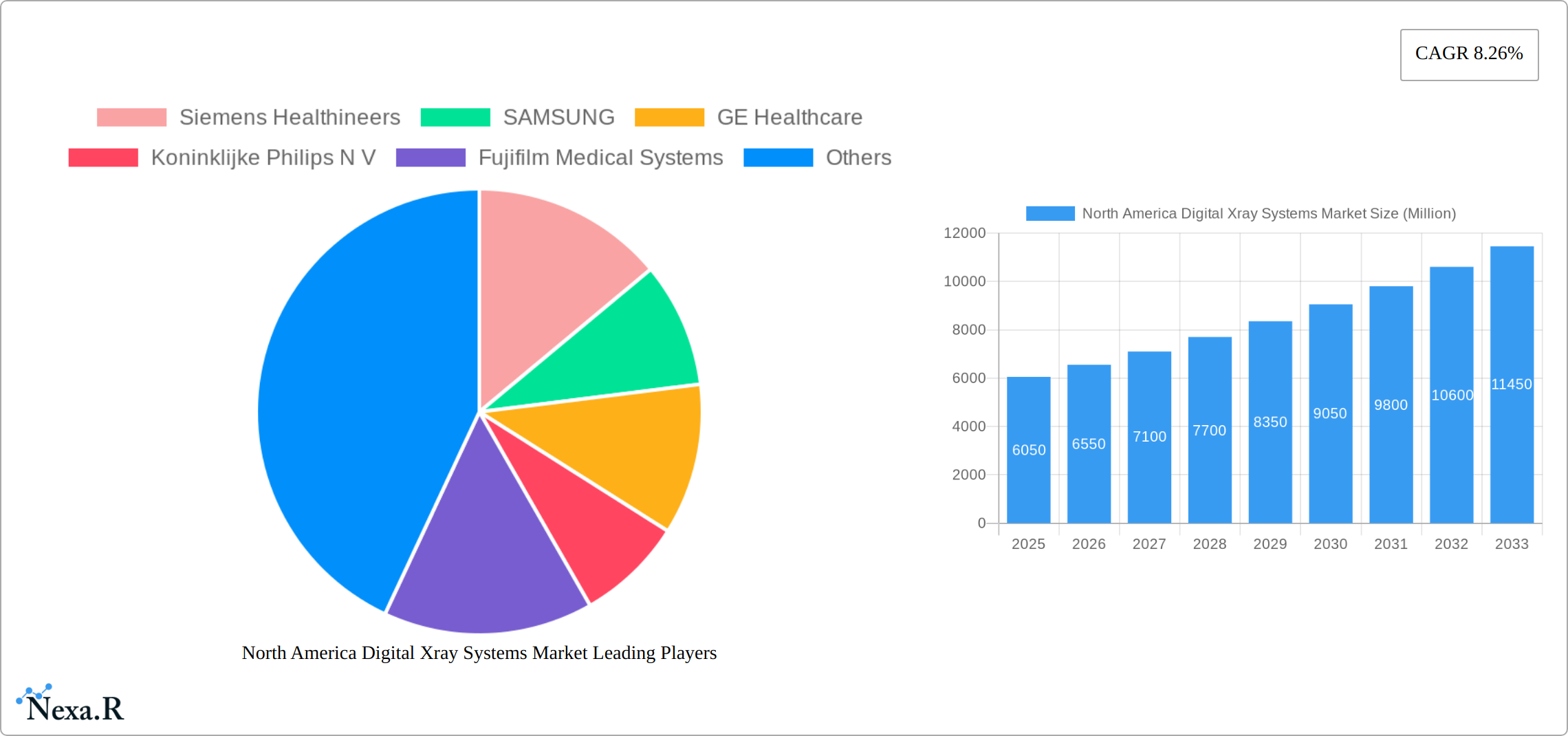

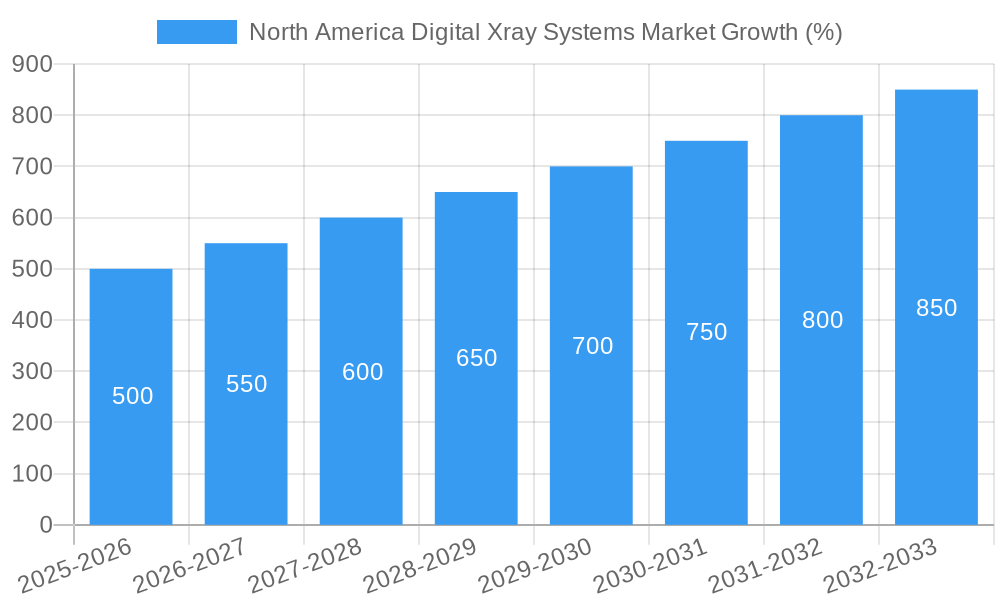

The North American digital X-ray systems market, valued at $6.05 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of chronic diseases like cancer and cardiovascular conditions necessitates frequent diagnostic imaging, fueling demand for advanced digital X-ray systems. Technological advancements, such as the transition from computed radiography (CR) to direct radiography (DR), are enhancing image quality, reducing radiation exposure, and improving workflow efficiency, further stimulating market expansion. The growing preference for portable systems in emergency rooms and outpatient settings is also contributing to market growth. Hospitals and diagnostic centers represent the largest end-user segments, although the "other end-users" category, encompassing clinics and mobile imaging units, is demonstrating significant growth potential. While the market faces some restraints, such as high initial investment costs and the need for skilled technicians, the overall growth trajectory remains positive, particularly given the ongoing technological innovations and increasing healthcare spending in North America.

The market's 8.26% CAGR suggests a significant expansion over the forecast period (2025-2033). This growth is likely to be most pronounced in the DR segment due to its superior image quality and speed compared to CR. Within applications, orthopedic and cardiovascular imaging are anticipated to dominate due to the high volume of procedures requiring X-ray imaging. The United States is expected to remain the largest market within North America, followed by Canada and Mexico. The competitive landscape is characterized by the presence of major players like Siemens Healthineers, GE Healthcare, and Fujifilm, who are actively engaged in research and development, product innovation, and strategic acquisitions to strengthen their market positions. This intense competition benefits consumers by driving down costs and improving product quality. The continued focus on improving image quality, reducing radiation dose, and enhancing workflow efficiency will shape future market trends.

North America Digital X-Ray Systems Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America digital X-ray systems market, encompassing the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by application (Orthopedic, Cancer, Dental, Cardiovascular, Other Applications), technology (Computed Radiography, Direct Radiography), portability (Fixed Systems, Portable Systems), and end-user (Hospitals, Diagnostic Centers, Other End-Users). The total market size is expected to reach xx Million units by 2033.

North America Digital X-Ray Systems Market Dynamics & Structure

The North American digital X-ray systems market is characterized by a moderately concentrated landscape, with key players like Siemens Healthineers, SAMSUNG, GE Healthcare, and Koninklijke Philips N.V. holding significant market share. Technological innovation, particularly in direct radiography and AI-powered image analysis, is a major growth driver. Stringent regulatory frameworks governing medical devices influence market access and product development. The market also faces competition from alternative imaging modalities, such as ultrasound and MRI. The end-user demographic is primarily comprised of hospitals and diagnostic centers, with a growing contribution from smaller clinics and ambulatory care settings. M&A activity has been moderate in recent years, with a focus on strategic acquisitions to expand product portfolios and geographic reach. Approximately xx M&A deals were recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Driven by advancements in direct radiography, detector technology, and AI-powered image processing.

- Regulatory Landscape: Stringent FDA regulations impact market entry and product approvals.

- Competitive Substitutes: Ultrasound, MRI, and CT scans offer alternative imaging solutions.

- End-User Demographics: Hospitals and diagnostic centers represent the primary end-users.

- M&A Activity: Moderate activity, driven by expansion strategies and technology acquisition.

North America Digital X-Ray Systems Market Growth Trends & Insights

The North American digital X-ray systems market witnessed robust growth during the historical period (2019-2024), driven by increasing prevalence of chronic diseases, technological advancements, and rising healthcare expenditure. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. Increased adoption of digital X-ray systems over analog technologies, fueled by improved image quality, faster processing times, and reduced radiation exposure, is a significant growth factor. Technological disruptions, such as the integration of AI and machine learning for automated image analysis, are transforming the market landscape. Consumer behavior shifts toward minimally invasive procedures and personalized medicine are also contributing to the market's expansion. Market penetration of digital X-ray systems in smaller healthcare facilities is expected to increase significantly during the forecast period.

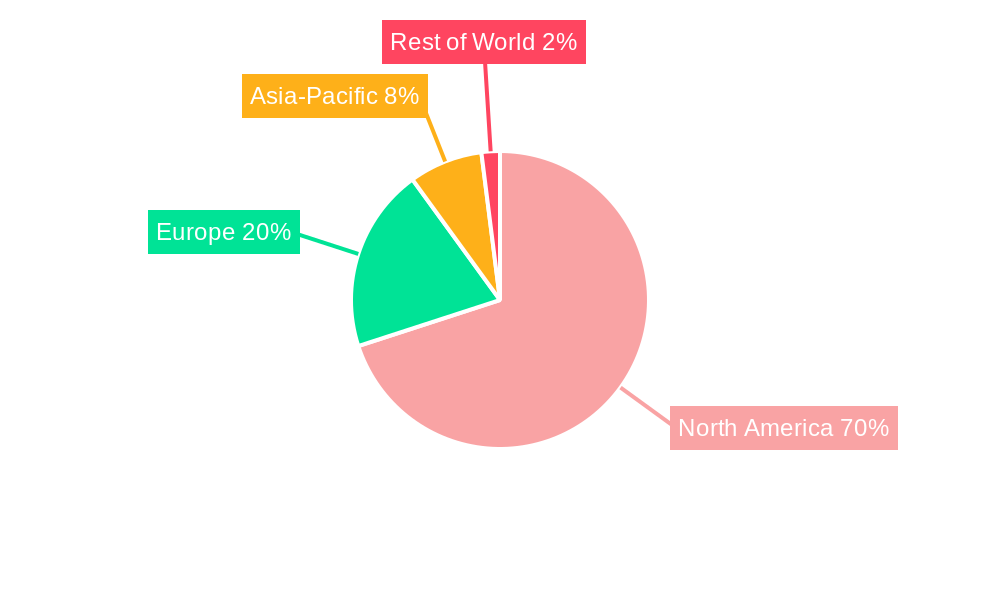

Dominant Regions, Countries, or Segments in North America Digital X-Ray Systems Market

The United States dominates the North American digital X-ray systems market, driven by high healthcare expenditure, advanced healthcare infrastructure, and a large patient population. Within the application segment, orthopedic imaging represents the largest market share due to its high prevalence and demand. Direct radiography technology holds a significant share due to its superior image quality and efficiency. Hospitals constitute the largest end-user segment.

- Leading Region: United States

- Dominant Application: Orthopedic imaging

- Leading Technology: Direct Radiography

- Largest End-User: Hospitals

- Key Growth Drivers: High healthcare spending, technological advancements, aging population

North America Digital X-Ray Systems Market Product Landscape

The digital X-ray systems market offers a diverse range of products, including fixed and portable systems with varying levels of automation and image processing capabilities. Recent innovations include systems with advanced detectors, improved image quality, and AI-powered image analysis tools. Unique selling propositions often center on ease of use, workflow efficiency, reduced radiation dose, and superior diagnostic accuracy. Manufacturers are increasingly focusing on integrating their systems with hospital information systems (HIS) and picture archiving and communication systems (PACS) to streamline workflow and improve data management.

Key Drivers, Barriers & Challenges in North America Digital X-Ray Systems Market

Key Drivers:

- Increasing prevalence of chronic diseases requiring imaging diagnostics.

- Technological advancements enhancing image quality and efficiency.

- Rising healthcare expenditure and insurance coverage.

- Growing adoption of minimally invasive procedures.

Challenges & Restraints:

- High initial investment costs for advanced systems.

- Stringent regulatory approvals and compliance requirements.

- Competition from alternative imaging modalities.

- Supply chain disruptions impacting component availability. These disruptions led to a xx% increase in average system cost in 2024.

Emerging Opportunities in North America Digital X-Ray Systems Market

- Growing demand for portable and mobile X-ray systems for point-of-care diagnostics.

- Expansion into underserved rural and remote healthcare settings.

- Increasing adoption of AI-powered image analysis and diagnostic support tools.

- Development of specialized X-ray systems for specific applications (e.g., dental, veterinary).

Growth Accelerators in the North America Digital X-Ray Systems Market Industry

Technological breakthroughs, such as the development of advanced detectors and AI algorithms, are major growth catalysts. Strategic partnerships between manufacturers and healthcare providers to integrate systems and improve workflow are also accelerating market expansion. Expanding into untapped markets, such as smaller clinics and ambulatory surgery centers, presents further opportunities for growth.

Key Players Shaping the North America Digital X-Ray Systems Market Market

- Siemens Healthineers

- SAMSUNG

- GE Healthcare

- Koninklijke Philips N.V.

- Fujifilm Medical Systems

- Hitachi Medical Corporation

- Canon Medical Systems Corporation

- Carestream Health Inc

- Hologic Corporation

- Shimadzu Corporation

Notable Milestones in North America Digital X-Ray Systems Market Sector

- August 2022: GE Healthcare launched the Definium 656 HD, a next-generation advanced fixed X-ray system, enhancing efficiency and automation in radiology departments.

- April 2022: Samsung launched the GM85 Fit, a user-centric mobile X-ray system, expanding options for portable imaging.

In-Depth North America Digital X-Ray Systems Market Outlook

The North American digital X-ray systems market is poised for continued growth, driven by ongoing technological advancements, increasing healthcare spending, and the expanding adoption of digital imaging across diverse healthcare settings. Strategic partnerships, focused on integration and service offerings, will play a crucial role in driving market penetration and shaping the future of digital X-ray technology. The market presents attractive opportunities for both established players and innovative entrants focusing on advanced technologies, enhanced user experience, and improved workflow efficiency.

North America Digital Xray Systems Market Segmentation

-

1. Application

- 1.1. Orthopedic

- 1.2. Cancer

- 1.3. Dental

- 1.4. Cardiovascular

- 1.5. Other Applications

-

2. Technology

- 2.1. Computed Radiography

- 2.2. Direct Radiography

-

3. Portability

- 3.1. Fixed Systems

- 3.2. Portable Systems

-

4. End User

- 4.1. Hospitals

- 4.2. Diagnostic Centers

- 4.3. Other End-Users

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Digital Xray Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Digital Xray Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Occurrence of Orthopedic Diseases and Cancers; Technological Advancements in Digital X-Ray Technology; Advantages over Conventional X-rays

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installation

- 3.4. Market Trends

- 3.4.1. Portable Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Orthopedic

- 5.1.2. Cancer

- 5.1.3. Dental

- 5.1.4. Cardiovascular

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Computed Radiography

- 5.2.2. Direct Radiography

- 5.3. Market Analysis, Insights and Forecast - by Portability

- 5.3.1. Fixed Systems

- 5.3.2. Portable Systems

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Hospitals

- 5.4.2. Diagnostic Centers

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United States North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Orthopedic

- 6.1.2. Cancer

- 6.1.3. Dental

- 6.1.4. Cardiovascular

- 6.1.5. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Computed Radiography

- 6.2.2. Direct Radiography

- 6.3. Market Analysis, Insights and Forecast - by Portability

- 6.3.1. Fixed Systems

- 6.3.2. Portable Systems

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Hospitals

- 6.4.2. Diagnostic Centers

- 6.4.3. Other End-Users

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Canada North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Orthopedic

- 7.1.2. Cancer

- 7.1.3. Dental

- 7.1.4. Cardiovascular

- 7.1.5. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Computed Radiography

- 7.2.2. Direct Radiography

- 7.3. Market Analysis, Insights and Forecast - by Portability

- 7.3.1. Fixed Systems

- 7.3.2. Portable Systems

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Hospitals

- 7.4.2. Diagnostic Centers

- 7.4.3. Other End-Users

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Mexico North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Orthopedic

- 8.1.2. Cancer

- 8.1.3. Dental

- 8.1.4. Cardiovascular

- 8.1.5. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Computed Radiography

- 8.2.2. Direct Radiography

- 8.3. Market Analysis, Insights and Forecast - by Portability

- 8.3.1. Fixed Systems

- 8.3.2. Portable Systems

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Hospitals

- 8.4.2. Diagnostic Centers

- 8.4.3. Other End-Users

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United States North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Digital Xray Systems Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Siemens Healthineers

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SAMSUNG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 GE Healthcare

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Koninklijke Philips N V

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fujifilm Medical Systems

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Hitachi Medical Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Canon Medical Systems Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Carestream Health Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Hologic Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Shimadzu Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Siemens Healthineers

List of Figures

- Figure 1: North America Digital Xray Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digital Xray Systems Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digital Xray Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digital Xray Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: North America Digital Xray Systems Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Digital Xray Systems Market Revenue Million Forecast, by Portability 2019 & 2032

- Table 5: North America Digital Xray Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: North America Digital Xray Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 7: North America Digital Xray Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Digital Xray Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Digital Xray Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Digital Xray Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Digital Xray Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Digital Xray Systems Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Digital Xray Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America Digital Xray Systems Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 15: North America Digital Xray Systems Market Revenue Million Forecast, by Portability 2019 & 2032

- Table 16: North America Digital Xray Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 17: North America Digital Xray Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Digital Xray Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Digital Xray Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: North America Digital Xray Systems Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 21: North America Digital Xray Systems Market Revenue Million Forecast, by Portability 2019 & 2032

- Table 22: North America Digital Xray Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 23: North America Digital Xray Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: North America Digital Xray Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: North America Digital Xray Systems Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America Digital Xray Systems Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 27: North America Digital Xray Systems Market Revenue Million Forecast, by Portability 2019 & 2032

- Table 28: North America Digital Xray Systems Market Revenue Million Forecast, by End User 2019 & 2032

- Table 29: North America Digital Xray Systems Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Digital Xray Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digital Xray Systems Market?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the North America Digital Xray Systems Market?

Key companies in the market include Siemens Healthineers, SAMSUNG, GE Healthcare, Koninklijke Philips N V, Fujifilm Medical Systems, Hitachi Medical Corporation, Canon Medical Systems Corporation, Carestream Health Inc, Hologic Corporation, Shimadzu Corporation.

3. What are the main segments of the North America Digital Xray Systems Market?

The market segments include Application, Technology, Portability, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Occurrence of Orthopedic Diseases and Cancers; Technological Advancements in Digital X-Ray Technology; Advantages over Conventional X-rays.

6. What are the notable trends driving market growth?

Portable Systems Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Initial Cost of Installation.

8. Can you provide examples of recent developments in the market?

August 2022: GE Healthcare launched the Definium 656 HD, the next-generation advanced fixed X-ray system. The system provides consistent, efficient, and highly automated exams that are beneficial for radiology departments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digital Xray Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digital Xray Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digital Xray Systems Market?

To stay informed about further developments, trends, and reports in the North America Digital Xray Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence