Key Insights

The North American Mezcal market, currently experiencing robust growth, is projected to reach a significant valuation by 2033. Driven by increasing consumer awareness of premium spirits and the unique character of Mezcal, the market shows a Compound Annual Growth Rate (CAGR) of 14.50%. This growth is fueled by several factors. The rising popularity of agave-based spirits amongst millennial and Gen Z consumers, who are known for their adventurous palates and preference for artisanal products, is a key driver. Furthermore, the increasing availability of Mezcal in both on-trade (bars, restaurants) and off-trade (retail stores) channels contributes significantly to market expansion. The diverse range of Mezcal types—Joven, Reposado, Añejo, and others—provides consumers with a wide selection, catering to varying taste preferences and price points. The presence of established international players like Pernod Ricard and Diageo, alongside smaller, artisanal producers, ensures a dynamic and competitive market landscape. While challenges like maintaining consistent supply to meet growing demand and managing the sustainability of agave cultivation exist, the overall outlook for the North American Mezcal market remains exceptionally positive.

The market segmentation, with its diverse product types and distribution channels, provides opportunities for both large corporations and smaller, craft producers. The United States, as the largest market within North America, contributes significantly to the overall growth, with Canada and Mexico also showing considerable promise. The strategic marketing initiatives focusing on the unique heritage and production methods of Mezcal further enhance its appeal and drive sales. As consumer interest in authentic and high-quality spirits continues to grow, the North American Mezcal market is poised for sustained expansion in the coming years, presenting promising opportunities for investment and growth within the spirits industry. Future growth will depend on effective supply chain management, sustainable agave farming practices, and continued marketing efforts to educate consumers about the complexities and nuances of Mezcal.

This comprehensive report provides an in-depth analysis of the North America Mezcal market, covering market dynamics, growth trends, key players, and future outlook. With a focus on both parent (Spirits Market) and child (Mezcal) markets, this report is essential for industry professionals seeking to understand and capitalize on the burgeoning Mezcal market. The report utilizes data from 2019-2024 (Historical Period), with a base year of 2025 and a forecast period extending to 2033 (Forecast Period: 2025-2033). All values are presented in million units.

North America Mezcal Market Dynamics & Structure

The North American Mezcal market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is currently moderate, with several key players dominating alongside numerous smaller, artisanal producers. Technological innovation, while present, is relatively nascent compared to other spirits categories, with opportunities for improvement in production processes and marketing techniques. Regulatory frameworks vary across North American jurisdictions, impacting pricing, distribution, and labeling requirements. The market faces competition from other agave-based spirits like Tequila, and increasingly, other premium spirits. End-user demographics skew towards affluent millennials and Gen Z consumers, attracted to the artisanal nature and unique flavor profiles. The market has also witnessed increased M&A activity, indicating industry consolidation and the influx of larger players.

- Market Concentration: Moderate, with xx% market share held by the top 5 players.

- Technological Innovation: Focus on sustainable production methods and improved quality control.

- Regulatory Landscape: Varying regulations across North America impact distribution and labeling.

- Competitive Landscape: Competition from Tequila and other premium spirits.

- End-User Demographics: Predominantly affluent millennials and Gen Z consumers.

- M&A Activity: xx deals recorded in the past 5 years, indicating industry consolidation.

North America Mezcal Market Growth Trends & Insights

The North American Mezcal market exhibits strong growth potential, driven by increasing consumer awareness, premiumization trends, and the appeal of artisanal products. The market size has experienced significant expansion, with a CAGR of xx% during the historical period (2019-2024). Adoption rates are particularly high in urban centers and among consumers seeking unique and high-quality spirit experiences. Technological disruptions are expected to play a role in optimizing production, enhancing traceability, and expanding distribution channels. Consumer behavior shifts towards premiumization and authentic experiences further fuel market expansion. This is complemented by rising disposable incomes among target demographics, a growing preference for sophisticated alcoholic beverages, and the desire to explore international spirits.

- Market Size (2024): xx Million Units

- CAGR (2019-2024): xx%

- Market Penetration: xx% in major urban areas.

- Consumer Behavior: Growing preference for premium and artisanal products.

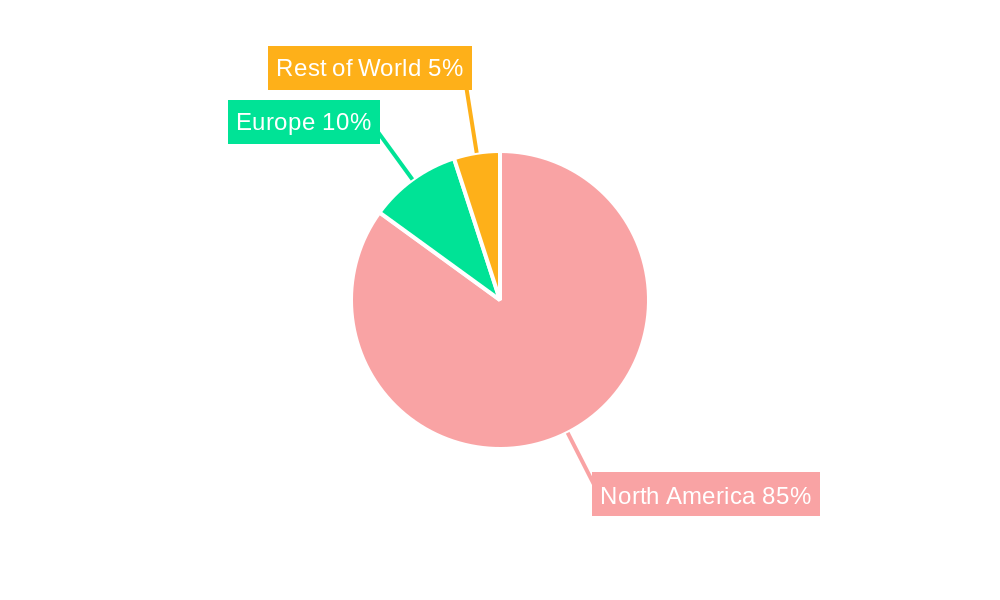

Dominant Regions, Countries, or Segments in North America Mezcal Market

The US dominates the North American Mezcal market, accounting for xx% of total consumption, followed by Canada with xx% and Mexico with xx%. Within the product type segment, Mezcal Joven holds the largest market share (xx%), followed by Mezcal Reposado (xx%) and Mezcal Anejo (xx%). The Off-Trade Channel (xx%) currently surpasses the On-Trade Channel (xx%) in terms of sales volume.

- Key Drivers (US): Strong consumer demand for premium spirits, favorable economic conditions, and widespread distribution networks.

- Key Drivers (Canada): Growing interest in unique alcoholic beverages, higher disposable incomes among consumers.

- Key Drivers (Mexico): Strong domestic consumption coupled with export opportunities.

- Mezcal Joven Dominance: Driven by its accessibility and wider appeal.

- Off-Trade Channel Dominance: Greater reach and convenience for consumers.

North America Mezcal Market Product Landscape

The North American Mezcal market showcases a range of product innovations, including different agave varietals, unique production techniques, and varying aging processes resulting in distinct flavor profiles. Companies are focusing on highlighting the artisanal production methods, emphasizing origin and terroir to appeal to consumers seeking authentic and high-quality experiences. The market also sees a gradual introduction of ready-to-drink (RTD) cocktails featuring Mezcal. These innovations are largely driven by consumer demand for diverse flavors and premium experiences.

Key Drivers, Barriers & Challenges in North America Mezcal Market

Key Drivers: Growing consumer preference for premium spirits, increasing disposable incomes, and rising awareness of Mezcal’s unique characteristics.

Challenges: Maintaining consistent product quality, addressing supply chain challenges, overcoming regulatory hurdles, and navigating intense competition within the premium spirits market. Supply chain disruptions could lead to price increases and limited availability. Strict labeling and import regulations also pose challenges to smaller producers.

Emerging Opportunities in North America Mezcal Market

The market presents opportunities for expansion into untapped markets such as smaller cities and rural areas with exposure to premium spirits. Development of innovative product formats, such as ready-to-drink cocktails and flavored variations, caters to evolving consumer preferences. The growing demand for sustainable and ethically sourced products presents an opportunity for brands to highlight their sustainable practices.

Growth Accelerators in the North America Mezcal Market Industry

Technological advancements in production and distribution, strategic partnerships between established players and smaller producers, and expansion into new markets through effective marketing strategies are all vital growth accelerators.

Key Players Shaping the North America Mezcal Market Market

- Wahaka Mezcal

- Ilegal Mezcal

- Mezcal Vago

- Casa Lumbre Group

- Lágrimas de Dolores

- William Grant & Sons Ltd

- Rey Campero

- El Silencio Holdings Inc

- The Producer

- Pernod Ricard

- Diageo PLC

Notable Milestones in North America Mezcal Market Sector

- September 2021: The Producer launches in the US market with Ensamble and Tepeztate expressions.

- July 2022: Casa Lumbre releases Contraluz, the first premium cristalino mezcal.

- October 2022: Pernod Ricard acquires a majority stake in Código 1530 Tequila, signaling increased interest in the agave category.

In-Depth North America Mezcal Market Market Outlook

The North American Mezcal market is poised for continued expansion, fueled by the increasing consumer demand for premium and authentic spirits. Strategic partnerships, product innovation, and effective marketing strategies will play a crucial role in shaping the market’s future growth trajectory. The market presents lucrative opportunities for established players and emerging brands alike, with potential for significant expansion through market diversification, product development, and strategic alliances.

North America Mezcal Market Segmentation

-

1. Type

- 1.1. Mezcal Joven

- 1.2. Mezcal Reposado

- 1.3. Mezcal Anejo

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. On-Trade Channel

- 2.2. Off-Trade Channel

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Mezcal Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Mezcal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Agave-based Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mezcal Joven

- 5.1.2. Mezcal Reposado

- 5.1.3. Mezcal Anejo

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade Channel

- 5.2.2. Off-Trade Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mezcal Joven

- 6.1.2. Mezcal Reposado

- 6.1.3. Mezcal Anejo

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade Channel

- 6.2.2. Off-Trade Channel

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mezcal Joven

- 7.1.2. Mezcal Reposado

- 7.1.3. Mezcal Anejo

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade Channel

- 7.2.2. Off-Trade Channel

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mezcal Joven

- 8.1.2. Mezcal Reposado

- 8.1.3. Mezcal Anejo

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade Channel

- 8.2.2. Off-Trade Channel

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mezcal Joven

- 9.1.2. Mezcal Reposado

- 9.1.3. Mezcal Anejo

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade Channel

- 9.2.2. Off-Trade Channel

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Mezcal Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Wahaka Mezcal

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Ilegal Mezcal

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Mezcal Vago

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Casa Lumbre Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Lágrimas de Dolores

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 William Grant & Sons Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Rey Campero

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 El Silencio Holdings Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 The Producer*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Pernod Ricard

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Diageo PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Wahaka Mezcal

List of Figures

- Figure 1: North America Mezcal Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mezcal Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 9: North America Mezcal Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Mezcal Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Mezcal Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Mezcal Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 23: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 27: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 29: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 31: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 35: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 37: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 39: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 43: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

- Table 45: North America Mezcal Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Mezcal Market Volume Million Forecast, by Type 2019 & 2032

- Table 47: North America Mezcal Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: North America Mezcal Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 49: North America Mezcal Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Mezcal Market Volume Million Forecast, by Geography 2019 & 2032

- Table 51: North America Mezcal Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Mezcal Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mezcal Market?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the North America Mezcal Market?

Key companies in the market include Wahaka Mezcal, Ilegal Mezcal, Mezcal Vago, Casa Lumbre Group, Lágrimas de Dolores, William Grant & Sons Ltd, Rey Campero, El Silencio Holdings Inc, The Producer*List Not Exhaustive, Pernod Ricard, Diageo PLC.

3. What are the main segments of the North America Mezcal Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Popularity of Agave-based Beverages.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

October 2022: Pernod Ricard announced the signing of an agreement for the acquisition of a majority shareholding of Código 1530 Tequila, a range of Ultra-Premium and Prestige tequila. This new investment into the fast-growing agave category, mainly driven by the US market, complements the Group's very comprehensive portfolio across price points and occasions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mezcal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mezcal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mezcal Market?

To stay informed about further developments, trends, and reports in the North America Mezcal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence