Key Insights

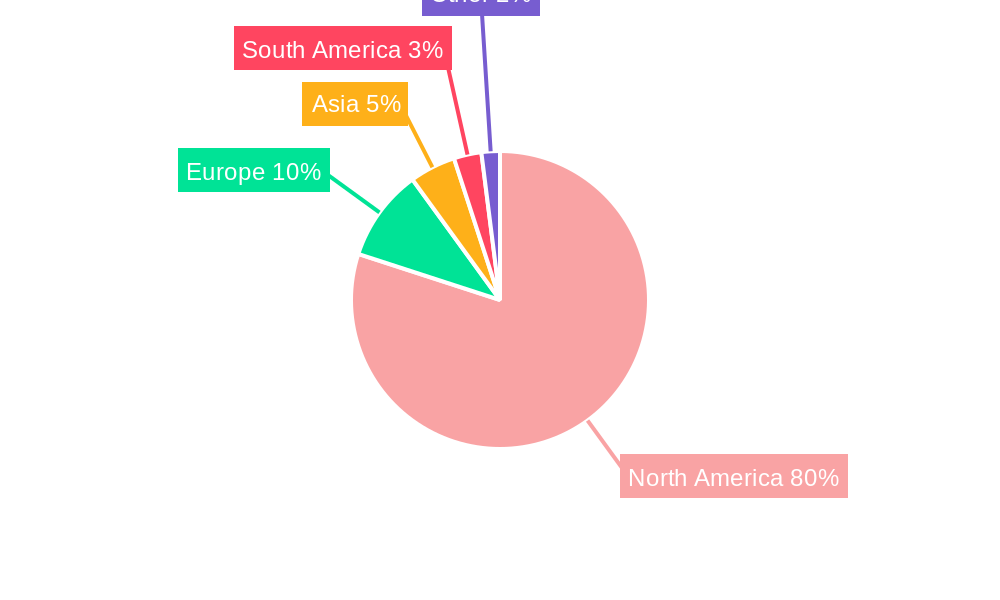

The North American orange industry, encompassing fresh and processed segments, presents a dynamic market landscape projected to experience steady growth. The market, valued at approximately $5 billion in 2025, is driven by increasing consumer demand for healthy and convenient food and beverage options, fueled by rising health consciousness and the versatility of oranges in various culinary applications. The food and beverage industry, particularly juice manufacturers and beverage companies, remains the largest end-user segment, while the retail sector, encompassing both traditional grocery stores and rapidly growing online platforms, shows significant potential for expansion. Premium orange varieties are gaining traction, reflecting a willingness among consumers to pay more for higher quality and taste. However, the market faces challenges such as fluctuating weather patterns impacting crop yields and increasing production costs, potentially leading to price fluctuations. Competition among established players like Sunkist Growers and Tropicana, alongside emerging brands, necessitates innovative product development and efficient supply chain management. Furthermore, sustainability concerns and consumer preference for ethically sourced products are influencing industry practices, driving adoption of environmentally friendly farming techniques.

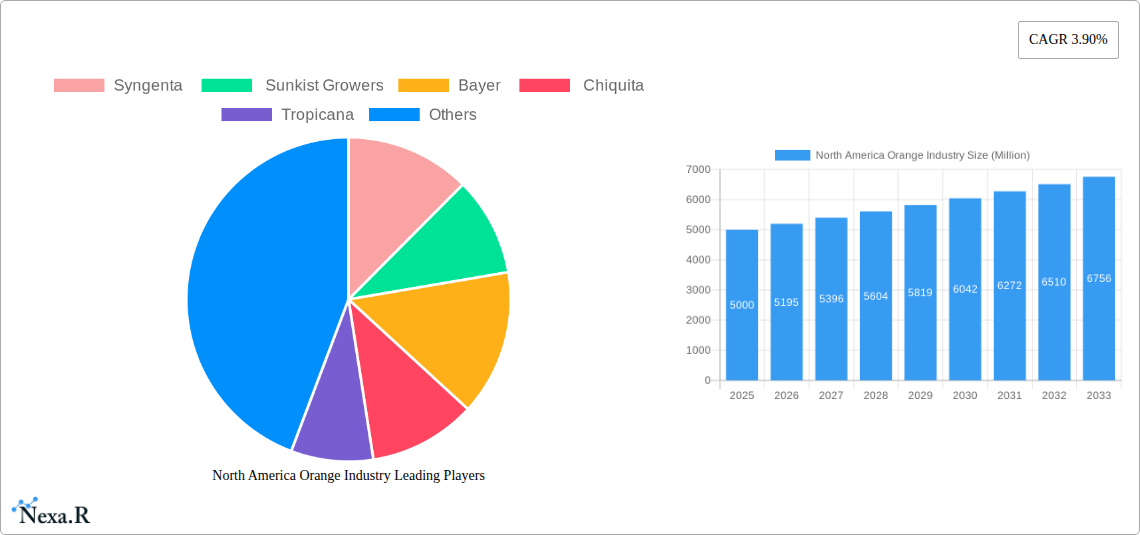

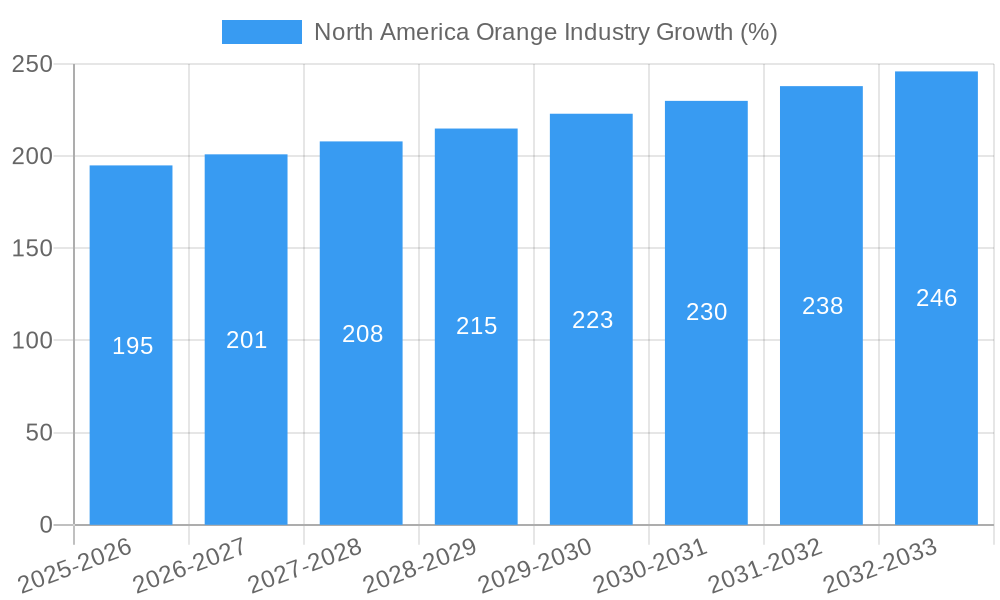

The forecast period of 2025-2033 indicates a promising outlook for the North American orange industry, with a projected Compound Annual Growth Rate (CAGR) of 3.9%. This growth is anticipated to be driven by factors including the increasing adoption of orange-based functional beverages, the rising popularity of convenient, ready-to-consume orange products, and strategic marketing initiatives by key players. Nevertheless, maintaining consistent growth requires navigating potential challenges such as labor shortages, disease outbreaks, and evolving consumer preferences. Investing in research and development, fostering strong supply chain relationships, and emphasizing sustainability practices will be crucial for industry participants to capitalize on the growth opportunities and ensure long-term success within the competitive North American market. Regional variations within North America (United States, Canada, and Mexico) also present strategic considerations, with specific consumer preferences and market dynamics requiring tailored approaches.

North America Orange Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the North America orange industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on both fresh and processed oranges, this report is essential for industry professionals, investors, and anyone seeking to understand this dynamic market. The study period spans from 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in millions of units.

North America Orange Industry Market Dynamics & Structure

The North American orange industry is characterized by a moderately concentrated market structure, with several large players dominating production and processing. Technological innovation, particularly in post-harvest handling and processing, is a key driver, alongside evolving consumer preferences towards premium and organic products. Stringent regulatory frameworks concerning food safety and pesticide use significantly impact operational costs and market dynamics. The industry faces competition from substitute fruits and beverages, requiring continuous product diversification and marketing efforts. Mergers and acquisitions (M&A) activity has been moderate, primarily focused on consolidation within processing and distribution segments.

- Market Concentration: The top five players account for approximately xx% of the total market share in 2025.

- Technological Innovation: Investments in automated harvesting, improved preservation techniques, and advanced processing technologies are driving efficiency gains.

- Regulatory Landscape: Compliance with FDA regulations and other food safety standards represents a significant cost factor.

- Competitive Substitutes: The industry competes with other citrus fruits, tropical fruits, and non-citrus juices.

- M&A Activity: An estimated xx M&A deals occurred between 2019 and 2024.

- End-User Demographics: Growing health consciousness is driving demand for fresh, minimally processed orange products.

North America Orange Industry Growth Trends & Insights

The North American orange industry experienced a fluctuating growth trajectory during the historical period (2019-2024), primarily influenced by weather patterns affecting yields and fluctuating consumer spending. However, the market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven by increasing demand, particularly from the processed orange segment. Consumer preferences are shifting toward healthier and convenient options, influencing product innovation and marketing strategies. Technological advancements in processing and packaging are enhancing product shelf life and reducing waste.

The market penetration of processed orange products remains high, with juice accounting for a significant share. However, the demand for premium fresh oranges, including organic varieties, is rising steadily. The adoption rate of innovative processing technologies, such as advanced juice extraction methods, is increasing, leading to improved product quality and yield. Changing consumer behaviors, driven by health awareness, are fostering demand for fortified juices and functional beverages.

Dominant Regions, Countries, or Segments in North America Orange Industry

Florida remains the dominant region for orange production in North America, accounting for approximately xx% of the total output in 2025. California also holds a significant share, particularly in the premium orange segment. Within the processed orange segment, orange juice dominates the market, followed by orange pulp and orange oils. The food and beverage industry, including juice manufacturers and beverage companies, constitutes the largest end-user segment.

- Key Drivers (Florida): Favorable climate, established infrastructure, and experienced workforce.

- Key Drivers (California): Premium orange cultivation, focus on organic farming, and proximity to large markets.

- Market Share: Florida: xx%, California: xx%, Other Regions: xx% (2025).

- Growth Potential: Premium orange segment (xx% CAGR), Organic orange segment (xx% CAGR).

North America Orange Industry Product Landscape

The North American orange industry offers a diverse product landscape encompassing fresh oranges (premium and conventional) and processed oranges (juice, pulp, and oils). Product innovations are focusing on enhancing nutritional value, extending shelf life, and offering convenient packaging formats. Technological advancements, such as high-pressure processing (HPP) and aseptic packaging, are improving product quality and safety. Unique selling propositions include organic certification, enhanced flavor profiles, and functional ingredients in processed products.

Key Drivers, Barriers & Challenges in North America Orange Industry

Key Drivers: Growing health consciousness, increasing demand for convenient food options, and technological advancements in processing and packaging drive market growth. Government initiatives promoting agricultural sustainability also contribute positively.

Key Challenges: Adverse weather conditions, supply chain disruptions (xx% increase in transportation costs in 2024), fluctuating orange prices, and intense competition from substitute beverages represent significant obstacles. Regulatory compliance and rising labor costs further impact profitability. Disease outbreaks, such as citrus greening disease, can severely impact yields and production.

Emerging Opportunities in North America Orange Industry

Emerging opportunities lie in the growing demand for functional and fortified orange juices, organic and premium orange products, and convenient packaging formats like single-serve pouches. Expanding into new markets, developing innovative product applications (e.g., orange-infused functional foods), and catering to evolving consumer preferences towards sustainable and ethically sourced products present significant growth potential.

Growth Accelerators in the North America Orange Industry Industry

Technological advancements in post-harvest management, innovative processing technologies, and strategic partnerships to enhance supply chain efficiency represent significant catalysts for long-term growth. Market expansion into new regions and tapping into untapped consumer segments (e.g., younger demographics) also contribute to market expansion. The development of resilient and disease-resistant orange varieties is vital for long-term sustainability.

Key Players Shaping the North America Orange Industry Market

Notable Milestones in North America Orange Industry Sector

- 2020: Launch of several new functional orange juice varieties enriched with vitamins and minerals by Tropicana.

- 2022: Syngenta introduces a new disease-resistant orange tree variety.

- 2023: Sunkist Growers expands its organic orange production.

- 2024: Several smaller orange juice manufacturers merge to create larger processing units.

In-Depth North America Orange Industry Market Outlook

The North America orange industry is poised for continued growth, driven by innovation, consumer demand for premium and convenient products, and efforts toward enhancing supply chain efficiency. The industry's ability to adapt to climate change, manage disease outbreaks, and implement sustainable practices will be crucial for long-term success. Strategic partnerships, investments in advanced technologies, and exploration of new markets and product applications will shape the future of this vital sector.

North America Orange Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Orange Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Orange Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Continuous Increase in Production of Oranges in Mexico

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Canada North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Mexico North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. United States North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Orange Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Syngenta

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sunkist Growers

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Bayer

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Chiquita

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tropicana

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 Syngenta

List of Figures

- Figure 1: North America Orange Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Orange Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Orange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Orange Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: North America Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: North America Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 5: North America Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: North America Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 7: North America Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: North America Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: North America Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: North America Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: North America Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: North America Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: North America Orange Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Orange Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 15: North America Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 17: United States North America Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America North America Orange Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of North America North America Orange Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 25: North America Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: North America Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 27: North America Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: North America Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 29: North America Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: North America Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: North America Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: North America Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: North America Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: North America Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: North America Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 37: North America Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 38: North America Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 39: North America Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 40: North America Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 41: North America Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 42: North America Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 43: North America Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 44: North America Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 45: North America Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 46: North America Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 47: North America Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: North America Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 49: North America Orange Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 50: North America Orange Industry Volume Kiloton Forecast, by Production Analysis 2019 & 2032

- Table 51: North America Orange Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 52: North America Orange Industry Volume Kiloton Forecast, by Consumption Analysis 2019 & 2032

- Table 53: North America Orange Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 54: North America Orange Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 55: North America Orange Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 56: North America Orange Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 57: North America Orange Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 58: North America Orange Industry Volume Kiloton Forecast, by Price Trend Analysis 2019 & 2032

- Table 59: North America Orange Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: North America Orange Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Orange Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the North America Orange Industry?

Key companies in the market include Syngenta , Sunkist Growers, Bayer , Chiquita, Tropicana.

3. What are the main segments of the North America Orange Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Continuous Increase in Production of Oranges in Mexico.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Orange Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Orange Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Orange Industry?

To stay informed about further developments, trends, and reports in the North America Orange Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence