Key Insights

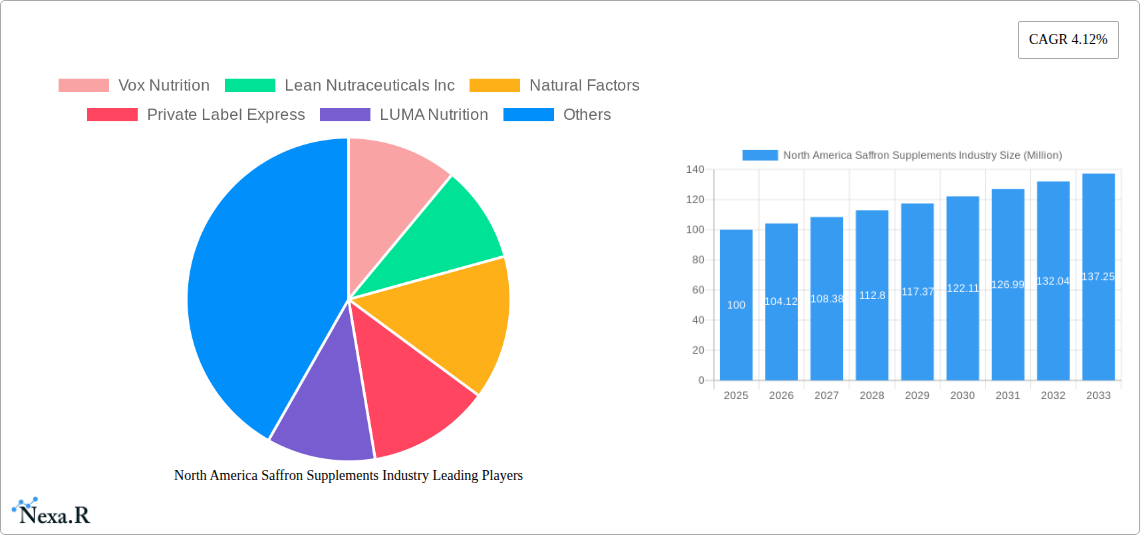

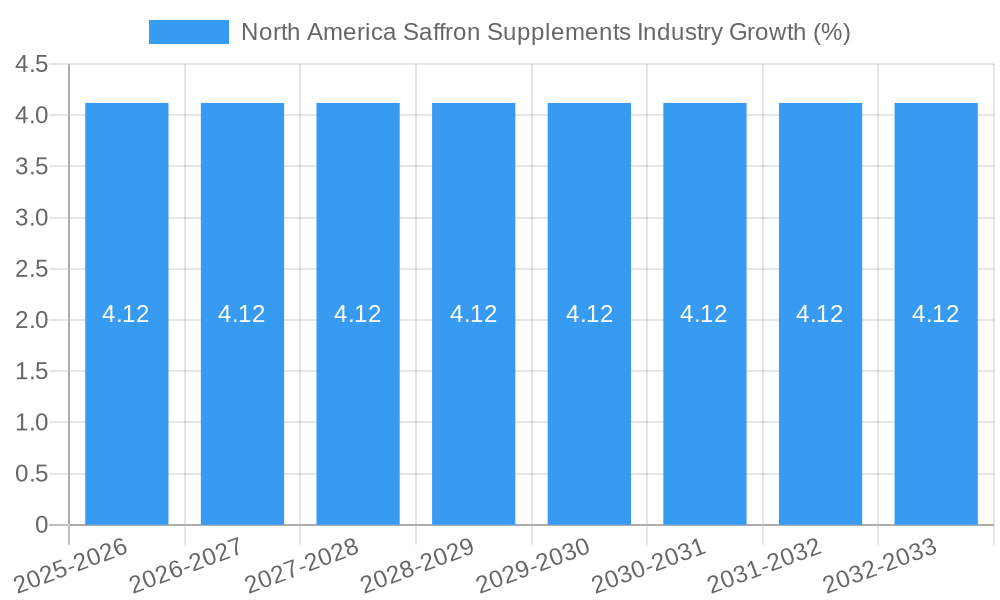

The North American saffron supplement market, valued at approximately $XX million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.12% from 2025 to 2033. This expansion is driven by increasing consumer awareness of saffron's potential health benefits, including its antioxidant and anti-inflammatory properties, its mood-boosting effects, and its potential role in improving cognitive function. The rising prevalence of chronic diseases and a growing preference for natural and herbal remedies further fuel market demand. The market is segmented by form (gummy, tablet/capsule, powder, liquid) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, specialty stores, online retail stores). The online retail channel is expected to witness significant growth due to its convenience and expanding reach. Major players like Vox Nutrition, Lean Nutraceuticals Inc, and Natural Factors are contributing to market growth through product innovation and expansion of distribution networks. However, factors such as price volatility of saffron raw material and potential inconsistencies in product quality could act as restraints on the market's overall growth trajectory.

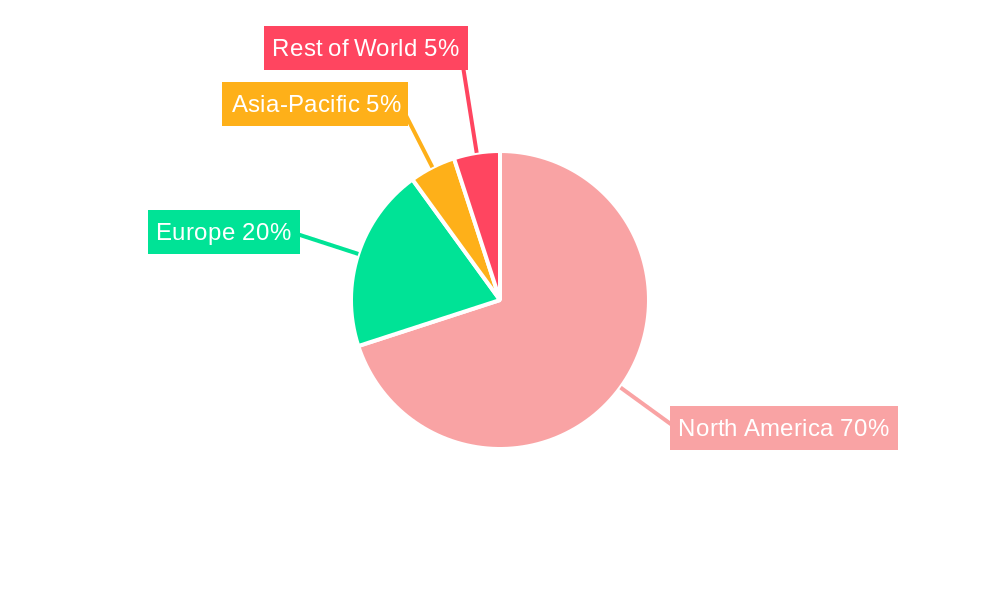

The dominance of the tablet/capsule segment reflects consumer preference for convenient dosage forms. However, the gummy segment is likely to show faster growth due to its appeal to health-conscious consumers seeking palatable options. Geographic segmentation reveals that the United States holds the largest market share within North America, driven by high consumer spending on health and wellness products. Canada and Mexico are also showing promising growth, although at a potentially slower pace than the US market. Future growth will likely be influenced by factors like enhanced regulatory frameworks, increased research validating saffron's efficacy, and successful marketing campaigns that effectively communicate the supplement's benefits to a wider consumer base. Competition is expected to remain intense, with both established players and new entrants vying for market share through product differentiation and strategic partnerships.

North America Saffron Supplements Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America saffron supplements market, encompassing market dynamics, growth trends, leading players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report segments the market by form (gummy, tablet/capsules, powder, liquid) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, specialty stores, online retail stores, other distribution channels), offering granular insights into the industry's structure and performance. The total market value is projected at xx Million by 2033.

North America Saffron Supplements Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American saffron supplements market. The market is characterized by a moderate level of concentration, with several key players holding significant market share. However, the entry of new players and the increasing popularity of saffron supplements are driving competition.

Market Concentration: The top five players account for approximately xx% of the market share in 2025. This indicates a moderately consolidated market with room for growth and consolidation through mergers and acquisitions (M&A).

Technological Innovation: The industry is witnessing continuous innovation in extraction methods, formulation technologies, and product delivery systems. Developments like Activ'Inside's Safr'Inside patent highlight the focus on enhancing saffron's bioavailability and efficacy. However, challenges remain in scaling up production and ensuring consistent quality.

Regulatory Framework: Regulatory compliance (e.g., FDA regulations in the US) is a key consideration for manufacturers. Stringent quality standards and labeling requirements contribute to the cost of production and entry barriers.

Competitive Substitutes: Other herbal supplements and mood-supporting medications are direct competitors to saffron supplements. To maintain market share, saffron supplement manufacturers are focusing on highlighting the unique benefits of saffron and superior product quality.

End-User Demographics: The primary consumers are health-conscious individuals seeking natural remedies for stress, anxiety, and sleep problems, primarily the 35-55 age demographic, with a growing interest from younger consumers.

M&A Trends: The number of M&A deals in the industry has been moderate (xx deals in 2024), reflecting both consolidation and strategic expansion efforts.

North America Saffron Supplements Industry Growth Trends & Insights

The North American saffron supplements market has experienced significant growth in recent years, driven by increasing awareness of saffron's health benefits and rising demand for natural alternatives.

The market size grew from xx Million in 2019 to xx Million in 2024. A Compound Annual Growth Rate (CAGR) of xx% is projected from 2025 to 2033, driven by factors like increasing consumer health awareness, growing prevalence of stress and anxiety disorders, and growing e-commerce penetration. Market penetration is currently at xx% in the US and is expected to rise gradually.

Technological advancements like improved extraction methods and targeted formulations are enabling the development of more effective and bioavailable saffron supplements. Consumer behavior is shifting towards natural and herbal remedies, increasing demand for saffron-based products. The rise of online retail channels is also contributing to market growth, providing broader access to saffron supplements.

Dominant Regions, Countries, or Segments in North America Saffron Supplements Industry

The US currently dominates the North American saffron supplements market, accounting for the largest market share (xx%). The high concentration of consumers who are health-conscious and receptive to natural products contributes greatly to this dominance. Within the US, the western and eastern coastal regions show higher adoption rates compared to the central regions.

By Form: Tablet/Capsules currently hold the largest market share (xx%) due to their convenience and ease of consumption. However, the gummy segment is experiencing rapid growth (xx% CAGR) due to its appeal to consumers looking for enjoyable and palatable options.

By Distribution Channel: Online retail stores are rapidly gaining popularity (xx% CAGR), driven by the increased usage of e-commerce and consumers’ preference for home delivery. However, supermarkets/hypermarkets still contribute to a significant portion of sales (xx%) due to their wide reach and established customer base.

Key Drivers:

- Rising consumer awareness of saffron's health benefits.

- Growing prevalence of stress, anxiety, and sleep disorders.

- Increasing demand for natural and herbal remedies.

- Evolving consumer preference for convenience and palatable options.

- Expansion of online retail channels.

North America Saffron Supplements Industry Product Landscape

Saffron supplements are available in various forms, including capsules, tablets, powders, and liquids. Innovations focus on improving bioavailability, enhancing absorption, and delivering higher concentrations of active compounds. Unique selling propositions often highlight specific saffron extracts (like Affron) with patented formulations for improved efficacy.

Key Drivers, Barriers & Challenges in North America Saffron Supplements Industry

Key Drivers: The rising prevalence of stress, anxiety, and sleep disorders, coupled with increased consumer awareness of natural health solutions, fuels market growth. The increasing popularity of online retail channels also expands market access. Technological advancements improving saffron extraction and formulation further enhance the product's appeal and efficacy.

Key Challenges: Fluctuations in saffron prices and supply chain disruptions due to saffron's delicate nature are key challenges. Stringent regulatory requirements add to the cost of production and entry barriers for smaller companies. Competition from other herbal supplements and pharmaceuticals adds to the market pressure. Counterfeit products and inconsistent product quality are also significant concerns.

Emerging Opportunities in North America Saffron Supplements Industry

Untapped markets exist in specific demographics (e.g., younger adults) who are increasingly health-conscious. Opportunities exist to innovate product forms, such as incorporating saffron into functional foods and beverages. The rising interest in personalized nutrition provides room for developing targeted saffron supplements based on individual needs.

Growth Accelerators in the North America Saffron Supplements Industry Industry

Technological breakthroughs in saffron cultivation and extraction techniques will improve saffron quality and reduce production costs, accelerating market expansion. Strategic partnerships between saffron producers, supplement manufacturers, and retailers can facilitate wider product distribution and reach. Educating consumers about the benefits of saffron supplements will drive further adoption and market expansion.

Key Players Shaping the North America Saffron Supplements Industry Market

- Vox Nutrition

- Lean Nutraceuticals Inc

- Natural Factors

- Private Label Express

- LUMA Nutrition

- Herbamax LLC

- Life Extension

- Persavita Inc

- Epicure Garden

Notable Milestones in North America Saffron Supplements Industry Sector

- February 2023: Activ'Inside's Safr'Inside saffron extract receives a US patent, highlighting advancements in saffron encapsulation technology.

- May 2022: Affron's double-digit growth underscores the increasing demand for saffron in mental wellness products.

In-Depth North America Saffron Supplements Industry Market Outlook

The North American saffron supplements market is poised for substantial growth over the forecast period (2025-2033), propelled by favorable market dynamics. Continued innovation, strategic partnerships, and expanding consumer awareness will contribute to increased market penetration and sustained growth. The market offers significant opportunities for both established players and new entrants with innovative products and effective market strategies.

North America Saffron Supplements Industry Segmentation

-

1. Form

- 1.1. Gummy

- 1.2. Tablet/Capsules

- 1.3. Powder

- 1.4. Liquid

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geograhy

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

North America Saffron Supplements Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Saffron Supplements Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Uses and Effectiveness of Saffron Supplements to Fuel Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Saffron Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Gummy

- 5.1.2. Tablet/Capsules

- 5.1.3. Powder

- 5.1.4. Liquid

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geograhy

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United States North America Saffron Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Saffron Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Saffron Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Saffron Supplements Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vox Nutrition

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lean Nutraceuticals Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Natural Factors

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Private Label Express

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 LUMA Nutrition

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Herbamax LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Life Extension

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Persavita Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Epicure Garden

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Vox Nutrition

List of Figures

- Figure 1: North America Saffron Supplements Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Saffron Supplements Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Saffron Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Saffron Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 3: North America Saffron Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Saffron Supplements Industry Revenue Million Forecast, by Geograhy 2019 & 2032

- Table 5: North America Saffron Supplements Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Saffron Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Saffron Supplements Industry Revenue Million Forecast, by Form 2019 & 2032

- Table 12: North America Saffron Supplements Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Saffron Supplements Industry Revenue Million Forecast, by Geograhy 2019 & 2032

- Table 14: North America Saffron Supplements Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Saffron Supplements Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Saffron Supplements Industry?

The projected CAGR is approximately 4.12%.

2. Which companies are prominent players in the North America Saffron Supplements Industry?

Key companies in the market include Vox Nutrition, Lean Nutraceuticals Inc, Natural Factors, Private Label Express, LUMA Nutrition, Herbamax LLC, Life Extension, Persavita Inc, Epicure Garden.

3. What are the main segments of the North America Saffron Supplements Industry?

The market segments include Form, Distribution Channel, Geograhy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Uses and Effectiveness of Saffron Supplements to Fuel Demand.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

February 2023: A saffron stigma extract from Activ'Inside (Bordeaux, France), called Safr'Inside, obtained a new patent in the United States which protects the composition and dosage of safranol in the encapsulated saffron extract. The extract is made using a unique encapsulation technology called Techcare that protects saffron from alterations and preserves its native composition to ensure a full spectrum product, enabling it to offer a high concentration of safranal content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Saffron Supplements Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Saffron Supplements Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Saffron Supplements Industry?

To stay informed about further developments, trends, and reports in the North America Saffron Supplements Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence