Key Insights

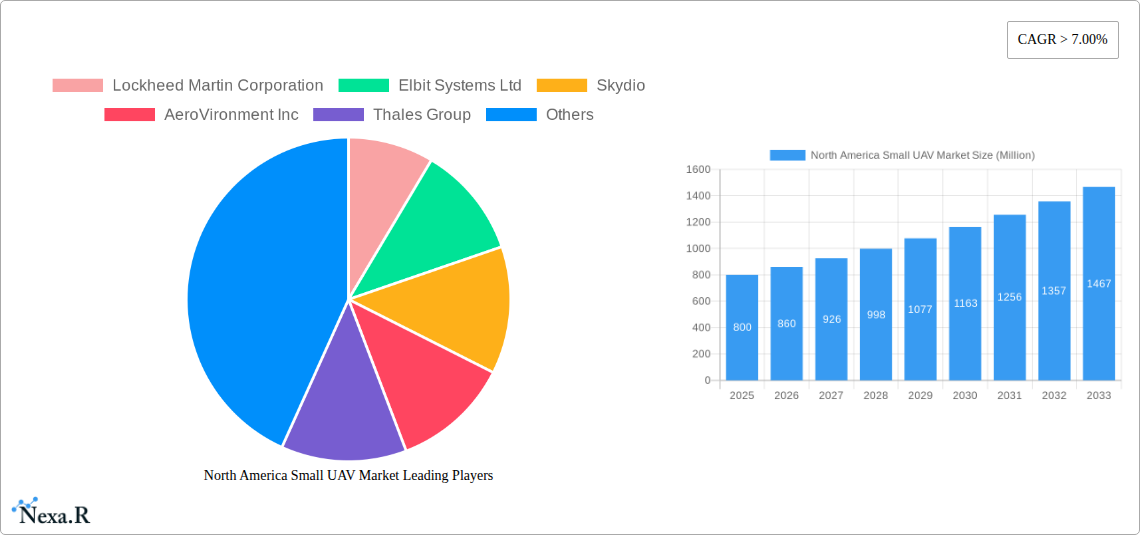

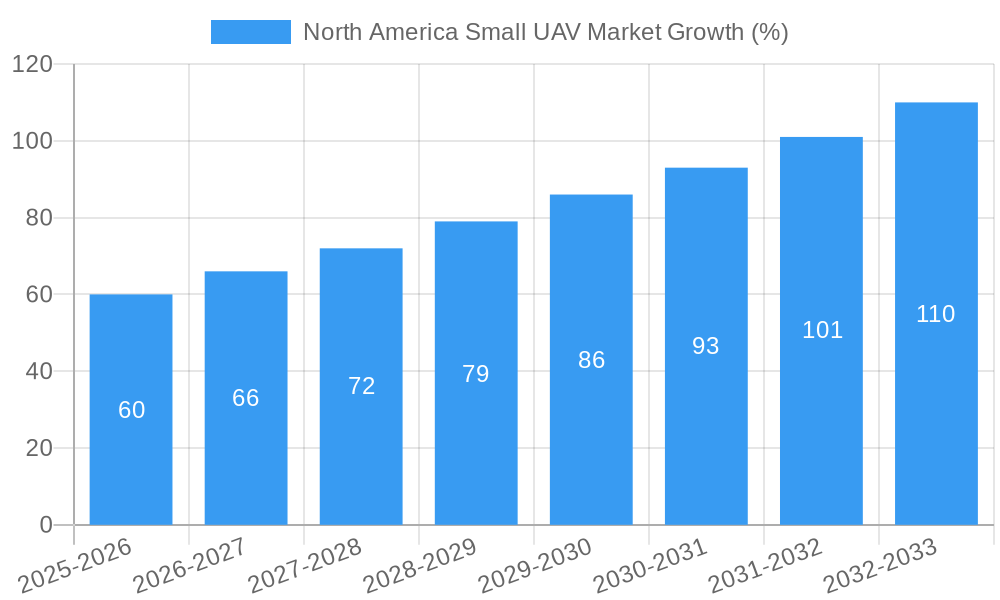

The North American small unmanned aerial vehicle (UAV) market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption across diverse sectors like construction (for site surveying and progress monitoring), agriculture (precision farming and crop monitoring), and energy (infrastructure inspection and maintenance) fuels significant demand. Furthermore, advancements in propulsion technology, particularly the development of more efficient and longer-lasting lithium-ion and hybrid batteries, are extending flight times and operational capabilities, making small UAVs more versatile and cost-effective. Regulatory streamlining and increased awareness of the safety and operational benefits are also contributing to market growth. The dominant players in this market, including Lockheed Martin, Elbit Systems, and DJI, are continuously innovating, introducing smaller, more affordable, and feature-rich UAVs to cater to a broadening user base. Competition is fierce, pushing companies to enhance their offerings through superior image processing capabilities, advanced AI integration, and improved data analytics solutions.

The market segmentation reveals a preference for fixed-wing and rotary-wing UAVs, with lithium-ion batteries currently holding the largest share in the propulsion technology segment. However, the growing interest in sustainable technologies is driving exploration and investment in hydrogen cell and solar-powered UAVs, potentially shifting market dynamics in the coming years. While challenges remain, such as concerns over airspace safety and data privacy, the overall outlook for the North American small UAV market remains positive, with significant growth opportunities across various end-user industries and geographical regions within North America, particularly in the United States and Canada. Further growth is expected from emerging applications in areas such as delivery services and environmental monitoring. The market size in 2025 is estimated to be in the high hundreds of millions of dollars, growing to over a billion dollars by 2033, based on the provided CAGR and market trends.

North America Small UAV Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America small unmanned aerial vehicle (UAV) market, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the United States and Canada, this study covers the period from 2019 to 2033, providing historical data (2019-2024), base year estimates (2025), and future projections (2025-2033). The report segments the market by UAV type (fixed-wing, rotary-wing), propulsion technology (hydrogen cell, hybrid, solar, lithium-ion), and end-user industry (construction, agriculture, energy, entertainment, defense & law enforcement, other). Market size is presented in million units.

North America Small UAV Market Dynamics & Structure

The North American small UAV market is experiencing dynamic growth fueled by technological advancements, increasing demand across diverse sectors, and supportive regulatory frameworks. However, market concentration is moderate, with several key players competing for market share. The market is characterized by continuous technological innovation, particularly in areas such as extended flight times, enhanced payload capacity, and improved autonomous capabilities. Regulatory frameworks, while evolving, are generally supportive of safe and responsible UAV operations, albeit with varying regional nuances. Competitive pressures arise from both established players and new entrants offering innovative solutions. The market also witnesses ongoing mergers and acquisitions (M&A) activity, with larger companies seeking to consolidate their position and gain access to cutting-edge technologies.

- Market Concentration: Moderate, with top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on AI-powered autonomy, extended battery life, and advanced sensor integration.

- Regulatory Framework: Evolving but generally supportive, with ongoing discussions regarding airspace management and safety regulations.

- Competitive Landscape: Intense, with established players facing competition from agile startups and international companies.

- M&A Activity: Significant, with an estimated xx M&A deals in the North American small UAV market between 2019 and 2024.

- Innovation Barriers: High initial investment costs for R&D and certification processes.

North America Small UAV Market Growth Trends & Insights

The North American small UAV market is projected to experience significant growth over the forecast period (2025-2033), driven by increasing adoption across various sectors and technological advancements. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is expected to maintain a CAGR of xx% from 2025 to 2033. This growth is fueled by factors such as decreasing UAV costs, improved ease of use, and a growing understanding of the potential benefits across numerous applications. The rising adoption of UAVs in the defense and law enforcement sectors, along with increasing demand from commercial sectors such as agriculture and construction, are key drivers. The market penetration rate is currently at xx% and is projected to reach xx% by 2033. Technological disruptions, such as the development of advanced AI and autonomous flight capabilities, will continue to shape market growth. Consumer behavior shifts towards greater acceptance and integration of UAV technology into daily operations will further fuel expansion.

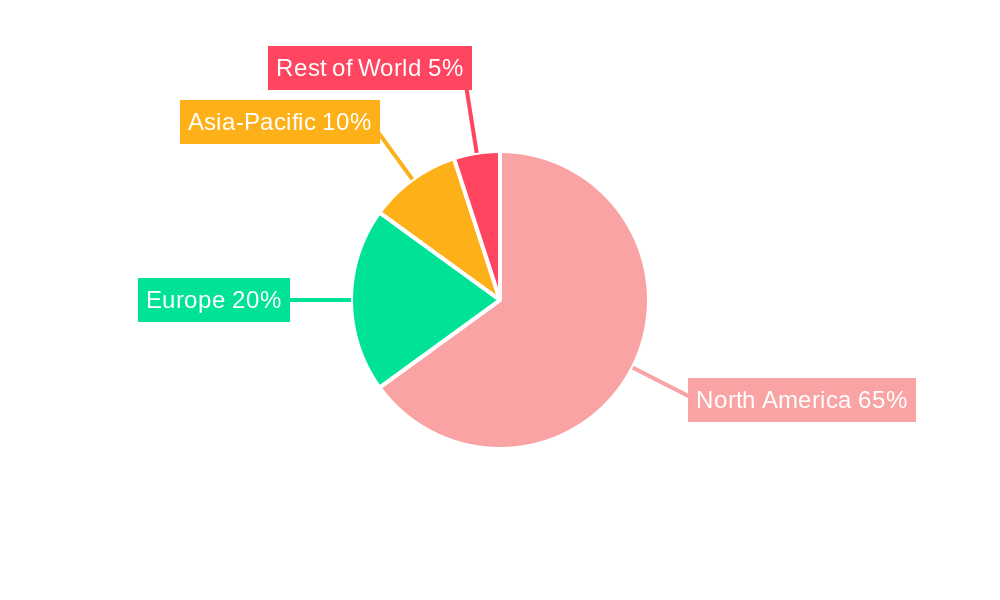

Dominant Regions, Countries, or Segments in North America Small UAV Market

The United States dominates the North American small UAV market, accounting for approximately xx% of the market share in 2025, driven by a robust defense sector and a thriving commercial ecosystem. Canada represents a significant portion of the market, albeit smaller than the United States.

- Dominant Segment (UAV Type): Rotary-wing UAVs currently hold the largest market share due to their versatility and ease of operation in various environments.

- Dominant Segment (Propulsion): Lithium-ion batteries currently dominate due to their energy density and relatively low cost.

- Dominant Segment (End-User Industry): The defense and law enforcement sector is the leading end-user industry, followed by the agriculture and construction sectors.

- Key Growth Drivers (US): Strong government support for UAV technology, a large and diverse commercial sector, and a well-established aerospace industry.

- Key Growth Drivers (Canada): Growing investment in infrastructure development and increasing adoption in sectors such as agriculture and natural resources.

North America Small UAV Market Product Landscape

The North American small UAV market offers a diverse range of products, characterized by technological advancements in areas such as autonomous flight, sensor integration, and payload capacity. Manufacturers are focusing on developing UAVs with extended flight times, improved stability, and enhanced data processing capabilities. Key features driving market acceptance include user-friendly interfaces, advanced safety features, and robust data analytics platforms. The competitive landscape encourages continuous innovation, resulting in a wide selection of UAV models catering to the specific needs of various end-user industries.

Key Drivers, Barriers & Challenges in North America Small UAV Market

Key Drivers:

- Increasing demand from defense and commercial sectors.

- Technological advancements in autonomy, sensor technology, and battery life.

- Decreasing UAV costs and improved accessibility.

- Supportive government policies and regulatory frameworks (with some regional variations).

Key Barriers & Challenges:

- Stringent regulatory hurdles and certification processes.

- Concerns regarding data privacy and security.

- Potential for malicious use and cybersecurity threats.

- Supply chain disruptions impacting component availability and production costs.

- Intense competition from established and emerging players. This leads to price pressures and necessitates constant innovation.

Emerging Opportunities in North America Small UAV Market

Emerging opportunities lie in the expanding applications of small UAVs in sectors such as infrastructure inspection, precision agriculture, and environmental monitoring. The development of advanced AI and machine learning capabilities will further unlock new applications and improve operational efficiency. Growth in the delivery and logistics sectors presents significant potential for small UAV deployment. Furthermore, exploring niche markets, like search and rescue operations or wildlife monitoring, offers considerable growth potential.

Growth Accelerators in the North America Small UAV Market Industry

Strategic partnerships between UAV manufacturers and technology providers are accelerating market growth by fostering innovation and expanding market reach. Government investments in UAV research and development are fueling technological advancements and supporting the development of new applications. Continued market expansion into new sectors, coupled with the development of new business models, will further enhance market growth in the long term.

Key Players Shaping the North America Small UAV Market Market

- Lockheed Martin Corporation

- Elbit Systems Ltd

- Skydio

- AeroVironment Inc

- Thales Group

- BAE Systems PLC

- Parrot Drone SA

- Israel Aerospace Industries Ltd

- SZ DJI Technology Co Ltd

- Aeronautics Ltd

Notable Milestones in North America Small UAV Market Sector

- May 2022: Teledyne FLIR Defense secured a USD 14 million contract to supply Black Hornet 3 drones to the US Army.

- February 2022: Skydio received a USD 99.8 million contract from the US Army for X2D UAVs.

In-Depth North America Small UAV Market Market Outlook

The North American small UAV market is poised for sustained growth, driven by technological advancements, expanding applications across diverse sectors, and supportive regulatory environments. Strategic investments in R&D, coupled with the emergence of innovative business models, will further propel market expansion. The continued integration of AI and automation will enhance UAV capabilities, unlocking new opportunities and driving market growth throughout the forecast period. The market's future is bright, presenting significant opportunities for both established players and new entrants.

North America Small UAV Market Segmentation

-

1. UAV Type

- 1.1. Fixed-wing

- 1.2. Rotary-wing

-

2. Propulsion Technology

- 2.1. Hydrogen Cell

- 2.2. Hybrid

- 2.3. Solar

- 2.4. Lithium-ion

-

3. End-user Industry

- 3.1. Construction

- 3.2. Agriculture

- 3.3. Energy

- 3.4. Entertainment

- 3.5. Defense and Law Enforcement

- 3.6. Other End-user Industries

North America Small UAV Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Small UAV Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Agriculture Industry to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 5.1.1. Fixed-wing

- 5.1.2. Rotary-wing

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Technology

- 5.2.1. Hydrogen Cell

- 5.2.2. Hybrid

- 5.2.3. Solar

- 5.2.4. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Construction

- 5.3.2. Agriculture

- 5.3.3. Energy

- 5.3.4. Entertainment

- 5.3.5. Defense and Law Enforcement

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by UAV Type

- 6. United States North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Small UAV Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lockheed Martin Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Elbit Systems Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Skydio

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AeroVironment Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Thales Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BAE Systems PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Parrot Drone SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Israel Aerospace Industries Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SZ DJI Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aeronautics Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: North America Small UAV Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Small UAV Market Share (%) by Company 2024

List of Tables

- Table 1: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 3: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 4: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: North America Small UAV Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Small UAV Market Revenue Million Forecast, by UAV Type 2019 & 2032

- Table 12: North America Small UAV Market Revenue Million Forecast, by Propulsion Technology 2019 & 2032

- Table 13: North America Small UAV Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: North America Small UAV Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Small UAV Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Small UAV Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America Small UAV Market?

Key companies in the market include Lockheed Martin Corporation, Elbit Systems Ltd, Skydio, AeroVironment Inc, Thales Group, BAE Systems PLC, Parrot Drone SA, Israel Aerospace Industries Ltd, SZ DJI Technology Co Ltd, Aeronautics Ltd.

3. What are the main segments of the North America Small UAV Market?

The market segments include UAV Type, Propulsion Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Agriculture Industry to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In May 2022, Teledyne FLIR Defense signed a contract worth 14 million to deliver Black Hornet 3 drones to the US Army. The advanced nano UAVs augment squad and small unit surveillance and reconnaissance capabilities as part of the Army's Soldier Borne Sensor program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Small UAV Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Small UAV Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Small UAV Market?

To stay informed about further developments, trends, and reports in the North America Small UAV Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence