Key Insights

The North American specialty coffee market, a dynamic sector characterized by a growing appreciation for high-quality coffee beans and brewing methods, is projected to experience robust growth. The market's expansion is driven by several key factors, including rising disposable incomes, a surge in coffee consumption among millennials and Gen Z, and a greater awareness of ethically sourced and sustainably produced coffee. The increasing popularity of specialty coffee shops and cafes, coupled with the convenience of single-serve coffee pods and capsules, fuels market expansion across various distribution channels, including both on-trade (restaurants, cafes) and off-trade (grocery stores, online retailers). While whole bean coffee remains a dominant segment, the convenience of ground coffee and coffee pods continues to drive significant growth. The presence of established global players like Starbucks, JAB Holding Company, and Nestlé, alongside regional and independent roasters, creates a competitive yet innovative landscape. Premiumization, encompassing a wider range of roasts, origins, and brewing methods, further enhances market attractiveness.

Looking forward, the market is expected to maintain a steady growth trajectory, although potential restraints include fluctuating coffee bean prices and increasing competition. However, the North American market's focus on quality, sustainability, and innovative brewing techniques, coupled with the rising demand for premium coffee experiences, will likely offset these challenges. The continued expansion of specialty coffee shops, alongside the growing online retail sector, ensures diverse avenues for market growth, presenting considerable opportunities for established players and new entrants alike. The shift toward more sustainable practices, including fair trade and organic certifications, will further shape the market's future, solidifying its position as a thriving segment within the broader beverage industry. This trend supports consumer demand for ethically conscious purchases, and companies that prioritize sustainability are expected to gain a competitive edge.

North America Specialty Coffee Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America specialty coffee market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on both parent and child markets, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is valued in Million units.

North America Specialty Coffee Market Market Dynamics & Structure

The North American specialty coffee market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is relatively high, with major players like Starbucks Corporation and Keurig Dr Pepper Inc. holding significant market share. However, smaller, artisanal roasters also contribute substantially, creating a diverse landscape. Technological innovation, particularly in brewing methods (e.g., single-serve pods) and processing techniques (e.g., water-based decaffeination), significantly drives market expansion. Stringent regulatory frameworks regarding labeling, organic certification, and fair trade practices influence industry operations. Competitive product substitutes, such as tea and other beverages, pose moderate challenges. The end-user demographics are largely comprised of millennials and Gen Z, known for their preference for high-quality, ethically sourced coffee. Finally, M&A activity remains significant, reflecting consolidation and expansion efforts within the sector.

- Market Concentration: High, with major players holding xx% market share.

- Technological Innovation: Significant advancements in brewing and processing methods.

- Regulatory Framework: Stringent regulations impacting labeling and sourcing.

- Competitive Substitutes: Tea and other beverages present moderate competition.

- End-User Demographics: Millennials and Gen Z are key consumer groups.

- M&A Activity: xx major mergers and acquisitions recorded between 2019 and 2024.

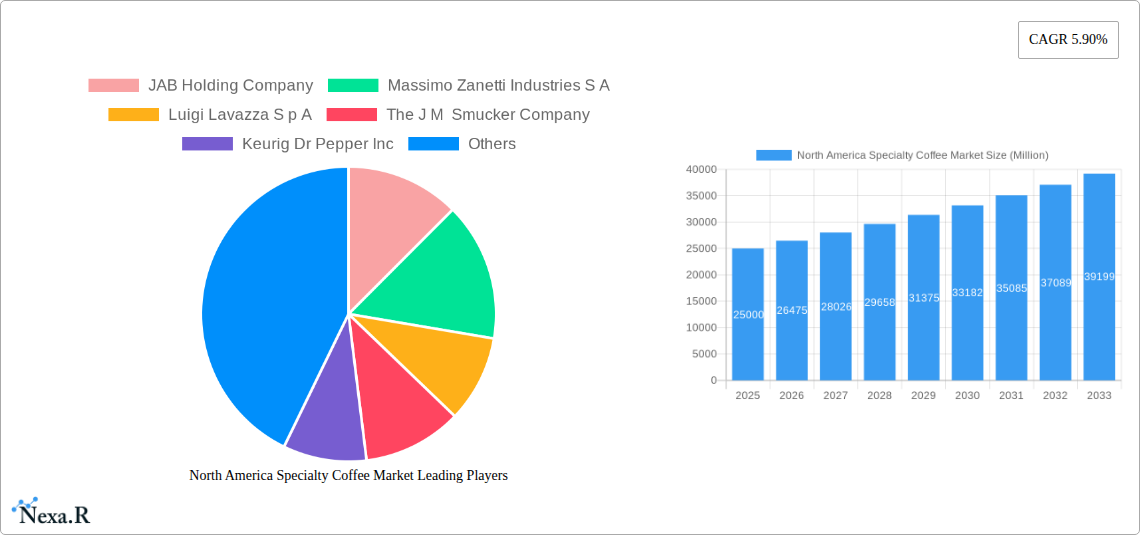

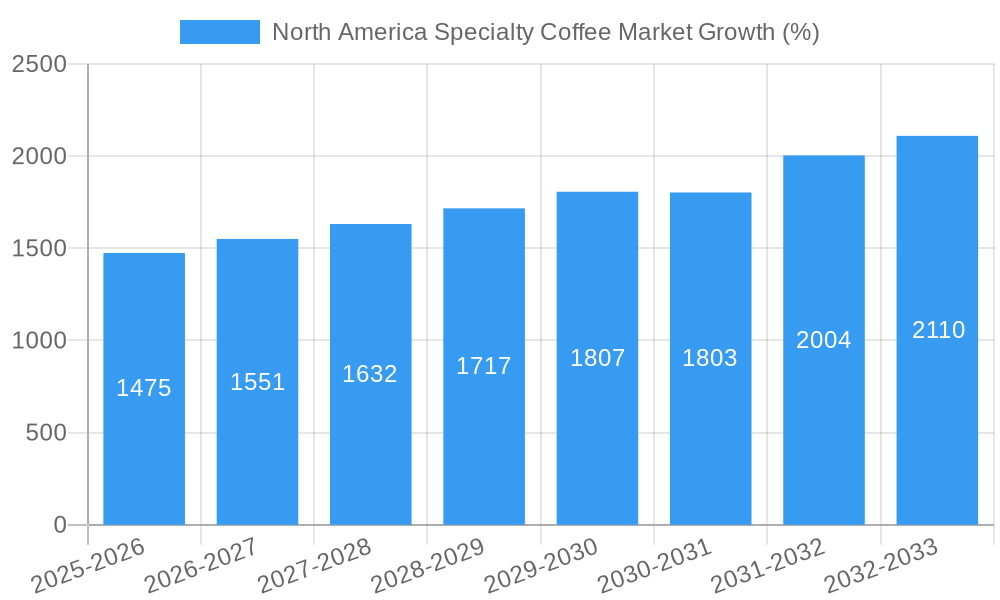

North America Specialty Coffee Market Growth Trends & Insights

The North America specialty coffee market experienced robust growth during the historical period (2019-2024), driven by increasing consumer demand for premium coffee experiences and a rising preference for convenience. This trend is projected to continue during the forecast period (2025-2033), although at a potentially moderating rate. The market size, currently estimated at xx Million units in 2025, is expected to reach xx Million units by 2033, exhibiting a CAGR of xx%. This growth is attributed to several factors, including rising disposable incomes, increasing coffee consumption per capita, the increasing popularity of specialty coffee shops and cafes, and the proliferation of convenient brewing methods like single-serve coffee pods. Technological disruptions, such as the introduction of new brewing technologies and smart coffee makers, are further fueling market expansion. Consumer behavior shifts are also playing a significant role, with growing emphasis on sustainability, ethically sourced coffee, and unique flavor profiles. Market penetration of specialty coffee is expected to increase from xx% in 2025 to xx% by 2033.

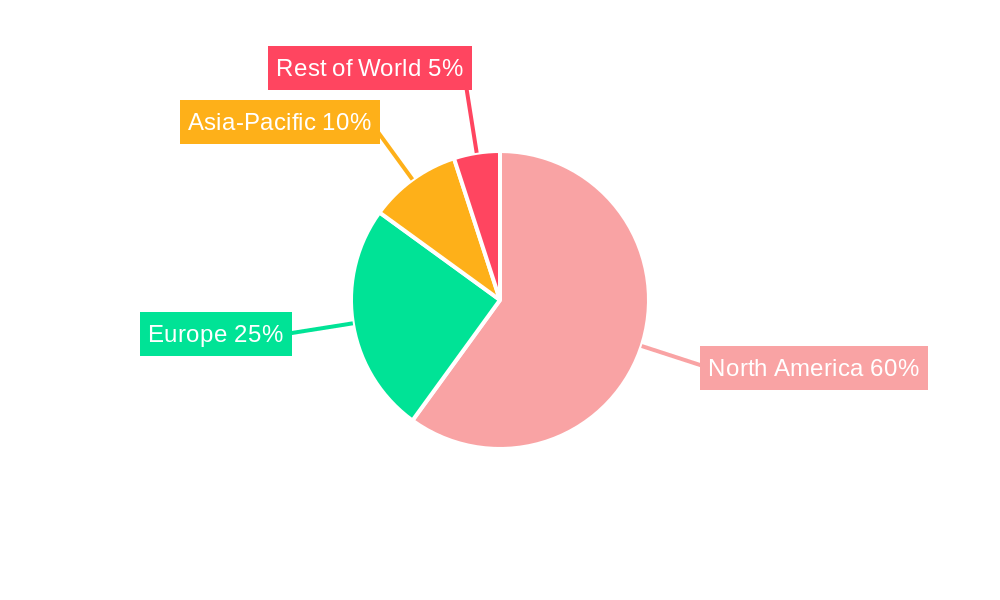

Dominant Regions, Countries, or Segments in North America Specialty Coffee Market

The United States dominates the North American specialty coffee market, accounting for xx% of the total market value in 2025. Within the product type segment, coffee pods and capsules demonstrate the highest growth potential, driven by consumer convenience. The off-trade distribution channel holds a significant share, owing to the widespread availability of specialty coffee in supermarkets, grocery stores, and online retailers. Canada exhibits strong growth prospects, driven by a rising middle class and an increasing preference for specialty coffee.

- Key Drivers in the US: Strong consumer demand, high disposable incomes, robust café culture.

- Key Drivers in Canada: Growing middle class, increasing coffee consumption, adoption of convenient brewing methods.

- Product Type: Coffee pods and capsules show the highest growth potential due to consumer convenience.

- Distribution Channel: Off-trade channels dominate owing to widespread availability.

North America Specialty Coffee Market Product Landscape

The North American specialty coffee market offers a wide variety of products, ranging from whole bean and ground coffee to instant coffee and coffee pods and capsules. Continuous product innovation focuses on enhancing convenience, flavor profiles, and sustainability. Single-serve pods remain a dominant force, while ready-to-drink (RTD) coffee and cold brew options are gaining traction. Key innovations involve creating unique flavor blends, incorporating functional ingredients, and developing more sustainable packaging options. The focus remains on delivering a premium and convenient coffee experience catering to diverse consumer preferences.

Key Drivers, Barriers & Challenges in North America Specialty Coffee Market

Key Drivers: Rising disposable incomes, increasing coffee consumption, preference for premium coffee experiences, expansion of specialty coffee shops, technological advancements in brewing and processing.

Challenges: Fluctuating coffee bean prices, supply chain disruptions, intense competition, environmental concerns (e.g., sustainability of coffee production), regulatory compliance. The impact of supply chain disruptions has led to estimated price increases of xx% in certain segments over the past three years.

Emerging Opportunities in North America Specialty Coffee Market

The market presents several opportunities: growing demand for organic and sustainably sourced coffee, expanding RTD coffee market, increasing popularity of cold brew coffee, customization options (e.g., personalized blends), the rise of specialty coffee subscriptions. Untapped markets include specific demographics (e.g., health-conscious consumers seeking low-calorie options) and geographic regions with lower specialty coffee penetration.

Growth Accelerators in the North America Specialty Coffee Market Industry

Technological breakthroughs in brewing methods and packaging, strategic partnerships between coffee roasters and retailers, expansion into emerging markets and underserved demographics, and the integration of sustainable practices will significantly accelerate market growth. Emphasis on brand building and building stronger customer loyalty is also critical.

Key Players Shaping the North America Specialty Coffee Market Market

- JAB Holding Company

- Massimo Zanetti Industries S A

- Luigi Lavazza S p A

- The J M Smucker Company

- Keurig Dr Pepper Inc

- The Kraft Heinz Company

- Starbucks Corporation

- Tata Group (Eight O'Clock Coffee Company)

- Maxingvest AG (Tchibo)

- Nestlé S A

Notable Milestones in North America Specialty Coffee Market Sector

- April 2021: Nestlé's development of low-carbon coffee varieties, reducing CO2e footprint by up to 30%.

- January 2022: Peet's Coffee's full transition to water-based decaffeination.

- July 2022: Keurig Dr Pepper's launch of Intelligentsia K-Cup pods.

In-Depth North America Specialty Coffee Market Market Outlook

The North America specialty coffee market exhibits strong growth potential, driven by continuous innovation, evolving consumer preferences, and expanding distribution channels. Strategic partnerships, focusing on sustainability and convenience, will play a key role in shaping future market dynamics. Opportunities exist in developing niche products catering to specific dietary needs or preferences, and by leveraging digital marketing and e-commerce platforms to reach wider consumer bases. The market is poised for continued expansion, with strong potential for both established players and new entrants.

North America Specialty Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Online Retail Stores

- 2.2.5. Other Off-Trade Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Specialty Coffee Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Specialty Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Increase in Coffee Consumption Among Working Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Off-Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Online Retail Stores

- 6.2.2.5. Other Off-Trade Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Online Retail Stores

- 7.2.2.5. Other Off-Trade Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Online Retail Stores

- 8.2.2.5. Other Off-Trade Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Online Retail Stores

- 9.2.2.5. Other Off-Trade Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 JAB Holding Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Massimo Zanetti Industries S A

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Luigi Lavazza S p A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 The J M Smucker Company

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Keurig Dr Pepper Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 The Kraft Heinz Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Starbucks Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Tata Group (Eight O'Clock Coffee Company)*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Maxingvest AG (Tchibo)

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nestlé S A

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 JAB Holding Company

List of Figures

- Figure 1: North America Specialty Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Specialty Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: North America Specialty Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Specialty Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Specialty Coffee Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the North America Specialty Coffee Market?

Key companies in the market include JAB Holding Company, Massimo Zanetti Industries S A, Luigi Lavazza S p A, The J M Smucker Company, Keurig Dr Pepper Inc, The Kraft Heinz Company, Starbucks Corporation, Tata Group (Eight O'Clock Coffee Company)*List Not Exhaustive, Maxingvest AG (Tchibo), Nestlé S A.

3. What are the main segments of the North America Specialty Coffee Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Increase in Coffee Consumption Among Working Population.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

July 2022: Keurig Dr. Pepper announced the launch of Intelligentsia K-Cup pods for its Keurig brewing system to capitalize on the growing demand for specialty coffee in the United States. Intelligentsia K-Cups are available in two flavors: House and Organic El Gallo, and can be purchased for 90 cents per pod in a 60-count box from Keurig.com.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Specialty Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Specialty Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Specialty Coffee Market?

To stay informed about further developments, trends, and reports in the North America Specialty Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence