Key Insights

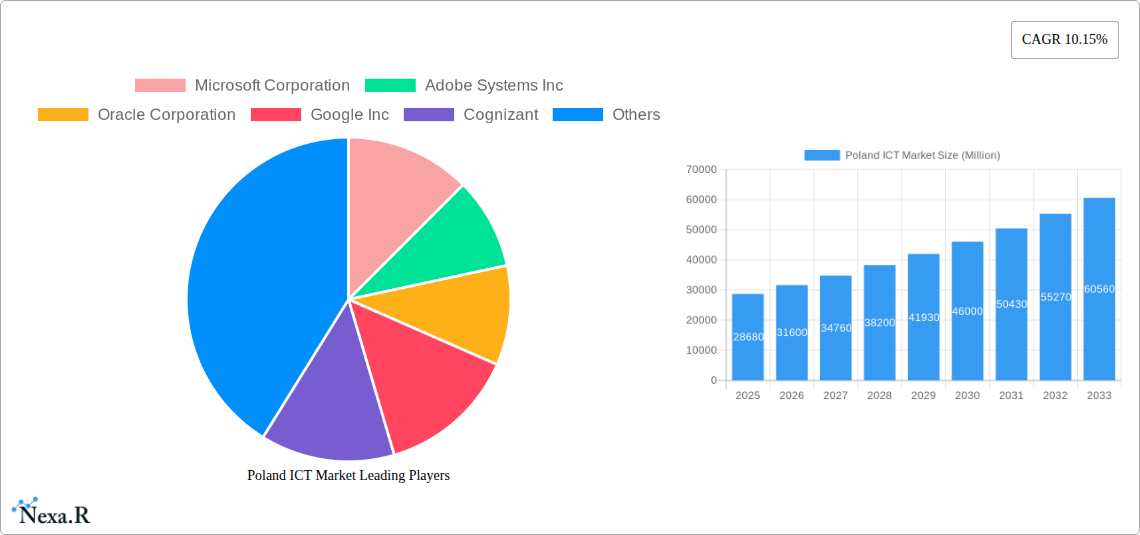

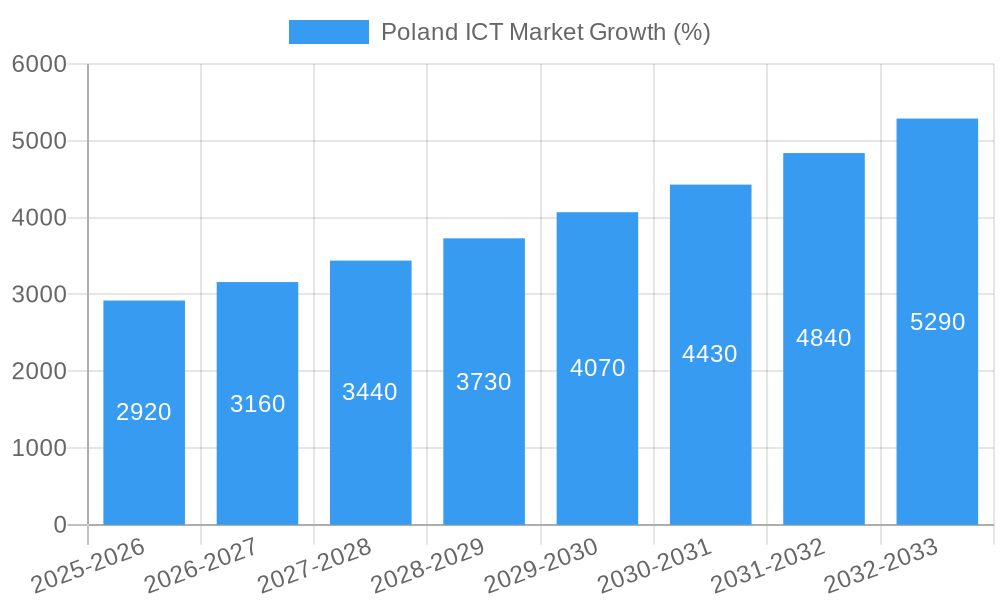

The Poland ICT market, valued at €28.68 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 10.15% from 2025 to 2033. This expansion is driven by several key factors. Increasing digitalization across various sectors, including government, finance, and manufacturing, fuels significant demand for ICT services and infrastructure. The rise of cloud computing, Big Data analytics, and the Internet of Things (IoT) is further accelerating market growth. Growing investments in 5G infrastructure and the increasing adoption of advanced technologies like AI and machine learning contribute to this positive trajectory. Furthermore, a skilled workforce and government initiatives promoting digital transformation within Poland are creating a favorable environment for ICT market expansion. Strong consumer adoption of smartphones and broadband internet access also underscores the market's dynamic nature.

However, the market is not without its challenges. Competition from established international players and smaller, agile domestic firms can intensify price pressures. Data security concerns and the need for robust cybersecurity measures present ongoing hurdles for businesses operating within the sector. Maintaining a competitive edge requires continuous innovation, investment in R&D, and adaptation to evolving technological landscapes. The market's future trajectory will depend on effectively addressing these challenges while leveraging the opportunities presented by technological advancements and increasing digital adoption across various sectors within Poland. Key players like Microsoft, Adobe, Oracle, Google, and numerous telecommunications companies are actively shaping the market's evolution.

Poland ICT Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Poland ICT market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report delves into parent and child markets, providing granular insights into specific segments for a more detailed understanding. The market size is valued in millions of units.

Poland ICT Market Dynamics & Structure

The Poland ICT market, valued at XX million in 2025, exhibits a moderately concentrated structure with several large multinational corporations and domestic players vying for market share. Technological innovation, particularly in areas like 5G deployment, cloud computing, and AI, are key drivers. The regulatory framework, while generally supportive of ICT development, presents certain challenges related to data privacy and cybersecurity. Competitive pressures from substitute products and services (e.g., open-source solutions) are also noteworthy. End-user demographics are shifting towards increased digital adoption across all age groups, fueling demand. M&A activity remains robust, with approximately XX deals recorded in the historical period (2019-2024), indicating ongoing consolidation and expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Driven by 5G, cloud computing, AI, and IoT.

- Regulatory Framework: Supportive but with challenges in data privacy and cybersecurity.

- Competitive Substitutes: Open-source solutions and alternative technologies pose a threat.

- End-User Demographics: Growing digital adoption across all age groups.

- M&A Trends: Significant M&A activity, with approximately XX deals (2019-2024).

Poland ICT Market Growth Trends & Insights

The Poland ICT market has witnessed consistent growth throughout the historical period (2019-2024), exhibiting a CAGR of XX%. This growth trajectory is projected to continue into the forecast period (2025-2033), with a projected CAGR of XX%. Factors such as increasing government investment in digital infrastructure, rising internet penetration rates, and growing adoption of cloud services have significantly contributed to this expansion. Technological disruptions, particularly in areas like AI and machine learning, are further accelerating market growth. Shifts in consumer behavior, marked by increasing reliance on mobile devices and digital platforms, are also driving demand for ICT products and services. Market penetration for key segments like cloud computing and 5G is expected to reach XX% by 2033.

Dominant Regions, Countries, or Segments in Poland ICT Market

The major urban centers of Poland, including Warsaw, Krakow, and Gdansk, are driving market growth, owing to higher concentrations of businesses and a more technologically advanced population. These regions benefit from robust digital infrastructure, skilled workforce, and government initiatives promoting digitalization. Key growth drivers include:

- Government Initiatives: Investment in digital infrastructure and incentives for ICT adoption.

- Skilled Workforce: Availability of skilled professionals in the IT sector.

- High Internet Penetration: High internet and mobile penetration rates.

- Foreign Investment: Significant FDI inflows into the Polish ICT sector.

Market share dominance is held by XX region/segment, accounting for XX% of the total market value in 2025. This dominance stems from factors such as higher per capita income, advanced infrastructure, and a higher concentration of tech companies. The region/segment’s growth potential remains significant, with a forecasted CAGR of XX% during the forecast period.

Poland ICT Market Product Landscape

The Poland ICT market offers a diverse range of products and services, encompassing hardware, software, telecommunications, and IT services. Innovation is evident in areas like AI-powered solutions, advanced cybersecurity platforms, and cloud-based applications. Companies are focusing on offering user-friendly interfaces, enhanced security features, and improved performance metrics to differentiate their products. Key innovations include the integration of IoT devices, edge computing technologies, and the adoption of blockchain for secure data management.

Key Drivers, Barriers & Challenges in Poland ICT Market

Key Drivers: Government investments in digital infrastructure, rising internet penetration, growing adoption of cloud computing and 5G, and increasing demand for data analytics and cybersecurity solutions are key drivers.

Key Challenges: Competition from international players, skills shortage in specialized areas, and potential regulatory hurdles related to data privacy and cybersecurity pose significant challenges. The impact of these challenges on market growth is estimated at XX million units by 2033.

Emerging Opportunities in Poland ICT Market

Emerging opportunities include growth in the Internet of Things (IoT) sector, expansion of 5G networks, and the increasing adoption of AI-powered solutions across various industries. The development of fintech solutions and the rise of e-commerce are also creating significant opportunities for ICT companies. Untapped markets in rural areas also present potential for growth.

Growth Accelerators in the Poland ICT Market Industry

Strategic partnerships between domestic and international players are fostering innovation and market expansion. Technological breakthroughs in areas like AI and 5G are driving new product development and enhancing service capabilities. Government initiatives aimed at supporting digitalization and attracting foreign investment are contributing to overall market growth. The adoption of cloud-based solutions and the increasing demand for cybersecurity are further accelerating growth.

Key Players Shaping the Poland ICT Market Market

- Microsoft Corporation

- Adobe Systems Inc

- Oracle Corporation

- Google Inc

- Cognizant

- Orange Polska SA

- T-Mobile Polska SA

- Honeywell International Inc

- Verizon Polska Sp Z o o

- AT&T Inc

- Capgemini SE

- Polkomtel Sp z o o

Notable Milestones in Poland ICT Market Sector

- May 2024: Vecima Networks Inc. partners with Vector Tech Solutions to deploy access node and controller solutions to ASTA-NET, expanding Vecima's European presence.

- March 2024: Infopro Digital Automotive launches Atelio Data in Poland, providing automotive repair data to workshops and expanding its Central and Eastern European reach.

In-Depth Poland ICT Market Market Outlook

The Poland ICT market is poised for sustained growth, driven by technological advancements, government initiatives, and increasing digital adoption across various sectors. The market’s future potential is vast, with significant opportunities arising from the expansion of 5G networks, the growing adoption of AI and IoT, and the increasing demand for cybersecurity solutions. Strategic partnerships and innovation in areas like cloud computing and data analytics will further fuel market expansion, creating lucrative opportunities for both domestic and international players.

Poland ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Poland ICT Market Segmentation By Geography

- 1. Poland

Poland ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country

- 3.3. Market Restrains

- 3.3.1. Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country

- 3.4. Market Trends

- 3.4.1. Growing Telecommunication Services in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adobe Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oracle Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Google Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cognizant

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Orange Polska SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 T-Mobile Polska SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honeywell International Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verizon Polska Sp Z o o

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AT&T Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Capgemini SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Polkomtel Sp z o o

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Microsoft Corporation

List of Figures

- Figure 1: Poland ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Poland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Poland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Poland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Poland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 6: Poland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 7: Poland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 8: Poland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 9: Poland ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Poland ICT Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Poland ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Poland ICT Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Poland ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Poland ICT Market Volume Billion Forecast, by Size of Enterprise 2019 & 2032

- Table 15: Poland ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 16: Poland ICT Market Volume Billion Forecast, by Industry Vertical 2019 & 2032

- Table 17: Poland ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Poland ICT Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland ICT Market?

The projected CAGR is approximately 10.15%.

2. Which companies are prominent players in the Poland ICT Market?

Key companies in the market include Microsoft Corporation, Adobe Systems Inc, Oracle Corporation, Google Inc, Cognizant, Orange Polska SA, T-Mobile Polska SA, Honeywell International Inc, Verizon Polska Sp Z o o, AT&T Inc, Capgemini SE, Polkomtel Sp z o o.

3. What are the main segments of the Poland ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country.

6. What are the notable trends driving market growth?

Growing Telecommunication Services in the Country.

7. Are there any restraints impacting market growth?

Rising Need to Explore and Adopt Digital Technologies and Initiatives; Rising Internet Penetration in the Country.

8. Can you provide examples of recent developments in the market?

May 2024: Vecima Networks Inc. announced its partnership with Vector Tech Solutions to deploy Vecima's Entra SC-1D Access Node and Entra Access Controller (EAC) solutions to telecommunication provider ASTA-NET in Poland. With this collaboration, the company aims to expand its presence in Europe, providing local expertise as a Vecima reseller in Poland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland ICT Market?

To stay informed about further developments, trends, and reports in the Poland ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence