Key Insights

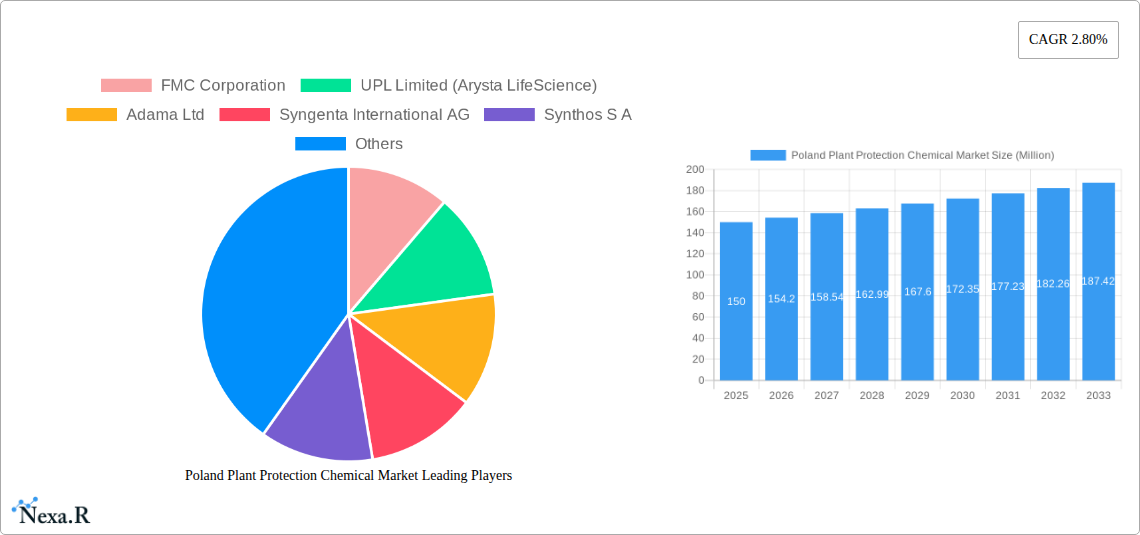

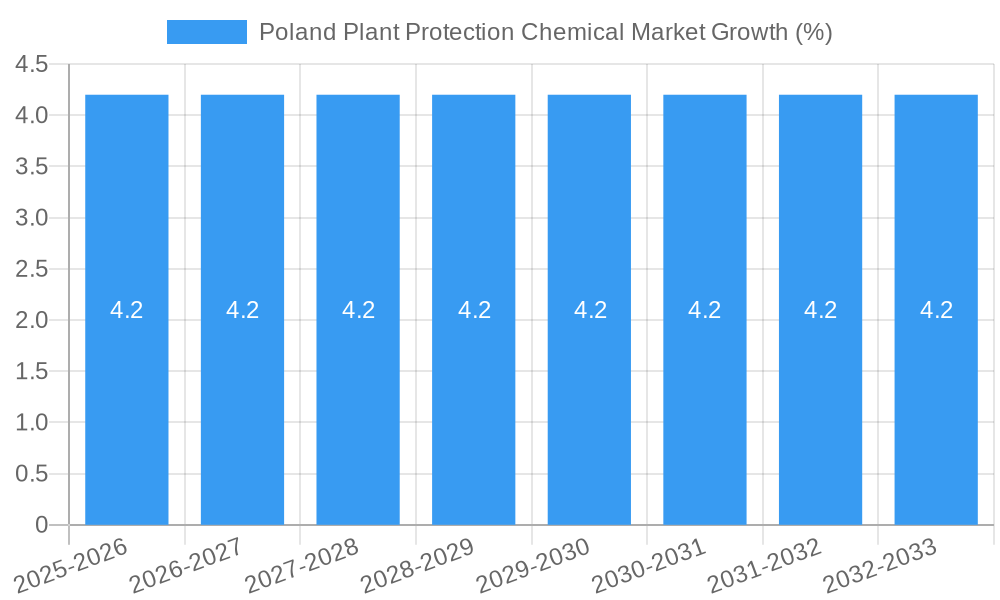

The Poland Plant Protection Chemical market, valued at approximately €150 million in 2025, is projected to experience steady growth, driven by increasing agricultural output and the rising prevalence of crop diseases and pests. A CAGR of 2.80% from 2025 to 2033 indicates a gradual but consistent expansion. Key drivers include rising demand for high-yielding crops, government initiatives supporting sustainable agriculture practices, and the adoption of advanced crop protection technologies. The market is segmented by type (herbicides, fungicides, insecticides, nematicides, molluscicides, and others), application (grains and cereals, pulses and oilseeds, fruits and vegetables, commercial crops, and others), and origin (synthetic and bio-based). Herbicides and fungicides are expected to dominate the market due to their widespread use in various crops. The increasing focus on environmentally friendly solutions is driving growth within the bio-based segment, although synthetic chemicals remain prevalent due to their efficacy and cost-effectiveness. Potential restraints include stringent regulatory frameworks concerning pesticide use, environmental concerns regarding chemical residue, and fluctuations in agricultural commodity prices. Major players like FMC Corporation, UPL Limited, Adama Ltd., Syngenta, and BASF compete fiercely, focusing on product innovation and expansion to maintain market share. The Polish government's initiatives aimed at promoting sustainable agriculture will likely shape the future trajectory of the market, influencing both adoption of bio-based solutions and the adoption of precision agriculture techniques to minimize pesticide use.

The forecast period of 2025-2033 anticipates continued growth, influenced by evolving farming practices, the introduction of new and more efficient plant protection chemicals, and the increasing adoption of integrated pest management strategies. The market's segmentation offers opportunities for specialized players to target specific crop types and address specific pest and disease challenges. Companies are likely to focus on research and development to create innovative solutions that meet the dual demands of high crop yields and environmental sustainability. Pricing pressures and competition will remain significant factors, potentially leading to consolidation within the market. The Polish Plant Protection Chemical market's future hinges on successfully balancing the need for crop protection with environmental preservation and the increasing focus on sustainable farming practices.

Poland Plant Protection Chemical Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland plant protection chemical market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report delves into the parent market (plant protection chemicals in Europe) and child markets (specific types and applications within Poland), offering a granular understanding of this vital sector. The total market size is projected to reach xx Million units by 2033.

Poland Plant Protection Chemical Market Dynamics & Structure

This section analyzes the competitive landscape of the Polish plant protection chemical market, including market concentration, technological advancements, regulatory influences, and the impact of mergers and acquisitions (M&A). The market is moderately concentrated with key players holding significant market share. Technological innovation, driven by the need for higher efficacy and sustainability, is a key growth driver.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Technological Innovation: Focus on developing bio-based pesticides and precision application technologies is increasing. Barriers to innovation include high R&D costs and stringent regulatory approvals.

- Regulatory Framework: Stringent regulations concerning pesticide registration and usage are shaping market dynamics. Compliance costs impact smaller players disproportionately.

- Competitive Product Substitutes: The increasing popularity of integrated pest management (IPM) strategies presents a challenge to traditional chemical pesticides.

- End-User Demographics: The market is primarily driven by large-scale agricultural operations, but the segment of smaller farms is also showing growth.

- M&A Trends: Consolidation within the industry is expected to continue, with larger players acquiring smaller companies to expand their product portfolios and market reach. The number of M&A deals from 2019-2024 averaged xx per year.

Poland Plant Protection Chemical Market Growth Trends & Insights

The Polish plant protection chemical market is experiencing steady growth, driven by factors such as increasing agricultural production, growing demand for higher crop yields, and the rising incidence of crop diseases and pests. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Market penetration of advanced technologies like precision spraying is gradually increasing, enhancing the efficiency of pesticide application. Changing consumer preferences towards sustainably produced food are also driving the adoption of bio-based alternatives.

Dominant Regions, Countries, or Segments in Poland Plant Protection Chemical Market

The market is geographically spread across various regions of Poland, with higher concentrations in key agricultural areas. Among the application segments, Grains and Cereals dominate, driven by the country's significant cereal production. Herbicides constitute the largest type segment, followed by fungicides. Synthetic origin pesticides hold the dominant market share.

- Leading Segment (Application): Grains and Cereals (xx% market share in 2025) due to extensive cultivation and susceptibility to pests and diseases.

- Leading Segment (Type): Herbicides (xx% market share in 2025) owing to the prevalence of weeds in various crops.

- Leading Segment (Origin): Synthetic pesticides (xx% market share in 2025) due to their higher efficacy and wider availability.

- Key Regional Drivers: Favorable government policies supporting agriculture, advancements in agricultural infrastructure, and increasing farmer awareness about pest management solutions.

Poland Plant Protection Chemical Market Product Landscape

The Polish market features a diverse range of plant protection chemicals, encompassing herbicides, fungicides, insecticides, nematicides, and molluscicides. Innovation is focused on enhancing efficacy, reducing environmental impact, and improving safety for applicators. Recent introductions include targeted formulations, bio-pesticides, and advanced application technologies. Companies are increasingly emphasizing unique selling propositions centered around sustainability, efficacy, and ease of use.

Key Drivers, Barriers & Challenges in Poland Plant Protection Chemical Market

Key Drivers: Rising agricultural output, growing awareness of pest control, stringent regulatory norms promoting sustainable products, and government support for agricultural technology adoption.

Challenges: Stringent regulatory approvals, potential environmental concerns associated with pesticide use, fluctuations in raw material prices, and competition from bio-based alternatives. The regulatory landscape and import restrictions pose challenges for smaller companies.

Emerging Opportunities in Poland Plant Protection Chemical Market

Growth opportunities exist in bio-based pesticides, precision agriculture technologies, and tailored solutions for specific crops and pests. Untapped market segments include organic farming and the adoption of integrated pest management (IPM) strategies. The increasing demand for sustainable agriculture practices presents significant growth opportunities for bio-based and environmentally friendly solutions.

Growth Accelerators in the Poland Plant Protection Chemical Market Industry

Long-term growth will be accelerated by technological advancements in pesticide formulation and application, strategic partnerships between chemical companies and agricultural technology providers, and expansion into untapped regional markets. The ongoing development and adoption of sustainable agricultural practices will also drive future growth.

Key Players Shaping the Poland Plant Protection Chemical Market Market

- FMC Corporation

- UPL Limited (Arysta LifeScience)

- Adama Ltd

- Syngenta International AG

- Synthos S A

- CEIGH Group

- Corteva Agriscience

- Bayer CropScience AG

- BASF SE

Notable Milestones in Poland Plant Protection Chemical Market Sector

- January 2023: CIECH Group launches Halvetic, a sustainable crop protection product, and plans expansion into 13 countries, including Poland.

- November 2021: Syngenta launches PLINAZOLIN technology, a new active ingredient effective against various pests.

- July 2021: Enko collaborates with Bayer to develop new pesticide chemistries for superweed control.

In-Depth Poland Plant Protection Chemical Market Outlook

The Polish plant protection chemical market exhibits strong growth potential, driven by continuous advancements in agricultural technologies, increasing awareness of sustainable farming practices, and supportive government policies. Strategic partnerships, product innovation, and expansion into niche markets will be crucial for sustained growth. The market's future is bright, with significant opportunities for companies that can adapt to evolving consumer demands and regulatory landscapes.

Poland Plant Protection Chemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Poland Plant Protection Chemical Market Segmentation By Geography

- 1. Poland

Poland Plant Protection Chemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increase in Grains and Cereals demand is driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Plant Protection Chemical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPL Limited (Arysta LifeScience)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Adama Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta International AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Synthos S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEIGH Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bayer CropScience AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Poland Plant Protection Chemical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Plant Protection Chemical Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Plant Protection Chemical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Plant Protection Chemical Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Poland Plant Protection Chemical Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Poland Plant Protection Chemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Poland Plant Protection Chemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Poland Plant Protection Chemical Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Poland Plant Protection Chemical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Poland Plant Protection Chemical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Poland Plant Protection Chemical Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Poland Plant Protection Chemical Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Poland Plant Protection Chemical Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Poland Plant Protection Chemical Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Poland Plant Protection Chemical Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Poland Plant Protection Chemical Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Plant Protection Chemical Market?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Poland Plant Protection Chemical Market?

Key companies in the market include FMC Corporation, UPL Limited (Arysta LifeScience), Adama Ltd, Syngenta International AG, Synthos S A, CEIGH Grou, Corteva Agriscience, Bayer CropScience AG, BASF SE.

3. What are the main segments of the Poland Plant Protection Chemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increase in Grains and Cereals demand is driving the Market.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

January 2023: The CIECH Group has launched Halvetic - an innovative and sustainable crop protection product, and CIECH Sarzyna plans to expand its distribution in 13 countries to include Poland, Italy, the United Kingdom, and other European Union countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Plant Protection Chemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Plant Protection Chemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Plant Protection Chemical Market?

To stay informed about further developments, trends, and reports in the Poland Plant Protection Chemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence