Key Insights

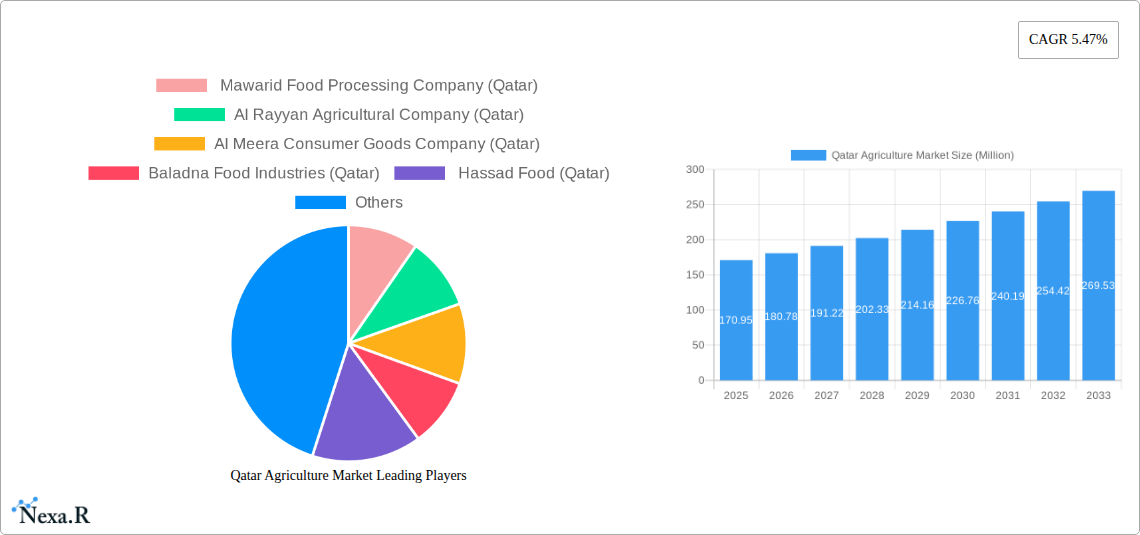

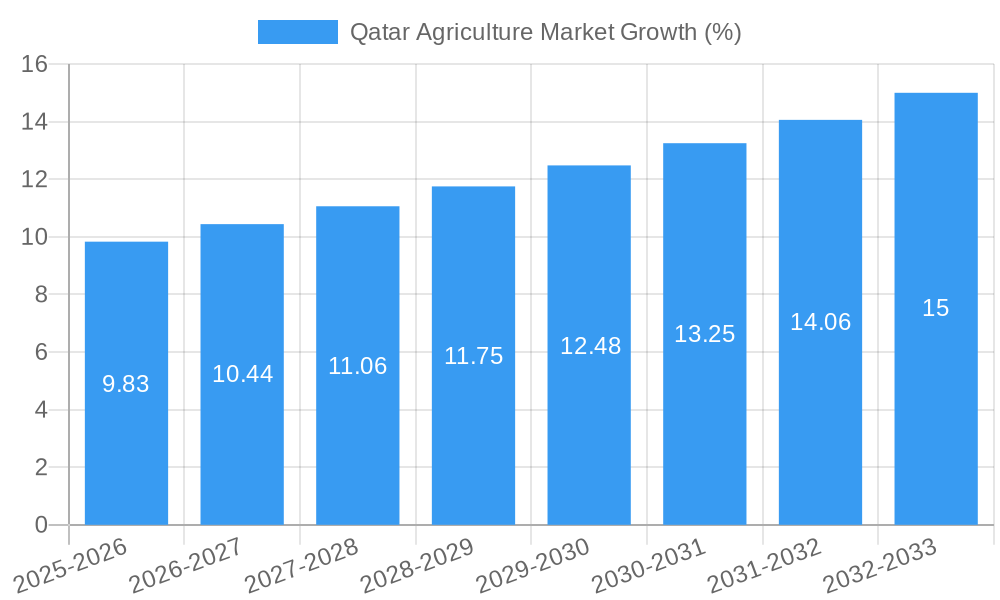

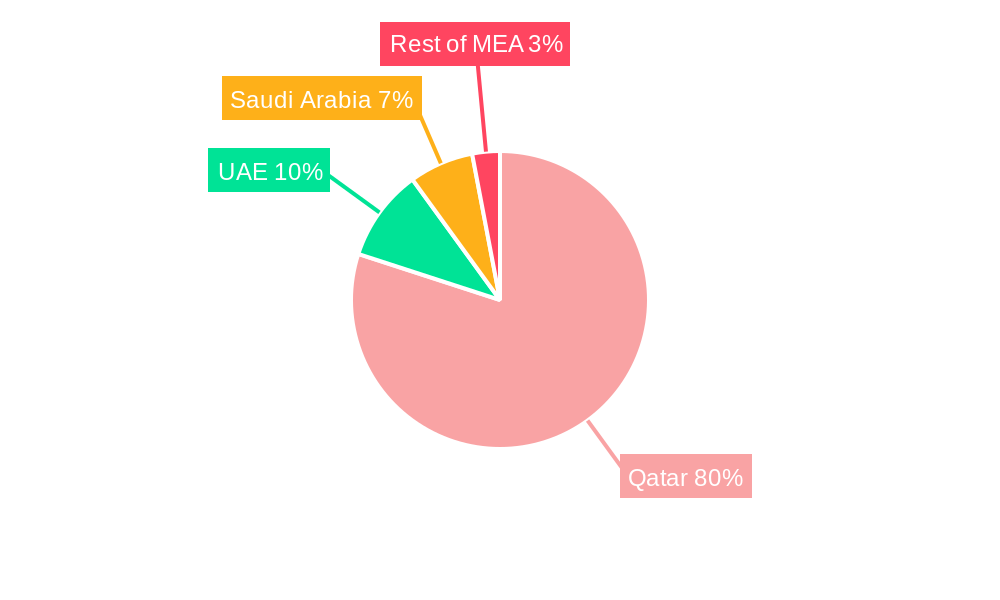

The Qatar agriculture market, valued at $170.95 million in 2025, is projected to experience robust growth, driven by increasing government initiatives promoting food security and self-sufficiency. A Compound Annual Growth Rate (CAGR) of 5.47% from 2025 to 2033 signifies a significant expansion of this sector. Key drivers include rising disposable incomes leading to increased demand for high-quality produce, a growing population necessitating greater food production, and strategic investments in advanced agricultural technologies such as hydroponics and vertical farming to combat water scarcity. The market is segmented by product type (fresh produce, dairy & poultry, fish & seafood) and application (human consumption, animal feed), with human consumption dominating the market share. Leading companies like Mawarid Food Processing Company, Al Rayyan Agricultural Company, Al Meera Consumer Goods Company, Baladna Food Industries, and Hassad Food are playing a crucial role in shaping the market landscape through investments in infrastructure, technology, and sustainable farming practices. The Middle East and Africa region, particularly the UAE and Saudi Arabia, alongside Qatar itself, presents significant growth opportunities, fueled by regional collaborations and increasing demand for locally sourced food products. However, challenges such as limited arable land and water resources, as well as dependence on imports for certain agricultural products, present ongoing constraints.

Despite these challenges, the long-term outlook for the Qatar agriculture market remains positive. Government policies emphasizing sustainable agriculture, coupled with private sector investments in innovative farming techniques, are expected to mitigate some of the existing constraints. Furthermore, increasing consumer awareness regarding healthy eating and the demand for organically produced food are driving growth in specific market segments, such as organic fruits and vegetables. The diversification of agricultural products and the development of efficient supply chains are expected to further contribute to the sector’s expansion over the forecast period. The focus on improving the efficiency of existing agricultural practices and encouraging the adoption of technology will play a critical role in achieving the projected growth targets.

Qatar Agriculture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Qatar agriculture market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and anyone seeking to understand the evolving landscape of Qatar's agricultural sector. The market is segmented by product (Fresh Produce, Dairy & Poultry, Fish & Seafood) and application (Human Consumption, Animal Feed), offering granular insights into market performance and future potential. The total market size in 2025 is estimated at xx Million.

Qatar Agriculture Market Dynamics & Structure

The Qatar agriculture market is characterized by a moderate level of concentration, with several key players dominating specific segments. Technological innovation, driven by initiatives like the QNRF, is a key driver of growth, while regulatory frameworks play a significant role in shaping market dynamics. The market faces competition from imported produce, necessitating a focus on enhancing domestic production and efficiency. End-user demographics, largely influenced by a growing population and changing dietary preferences, impact demand for diverse agricultural products. Mergers and acquisitions (M&A) activity remains relatively low, though strategic partnerships are increasingly common.

- Market Concentration: Moderate, with a few dominant players in specific segments (e.g., dairy, poultry). Market share data for 2025 is predicted as follows: Hassad Food (Qatar): xx%, Baladna Food Industries (Qatar): xx%, Al Meera Consumer Goods Company (Qatar): xx%, others: xx%.

- Technological Innovation: Strong push towards precision agriculture, vertical farming, and automation driven by government initiatives and research collaborations (e.g., CMU-Q's greenhouse optimization project).

- Regulatory Framework: Government policies promoting food security and local production heavily influence market growth and investment.

- Competitive Product Substitutes: Imported agricultural products pose a significant competitive challenge.

- M&A Activity: Limited in recent years, but strategic partnerships are on the rise. Predicted M&A deal volume for 2025-2033: xx deals.

- Innovation Barriers: High initial investment costs for advanced technologies and a limited skilled workforce can hinder innovation adoption.

Qatar Agriculture Market Growth Trends & Insights

The Qatar agriculture market is experiencing robust growth, driven by a combination of factors. Government initiatives to bolster food security, rising disposable incomes, and shifting consumer preferences towards healthier, locally sourced food are key drivers. The adoption of advanced technologies, such as vertical farming and precision agriculture, is further accelerating growth. The market size is expected to register a CAGR of xx% during the forecast period (2025-2033). Market penetration of locally produced food is projected to increase from xx% in 2025 to xx% by 2033. Technological disruptions, particularly in areas such as hydroponics and automation, are fundamentally transforming the industry. Changes in consumer behavior, including a greater willingness to pay for premium, locally-sourced products, are fueling demand for high-quality, sustainably produced food.

Dominant Regions, Countries, or Segments in Qatar Agriculture Market

Within Qatar, the agricultural sector is relatively concentrated. However, the segment showing the strongest growth potential and commanding significant market share is the Dairy & Poultry segment, followed by the Fresh Produce segment. The high demand for fresh, locally-sourced dairy products, eggs, and poultry fuels this growth. Government support programs aimed at increasing domestic production of these essential food items further contribute to market dominance.

- Key Drivers:

- Government incentives and subsidies for local agricultural production.

- Growing consumer demand for fresh, high-quality dairy and poultry products.

- Investments in modern farming technologies and infrastructure.

- Dominance Factors:

- High profitability compared to other segments.

- Relatively less reliance on imported goods.

- Strong support from the government and private sector investment.

Qatar Agriculture Market Product Landscape

Product innovation in the Qatar agriculture market focuses on enhancing yields, improving quality, and extending shelf life. Advanced technologies like hydroponics and vertical farming are gaining traction, enabling year-round production of leafy greens and other produce, as demonstrated by iFarm's partnership in 2021. Unique selling propositions increasingly emphasize sustainability, traceability, and high nutritional value. Performance metrics are focused on yield per unit area, water usage efficiency, and production costs.

Key Drivers, Barriers & Challenges in Qatar Agriculture Market

Key Drivers:

- Government initiatives promoting food security and local production.

- Growing consumer demand for fresh, locally sourced food.

- Technological advancements improving efficiency and yields.

- Increased investment in agricultural infrastructure.

Key Challenges & Restraints:

- High production costs due to limited water resources and extreme climatic conditions.

- Dependence on imported feed and inputs.

- Competition from cheaper imported agricultural products.

- Skilled labor shortages. A projected xx% shortfall in skilled labor by 2030.

Emerging Opportunities in Qatar Agriculture Market

- Expansion of vertical farming: Utilizing advanced technologies to maximize production efficiency in a space-constrained environment.

- Development of sustainable farming practices: Reducing water consumption and promoting environmentally friendly agricultural methods.

- Growing demand for organic and specialty crops: Catering to increasingly discerning consumers seeking higher quality and healthier food options.

- Focus on value-added agricultural products: Processing and packaging locally produced agricultural goods to increase their market value.

Growth Accelerators in the Qatar Agriculture Market Industry

Technological breakthroughs, particularly in areas like precision agriculture and automation, are playing a significant role in accelerating growth. Strategic partnerships between local companies and international agritech firms, as seen with iFarm's collaboration, are introducing advanced farming techniques to Qatar. Government initiatives focused on enhancing agricultural infrastructure and providing financial support to farmers further contribute to growth acceleration.

Key Players Shaping the Qatar Agriculture Market Market

- Mawarid Food Processing Company (Qatar)

- Al Rayyan Agricultural Company (Qatar)

- Al Meera Consumer Goods Company (Qatar)

- Baladna Food Industries (Qatar)

- Hassad Food (Qatar)

Notable Milestones in Qatar Agriculture Market Sector

- June 2021: iFarm partners with Sadarah Partners to establish a commercial-scale indoor farm, introducing vertical farming technology for year-round fresh produce supply.

- August 2022: CMU-Q launches a research project using AI and machine learning to optimize greenhouse operations, enhancing efficiency and yield.

In-Depth Qatar Agriculture Market Market Outlook

The Qatar agriculture market is poised for continued strong growth, driven by ongoing government support, technological advancements, and evolving consumer preferences. Strategic opportunities exist in expanding vertical farming operations, developing sustainable agricultural practices, and focusing on niche markets such as organic produce. The market's future potential is significant, presenting opportunities for both domestic and international players to participate in this dynamic sector.

Qatar Agriculture Market Segmentation

- 1. Food Crops/Cereals

- 2. Fruits

- 3. Vegetables

- 4. Food Crops/Cereals

- 5. Fruits

- 6. Vegetables

Qatar Agriculture Market Segmentation By Geography

- 1. Qatar

Qatar Agriculture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.47% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of High Technology Farming Practices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.2. Market Analysis, Insights and Forecast - by Fruits

- 5.3. Market Analysis, Insights and Forecast - by Vegetables

- 5.4. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 5.5. Market Analysis, Insights and Forecast - by Fruits

- 5.6. Market Analysis, Insights and Forecast - by Vegetables

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Qatar

- 5.1. Market Analysis, Insights and Forecast - by Food Crops/Cereals

- 6. UAE Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Qatar Agriculture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Mawarid Food Processing Company (Qatar)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Al Rayyan Agricultural Company (Qatar)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Al Meera Consumer Goods Company (Qatar)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Baladna Food Industries (Qatar)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hassad Food (Qatar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Mawarid Food Processing Company (Qatar)

List of Figures

- Figure 1: Qatar Agriculture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Qatar Agriculture Market Share (%) by Company 2024

List of Tables

- Table 1: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 3: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 4: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 5: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 6: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 7: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 8: Qatar Agriculture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: UAE Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of MEA Qatar Agriculture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 15: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 16: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 17: Qatar Agriculture Market Revenue Million Forecast, by Food Crops/Cereals 2019 & 2032

- Table 18: Qatar Agriculture Market Revenue Million Forecast, by Fruits 2019 & 2032

- Table 19: Qatar Agriculture Market Revenue Million Forecast, by Vegetables 2019 & 2032

- Table 20: Qatar Agriculture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Qatar Agriculture Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Qatar Agriculture Market?

Key companies in the market include Mawarid Food Processing Company (Qatar) , Al Rayyan Agricultural Company (Qatar), Al Meera Consumer Goods Company (Qatar) , Baladna Food Industries (Qatar), Hassad Food (Qatar).

3. What are the main segments of the Qatar Agriculture Market?

The market segments include Food Crops/Cereals, Fruits, Vegetables, Food Crops/Cereals, Fruits, Vegetables.

4. Can you provide details about the market size?

The market size is estimated to be USD 170.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Indian Rice; Enhancing Production Capacities; Increasing Government Initiatives.

6. What are the notable trends driving market growth?

Increase in Adoption of High Technology Farming Practices.

7. Are there any restraints impacting market growth?

Abiotic and Biotic Stresses in Rice Cultivation; High Market Entry Costs.

8. Can you provide examples of recent developments in the market?

August 2022: Carnegie Mellon University has launched a new research project in Qatar (CMU-Q), a Qatar Foundation (QF) partner university, to optimize the operations of greenhouses in Qatar. This project is funded by the Qatar National Research Fund through the National Priorities Research Program (QNRF) and will use machine learning (ML) to coordinate a fleet of mobile robots to collect visual data from Qatar greenhouse plants autonomously and use AI and machine learning to create predictive models of the crop's development status, quality, health, and expected yield.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Qatar Agriculture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Qatar Agriculture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Qatar Agriculture Market?

To stay informed about further developments, trends, and reports in the Qatar Agriculture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence