Key Insights

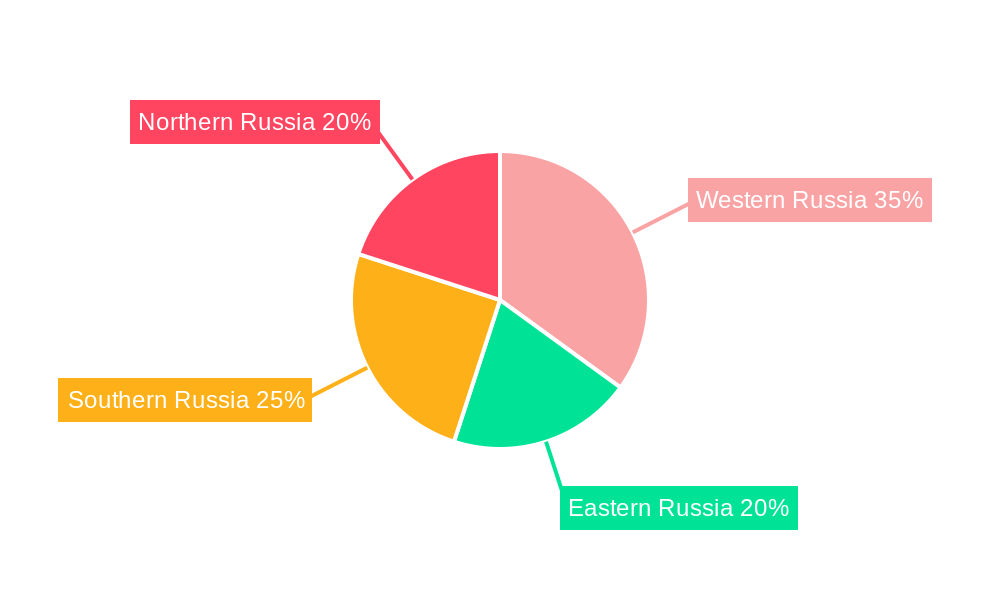

The Russian used car market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several factors. A significant driver is the increasing affordability of used vehicles compared to new cars, particularly amidst economic fluctuations. Furthermore, a growing preference for SUVs and hatchbacks, fueled by changing consumer preferences and the increasing availability of diverse models in the used car segment, is significantly impacting market dynamics. The rise of online marketplaces and organized dealerships is streamlining the buying process, improving transparency and building consumer trust, thus further boosting market expansion. However, the market faces challenges. Fluctuations in the ruble's exchange rate and economic sanctions impacting vehicle imports can create instability. Additionally, the relatively underdeveloped infrastructure for used car inspections and certification presents a hurdle to consistent quality assurance and transparency in transactions. The market is segmented by car type (hatchback, sedan, SUV), propulsion (internal combustion engine, electric), and vendor type (organized, unorganized), offering diverse opportunities and challenges across these segments. The unorganized sector, while large, faces potential disruption from the growing organized sector due to its lack of transparency and standardization. The regional breakdown shows varying market strengths across Western, Eastern, Southern, and Northern Russia, reflecting regional economic disparities and consumer purchasing power. The continued growth trajectory is expected to be influenced by government policies, economic stability, and the evolving consumer landscape.

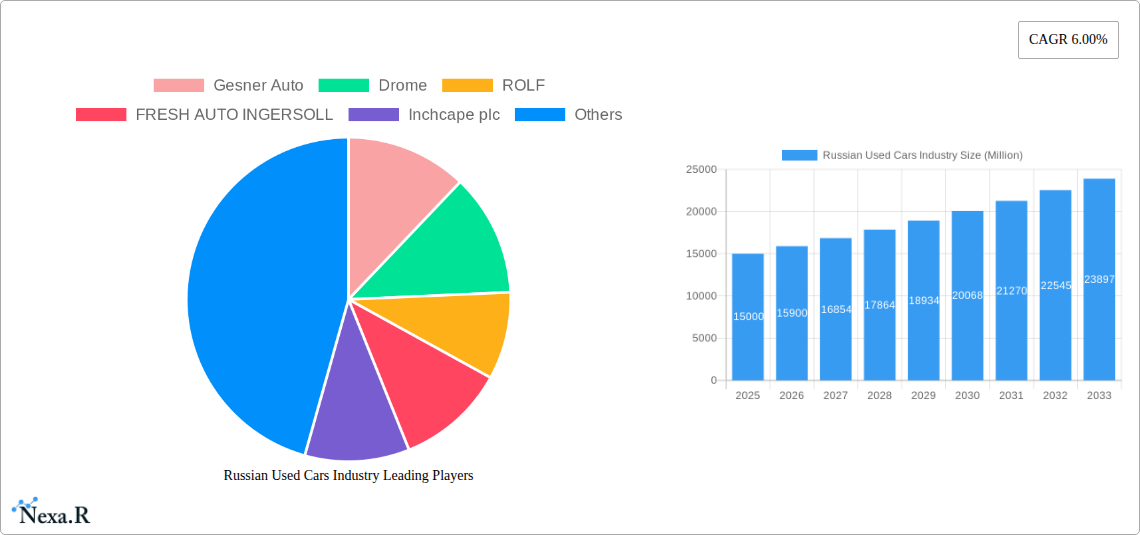

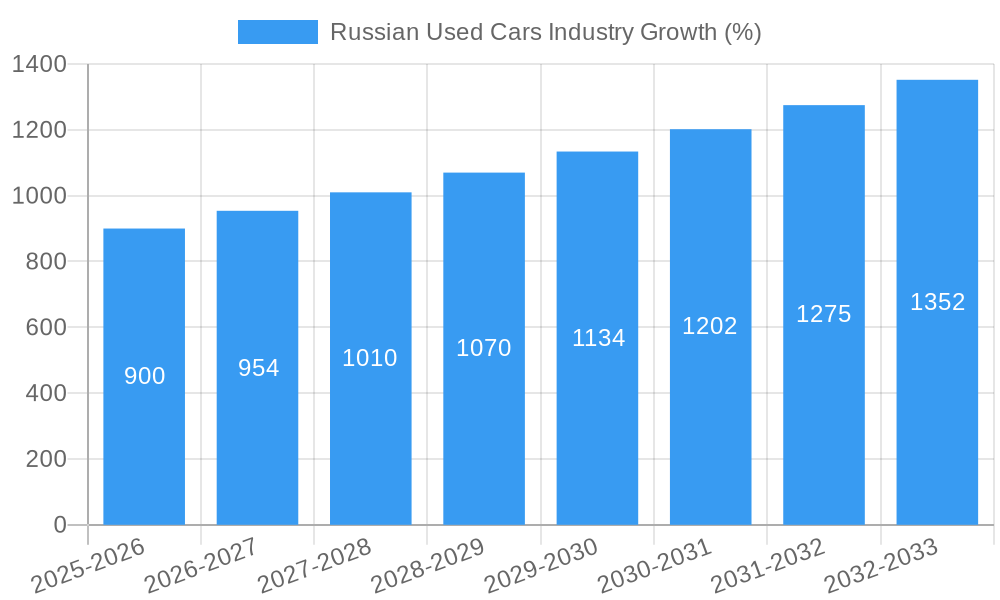

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 6.00%, suggesting a substantial market expansion. This growth will be influenced by the increasing penetration of online platforms, improved financing options for used car purchases, and potentially a shift towards electric vehicles as affordability improves. The competitive landscape involves a mix of international and domestic players, with established companies like Inchcape plc and JSC AVTOVAZ competing alongside smaller, regional players. The strategic focus for many players will likely center on expanding online presence, improving customer experience, and providing better vehicle quality assurance to maintain growth and mitigate risks associated with economic volatility and regulatory changes within the Russian market. The market's evolution will significantly depend on the resolution of geopolitical factors and the pace of economic recovery.

Russian Used Car Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Russian used car market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by car type (hatchback, sedan, SUV), propulsion (internal combustion engine, electric), and vendor type (organized, unorganized), providing granular insights into this dynamic sector. This report is essential for industry professionals, investors, and anyone seeking a comprehensive understanding of the Russian used car market.

Russian Used Cars Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the Russian used car market, focusing on market concentration, technological advancements, regulatory influences, and M&A activity. The market is characterized by a mix of organized and unorganized vendors, with varying degrees of market share. The historical period (2019-2024) witnessed significant fluctuations influenced by economic conditions and geopolitical events.

- Market Concentration: The Russian used car market exhibits a moderately concentrated structure with a few large players like ROLF and Favorit Motors commanding significant shares alongside a vast number of smaller, unorganized vendors. Organized players hold approximately xx% market share in 2024, estimated to grow to xx% by 2033.

- Technological Innovation: Adoption of online platforms (e.g., Drome) for car sales is increasing, but penetration rates remain relatively low compared to developed markets. Innovation is largely focused on improving the online car buying experience rather than disruptive technologies.

- Regulatory Framework: Government regulations concerning used car imports, emission standards, and vehicle safety inspections influence market dynamics, impacting both organized and unorganized vendors. Changes in these regulations could significantly affect market growth.

- Competitive Substitutes: Public transportation and ride-sharing services pose some level of competition, particularly in urban areas. However, the used car market remains largely independent of these substitutes.

- End-User Demographics: The primary consumer base consists of individuals seeking affordable transportation options, with a significant portion residing in smaller cities and towns.

- M&A Trends: The sale of ROLF to KlyuchAvto in December 2021 for an estimated USD 400-500 million illustrates the ongoing consolidation within the organized sector. Further M&A activity is expected in the coming years.

Russian Used Cars Industry Growth Trends & Insights

The Russian used car market experienced significant growth during the historical period, followed by a period of contraction linked to geopolitical factors and economic instability. The forecast period (2025-2033) anticipates a gradual recovery and moderate growth driven by increasing affordability and the growing need for personal transportation in expanding urban areas.

The market size is estimated at xx million units in 2025, exhibiting a CAGR of xx% during the forecast period. The adoption rate of online platforms is projected to increase significantly, although the unorganized sector is likely to remain a considerable part of the market. Consumer behavior is shifting towards online research and price comparison before purchasing, influencing the strategies of organized players. Technological disruptions are expected to be gradual, primarily focusing on improving the efficiency of online platforms.

Dominant Regions, Countries, or Segments in Russian Used Cars Industry

The Moscow and St. Petersburg regions, along with other major urban centers, are driving growth in the Russian used car market. The internal combustion engine (ICE) segment remains dominant due to affordability and accessibility. The organized sector is expected to exhibit faster growth rates compared to the unorganized sector.

- By Car Type: SUVs are becoming increasingly popular, driven by rising disposable income and changing lifestyle preferences. Sedans continue to hold a significant share of the market. Hatchbacks remain affordable options for a larger segment of buyers.

- By Propulsion: The ICE vehicle segment is projected to maintain its dominance throughout the forecast period due to cost considerations. Electric vehicles (EVs) have limited penetration, primarily due to high prices and limited charging infrastructure.

- By Vendor Type: The organized sector, encompassing larger dealerships and online platforms, is projected to increase its market share. However, the unorganized sector, representing independent sellers, will continue to be a major segment of the market due to lower transaction costs and wide availability of vehicles.

Russian Used Cars Industry Product Landscape

The Russian used car market is characterized by a wide range of vehicles, spanning various makes, models, ages, and conditions. Technological advancements have primarily focused on improving online platforms, providing better search and filtering capabilities, and enhancing the customer experience with virtual inspections and online financing options. The main differentiators include price, vehicle condition, and availability of documentation and service history.

Key Drivers, Barriers & Challenges in Russian Used Cars Industry

Key Drivers:

- Increasing affordability of used cars.

- Growing demand for personal transportation in expanding urban areas.

- Development of online platforms facilitating easier transactions.

Key Challenges:

- Economic instability and fluctuations in the ruble's exchange rate impacting both import and domestic sales.

- Limited access to financing for buyers in certain regions.

- Regulatory challenges and complexities in the used car import process and lack of comprehensive vehicle history reports.

Emerging Opportunities in Russian Used Cars Industry

- Expansion of online platforms to reach smaller cities and towns.

- Development of specialized services for used car inspection and certification.

- Growing demand for certified pre-owned vehicles.

- Integration of fintech solutions for online financing and insurance.

Growth Accelerators in the Russian Used Cars Industry Industry

The market's long-term growth will be spurred by continued development of online platforms, expansion of financing options, and government initiatives aimed at promoting safer and more transparent used car transactions. Improving vehicle history reporting standards could build trust and accelerate market growth.

Key Players Shaping the Russian Used Cars Industry Market

- Gesner Auto

- Drome

- ROLF

- FRESH AUTO INGERSOLL

- Inchcape plc

- JSC AVTOVAZ

- Favorit Motors

- TrueCar Inc

Notable Milestones in Russian Used Cars Industry Sector

- March 2022: Inchcape plc exits the Russian market due to the conflict in Ukraine.

- December 2021: ROLF, Russia's largest car dealer, is sold to KlyuchAvto for an estimated USD 400-500 million.

In-Depth Russian Used Cars Industry Market Outlook

The Russian used car market is poised for gradual recovery and growth in the coming years, driven by the factors discussed above. Strategic opportunities lie in expanding online market penetration, enhancing transparency and trust, and offering innovative financing and insurance solutions. The market's long-term potential remains significant despite the current challenges.

Russian Used Cars Industry Segmentation

-

1. Car Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Propulsion

- 2.1. Internal Combustion Engine

- 2.2. Electric

-

3. Vendor Type

- 3.1. Organized

- 3.2. Unorganized

Russian Used Cars Industry Segmentation By Geography

- 1. Russia

Russian Used Cars Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Hatchback and Sedan Used Car Sales to Witness Surge During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Used Cars Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Internal Combustion Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Car Type

- 6. Western Russia Russian Used Cars Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russian Used Cars Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russian Used Cars Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russian Used Cars Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Gesner Auto

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Drome

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ROLF

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 FRESH AUTO INGERSOLL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Inchcape plc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 JSC AVTOVAZ

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Favorit Motors

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TrueCar Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Gesner Auto

List of Figures

- Figure 1: Russian Used Cars Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russian Used Cars Industry Share (%) by Company 2024

List of Tables

- Table 1: Russian Used Cars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russian Used Cars Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 3: Russian Used Cars Industry Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 4: Russian Used Cars Industry Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 5: Russian Used Cars Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Russian Used Cars Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Western Russia Russian Used Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Russia Russian Used Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Russia Russian Used Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Northern Russia Russian Used Cars Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Russian Used Cars Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 12: Russian Used Cars Industry Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 13: Russian Used Cars Industry Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 14: Russian Used Cars Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Used Cars Industry?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Russian Used Cars Industry?

Key companies in the market include Gesner Auto, Drome, ROLF, FRESH AUTO INGERSOLL, Inchcape plc, JSC AVTOVAZ, Favorit Motors, TrueCar Inc.

3. What are the main segments of the Russian Used Cars Industry?

The market segments include Car Type, Propulsion, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Hatchback and Sedan Used Car Sales to Witness Surge During Forecast Period.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In March 2022, Inchcape announced that it is pulling out of the Russian market as a result of the ongoing conflict in Ukraine. The company stated that in light of the current circumstances, they have concluded that the Group's ownership of its business interests in Russia is no longer tenable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Used Cars Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Used Cars Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Used Cars Industry?

To stay informed about further developments, trends, and reports in the Russian Used Cars Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence