Key Insights

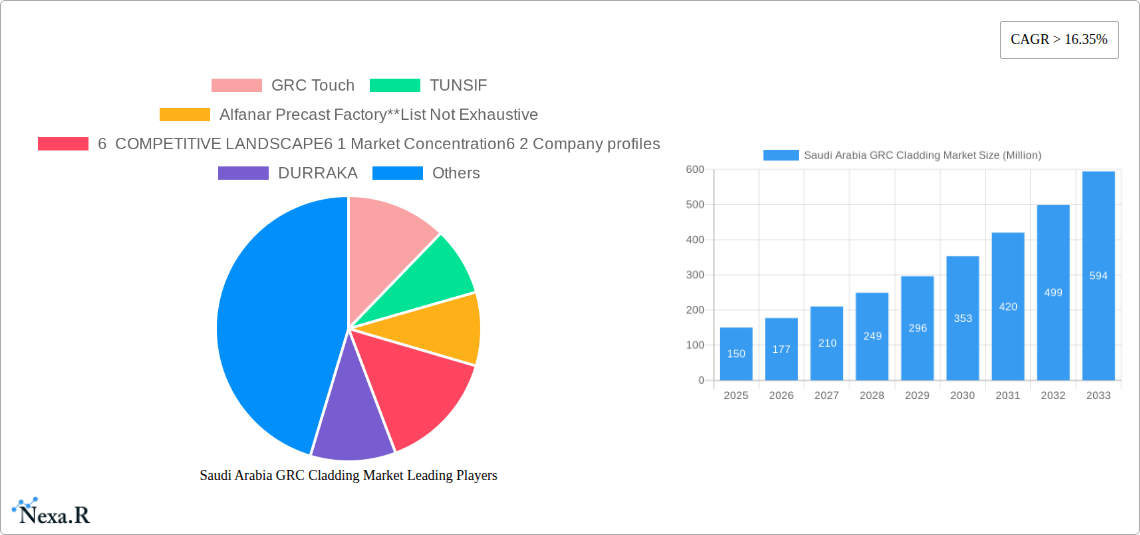

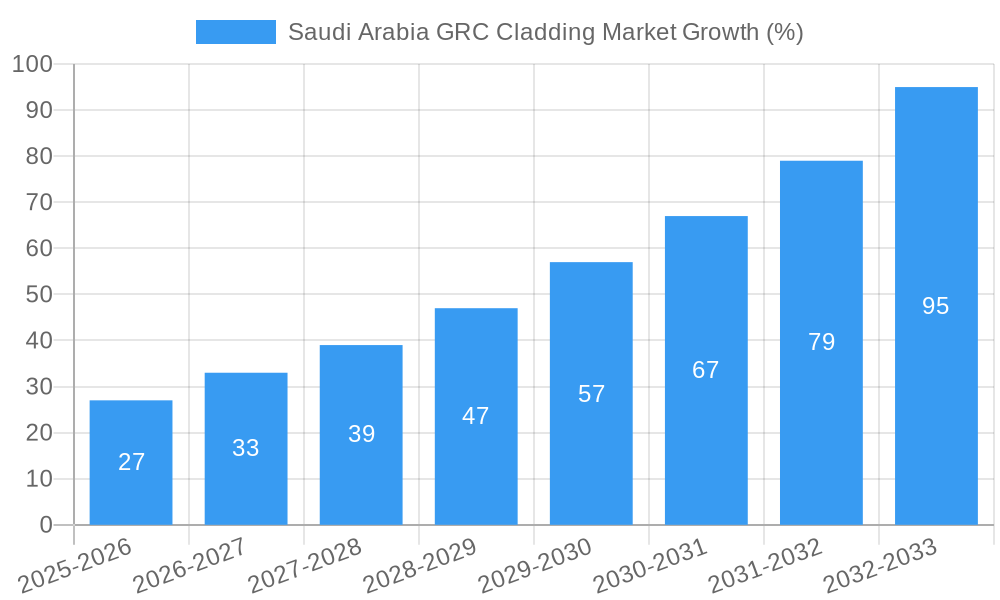

The Saudi Arabian GRC cladding market is experiencing robust growth, driven by the nation's ambitious infrastructure development projects and a burgeoning construction sector. With a current market size exceeding a projected $XX million in 2025 and a Compound Annual Growth Rate (CAGR) exceeding 16.35%, the market is poised for significant expansion through 2033. Key drivers include government initiatives promoting sustainable building materials, increasing urbanization, and a rising demand for aesthetically pleasing and durable exterior cladding solutions in both commercial and residential construction. The preference for premix and spray application methods reflects a push for efficiency and speed in construction projects. Segmentation by application reveals strong demand from commercial construction, followed by residential and civil infrastructure projects. Competitive intensity is moderate, with key players like GRC Touch, TUNSIF, and Alfanar Precast Factory vying for market share alongside other established companies. Regional variations exist within Saudi Arabia, with potential for higher growth in regions experiencing rapid development. The market's continued expansion is, however, subject to potential restraints, such as fluctuations in raw material prices and the overall economic climate. Future growth will depend on sustained government investment in infrastructure, the ongoing adoption of sustainable construction practices, and the continued innovation in GRC cladding technologies.

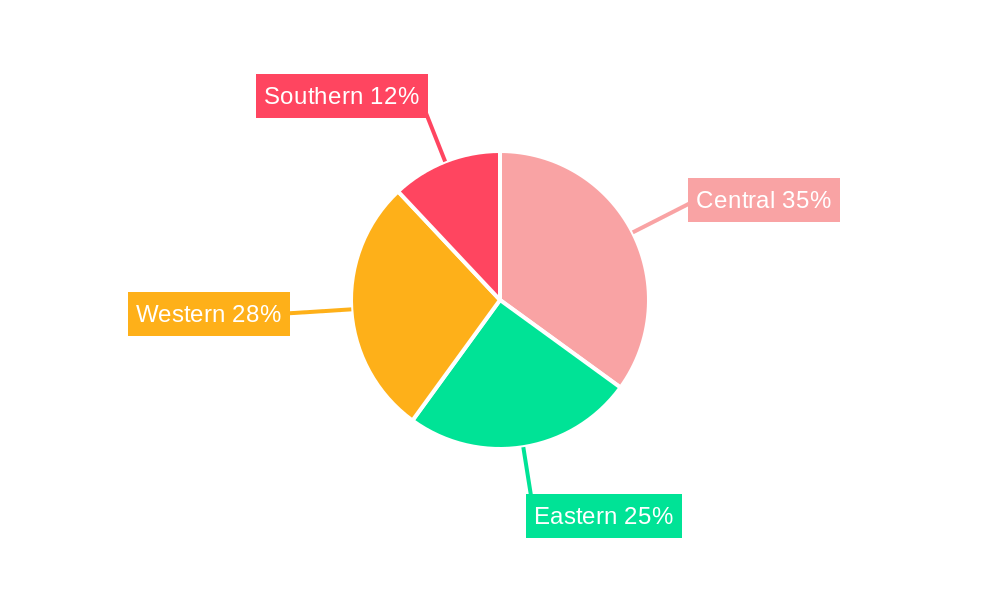

The projected growth trajectory for the Saudi Arabian GRC cladding market anticipates substantial expansion over the forecast period (2025-2033). The market's segmentation into spray, premix, and hybrid processes offers diverse options tailored to various project needs and scales. The application-based segmentation highlights the robust demand from both commercial and residential construction sectors, demonstrating the market's broad appeal. Given the current CAGR and market dynamics, strategic investments by key players in research and development, expansion of production capacity, and targeted marketing campaigns are likely to be pivotal in capitalizing on the growth opportunities. Furthermore, focusing on sustainable and cost-effective solutions will be crucial for companies to gain a competitive edge in this dynamic market. A deeper analysis into specific regional growth patterns within Saudi Arabia (Central, Eastern, Western, Southern) will provide crucial insights for targeted market penetration strategies.

Saudi Arabia GRC Cladding Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia GRC Cladding market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The Saudi Arabia GRC Cladding market is segmented by process (Spray, Premix, Hybrid) and application (Commercial Construction, Residential Construction, Civil and Other Infrastructure Construction), offering a granular understanding of market dynamics. The market size is presented in Million units.

Saudi Arabia GRC Cladding Market Dynamics & Structure

This section analyzes the Saudi Arabia GRC Cladding market's competitive landscape, technological advancements, regulatory environment, and market trends. The market is characterized by a moderately concentrated structure, with key players such as GRC Touch, TUNSIF, and Alfanar Precast Factory holding significant market share. However, smaller players are also actively contributing.

- Market Concentration: The market concentration ratio (CR6) in 2024 was approximately xx%, indicating a moderately concentrated market. This is expected to remain relatively stable in the forecast period.

- Technological Innovation: The market is witnessing steady technological advancements in GRC cladding materials, focusing on improved durability, aesthetics, and energy efficiency. However, the high initial investment for new technologies acts as a barrier for many smaller players.

- Regulatory Framework: Saudi Arabian construction regulations significantly influence GRC cladding adoption, mandating specific safety and quality standards. These regulations are expected to become even more stringent in the coming years.

- Competitive Substitutes: Alternative cladding materials like metal composite panels and aluminum cladding pose competitive pressure. The market is actively expanding to introduce new substitutes.

- End-User Demographics: The growing construction sector, particularly in commercial and residential buildings, fuels demand for GRC cladding. The rising middle class and government investments in infrastructure projects are further driving market expansion.

- M&A Trends: The number of M&A deals in the Saudi Arabian GRC cladding market has been relatively low in recent years (xx deals between 2019-2024), with a predicted increase to xx deals during 2025-2033 due to increased market competition.

Saudi Arabia GRC Cladding Market Growth Trends & Insights

The Saudi Arabia GRC cladding market exhibited robust growth during the historical period (2019-2024), driven by sustained investment in infrastructure development and construction activities. The market size reached xx Million units in 2024, and is projected to reach xx Million units in 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is primarily attributed to:

- Rising disposable incomes and increased demand for aesthetically pleasing buildings in both commercial and residential sectors.

- Government initiatives promoting sustainable construction practices, leading to greater adoption of high-performance building materials like GRC cladding.

- Continued expansion of the construction industry fueled by Vision 2030, the Kingdom's national transformation plan.

Dominant Regions, Countries, or Segments in Saudi Arabia GRC Cladding Market

The Riyadh and Jeddah regions dominate the Saudi Arabia GRC cladding market, owing to their concentrated construction activities and high-rise building development. Within the segments, the commercial construction sector displays the most significant growth potential and is forecast to take the leading market share. The premix process currently holds a prominent position but hybrid processes are expected to gain traction in the coming years.

- Key Drivers:

- Economic growth and high government expenditure on infrastructure projects.

- Expanding tourism sector driving demand for aesthetically appealing buildings.

- Favorable government policies supporting the construction sector.

- Dominance Factors:

- High concentration of construction projects in major cities.

- Established supply chains and availability of skilled labor.

- Increasing preference for aesthetically superior cladding materials in high-rise buildings.

Saudi Arabia GRC Cladding Market Product Landscape

The GRC cladding market features a range of products with varying textures, colors, and designs to meet diverse aesthetic preferences. Product innovation focuses on improving durability, fire resistance, and ease of installation. Manufacturers are increasingly incorporating advanced technologies, such as incorporating nano-materials for enhanced properties and sustainable materials to meet environmental standards. Unique selling propositions include tailored designs, rapid installation, and superior durability.

Key Drivers, Barriers & Challenges in Saudi Arabia GRC Cladding Market

Key Drivers: The primary drivers include the booming construction industry, increasing government investments in infrastructure projects, and the growing preference for aesthetically pleasing and durable cladding materials. Vision 2030’s focus on infrastructure development significantly boosts market growth.

Key Challenges: High raw material costs, intense competition from alternative cladding materials, and the potential impact of fluctuations in global economic conditions pose significant challenges. Supply chain disruptions can impact project timelines and profitability. The regulatory landscape, while supporting industry growth, also adds complexity for businesses.

Emerging Opportunities in Saudi Arabia GRC Cladding Market

Emerging opportunities are visible in the use of GRC cladding in specialized projects, including large-scale infrastructure developments and high-profile commercial buildings. The adoption of innovative technologies such as smart cladding systems and the increasing use of sustainable GRC materials are promising opportunities. Furthermore, potential growth is present in the untapped potential of smaller towns and cities which may experience increased infrastructure development.

Growth Accelerators in the Saudi Arabia GRC Cladding Market Industry

Strategic partnerships between GRC manufacturers and construction companies accelerate market penetration. Technological advancements, specifically in materials science and manufacturing techniques, lead to enhanced product performance and reduced costs. Government initiatives promoting sustainable construction practices create a favorable environment for the growth of eco-friendly GRC cladding.

Key Players Shaping the Saudi Arabia GRC Cladding Market Market

- GRC Touch

- TUNSIF

- Alfanar Precast Factory

- DURRAKA

- PETRACO

- Station Contracting Co Ltd

- Arabian Tile Company

- ARTIC

- Albitar Factory Co

- Acementiat Factory

Notable Milestones in Saudi Arabia GRC Cladding Market Sector

- December 2022: Repairs commenced on the Makkah Gate, highlighting the ongoing need for maintenance and repair of existing GRC cladding installations.

- February 2022: Fibrex Construction Group's contract win in Abu Dhabi, although outside Saudi Arabia, indicates industry trends and the potential for cross-border collaborations impacting material sourcing and technological advancements.

In-Depth Saudi Arabia GRC Cladding Market Market Outlook

The Saudi Arabia GRC cladding market is poised for continued growth, driven by robust construction activity and ongoing investments in infrastructure development. Strategic partnerships, technological advancements, and the rising demand for sustainable building materials will further fuel market expansion. Opportunities lie in exploring niche applications and expanding into less-developed regions within the Kingdom. The market is expected to experience strong growth in the coming decade, presenting significant opportunities for both established and emerging players.

Saudi Arabia GRC Cladding Market Segmentation

-

1. Process

- 1.1. Spray

- 1.2. Premix

- 1.3. Hybrid

-

2. Application

- 2.1. Commercial Construction

- 2.2. Residential Construction

- 2.3. Civil and Other Infrastructure Construction

Saudi Arabia GRC Cladding Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia GRC Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 16.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio

- 3.3. Market Restrains

- 3.3.1. Lack of awareness of senior living options; Relatively small size of senior living population

- 3.4. Market Trends

- 3.4.1. Increasing Construction Spending in Saudi

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Spray

- 5.1.2. Premix

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Construction

- 5.2.2. Residential Construction

- 5.2.3. Civil and Other Infrastructure Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Central Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia GRC Cladding Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 GRC Touch

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 TUNSIF

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Alfanar Precast Factory**List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DURRAKA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PETRACO

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Station Contracting Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arabian Tile Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 ARTIC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Albitar Factory Co

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Acementiat Factory

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 GRC Touch

List of Figures

- Figure 1: Saudi Arabia GRC Cladding Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia GRC Cladding Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Process 2019 & 2032

- Table 3: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia GRC Cladding Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia GRC Cladding Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia GRC Cladding Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia GRC Cladding Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Process 2019 & 2032

- Table 11: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Saudi Arabia GRC Cladding Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia GRC Cladding Market?

The projected CAGR is approximately > 16.35%.

2. Which companies are prominent players in the Saudi Arabia GRC Cladding Market?

Key companies in the market include GRC Touch, TUNSIF, Alfanar Precast Factory**List Not Exhaustive, 6 COMPETITIVE LANDSCAPE6 1 Market Concentration6 2 Company profiles, DURRAKA, PETRACO, Station Contracting Co Ltd, Arabian Tile Company, ARTIC, Albitar Factory Co, Acementiat Factory.

3. What are the main segments of the Saudi Arabia GRC Cladding Market?

The market segments include Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Senior Population and Life Expectancy; Increase in Old Age Dependency Ratio.

6. What are the notable trends driving market growth?

Increasing Construction Spending in Saudi.

7. Are there any restraints impacting market growth?

Lack of awareness of senior living options; Relatively small size of senior living population.

8. Can you provide examples of recent developments in the market?

December 2022: On the imposing-looking Makkah Gate, which is situated on the Makkah-Jeddah Expressway, the Makkah Mayoralty has started performing short-term repairs. The Makkah Gate also referred to as the Qur'an Gate, is a monumental archway at the entry to Makkah from the Jeddah side and is located 27 kilometers from the Grand Mosque within the Haram border.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia GRC Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia GRC Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia GRC Cladding Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia GRC Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence