Key Insights

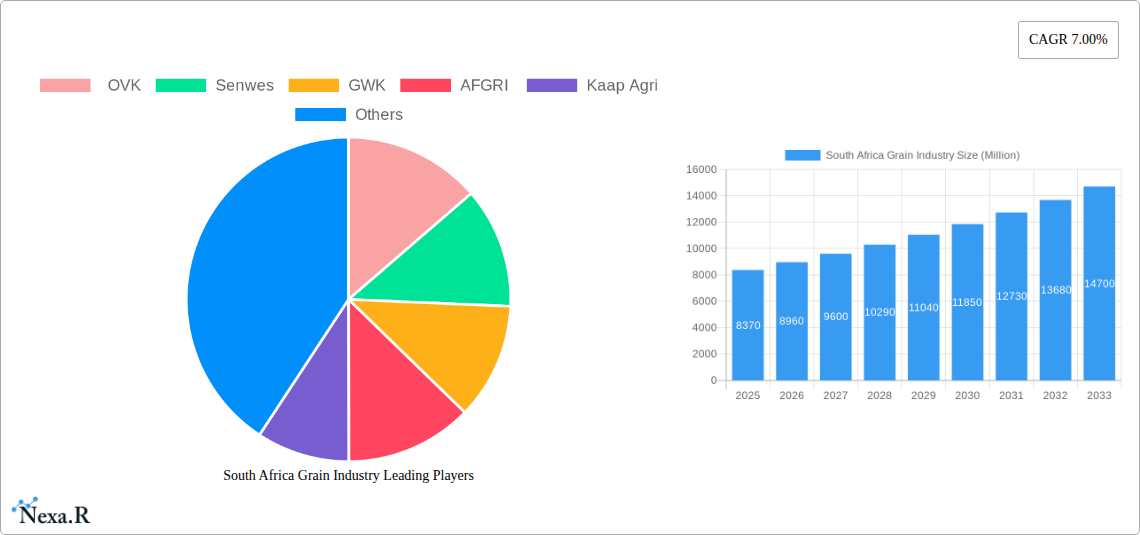

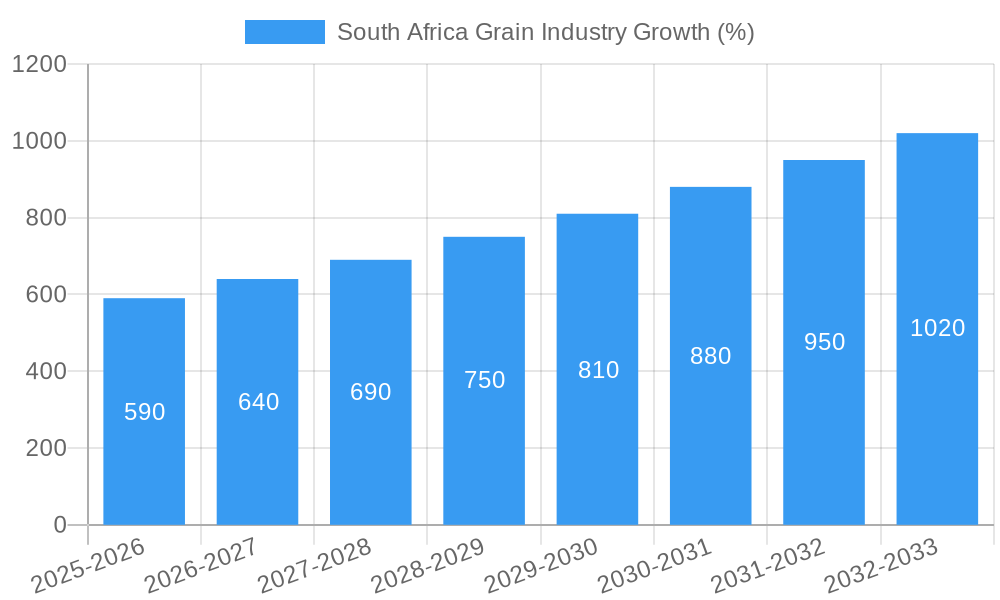

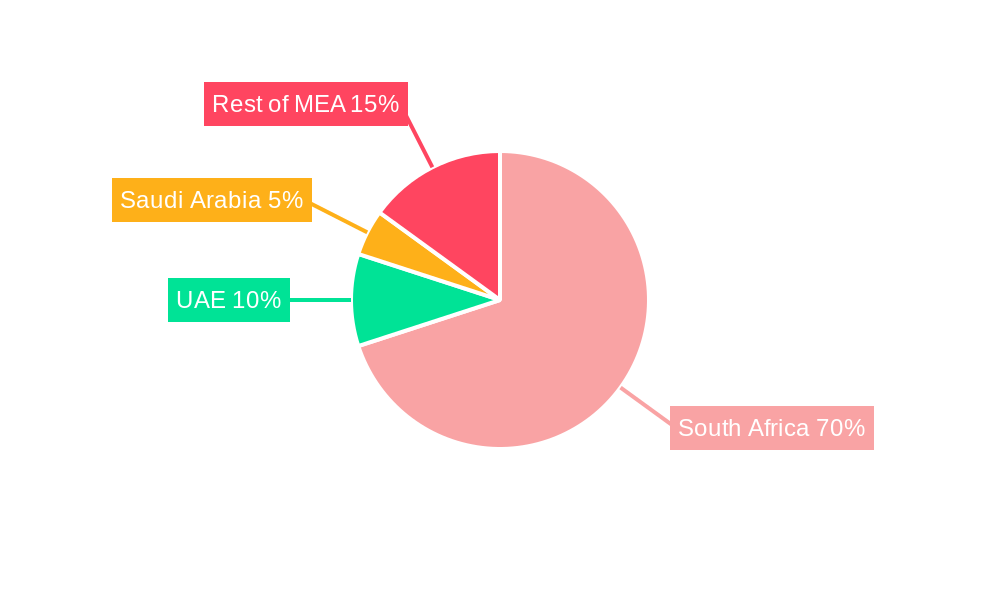

The South African grain industry, valued at $8.37 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing demand for grains in both human consumption and animal feed sectors, driven by a growing population and rising per capita income, plays a significant role. Furthermore, the industrial utilization of grains in sectors like biofuel production and food processing contributes to market growth. Favorable government policies supporting agricultural development and infrastructure improvements also contribute positively. However, the industry faces challenges such as climate change impacting crop yields and fluctuating global grain prices, potentially impacting profitability and export competitiveness. The segmentation reveals maize as the dominant grain type, followed by wheat and barley, reflecting South Africa's agricultural landscape. Distribution channels are diversified, with direct sales, wholesale, and retail segments all contributing to the market's dynamism. Key players like OVK, Senwes, GWK, AFGRI, Kaap Agri, Grain SA, and BKB Ltd compete within this landscape, leveraging their established networks and expertise. The Middle East and Africa region, particularly South Africa, the UAE, and Saudi Arabia, presents significant opportunities for growth due to increasing import demand and strong trade relationships.

Within the South African grain industry's diverse segments, the human consumption market segment shows the strongest growth potential, driven by increasing urbanization and changing dietary habits. The animal feed segment remains a significant consumer of grains, exhibiting steady growth due to the expansion of livestock farming. The industrial segment shows moderate growth, reflecting the growth of biofuel production and processing industries. Competitive dynamics are characterized by a mix of large multinational corporations and established local players, leading to both opportunities and challenges for companies seeking market share. Future growth will depend on managing climate risks, improving agricultural efficiency through technological advancements, and navigating global market volatility. The focus on sustainable farming practices and value chain optimization is crucial for long-term industry sustainability and competitiveness.

South Africa Grain Industry Market Report: 2019-2033

A comprehensive analysis of the South African grain market, encompassing market dynamics, growth trends, key players, and future outlook. This report provides invaluable insights for industry professionals, investors, and stakeholders seeking a deep understanding of this vital sector.

Keywords: South Africa Grain Industry, Maize, Wheat, Barley, Sorghum, Oats, Grain Market, Agricultural Market, OVK, Senwes, GWK, AFGRI, Kaap Agri, Grain SA, BKB Ltd, Market Size, Market Share, CAGR, Market Growth, Human Consumption, Animal Feed, Industrial Uses, Direct Sales, Wholesale, Retail, Market Analysis, Market Forecast, Industry Trends, South Africa Agriculture, Grain Production, Grain Exports, Grain Imports.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

South Africa Grain Industry Market Dynamics & Structure

This report analyzes the South African grain industry's structure, focusing on market concentration, technological advancements, regulatory landscapes, competitive dynamics, and M&A activities from 2019 to 2033. The analysis incorporates quantitative data, such as market share percentages and M&A deal volumes (in millions of units), alongside qualitative insights into innovation barriers and market trends. The parent market is the overall South African agricultural sector, and the child market is the grain sub-sector encompassing maize, wheat, barley, sorghum, oats, and other grains.

- Market Concentration: The market is moderately concentrated, with key players like OVK, Senwes, GWK, AFGRI, and BKB holding significant market shares. The exact percentages for 2025 are currently estimated at xx Million.

- Technological Innovation: Adoption of precision agriculture techniques (e.g., GPS-guided machinery, drone technology) is gradually increasing but faces barriers such as high initial investment costs and limited access to technology in certain regions.

- Regulatory Framework: Government policies on land reform, water usage, and trade regulations significantly influence market dynamics. Changes in export tariffs, for instance, can directly impact profitability and competitiveness.

- Competitive Product Substitutes: There are limited direct substitutes for grain in the animal feed sector; however, alternatives for human consumption (e.g., processed foods) pose a indirect competitive pressure.

- End-User Demographics: The industry caters to diverse end-users, including food processors, animal feed manufacturers, and industrial users (e.g., biofuel production). Population growth and dietary changes influence demand patterns.

- M&A Trends: Consolidation within the industry has been observed in recent years, with several mergers and acquisitions aimed at achieving economies of scale and enhancing market share. The total value of M&A deals in the historical period (2019-2024) is estimated at xx Million.

South Africa Grain Industry Growth Trends & Insights

This section delves into the historical and projected growth of the South African grain industry, analyzing market size evolution, adoption rates of new technologies, disruptive innovations, and shifting consumer behavior. Using proprietary data and industry insights, we project the Compound Annual Growth Rate (CAGR) and market penetration rate for different grain types and end-user segments. The analysis considers factors such as climate change impacts, evolving agricultural practices, and macroeconomic conditions.

Dominant Regions, Countries, or Segments in South Africa Grain Industry

This section identifies the dominant regions and segments within the South African grain market (by grain type, end-user, and distribution channel). The analysis highlights key geographic locations and market segments driving growth, exploring factors such as economic policies, infrastructure development, and regional disparities in production and consumption.

- By Grain Type: Maize consistently dominates the market in terms of production and consumption. However, wheat also holds a significant share due to the high demand for bread and other wheat-based products.

- By End-User: Animal feed constitutes a large portion of grain consumption, particularly maize, owing to its widespread use in livestock and poultry farming. Human consumption is also significant, mainly driven by the demand for staple foods.

- By Distribution Channel: Wholesale channels remain dominant, with a large network of intermediaries connecting producers to end-users. Direct sales are prevalent amongst larger buyers, such as food processors.

South Africa Grain Industry Product Landscape

The South African grain industry’s product landscape is characterized by various grain types (maize, wheat, barley, sorghum, oats, and others) with varying applications in food, feed, and industrial uses. Product innovations are focused on improving grain yield, quality, and resistance to diseases and pests, driven by technological advancements in seed breeding and crop management. Value-added products, such as processed grains and flours, are gaining traction.

Key Drivers, Barriers & Challenges in South Africa Grain Industry

Key Drivers:

- Favorable climatic conditions in certain regions.

- Growing demand for animal feed due to increasing livestock and poultry production.

- Government support for agricultural development through subsidies and research initiatives.

- Increased investment in irrigation and improved farming techniques.

Challenges:

- Climate change impacts (droughts, floods) pose a significant threat to grain production. The estimated economic losses due to these factors in 2024 were xx Million.

- Infrastructure limitations (e.g., inadequate storage facilities, transportation bottlenecks) lead to post-harvest losses.

- Competition from international grain markets.

- Fluctuations in global grain prices affecting profitability.

Emerging Opportunities in South Africa Grain Industry

- Growing demand for organic and sustainably produced grains.

- Expansion into value-added grain products (e.g., biofuels, specialized flours).

- Export opportunities to neighboring countries and beyond, particularly in processed grain products.

- Adoption of advanced agricultural technologies to enhance productivity and efficiency.

Growth Accelerators in the South Africa Grain Industry Industry

Technological advancements in precision agriculture, improved seed varieties, and efficient irrigation systems are major drivers of long-term growth. Strategic partnerships between farmers, processors, and retailers are creating more efficient value chains. Expansion into new markets and value-added products also contribute to future growth prospects.

Key Players Shaping the South Africa Grain Industry Market

Notable Milestones in South Africa Grain Industry Sector

- 2020: Government launched a new agricultural support program to improve farming practices and increase production.

- 2022: A major drought impacted yields, highlighting the vulnerability of the industry to climate change.

- 2023: Several companies invested in new grain storage and processing facilities.

In-Depth South Africa Grain Industry Market Outlook

The South African grain industry is poised for sustained growth, driven by several factors. Technological advancements, improved agricultural practices, and increasing demand for grain-based products create significant opportunities for expansion. However, challenges like climate change and infrastructure limitations need to be addressed to fully realize the industry's potential. Strategic investments in research and development, along with supportive government policies, are crucial for ensuring the sector's long-term sustainability and competitiveness.

South Africa Grain Industry Segmentation

- 1. Maize

- 2. Barley

- 3. Sorghum

- 4. Rice

- 5. Wheat

- 6. Maize

- 7. Barley

- 8. Sorghum

- 9. Rice

- 10. Wheat

South Africa Grain Industry Segmentation By Geography

- 1. South Africa

South Africa Grain Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. High Regional Trade of Grains is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Maize

- 5.2. Market Analysis, Insights and Forecast - by Barley

- 5.3. Market Analysis, Insights and Forecast - by Sorghum

- 5.4. Market Analysis, Insights and Forecast - by Rice

- 5.5. Market Analysis, Insights and Forecast - by Wheat

- 5.6. Market Analysis, Insights and Forecast - by Maize

- 5.7. Market Analysis, Insights and Forecast - by Barley

- 5.8. Market Analysis, Insights and Forecast - by Sorghum

- 5.9. Market Analysis, Insights and Forecast - by Rice

- 5.10. Market Analysis, Insights and Forecast - by Wheat

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Maize

- 6. UAE South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Grain Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 OVK

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Senwes

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 GWK

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AFGRI

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kaap Agri

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Grain SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BKB Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 OVK

List of Figures

- Figure 1: South Africa Grain Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Grain Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Grain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Grain Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 4: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 5: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 6: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 7: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 8: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 9: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 10: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 11: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 12: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 13: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 14: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 15: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 16: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 17: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 18: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 19: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 20: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 21: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 22: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 23: South Africa Grain Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 24: South Africa Grain Industry Volume Kiloton Forecast, by Region 2019 & 2032

- Table 25: South Africa Grain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa Grain Industry Volume Kiloton Forecast, by Country 2019 & 2032

- Table 27: UAE South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: UAE South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 29: South Africa South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: South Africa South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Saudi Arabia South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 33: Rest of MEA South Africa Grain Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of MEA South Africa Grain Industry Volume (Kiloton) Forecast, by Application 2019 & 2032

- Table 35: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 36: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 37: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 38: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 39: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 40: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 41: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 42: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 43: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 44: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 45: South Africa Grain Industry Revenue Million Forecast, by Maize 2019 & 2032

- Table 46: South Africa Grain Industry Volume Kiloton Forecast, by Maize 2019 & 2032

- Table 47: South Africa Grain Industry Revenue Million Forecast, by Barley 2019 & 2032

- Table 48: South Africa Grain Industry Volume Kiloton Forecast, by Barley 2019 & 2032

- Table 49: South Africa Grain Industry Revenue Million Forecast, by Sorghum 2019 & 2032

- Table 50: South Africa Grain Industry Volume Kiloton Forecast, by Sorghum 2019 & 2032

- Table 51: South Africa Grain Industry Revenue Million Forecast, by Rice 2019 & 2032

- Table 52: South Africa Grain Industry Volume Kiloton Forecast, by Rice 2019 & 2032

- Table 53: South Africa Grain Industry Revenue Million Forecast, by Wheat 2019 & 2032

- Table 54: South Africa Grain Industry Volume Kiloton Forecast, by Wheat 2019 & 2032

- Table 55: South Africa Grain Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South Africa Grain Industry Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Grain Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the South Africa Grain Industry?

Key companies in the market include OVK, Senwes, GWK, AFGRI , Kaap Agri, Grain SA , BKB Ltd.

3. What are the main segments of the South Africa Grain Industry?

The market segments include Maize, Barley, Sorghum, Rice, Wheat, Maize, Barley, Sorghum, Rice, Wheat.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

High Regional Trade of Grains is Driving the Market.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Grain Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Grain Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Grain Industry?

To stay informed about further developments, trends, and reports in the South Africa Grain Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence