Key Insights

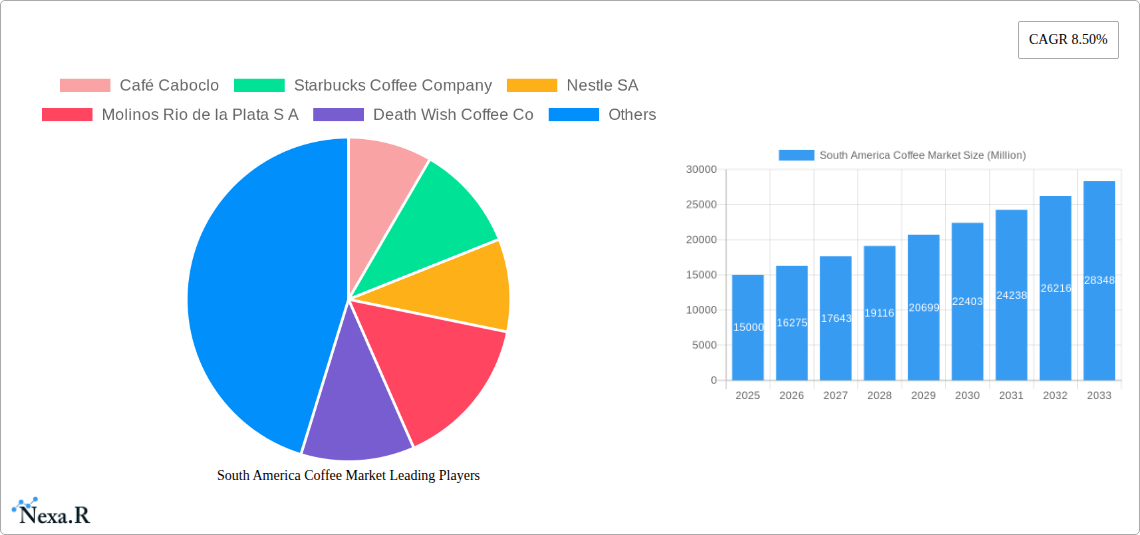

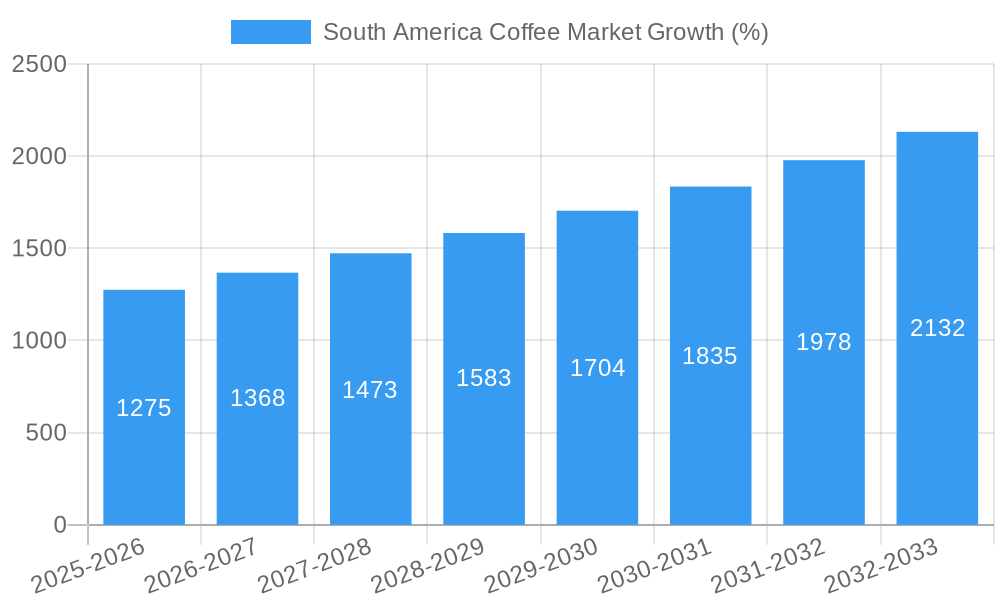

The South American coffee market, currently valued at approximately $XX million (assuming a reasonable market size based on global coffee market data and South America's significant coffee production), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.50% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across various South American countries are boosting coffee consumption, particularly among younger demographics who favor premium coffee experiences like specialty brews and single-origin offerings. The increasing popularity of coffee shops and cafes, mirroring global trends, further contributes to market growth. Additionally, innovative product formats, such as single-serve coffee pods and capsules, are gaining traction, offering convenience and attracting new consumers. However, the market faces certain restraints. Fluctuations in coffee bean prices due to climate change and global supply chain disruptions can negatively impact profitability. Furthermore, intense competition among established players and emerging brands necessitates strategic marketing and product differentiation to maintain market share.

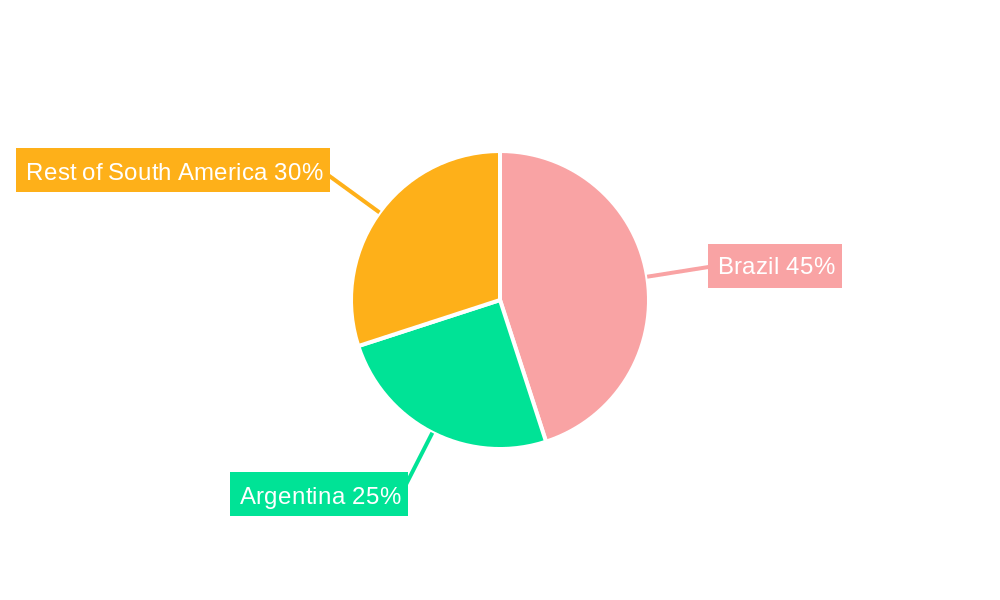

Segment-wise analysis reveals a dynamic landscape. Whole bean coffee maintains a significant share, reflecting a consumer preference for freshly ground coffee. However, the convenience offered by instant coffee and coffee pods and capsules is driving strong growth within these segments, particularly in urban areas. The distribution channel analysis indicates a prominent role for supermarkets/hypermarkets, though online retail stores are rapidly gaining ground, driven by e-commerce penetration and consumer demand for home delivery. Key players like Café Caboclo, Starbucks, Nestlé, and others are actively competing through brand building, product innovation, and expansion of distribution networks. Regional variations exist, with Brazil and Argentina leading the market, reflecting their extensive coffee cultivation and robust consumer bases. The "Rest of South America" segment also presents significant growth potential as coffee culture continues to evolve and consumer preferences diversify.

South America Coffee Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Coffee Market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report analyzes the market across various segments, including by product type (whole bean, ground coffee, instant coffee, coffee pods and capsules) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, online retail stores, other distribution channels).

South America Coffee Market Dynamics & Structure

The South America coffee market is characterized by a diverse landscape of both large multinational corporations and smaller, regional players. Market concentration is moderate, with a few dominant players holding significant market share, while numerous smaller companies cater to niche segments. Technological innovation, particularly in areas like roasting techniques, brewing methods, and sustainable farming practices, plays a crucial role in shaping market trends. Regulatory frameworks concerning coffee production, labeling, and trade vary across South American countries, influencing market dynamics. Consumers increasingly show preference for sustainable and ethically sourced coffee, which presents an opportunity for companies focusing on these aspects. The market also witnesses continuous M&A activity, aiming to expand market reach and diversify product offerings.

- Market Concentration: Moderate, with xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable farming, improved roasting techniques, and convenient brewing systems.

- Regulatory Frameworks: Vary across countries, impacting trade and labeling regulations.

- Competitive Product Substitutes: Tea, other beverages.

- End-User Demographics: Growing middle class, increasing disposable incomes, and changing consumer preferences.

- M&A Trends: xx M&A deals observed between 2019-2024, with an increasing focus on diversification and geographical expansion.

South America Coffee Market Growth Trends & Insights

The South American coffee market exhibits robust growth, driven by rising disposable incomes, increasing coffee consumption, and the growing popularity of convenient coffee formats like pods and capsules. The market size has expanded significantly over the historical period (2019-2024), reaching an estimated value of xx Million units in 2025. This growth is projected to continue with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of e-commerce and subscription models, are influencing consumer behavior and accelerating market growth. Consumer preferences are evolving towards premium, specialty coffees, and sustainable options, driving innovation within the industry. Market penetration for coffee pods and capsules is increasing rapidly in urban areas.

Dominant Regions, Countries, or Segments in South America Coffee Market

Brazil remains the dominant country in the South American coffee market, owing to its significant production capacity and established coffee culture. Colombia and Peru also contribute considerably to the overall market. By product type, ground coffee holds the largest market share in 2025, followed by instant coffee and whole bean coffee. Supermarkets/hypermarkets constitute the largest distribution channel, followed by convenience stores and online retail stores, experiencing significant growth driven by increased internet penetration.

- Key Drivers in Brazil: Large-scale production, strong coffee culture, favorable climate.

- Key Drivers in Colombia: High-quality Arabica beans, focus on specialty coffee.

- Key Drivers in Peru: Growing coffee tourism, increasing domestic consumption.

- Growth potential for coffee pods: High in urban areas due to convenience factors.

- Online Retail Growth: Driven by increased internet penetration and convenient delivery options.

South America Coffee Market Product Landscape

The South American coffee market presents a diverse product landscape with offerings ranging from traditional whole bean and ground coffees to convenient instant coffee and single-serve pods and capsules. Product innovations focus on sustainability, unique flavor profiles, and convenient brewing methods. Manufacturers are increasingly highlighting the origin and quality of coffee beans, catering to consumers' growing interest in ethical sourcing and premium coffee experiences. Technological advancements in roasting and extraction techniques contribute to improved flavor quality and consistency.

Key Drivers, Barriers & Challenges in South America Coffee Market

Key Drivers: Increasing disposable incomes, rising coffee consumption, growing popularity of convenient formats, technological advancements, and expansion of e-commerce.

Challenges: Fluctuating coffee prices, climate change impacts on coffee production, competition from substitute beverages, and regulatory hurdles in certain countries. Supply chain disruptions during the past years impacted the market by xx Million units.

Emerging Opportunities in South America Coffee Market

Emerging opportunities include the growth of specialty coffee segments, the increasing demand for sustainable and ethically sourced coffee, and the expanding market for ready-to-drink coffee products. Untapped markets in rural areas and the potential for innovative brewing technologies present significant growth avenues. Furthermore, capitalizing on evolving consumer preferences for unique flavors and functional coffee beverages can unlock new market segments.

Growth Accelerators in the South America Coffee Market Industry

Strategic partnerships between coffee producers, roasters, and retailers are driving growth, enhancing supply chains and expanding market reach. Technological advancements, such as improved roasting techniques and innovative brewing technologies, improve product quality and efficiency. The expansion of e-commerce channels and the growth of online subscription services provide convenient access to a wider customer base. Government initiatives to promote sustainable coffee farming contribute to increased production and quality.

Key Players Shaping the South America Coffee Market Market

- Nestle SA

- Starbucks Coffee Company

- JDE Peet's

- Café Caboclo

- Molinos Rio de la Plata S A

- Death Wish Coffee Co

- Cafes La Virginia S A

- Volcanica Coffee Company

- Pilao Coffee

- Cabrales S A

Notable Milestones in South America Coffee Market Sector

- December 2021: Starbucks expands café outlets in Minas Gerais, Brazil, opening eight new stores.

- April 2022: Starbucks and Nestlé launch an e-commerce site for Starbucks packaged coffee products in Brazil.

- May 2022: AriZona Beverages enters the coffee market with Sun Brew, offering 100% Arabica coffee in three roast styles, available online and in select grocery stores across South America.

In-Depth South America Coffee Market Market Outlook

The South American coffee market is poised for continued growth, driven by sustained economic expansion, evolving consumer preferences, and ongoing innovations within the industry. Strategic investments in sustainable farming practices, technological upgrades, and effective marketing strategies will be crucial for capturing future market opportunities. Expansion into untapped markets, particularly in rural areas, and the development of innovative product offerings catering to evolving consumer needs are expected to fuel significant growth in the coming years. Companies capable of adapting to changing consumer preferences and embracing sustainable practices are likely to achieve the highest levels of success.

South America Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

South America Coffee Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Spending Power Augmenting the Growth for Specialty Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Café Caboclo

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Starbucks Coffee Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nestle SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Molinos Rio de la Plata S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Death Wish Coffee Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cafes La Virginia S A *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Volcanica Coffee Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Pilao Coffee

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cabrales S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 JDE Peet's

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Café Caboclo

List of Figures

- Figure 1: South America Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 19: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 21: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Coffee Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the South America Coffee Market?

Key companies in the market include Café Caboclo, Starbucks Coffee Company, Nestle SA, Molinos Rio de la Plata S A, Death Wish Coffee Co, Cafes La Virginia S A *List Not Exhaustive, Volcanica Coffee Company, Pilao Coffee, Cabrales S A, JDE Peet's.

3. What are the main segments of the South America Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Spending Power Augmenting the Growth for Specialty Coffee.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In May 2022, AriZona Beverages announced its foray into the coffee space with Sun Brew with its new line of 100% Arabica coffee made with hand-selected beans from Central and South America. Sun Brew is available in three roast styles, namely, Snake Bite Blend, Cactus Blend, and Sedona Blend. The coffees are sold online at DrinkAriZona.com, Amazon.com, and at select grocery stores across South America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Coffee Market?

To stay informed about further developments, trends, and reports in the South America Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence