Key Insights

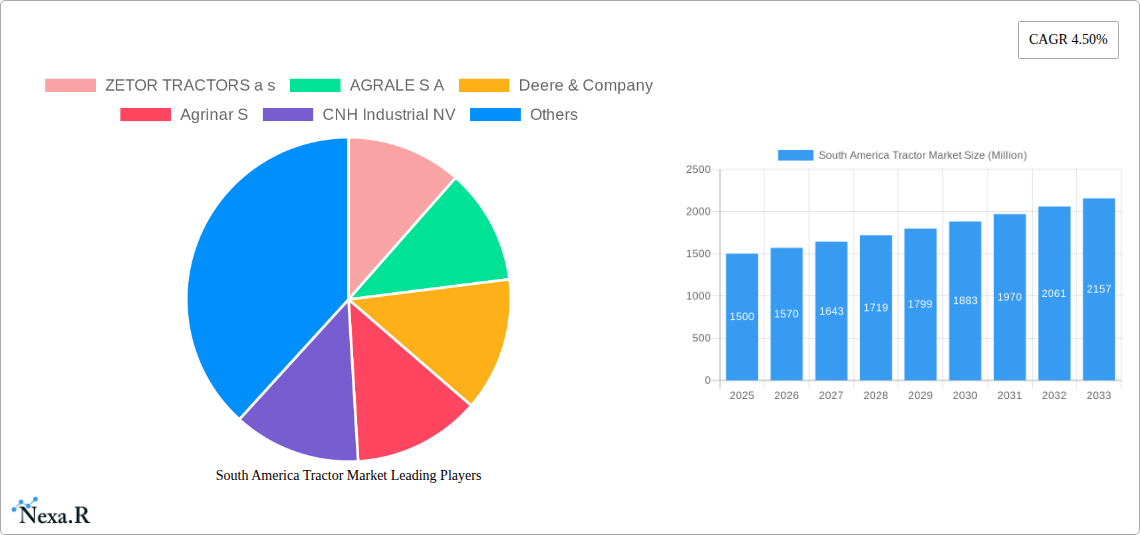

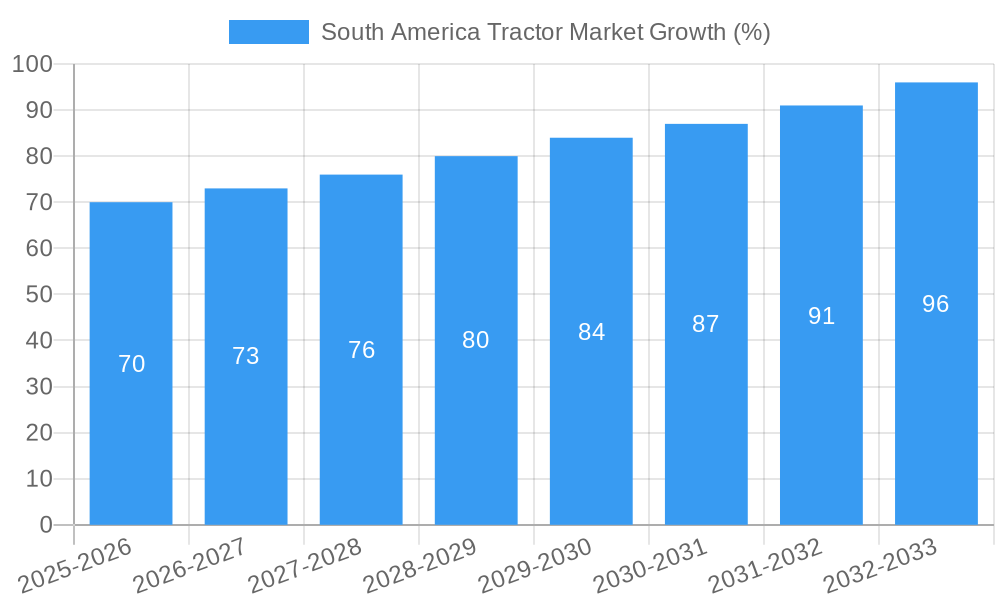

The South American tractor market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for efficient agricultural practices across Brazil and Argentina, the largest markets within the region, is a major catalyst. Modernization of farming techniques, coupled with government initiatives promoting agricultural development, are contributing significantly to tractor adoption. Secondly, the rising acreage under cultivation for key crops like soybeans and sugarcane necessitates robust and efficient machinery, boosting the demand for higher horsepower tractors. The expanding livestock sector also fuels demand, particularly for orchard and row-crop tractors. However, the market faces certain challenges. Economic fluctuations in the region can impact investment in agricultural equipment. Moreover, fluctuating commodity prices and competition from used tractor imports could present constraints on market growth. Segmentation reveals a preference for tractors in the 81-130 HP range, reflecting a balance between affordability and sufficient power for diverse applications. Key players such as ZETOR TRACTORS a s, AGCO Corporation, and Mahindra & Mahindra Ltd. are strategically focusing on product innovation and localized distribution networks to capitalize on this expanding market.

The forecast period (2025-2033) anticipates a continuous upward trajectory for the South American tractor market, though the pace might fluctuate slightly year-to-year due to macroeconomic factors. Brazil and Argentina, benefiting from relatively fertile land and supportive government policies, will likely remain the dominant markets within South America. Further growth is expected as farmers adopt more advanced technologies to enhance productivity and efficiency. The shift toward higher-horsepower tractors will continue, driven by the increasing scale of agricultural operations and the demand for specialized equipment for diverse crops and terrains. Companies are expected to respond by offering a wider array of models to cater to the varied needs of different farm sizes and agricultural practices across the region. The market is likely to witness increased competition, leading to innovative financing options and after-sales services to attract customers and secure market share.

South America Tractor Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the South America Tractor Market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report uses Million units as the unit of measurement for market size.

Keywords: South America Tractor Market, Tractor Market, Agricultural Machinery, Farm Equipment, Orchard Tractors, Row-Crop Tractors, ZETOR TRACTORS, AGRALE S.A, Deere & Company, Agrinar S, CNH Industrial, CLAAS, Kubota, Mahindra & Mahindra, AGCO, Below 80 HP Tractors, 81 HP to 130 HP Tractors, Above 130 HP Tractors, Market Size, Market Share, Market Growth, Market Forecast, Industry Analysis, Competitive Landscape

South America Tractor Market Dynamics & Structure

This section analyzes the South America tractor market's competitive landscape, technological advancements, and regulatory influences, shaping its current structure and future trajectory. The market is characterized by a moderate level of concentration, with a few major players holding significant market share. However, smaller regional players also contribute substantially to the overall market volume.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025.

- Technological Innovation: Precision agriculture technologies, such as GPS-guided tractors and automated systems, are driving innovation and efficiency gains. However, high initial investment costs and limited access to technology in certain regions represent barriers to wider adoption.

- Regulatory Framework: Government policies promoting agricultural modernization and rural development significantly impact market growth. Subsidies and financing schemes for tractor purchases influence market demand.

- Competitive Substitutes: The primary substitutes include used tractors and animal-powered farming, particularly in smaller farms. However, the increasing efficiency and productivity of modern tractors are driving substitution away from these alternatives.

- End-User Demographics: The market comprises a mix of large-scale commercial farms and smallholder farmers. The needs and preferences of these two groups influence tractor types and features in demand.

- M&A Trends: The tractor manufacturing landscape has witnessed xx M&A deals in the last five years, primarily focused on expanding market reach and technological capabilities.

South America Tractor Market Growth Trends & Insights

The South America Tractor Market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024). Market size reached xx Million units in 2024. Driven by increasing agricultural output and government initiatives to boost agricultural productivity, the market is projected to continue growing at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is influenced by factors such as rising demand for food and agricultural products, increasing adoption of modern farming techniques, and improvements in rural infrastructure. Technological disruptions like precision farming and autonomous tractors are gradually increasing market penetration, although adoption rates remain relatively low compared to developed markets. Consumer behavior shifts towards more efficient and technologically advanced tractors are shaping product development and market segmentation.

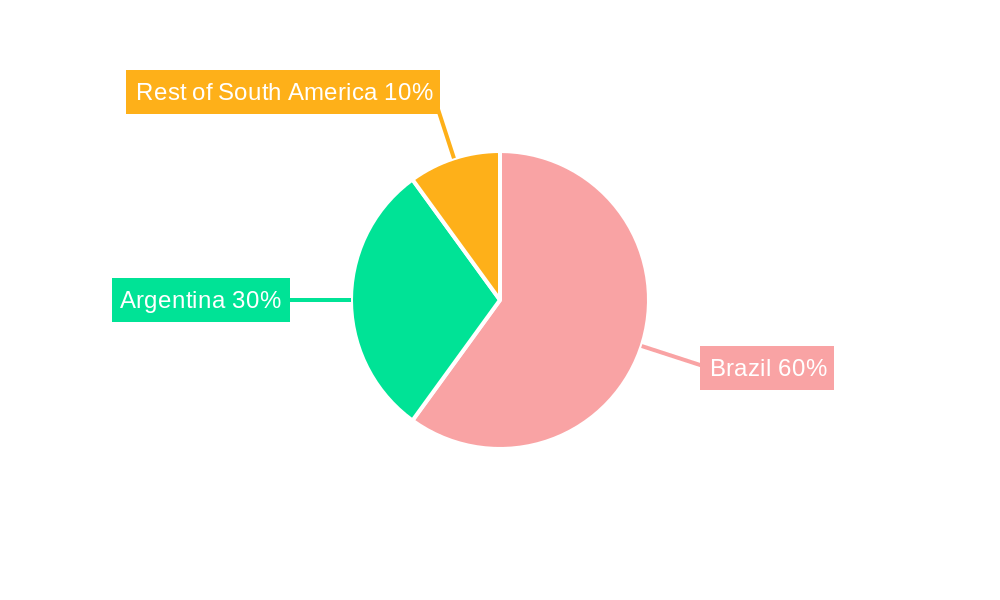

Dominant Regions, Countries, or Segments in South America Tractor Market

Brazil holds the largest market share within South America for tractors, accounting for approximately xx% of total sales in 2025. This dominance stems from its vast agricultural land, robust agricultural sector, and government support for agricultural mechanization. Argentina and Colombia also constitute significant markets.

- Horsepower: The 81 HP to 130 HP segment holds the largest market share, driven by the prevalence of medium-sized farms.

- Type: Row-crop tractors dominate the market due to the region's large-scale crop production.

- Key Drivers: Government incentives for farm mechanization, expanding agricultural land under cultivation, and favorable economic conditions in certain periods contribute to the market's growth in dominant regions.

South America Tractor Market Product Landscape

The South America tractor market exhibits a diverse product landscape encompassing various horsepower ranges, tractor types tailored to specific agricultural needs (orchard, row-crop, etc.), and technological features. Recent innovations focus on improving fuel efficiency, enhancing operator comfort, and integrating precision agriculture technologies like GPS-guided steering and automated functionalities. These advancements aim to boost productivity and reduce operational costs. Key selling propositions include enhanced durability, adaptability to varied terrains, and affordability for diverse farming operations.

Key Drivers, Barriers & Challenges in South America Tractor Market

Key Drivers: Expanding agricultural production, government support for farm modernization, rising disposable incomes (in certain segments), and increasing awareness about the benefits of mechanization are key drivers.

Challenges: High initial investment costs for tractors, particularly for smaller farmers, limited access to credit and financing, and infrastructural limitations in certain regions hinder market expansion. Fluctuations in agricultural commodity prices and economic instability can also impact demand. Import tariffs and trade restrictions may affect pricing and accessibility in certain regions.

Emerging Opportunities in South America Tractor Market

Untapped potential lies in expanding tractor sales to smallholder farmers through affordable financing schemes and tailored product offerings. The integration of precision agriculture technologies presents a significant opportunity for growth, as does catering to the demand for specialized tractors for specific crops and farming conditions.

Growth Accelerators in the South America Tractor Market Industry

Technological advancements in tractor design, efficiency, and automation will play a crucial role in driving market growth. Strategic partnerships between tractor manufacturers and agricultural input suppliers could unlock new value propositions. Government initiatives promoting agricultural modernization and infrastructure development will significantly enhance market potential. Expanding into new markets within South America and exploring export opportunities will also contribute to expansion.

Key Players Shaping the South America Tractor Market Market

- ZETOR TRACTORS a.s.

- AGRALE S.A

- Deere & Company

- Agrinar S

- CNH Industrial NV

- CLAAS KGaA mbH

- Kubota Corporation

- Mahindra & Mahindra Ltd

- AGCO Corporation

Notable Milestones in South America Tractor Market Sector

- 2022 Q3: Deere & Company launches a new series of high-horsepower tractors optimized for South American conditions.

- 2021 Q4: AGRALE S.A. announces a strategic partnership with a local financing company to expand access to credit for smallholder farmers.

- 2020 Q1: CNH Industrial invests in upgrading its manufacturing facilities in Brazil to boost production capacity. (Further milestones would be added here, based on actual data).

In-Depth South America Tractor Market Market Outlook

The South America tractor market exhibits strong growth potential, driven by ongoing agricultural expansion, increasing adoption of modern farming techniques, and government support for rural development. Strategic opportunities exist for companies focusing on innovation, affordability, and tailored solutions for diverse farming needs. The market is expected to witness significant technological advancements in the coming years, with increased adoption of precision agriculture and autonomous technologies. Expanding market access for smallholder farmers and further infrastructure development will be crucial for unlocking future growth potential.

South America Tractor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Tractor Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Tractor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Availability of Skilled Labor; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery

- 3.4. Market Trends

- 3.4.1. Increasing Cost of Farm Labor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Tractor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil South America Tractor Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Tractor Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Tractor Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 ZETOR TRACTORS a s

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 AGRALE S A

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Deere & Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Agrinar S

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 CNH Industrial NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 CLAAS KGaA mbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Kubota Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Mahindra & Mahindra Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 AGCO Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 ZETOR TRACTORS a s

List of Figures

- Figure 1: South America Tractor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Tractor Market Share (%) by Company 2024

List of Tables

- Table 1: South America Tractor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Tractor Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: South America Tractor Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: South America Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: South America Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: South America Tractor Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: South America Tractor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Tractor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South America Tractor Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 13: South America Tractor Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 14: South America Tractor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 15: South America Tractor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 16: South America Tractor Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 17: South America Tractor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Chile South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Colombia South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Uruguay South America Tractor Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Tractor Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the South America Tractor Market?

Key companies in the market include ZETOR TRACTORS a s, AGRALE S A, Deere & Company, Agrinar S, CNH Industrial NV, CLAAS KGaA mbH, Kubota Corporation, Mahindra & Mahindra Ltd, AGCO Corporation.

3. What are the main segments of the South America Tractor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Low Availability of Skilled Labor; Technological Advancements.

6. What are the notable trends driving market growth?

Increasing Cost of Farm Labor Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Farm Expenditure; Security Concerns in Modern Farming Machinery.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Tractor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Tractor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Tractor Market?

To stay informed about further developments, trends, and reports in the South America Tractor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence