Key Insights

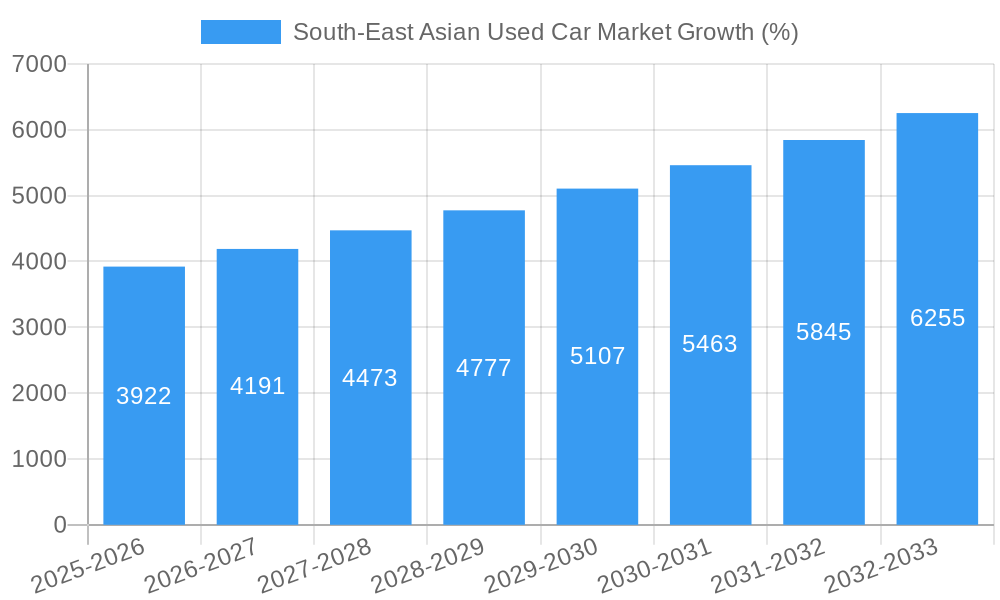

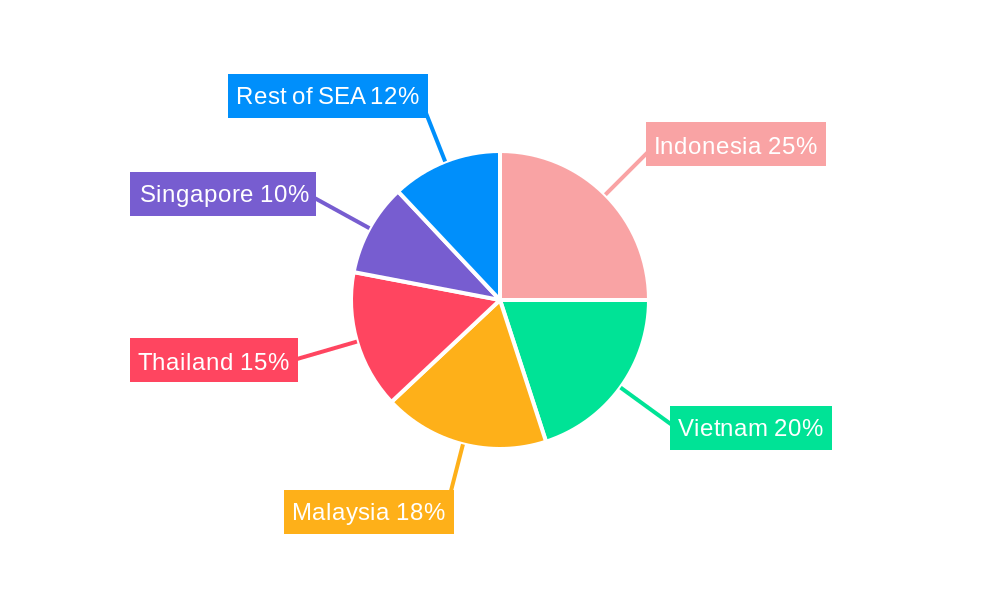

The South-East Asian used car market, valued at $62.31 billion in 2025, is projected to experience robust growth, driven by factors such as rising disposable incomes, increasing urbanization leading to higher vehicle ownership, and a preference for more affordable transportation options compared to new cars. The market's Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033 indicates a significant expansion over the forecast period. Key market segments include SUVs, which are experiencing strong demand due to their versatility and family-oriented features. Gasoline/petrol remains the dominant fuel type, although the gradual increase in diesel and alternative fuel vehicle adoption is expected to gain traction. The online booking segment is rapidly growing, reflecting the increasing digitalization and convenience sought by consumers. Organized vendors dominate the market due to their established infrastructure and brand reputation, offering greater trust and transparency compared to the unorganized sector. Among the countries, Indonesia and Vietnam are expected to lead the growth trajectory, fueled by their expanding economies and burgeoning middle classes. Competition is intensifying among established players like Cars24, Carsome, and OLX, alongside certified pre-owned programs offered by major automakers like Honda and Toyota. The market's success hinges on addressing challenges such as inconsistent vehicle quality, limited financing options, and the need for improved regulatory frameworks to enhance consumer protection.

The diverse landscape of the South-East Asian used car market presents both opportunities and challenges. The increasing adoption of online platforms for vehicle transactions is transforming the buying experience, creating new avenues for growth and competition. However, the market must contend with issues like the lack of standardized quality checks and a potential skills gap in vehicle assessment and repair. Addressing these concerns through investment in technology, enhanced consumer education, and robust regulatory oversight will be crucial in fostering sustainable growth and building consumer trust. The continued expansion of the middle class and the increasing preference for personal mobility, however, paint a positive long-term picture for the used car market in this dynamic region. The market's performance will significantly depend on the economic health of the region and government policies supporting sustainable growth.

South-East Asian Used Car Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South-East Asian used car market, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report dissects market dynamics, growth trends, and key players to illuminate lucrative opportunities within this rapidly evolving sector. The report segments the market by vehicle type (Hatchback, Sedan, SUV), fuel type (Diesel, Gasoline/Petrol, Other), booking type (Offline, Online), vendor type (Organized, Unorganized), and country (Vietnam, Indonesia, Malaysia, Thailand, Singapore, Rest of South-East Asia). With a detailed examination of market size (in Million units), CAGR, and key players such as Cars24, Honda Certified, OLX Indonesia, and Carsome, this report is an essential resource for navigating the complexities of this dynamic market.

South-East Asian Used Car Market Dynamics & Structure

The South-East Asian used car market is characterized by a diverse landscape of organized and unorganized players, with varying levels of market concentration across different countries. Technological innovations, particularly in online platforms and digital marketplaces, are significantly reshaping the industry. Regulatory frameworks, while evolving, play a crucial role in influencing market growth and transparency. The presence of competitive product substitutes, such as public transport and ride-hailing services, also impacts market dynamics. End-user demographics, including rising middle-class populations and changing consumer preferences, are key growth drivers. Furthermore, the market witnesses significant M&A activity, as larger players consolidate their market share and expand their reach.

- Market Concentration: Highly fragmented in some countries (e.g., xx% market share for top 3 players in Vietnam), more consolidated in others (e.g., yy% market share for top 3 players in Singapore).

- Technological Innovation: Online platforms drive efficiency and transparency, impacting the unorganized sector's share.

- Regulatory Framework: Varying regulations across countries impacting market entry and operations.

- Competitive Substitutes: Public transport and ride-hailing present alternatives, impacting demand for used cars.

- End-User Demographics: Growing middle class fuels demand for personal vehicles in several SEA countries.

- M&A Trends: xx M&A deals recorded in the last 5 years, indicating consolidation and increased investment.

South-East Asian Used Car Market Growth Trends & Insights

The South-East Asian used car market experienced significant growth during the historical period (2019-2024), driven by factors such as increasing urbanization, rising disposable incomes, and the affordability of used vehicles compared to new cars. The market size expanded from xx million units in 2019 to yy million units in 2024, exhibiting a CAGR of zz%. Technological disruptions, particularly the emergence of online marketplaces, have streamlined the buying and selling process, increasing market penetration and convenience for consumers. Consumer behavior is shifting towards online platforms, favoring transparency and ease of transaction. This trend is expected to continue during the forecast period (2025-2033), with a projected CAGR of ww% and the market reaching xx million units by 2033. The adoption rate of online platforms is increasing rapidly, particularly among younger demographics. This is also being boosted by government policies focused on improving infrastructure and promoting digital adoption. Furthermore, financing options and insurance products are becoming more readily available, enhancing affordability for a wider range of consumers. Finally, the market is witnessing a rising preference for SUVs, driven by changing lifestyle choices and family needs.

Dominant Regions, Countries, or Segments in South-East Asian Used Car Market

Indonesia and Thailand are currently the leading markets in terms of used car sales volume in South-East Asia, driven by their large populations and relatively strong economic growth. However, Vietnam is expected to exhibit the highest growth potential during the forecast period. Within segments, SUVs are experiencing the most significant growth, reflecting changing consumer preferences and increasing urbanization. Online booking is also rapidly gaining traction, fueled by technological advancements and convenience. Organized vendors are leading the market share growth, however the unorganized sector still dominates some countries.

- Key Drivers:

- Indonesia & Thailand: Large populations, growing middle class, and relatively developed automotive infrastructure.

- Vietnam: High economic growth, increasing urbanization, and growing demand for personal vehicles.

- SUVs: Rising popularity due to larger families, increased travel, and desire for higher ground clearance.

- Online Bookings: Convenience, transparency, and wider selection offered by online platforms.

- Organized Vendors: Greater trust and reliability, as well as established quality control processes.

- Dominance Factors:

- Market Share: Indonesia and Thailand hold the largest market share currently, followed by Malaysia and Vietnam.

- Growth Potential: Vietnam and other Southeast Asian countries are projected to demonstrate the highest growth rates in the coming years.

South-East Asian Used Car Market Product Landscape

The used car market offers a wide range of vehicles, encompassing various makes, models, and ages. Recent innovations focus on enhancing the online buying experience, including virtual inspections, detailed vehicle history reports, and streamlined financing options. Technological advancements in vehicle diagnostics and condition assessments are also improving transparency and trust between buyers and sellers. Key product innovations include improved online platforms that provide better search functionality, more detailed vehicle information, and enhanced security features. The focus is on providing a seamless, transparent, and trustworthy online car buying experience.

Key Drivers, Barriers & Challenges in South-East Asian Used Car Market

Key Drivers: Rising disposable incomes, increasing urbanization, and a preference for personal mobility are key drivers. The growth of e-commerce platforms is also providing greater access and transparency. Government initiatives to improve infrastructure further boost demand.

Challenges: The informal sector remains a significant challenge, hindering standardization and transparency. Supply chain disruptions can affect availability, while regulatory inconsistencies across nations pose hurdles. Competitive pressures among organized players, particularly online platforms, are also intense. Lastly, financing options for used car purchases need improvement, and a lack of transparency affects consumer trust.

Emerging Opportunities in South-East Asian Used Car Market

Untapped markets in smaller cities and rural areas offer significant potential. Innovative services like subscription models for used cars and enhanced warranty programs can boost market growth. Furthermore, catering to specific niche markets, such as electric vehicles and luxury cars, presents opportunities for specialized players. Addressing the financing gap for used car purchases is also a huge opportunity.

Growth Accelerators in the South-East Asian Used Car Market Industry

Technological advancements in vehicle inspection and authentication will improve consumer trust and increase transactions. Strategic partnerships between online platforms and financing institutions can improve access to credit. Expansion into underserved markets, such as rural areas, along with increased consumer awareness through targeted marketing initiatives, can greatly contribute to growth.

Key Players Shaping the South-East Asian Used Car Market Market

- Cars24 Services Private Limited

- Honda Certified (Honda Motor Corporation)

- OLX Indonesia

- Carousell

- Carsome Sdn Bhd

- PT Moladin Digita

- Toyota Trust (Toyota Motor Corporation)

- Nissan Intelligent Mobility (Nissan Motor Corporation)

- ICar Asia Limited

- Carro (Trusty Cars Pte Ltd)

Notable Milestones in South-East Asian Used Car Market Sector

- January 2022: Moladin, an Indonesian used car platform, raised USD 42 million in Series A funding.

- April 2022: Spinny launched its Spinnymax luxury used car segment in Vietnam, offering over 500 luxury cars.

In-Depth South-East Asian Used Car Market Market Outlook

The South-East Asian used car market holds substantial long-term growth potential, driven by increasing vehicle ownership, evolving consumer preferences, and technological advancements. Strategic partnerships, expansion into underserved markets, and innovative service offerings will be crucial for success. The market is poised for continued expansion, presenting lucrative opportunities for established players and new entrants alike. Addressing the challenges of the informal sector and creating a more transparent and regulated market will be crucial to unlocking the full potential of this dynamic sector.

South-East Asian Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sports Utility Vehicle (SUV)

- 1.4. Multi-Purpose Utility Vehicle (MPV)

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

- 2.3. Electric

- 2.4. Other Fuel Types (LPG, CNG, Etc.)

-

3. Sales Channel

- 3.1. Online

- 3.2. Offline

-

4. Vendor Type

- 4.1. Organized

- 4.2. Unorganized

-

5. Purchase Method

- 5.1. Outright Purchase

-

5.2. Financed Purchase

- 5.2.1. Captive Financing

- 5.2.2. Bank Financing

- 5.2.3. Non-banking Financial Corporations (NBFC)

South-East Asian Used Car Market Segmentation By Geography

-

1. South East Asia

- 1.1. Indonesia

- 1.2. Malaysia

- 1.3. Singapore

- 1.4. Thailand

- 1.5. Vietnam

- 1.6. Philippines

- 1.7. Myanmar

- 1.8. Cambodia

- 1.9. Laos

South-East Asian Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Distribution Channels; Others

- 3.3. Market Restrains

- 3.3.1. Lack Of Trust And Transparency; Others

- 3.4. Market Trends

- 3.4.1. Strengthening of Digital Platforms is Driving the Online Booking Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicle (SUV)

- 5.1.4. Multi-Purpose Utility Vehicle (MPV)

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.2.3. Electric

- 5.2.4. Other Fuel Types (LPG, CNG, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vendor Type

- 5.4.1. Organized

- 5.4.2. Unorganized

- 5.5. Market Analysis, Insights and Forecast - by Purchase Method

- 5.5.1. Outright Purchase

- 5.5.2. Financed Purchase

- 5.5.2.1. Captive Financing

- 5.5.2.2. Bank Financing

- 5.5.2.3. Non-banking Financial Corporations (NBFC)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South East Asia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 8. India South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific South-East Asian Used Car Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Cars24 Services Private Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Honda Certified (Honda Motor Corporation)

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 OLX Indonesia

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Carousell

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Carsome Sdn Bhd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PT Moladin Digita

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Toyota Trust (Toyota Motor Corporation)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nissan Intelligent Mobility (Nissan Motor Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ICar Asia Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Carro (Trusty Cars Pte Ltd)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Cars24 Services Private Limited

List of Figures

- Figure 1: South-East Asian Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South-East Asian Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: South-East Asian Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 5: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 6: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2019 & 2032

- Table 7: South-East Asian Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South-East Asian Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South-East Asian Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: South-East Asian Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 18: South-East Asian Used Car Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 19: South-East Asian Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 20: South-East Asian Used Car Market Revenue Million Forecast, by Purchase Method 2019 & 2032

- Table 21: South-East Asian Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Indonesia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Myanmar South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Cambodia South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Laos South-East Asian Used Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asian Used Car Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the South-East Asian Used Car Market?

Key companies in the market include Cars24 Services Private Limited, Honda Certified (Honda Motor Corporation), OLX Indonesia, Carousell, Carsome Sdn Bhd, PT Moladin Digita, Toyota Trust (Toyota Motor Corporation), Nissan Intelligent Mobility (Nissan Motor Corporation, ICar Asia Limited, Carro (Trusty Cars Pte Ltd).

3. What are the main segments of the South-East Asian Used Car Market?

The market segments include Vehicle Type, Fuel Type, Sales Channel, Vendor Type, Purchase Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Distribution Channels; Others.

6. What are the notable trends driving market growth?

Strengthening of Digital Platforms is Driving the Online Booking Segment.

7. Are there any restraints impacting market growth?

Lack Of Trust And Transparency; Others.

8. Can you provide examples of recent developments in the market?

April 2022: Spinny, a used car buying and selling platform, entered the luxury car used vehicle segment under the Spinnymax brand in the Vietnamese market. The platform will operate at a national scale and offers over 500 cars from various brands, including Mercedes-Benz, BMW, Audi, Jaguar, and Land Rover, with an all-India delivery service through 250 cities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asian Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asian Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asian Used Car Market?

To stay informed about further developments, trends, and reports in the South-East Asian Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence