Key Insights

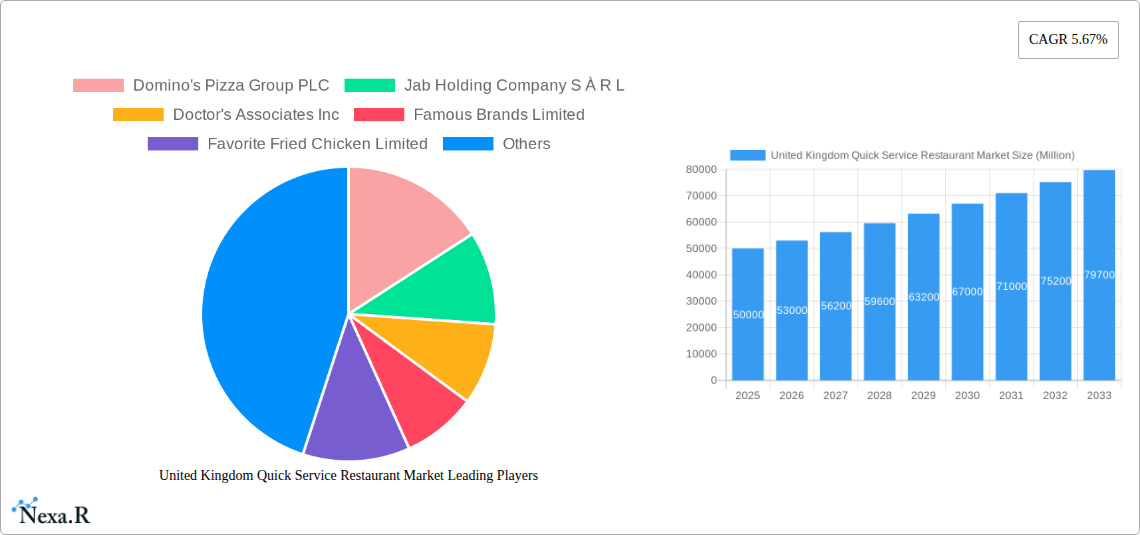

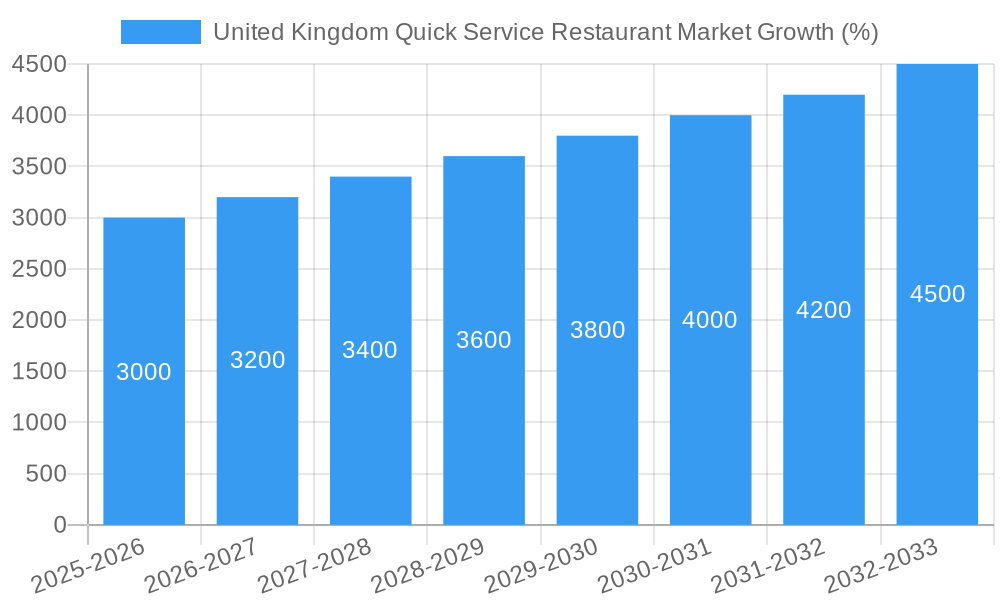

The United Kingdom Quick Service Restaurant (QSR) market, valued at approximately £X billion in 2025 (estimated based on global market size and UK's relative economic contribution), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.67% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of busy lifestyles and a preference for convenient, affordable dining options fuels demand for QSR offerings. Secondly, the UK's diverse population and evolving culinary preferences support the growth of various cuisines within the QSR sector, from traditional fish and chips to international options like pizza and burgers. The rise of online ordering and delivery services further enhances convenience, boosting sales and market penetration. Furthermore, innovative marketing strategies and loyalty programs employed by major chains are contributing to market growth. However, economic fluctuations, rising food costs, and intensifying competition among established chains and independent outlets present challenges to consistent growth. The market is segmented by cuisine (bakeries, burgers, ice cream, meat-based cuisines, pizza, other QSR cuisines), outlet type (chained outlets, independent outlets), and location (leisure, lodging, retail, standalone, travel). The dominance of chained outlets, particularly in urban areas, is notable, yet the independent sector remains a significant contributor, particularly in local and niche markets.

The UK QSR market's future growth will hinge on several crucial strategies. Adapting to consumer preferences through menu diversification and customization is paramount. Embracing sustainable and ethical sourcing practices is gaining traction, attracting environmentally conscious consumers. Technological advancements, such as AI-powered order management and personalized customer experiences, will become increasingly crucial for maintaining a competitive edge. Finally, effective management of operational costs and supply chain disruptions is vital for ensuring profitability and sustainable growth in a volatile market. The competitive landscape is characterized by prominent players like Domino's, McDonald's, and Greggs, alongside numerous smaller, independent businesses competing for market share. The continued success of the UK QSR market will depend on these players' ability to successfully navigate these dynamic market conditions and consumer demands.

This in-depth report provides a comprehensive analysis of the United Kingdom's dynamic Quick Service Restaurant market, encompassing market size, growth trends, competitive landscape, and future outlook. With a focus on key segments including bakeries, burgers, ice cream, pizza, and other cuisines, served through chained and independent outlets across various locations, this report is an invaluable resource for industry professionals, investors, and strategists. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering crucial insights for informed decision-making.

United Kingdom Quick Service Restaurant Market Dynamics & Structure

The UK QSR market is characterized by high competition, with both established multinational chains and smaller independent operators vying for market share. Market concentration is moderate, with a few dominant players holding significant shares, but a large number of smaller players contributing to overall market vibrancy. Technological innovation, particularly in areas like online ordering, delivery platforms, and personalized customer experiences, is a key driver of growth. The regulatory framework, including food safety regulations and labor laws, plays a significant role in shaping market dynamics. The market also faces competition from alternative food service options like meal delivery services and grocery store prepared meals. The demographic shift towards younger, more health-conscious consumers is influencing menu offerings and marketing strategies. M&A activity is relatively frequent, reflecting ongoing consolidation and expansion efforts by larger players.

- Market Concentration: Moderate, with top 5 players holding approximately xx% of the market (2024).

- Technological Innovation: High adoption of online ordering, mobile payment systems, and loyalty programs.

- Regulatory Framework: Stringent food safety and hygiene regulations influencing operating costs.

- Competitive Substitutes: Meal delivery services, grocery store prepared meals, and home cooking pose challenges.

- End-User Demographics: Growing demand from young adults and families, increasing focus on healthier options.

- M&A Trends: Consistent M&A activity, with xx deals recorded in the last 5 years (2019-2024), indicating consolidation and expansion.

United Kingdom Quick Service Restaurant Market Growth Trends & Insights

The UK QSR market has witnessed steady growth over the past few years, driven by factors such as rising disposable incomes, changing lifestyles, and increasing urbanization. The market size is projected to reach £xx million in 2025, with a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of online ordering and delivery services, are significantly impacting consumer behavior. Consumers are increasingly seeking convenience, value, and personalized experiences, leading to the growth of customized meal options and loyalty programs. Market penetration for online ordering is expected to reach xx% by 2033, demonstrating the digital transformation within the sector. This growth is further fuelled by an increasing preference for quick and convenient meal solutions amongst busy professionals and young adults. The rise of mobile payments has also influenced the seamless nature of the ordering and payment process, accelerating the growth further.

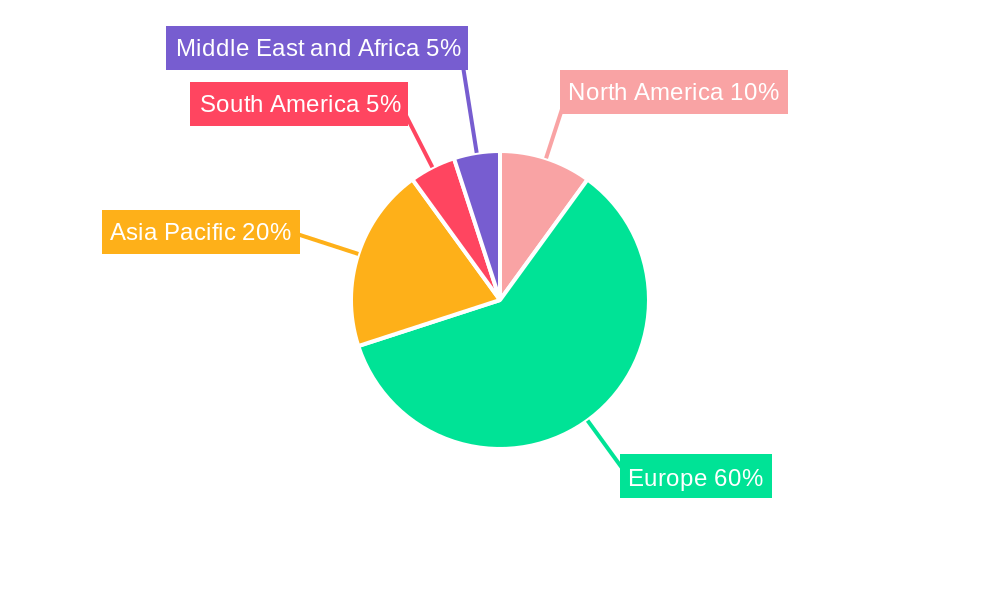

Dominant Regions, Countries, or Segments in United Kingdom Quick Service Restaurant Market

London and other major metropolitan areas currently dominate the UK QSR market due to higher population density, greater consumer spending, and increased tourism. Within the cuisine segments, Pizza and Burger chains continue to lead due to strong brand recognition and established customer bases. The chained outlet segment holds a larger market share compared to independent outlets owing to economies of scale, wider reach, and brand recognition. Retail and standalone locations are currently the most prevalent, followed by leisure and travel segments.

- Key Drivers: High population density in urban centers, strong consumer spending, tourism, established brands with widespread reach and economies of scale.

- Dominant Segments:

- Cuisine: Pizza and Burger representing xx% and xx% of the market respectively in 2024.

- Outlet: Chained Outlets holding xx% market share in 2024.

- Location: Retail and Standalone locations account for xx% of the market in 2024.

United Kingdom Quick Service Restaurant Market Product Landscape

The UK QSR market displays a diverse product landscape, with continuous innovation in menu offerings, packaging, and service delivery. Companies are introducing healthier options, catering to evolving consumer preferences. Technological advancements, such as self-service kiosks and advanced kitchen equipment, are enhancing operational efficiency and customer experience. Unique selling propositions are based on speed, convenience, value, and brand loyalty programs. Customization options and meal bundles contribute to increased customer engagement.

Key Drivers, Barriers & Challenges in United Kingdom Quick Service Restaurant Market

Key Drivers:

- Rising disposable incomes and increased urbanization.

- Growing preference for convenience and speed.

- Technological advancements driving operational efficiencies.

- Expansion of delivery services.

Challenges:

- Intense competition among existing players.

- Rising labor costs and supply chain disruptions causing price increases.

- Stricter food safety regulations and environmental concerns.

- Fluctuating commodity prices impacting profitability.

Emerging Opportunities in United Kingdom Quick Service Restaurant Market

- Growth of plant-based and healthier menu options.

- Expansion of delivery and online ordering services.

- Personalization of customer experience through loyalty programs.

- Increased focus on sustainable and ethical sourcing practices.

Growth Accelerators in the United Kingdom Quick Service Restaurant Market Industry

Long-term growth in the UK QSR market will be driven by continued technological innovation, strategic partnerships, and international expansion. The adoption of advanced analytics to understand consumer preferences will further enhance personalization and create tailored marketing campaigns. Strategic collaborations with technology providers and food delivery platforms are expected to drive market penetration. Exploring untapped markets in smaller towns and cities will also fuel growth.

Key Players Shaping the United Kingdom Quick Service Restaurant Market Market

- Domino's Pizza Group PLC

- Jab Holding Company S À R L

- Doctor's Associates Inc

- Famous Brands Limited

- Favorite Fried Chicken Limited

- Five Guys Enterprises LLC

- Samworth Brothers Limited

- Deep Blue Restaurants Ltd

- Co-operative Group Limited

- Starbucks Corporation

- Costa Coffee

- Greggs Plc

- McDonald's Corporation

- Ben & Jerry's Homemade Holdings Inc

Notable Milestones in United Kingdom Quick Service Restaurant Market Sector

- August 2023: Subway acquired by Roark Capital for USD 8.95 billion.

- August 2023: Starbucks plans to invest USD 32.78 million in opening 100 new UK outlets.

- January 2023: Five Guys to open new restaurants in Queensway and Bridgend following 20 openings in 2022.

In-Depth United Kingdom Quick Service Restaurant Market Market Outlook

The UK QSR market is poised for continued growth, fueled by evolving consumer preferences and technological advancements. Strategic investments in technology, expansion into new markets, and focus on personalization will be crucial for success. The market's future potential lies in its ability to adapt to changing consumer demands, embrace sustainable practices, and leverage technological innovation for enhanced efficiency and customer experience. The integration of data analytics for better understanding of customer preferences and trends will further propel the growth of the industry.

United Kingdom Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United Kingdom Quick Service Restaurant Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Russia

- 7.1.7 Rest of Europe

- 8. Asia Pacific United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United Kingdom Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Domino's Pizza Group PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jab Holding Company S À R L

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Doctor's Associates Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Famous Brands Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Favorite Fried Chicken Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Five Guys Enterprises LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samworth Brothers Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Deep Blue Restaurants Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Co-operative Group Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Starbucks Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Costa Coffee

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Greggs Plc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 McDonald's Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ben & Jerry's Homemade Holdings Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Domino's Pizza Group PLC

List of Figures

- Figure 1: United Kingdom Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa United Kingdom Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 34: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 36: United Kingdom Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Quick Service Restaurant Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the United Kingdom Quick Service Restaurant Market?

Key companies in the market include Domino's Pizza Group PLC, Jab Holding Company S À R L, Doctor's Associates Inc, Famous Brands Limited, Favorite Fried Chicken Limited, Five Guys Enterprises LLC, Samworth Brothers Limited, Deep Blue Restaurants Ltd, Co-operative Group Limited, Starbucks Corporatio, Costa Coffee, Greggs Plc, McDonald's Corporation, Ben & Jerry's Homemade Holdings Inc.

3. What are the main segments of the United Kingdom Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Consumers inclination towards fast food consumption led to an increasing number of fast food outlets in the country.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. To fully receive the amount, Subway needs to achieve certain cash flow milestones within a period of two or more years after the deal is completed.August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.January 2023: Five Guys Enterprises, LLC set to open restaurants in Queensway and Bridgend in 2023 after 20 new sites were opened in 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the United Kingdom Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence