Key Insights

The United States cafes and bars market, a vibrant segment of the food service industry, is experiencing robust growth, fueled by several key factors. The rising disposable incomes, coupled with evolving consumer preferences towards experiential dining and convenient grab-and-go options, are significant drivers. The increasing popularity of specialty coffee and tea, along with the diverse culinary offerings in cafes and bars catering to various dietary needs and preferences (e.g., vegan, gluten-free), contribute to market expansion. Furthermore, the strategic location of cafes and bars in high-traffic areas like retail centers, leisure destinations, and lodging establishments enhances accessibility and visibility, attracting a larger customer base. The market is also witnessing a surge in innovative beverage and food offerings, along with enhanced customer service and loyalty programs, which further boost market appeal. While challenges exist, such as increasing operational costs and competition from fast-casual dining options, the market's adaptability and consistent innovation suggest a positive trajectory.

Within the US market, the chained outlets segment is likely to maintain a significant market share due to their brand recognition, standardized quality, and efficient operational models. However, independent outlets, offering unique experiences and localized menus, also present a strong competitive landscape, catering to consumers seeking personalized experiences. The geographical distribution shows concentration in urban areas and major metropolitan regions, while smaller towns and rural areas present opportunities for growth, potentially driven by tourism or population expansion. The specialization of cafes and bars, such as those focused on specific cuisines (e.g., juice bars, dessert bars) allows for niche market penetration and strong customer loyalty, contributing further to market dynamism. Overall, the U.S. cafes and bars market is expected to maintain a steady growth trajectory over the forecast period, driven by consumer demand, evolving trends, and ongoing industry innovation.

United States Cafes & Bars Market: A Comprehensive Report (2019-2033)

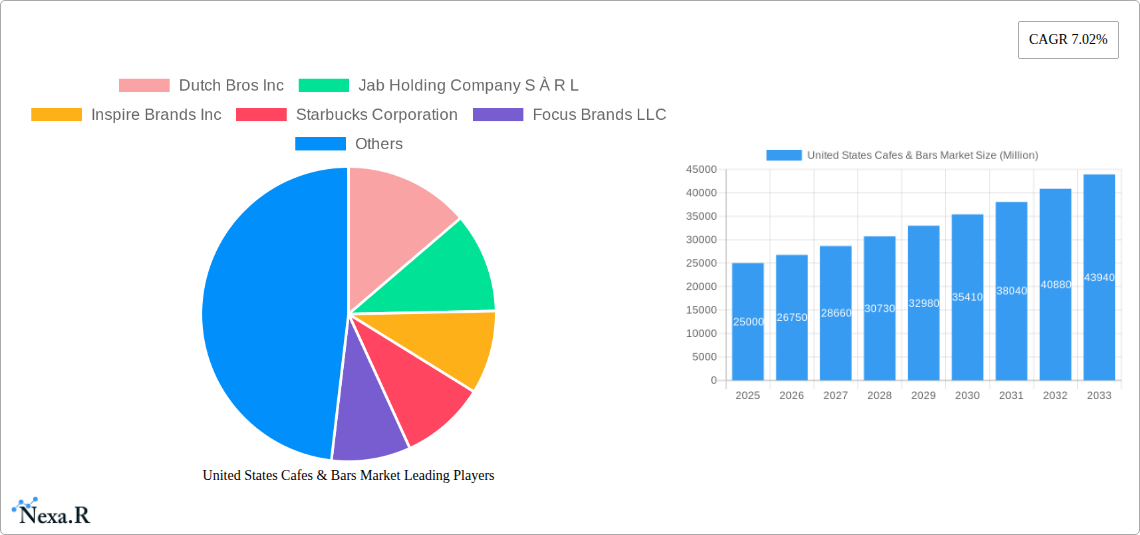

This in-depth report provides a comprehensive analysis of the United States Cafes & Bars Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period extending to 2033. The report segments the market by cuisine (Bars & Pubs, Cafes, Juice/Smoothie/Desserts Bars, Specialist Coffee & Tea Shops), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel). The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033. Key players analyzed include Dutch Bros Inc, Jab Holding Company S À R L, Inspire Brands Inc, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, Tropical Smoothie Cafe LL, and International Dairy Queen Inc.

United States Cafes & Bars Market Market Dynamics & Structure

The US cafes and bars market exhibits a moderately concentrated structure, with large chains holding significant market share. However, a vibrant landscape of independent outlets continues to thrive. Technological innovation, particularly in areas like mobile ordering, loyalty programs, and personalized experiences, is a key driver of growth. Regulatory frameworks concerning food safety, licensing, and alcohol service influence operational costs and market access. The market also faces competition from alternative beverage options and quick-service restaurants. M&A activity remains significant, with larger players consolidating their presence and expanding their brand portfolios.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: Mobile ordering apps, personalized recommendations, and loyalty programs are transforming customer experiences.

- Regulatory Framework: Varying state and local regulations impact operational costs and expansion strategies.

- Competitive Substitutes: Quick-service restaurants, home coffee brewing, and ready-to-drink beverages pose competitive pressure.

- End-User Demographics: Millennials and Gen Z are key demographics driving demand for specialty coffee, unique beverages, and social experiences.

- M&A Trends: The past five years have seen xx M&A deals in the cafes and bars segment, indicating a trend toward consolidation.

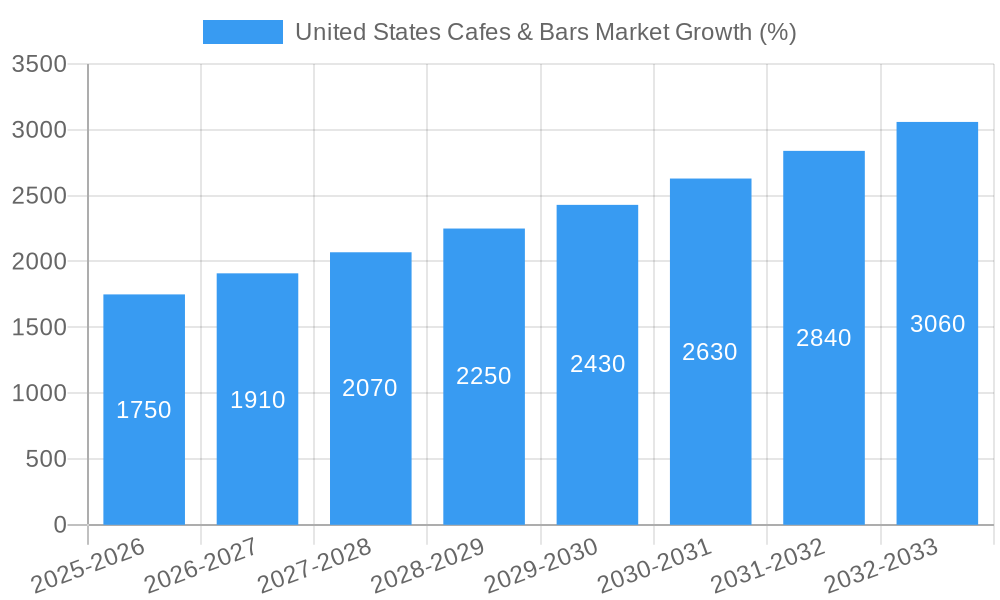

United States Cafes & Bars Market Growth Trends & Insights

The US cafes and bars market experienced significant growth between 2019 and 2024, with a CAGR of xx%. This growth is fueled by rising disposable incomes, changing consumer preferences towards premium experiences, and increasing urbanization. The market witnessed a temporary dip in 2020 due to the pandemic, but recovered strongly in the subsequent years. Technological disruptions, such as the adoption of contactless payment methods and online ordering platforms, further boosted market growth. Consumer behavior shifts, including increased demand for healthier options and personalized experiences, are shaping product innovation and marketing strategies. The market penetration of specialty coffee shops is steadily increasing, reaching xx% in 2025.

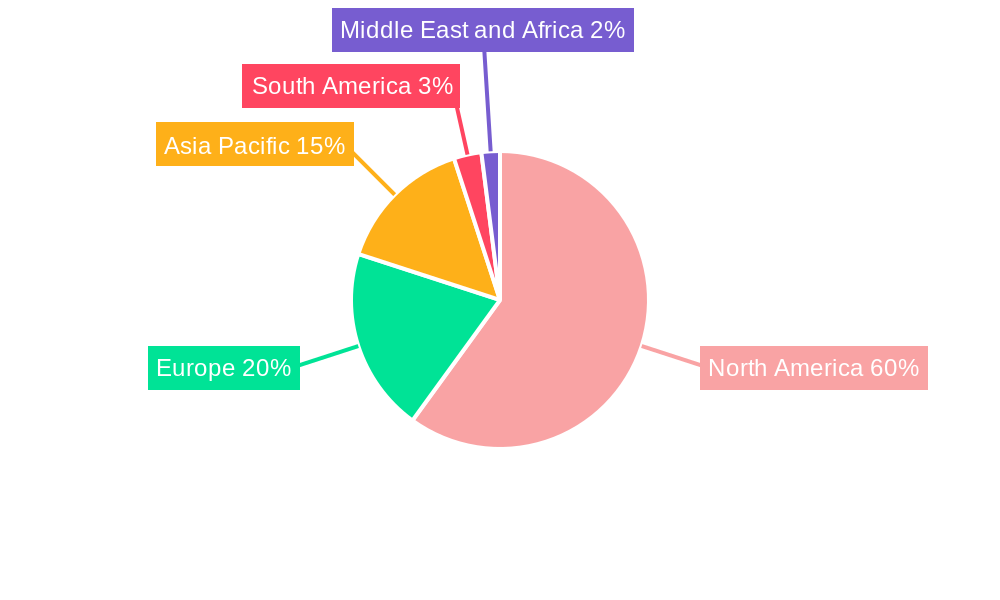

Dominant Regions, Countries, or Segments in United States Cafes & Bars Market

The largest segment in the market in 2025 is Specialty Coffee & Tea Shops, followed by Cafes and Bars & Pubs. This dominance is driven by the increasing consumer preference for high-quality coffee and tea, along with the appeal of sophisticated café environments and the social aspect of pubs and bars. The Chained Outlets segment holds the largest market share in terms of outlets, indicating the strength of established brands. In terms of location, the Retail segment contributes significantly, driven by high foot traffic in urban areas and shopping malls. California, New York, and Texas are the leading states in terms of market size and growth.

- Key Drivers: Rising disposable incomes, strong consumer preference for out-of-home experiences, increasing urbanization.

- Dominance Factors: Strong brand recognition, wide geographical reach, innovative product offerings, effective marketing strategies, and strategic location choices.

- Growth Potential: Expanding consumer base, increased tourist spending in key regions, increasing preference for premium offerings.

United States Cafes & Bars Market Product Landscape

The market offers a diverse range of products, from traditional coffee and tea to innovative beverages like cold brew, nitro coffee, and specialty cocktails. Product innovation is driven by consumer demand for healthier options, unique flavors, and convenient formats. Technological advancements, such as improved brewing equipment and automated ordering systems, enhance efficiency and customer experience. Unique selling propositions often revolve around high-quality ingredients, unique brand identities, and exceptional customer service.

Key Drivers, Barriers & Challenges in United States Cafes & Bars Market

Key Drivers: Growing consumer disposable incomes, increasing demand for premium experiences, technological advancements, changing consumer preferences towards healthier and more sustainable options. Government initiatives promoting local businesses also contribute.

Challenges & Restraints: Rising inflation, labor shortages leading to increased operational costs, stringent regulations, and intense competition from established players and new entrants impact profitability. Supply chain disruptions can also lead to temporary shortages of key ingredients and packaging.

Emerging Opportunities in United States Cafes & Bars Market

Untapped markets in smaller cities and rural areas present significant opportunities for expansion. Innovation in plant-based and functional beverages, sustainable practices, and personalized offerings cater to evolving consumer preferences. Collaboration with local food producers and incorporating unique local flavors enhance the brand appeal.

Growth Accelerators in the United States Cafes & Bars Market Industry

Technological breakthroughs in brewing techniques and ingredient sourcing enhance efficiency and product quality. Strategic partnerships between cafes/bars and food delivery services expand reach and convenience. Market expansion into underserved geographical locations leverages unmet consumer demand.

Key Players Shaping the United States Cafes & Bars Market Market

- Dutch Bros Inc

- Jab Holding Company S À R L

- Inspire Brands Inc

- Starbucks Corporation

- Focus Brands LLC

- Restaurant Brands International Inc

- McDonald's Corporation

- Smoothie King Franchises Inc

- Tropical Smoothie Cafe LL

- International Dairy Queen Inc

Notable Milestones in United States Cafes & Bars Market Sector

- December 2022: Dutch Bros launched eight classic drinks with sugar-free options.

- January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations.

- December 2022: Pret A Manger announced US expansion plans through a franchise partnership.

In-Depth United States Cafes & Bars Market Market Outlook

The US cafes and bars market is poised for continued growth, driven by factors such as evolving consumer preferences, technological advancements, and strategic market expansion initiatives. Opportunities abound for players who can effectively adapt to changing consumer demands, leverage technology, and build strong brand identities. The market will see continued consolidation as larger players acquire smaller chains, leading to greater market concentration. However, independent outlets will also thrive by focusing on niche offerings and providing personalized experiences.

United States Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

United States Cafes & Bars Market Segmentation By Geography

- 1. United States

United States Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.02% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 6.1.4 Rest of North America

- 7. Europe United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Spain

- 7.1.2 United Kingdom

- 7.1.3 Germany

- 7.1.4 France

- 7.1.5 Italy

- 7.1.6 Russia

- 7.1.7 Rest of Europe

- 8. Asia Pacific United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 Rest of Asia Pacific

- 9. South America United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Rest of South America

- 10. Middle East and Africa United States Cafes & Bars Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 South Africa

- 10.1.2 Saudi Arabia

- 10.1.3 Rest of Middle East and Africa

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dutch Bros Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jab Holding Company S À R L

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inspire Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Starbucks Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Focus Brands LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Restaurant Brands International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 McDonald's Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Smoothie King Franchises Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tropical Smoothie Cafe LL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Dairy Queen Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dutch Bros Inc

List of Figures

- Figure 1: United States Cafes & Bars Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Cafes & Bars Market Share (%) by Company 2024

List of Tables

- Table 1: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: United States Cafes & Bars Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Spain United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Russia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: South Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa United States Cafes & Bars Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: United States Cafes & Bars Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 34: United States Cafes & Bars Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 35: United States Cafes & Bars Market Revenue Million Forecast, by Location 2019 & 2032

- Table 36: United States Cafes & Bars Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Cafes & Bars Market?

The projected CAGR is approximately 7.02%.

2. Which companies are prominent players in the United States Cafes & Bars Market?

Key companies in the market include Dutch Bros Inc, Jab Holding Company S À R L, Inspire Brands Inc, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, Tropical Smoothie Cafe LL, International Dairy Queen Inc.

3. What are the main segments of the United States Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rapid expansion of coffee chains and the increased popularity of gourmet coffee is boosting the market.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.December 2022: Pret A Manger announced its expansion plans in the United States through a franchise partnership with restaurant ownership and operations firm Dallas Holdings. The partnership will bring a network of new Pret locations to Southern California, as well as a location in New York City's Hudson Yards neighborhood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the United States Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence