Key Insights

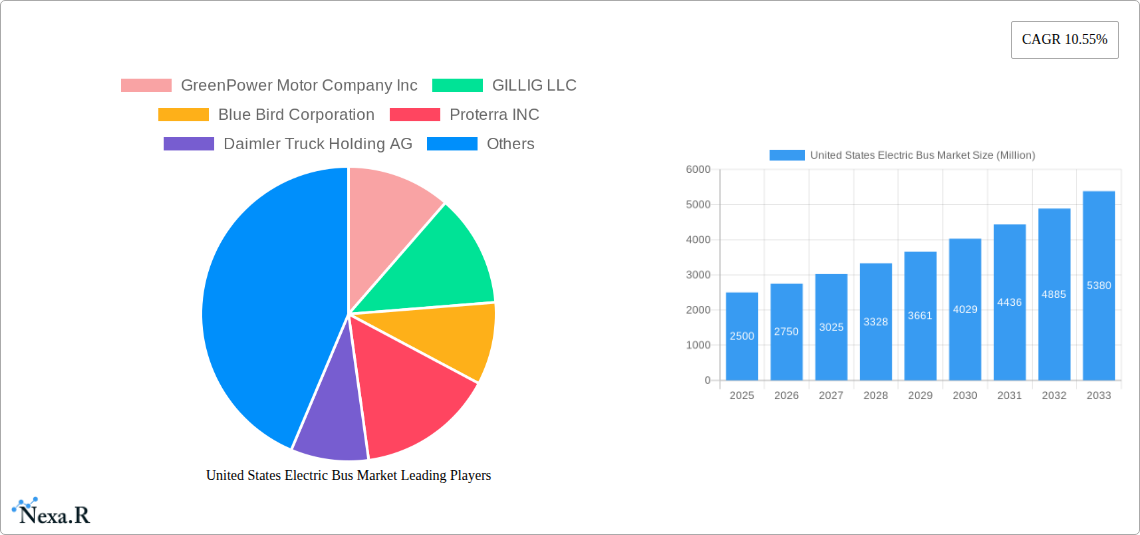

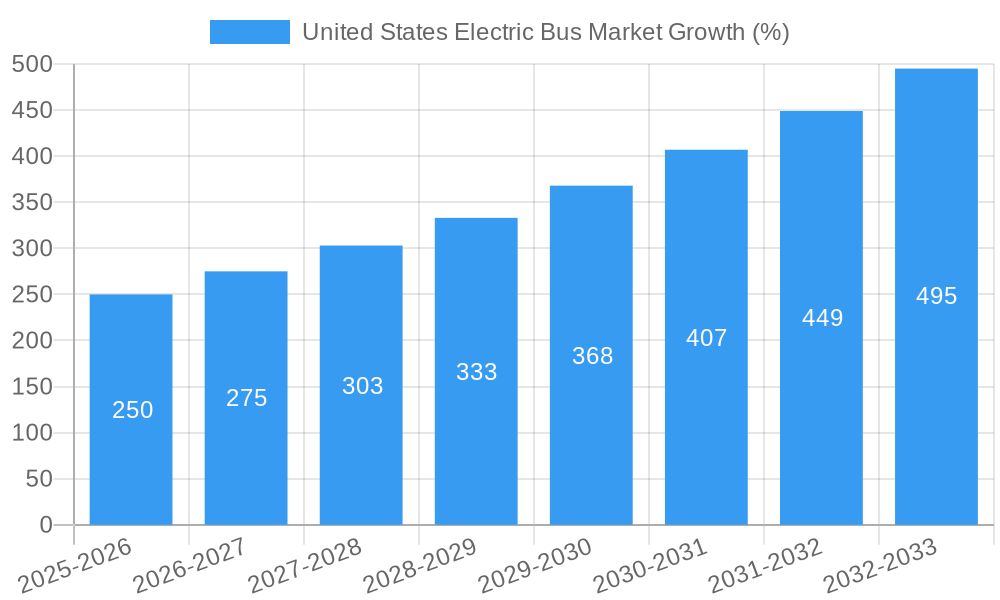

The United States electric bus market is experiencing robust growth, driven by increasing environmental concerns, stringent emission regulations, and government incentives promoting sustainable transportation. With a Compound Annual Growth Rate (CAGR) of 10.55% from 2019 to 2023, and a projected continuation of this trend through 2033, the market demonstrates significant potential. Key players like GreenPower Motor Company, Gillig, Blue Bird Corporation, Proterra, and BYD Auto are actively shaping the market landscape through technological innovations and strategic partnerships. The market is segmented by fuel category, encompassing Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), and Hybrid Electric Vehicles (HEVs), with BEVs currently dominating due to their relatively lower cost and readily available charging infrastructure. Growth is further fueled by expanding urban transit systems seeking to decarbonize their fleets and reduce operational costs associated with traditional diesel buses. Challenges remain, including the high initial cost of electric buses, limited charging infrastructure in certain regions, and the need for improved battery technology to address range anxiety and charging times. However, ongoing technological advancements and supportive government policies are gradually overcoming these hurdles.

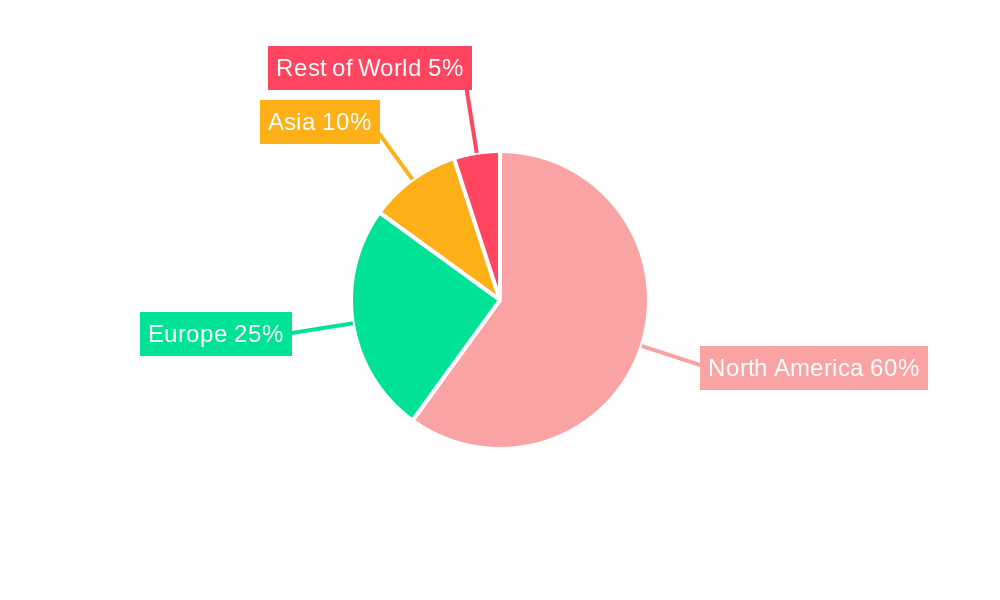

The forecast period (2025-2033) anticipates continued market expansion, with the value likely exceeding $X billion by 2033 (this figure is a reasonable estimation based on the provided 2019-2024 CAGR and market size at the base year 2025; the specific value of X would require more detailed data on the 2025 market size to accurately calculate). Market penetration will be influenced by factors such as the success of government initiatives promoting electric vehicle adoption, the development of efficient and affordable battery technologies, and advancements in charging infrastructure. Regional variations in market growth are expected, with densely populated urban areas and states with robust environmental regulations likely leading the charge. The competitive landscape will continue to evolve, driven by mergers, acquisitions, and the emergence of new players focused on innovative technologies and business models.

This comprehensive report provides an in-depth analysis of the rapidly evolving United States electric bus market, encompassing market size, growth trends, key players, and future outlook. With a detailed study period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an essential resource for industry professionals, investors, and policymakers seeking to understand and capitalize on the opportunities within this dynamic sector. The report examines the parent market of commercial vehicles and the child market of electric buses, providing a granular view of market segments including BEV, FCEV, and HEV.

United States Electric Bus Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the U.S. electric bus market. The market is characterized by a moderate level of concentration, with key players vying for market share. Technological innovation, driven by advancements in battery technology and charging infrastructure, is a significant growth driver. Stringent emission regulations are pushing the adoption of electric buses, while the availability of internal combustion engine (ICE) buses presents a competitive challenge.

- Market Concentration: xx% market share held by top 5 players (2024).

- Technological Innovation: Significant R&D investment in battery technology, charging solutions, and autonomous driving capabilities.

- Regulatory Framework: Stringent emission standards and government incentives are accelerating market growth.

- Competitive Substitutes: ICE buses remain a primary competitor, although their market share is declining.

- End-User Demographics: Primarily public transit agencies, school districts, and private shuttle operators.

- M&A Trends: xx M&A deals recorded between 2019 and 2024, indicating consolidation within the industry. Key factors influencing M&A activity include the desire to expand market reach and secure technological advantages.

United States Electric Bus Market Growth Trends & Insights

The U.S. electric bus market has witnessed substantial growth over the historical period (2019-2024), driven by increasing environmental concerns, supportive government policies, and declining battery costs. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. This growth is fueled by technological advancements, increasing consumer awareness, and a shift towards sustainable transportation solutions. Market penetration is expected to increase significantly, reaching xx% by 2033, particularly in urban areas with supportive infrastructure.

Dominant Regions, Countries, or Segments in United States Electric Bus Market

California and other states with aggressive emission reduction targets are leading the adoption of electric buses. The BEV segment dominates the market due to its maturity and cost-effectiveness compared to FCEV and HEV options.

Key Drivers:

- Strong government incentives and subsidies.

- Growing public awareness of environmental issues.

- Development of charging infrastructure in major cities.

- Increasing operational cost savings compared to diesel buses.

Dominance Factors:

- California’s ambitious zero-emission vehicle goals are driving significant adoption.

- Favorable regulatory environment and supportive policies in various states.

- Significant investments in charging infrastructure in major metropolitan areas.

United States Electric Bus Market Product Landscape

Electric buses are offered in various sizes and configurations, catering to different applications. Key features include advanced battery management systems, regenerative braking, and improved safety features. Technological advancements are focused on increasing range, reducing charging times, and improving overall efficiency. Unique selling propositions often involve enhanced passenger comfort, reduced noise pollution, and lower operating costs.

Key Drivers, Barriers & Challenges in United States Electric Bus Market

Key Drivers:

- Stringent emission regulations are mandating the transition to cleaner transportation.

- Government incentives and subsidies are making electric buses more affordable.

- Declining battery costs are increasing the economic viability of electric buses.

- Growing concerns about air quality and climate change are driving consumer demand.

Challenges & Restraints:

- High initial capital costs remain a barrier to entry for many transit agencies.

- Limited charging infrastructure in certain regions restricts widespread adoption.

- Range anxiety and charging times are concerns for some operators.

- Supply chain disruptions can impact the availability of key components.

Emerging Opportunities in United States Electric Bus Market

- Expansion into smaller cities and towns.

- Integration of smart technologies, such as autonomous driving and connected vehicle systems.

- Growth in the school bus and private shuttle segments.

- Development of innovative battery technologies to enhance range and reduce charging time.

Growth Accelerators in the United States Electric Bus Market Industry

Technological innovations in battery technology, charging infrastructure, and vehicle design are crucial. Strategic partnerships between manufacturers, charging infrastructure providers, and government agencies will be pivotal. Expanding into new market segments, such as school buses and private fleets, will unlock significant growth potential.

Key Players Shaping the United States Electric Bus Market Market

- GreenPower Motor Company Inc

- GILLIG LLC

- Blue Bird Corporation

- Proterra INC

- Daimler Truck Holding AG

- NFI Group Inc

- Volvo Group

- BYD Auto Co Ltd

- REV group Inc

- Lion Electric Company

Notable Milestones in United States Electric Bus Market Sector

- December 2023: Proterra announced its new EV battery factory in South Carolina, signaling increased production capacity to meet growing demand.

- October 2023: BYD's partnership with the Los Olivos Elementary School District marked the first 100% zero-emission school bus fleet in the U.S.

- October 2022: Solaris launched two new electric bus models, expanding the range of available electric bus options.

In-Depth United States Electric Bus Market Market Outlook

The U.S. electric bus market is poised for sustained growth over the forecast period. Continued technological advancements, supportive government policies, and rising environmental concerns will drive adoption. Strategic partnerships and investments in charging infrastructure will be essential for realizing the full market potential. The focus on improving battery technology, enhancing charging infrastructure, and reducing overall costs will further accelerate the transition to electric buses. Opportunities exist across various segments, making the U.S. electric bus market a compelling investment opportunity.

United States Electric Bus Market Segmentation

-

1. Fuel Category

- 1.1. BEV

- 1.2. FCEV

- 1.3. HEV

United States Electric Bus Market Segmentation By Geography

- 1. United States

United States Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Electric Bus Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 5.1.1. BEV

- 5.1.2. FCEV

- 5.1.3. HEV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GreenPower Motor Company Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GILLIG LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Bird Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Proterra INC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler Truck Holding AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NFI Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BYD Auto Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 REV group Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lion Electric Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GreenPower Motor Company Inc

List of Figures

- Figure 1: United States Electric Bus Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Electric Bus Market Share (%) by Company 2024

List of Tables

- Table 1: United States Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Electric Bus Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 3: United States Electric Bus Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: United States Electric Bus Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 5: United States Electric Bus Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Electric Bus Market?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the United States Electric Bus Market?

Key companies in the market include GreenPower Motor Company Inc, GILLIG LLC, Blue Bird Corporation, Proterra INC, Daimler Truck Holding AG, NFI Group Inc, Volvo Grou, BYD Auto Co Ltd, REV group Inc, Lion Electric Company.

3. What are the main segments of the United States Electric Bus Market?

The market segments include Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

December 2023: Proterra announced its new EV battery factory in South Carolina as demand for commercial electric vehicles increased.October 2023: In October 2022, Solaris launched two new electric buses, Urbino 12 Electric and Urbino 18.75 Electric, at the 6th International Fair of Public Transport – Transexpo in Kielce, Poland.October 2023: BYD (Build Your Dreams) announced that a partnership with the Los Olivos Elementary School District would bring a BYD Type A electric school bus to Santa Barbara County students, making the Los Olivos Elementary School District the first in the United States to have 100% zero-emission fleet of school buses.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Electric Bus Market?

To stay informed about further developments, trends, and reports in the United States Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence