Key Insights

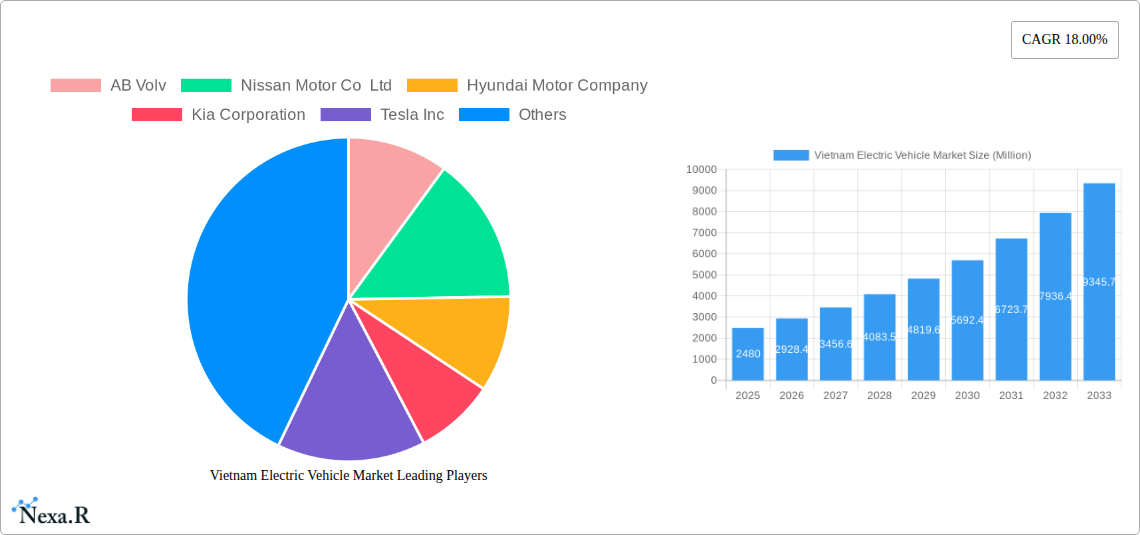

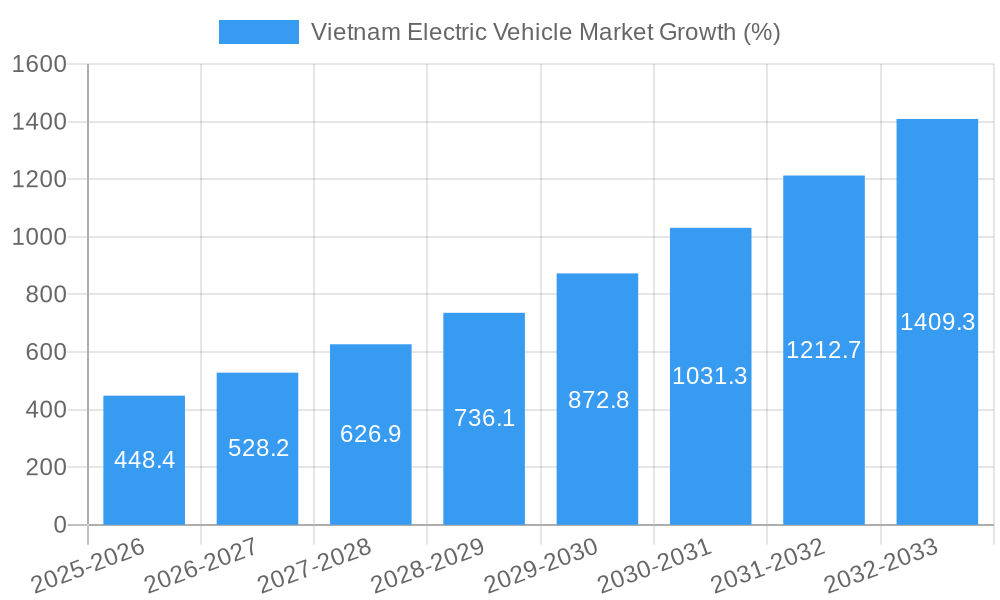

The Vietnam electric vehicle (EV) market is experiencing robust growth, projected to reach $2.48 billion in 2025 and maintain a compound annual growth rate (CAGR) of 18% from 2025 to 2033. This expansion is driven by several factors. Government initiatives promoting EV adoption, including subsidies and tax incentives, are significantly stimulating demand. Furthermore, rising fuel prices and growing environmental awareness among Vietnamese consumers are pushing the adoption of more sustainable transportation solutions. The increasing availability of charging infrastructure and advancements in battery technology, leading to improved range and reduced charging times, further contribute to market growth. The market is segmented by vehicle type (passenger cars and commercial vehicles) and propulsion type (battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs)). While BEVs are expected to dominate, PHEVs and HEVs will also contribute significantly to the market's expansion, given their affordability and wider availability. Key players such as VinFast, a domestic player, alongside international giants like Toyota, Hyundai, and Tesla, are actively investing in the Vietnamese market, fueling competition and innovation. However, challenges remain, including limited charging infrastructure in certain regions and the relatively higher initial cost of EVs compared to internal combustion engine (ICE) vehicles. Addressing these challenges will be crucial for sustaining the market's rapid growth trajectory.

The competitive landscape is dynamic, with both domestic and international players vying for market share. VinFast's strong local presence gives it an advantage, but established international brands possess superior brand recognition and technological expertise. Future growth will depend on the continued government support, further infrastructure development, and the successful integration of EVs into the existing transportation ecosystem. The focus on improving the charging infrastructure, particularly in rural areas, will be essential to unlocking the full potential of the Vietnamese EV market. Consumer education regarding the benefits of EVs and addressing range anxiety through improved battery technology and charging network expansion will also play a vital role in achieving the projected growth. The market’s success hinges on a multi-pronged approach that includes policy support, technological advancements, and effective consumer engagement.

Vietnam Electric Vehicle Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Vietnam electric vehicle (EV) market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This crucial analysis is vital for investors, manufacturers, policymakers, and anyone seeking to understand this rapidly evolving sector. The report segments the market by vehicle type (Passenger Cars, Commercial Vehicles) and propulsion type (Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles).

Vietnam Electric Vehicle Market Dynamics & Structure

This section analyzes the Vietnam EV market's structure, encompassing market concentration, technological innovation, regulatory landscape, competitive substitutes, end-user demographics, and M&A activity. The market is characterized by a dynamic interplay of established global automakers and emerging domestic players.

- Market Concentration: The market exhibits moderate concentration, with several key players vying for market share. xx% of the market is held by the top 5 players in 2025, indicating room for expansion for new entrants.

- Technological Innovation: Government incentives and growing consumer awareness are fueling innovation in battery technology, charging infrastructure, and vehicle design. However, challenges remain in reducing battery costs and improving charging infrastructure nationwide.

- Regulatory Framework: The Vietnamese government has implemented supportive policies, including tax incentives and subsidies, to accelerate EV adoption. However, regulatory clarity on standards and safety regulations is continuously evolving.

- Competitive Substitutes: Internal combustion engine (ICE) vehicles remain a significant competitor due to lower upfront costs and wider availability of fuel. However, rising fuel prices and environmental concerns are bolstering EV adoption.

- End-User Demographics: The primary end-users are urban residents and affluent consumers seeking eco-friendly and technologically advanced transportation. Growing middle class and increasing urbanization are key drivers of market growth.

- M&A Trends: The past five years have witnessed xx M&A deals in the EV sector in Vietnam, reflecting a strategic move by players to expand their market presence and technological capabilities.

Vietnam Electric Vehicle Market Growth Trends & Insights

The Vietnam EV market is experiencing substantial growth driven by government support, increasing consumer awareness of environmental concerns, and technological advancements in battery technology. The market size, measured in million units, is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033 from xx million units in 2025. Market penetration is expected to increase significantly from xx% in 2025 to xx% by 2033. This growth is fueled by:

- Increasing consumer demand: Driven by affordability, technological advancements and environmental concerns.

- Government support: Including subsidies, tax incentives, and infrastructure development.

- Technological advancements: Improved battery technology, longer range, and faster charging times.

Dominant Regions, Countries, or Segments in Vietnam Electric Vehicle Market

The dominant segment in the Vietnam EV market in 2025 is projected to be Passenger Cars, holding a market share of approximately xx%, followed by Commercial Vehicles at xx%. Within the propulsion segment, Battery Electric Vehicles (BEVs) are expected to dominate at xx%, reflecting the growing preference for fully electric vehicles. Several factors contribute to this dominance:

- Passenger Car Segment: Higher consumer demand driven by rising disposable incomes and preference for personal vehicles.

- Battery Electric Vehicles (BEVs): Lower running costs, improved range, and government incentives favoring BEVs.

- Urban Regions: Higher EV adoption in urban areas due to better charging infrastructure and government policies promoting cleaner transportation in cities.

The key drivers of growth include:

- Government policies: Supportive regulatory frameworks and infrastructure development are crucial.

- Economic factors: Rising disposable incomes and growing middle class.

- Infrastructure development: Expansion of charging stations and supportive grid infrastructure.

Vietnam Electric Vehicle Market Product Landscape

The Vietnam EV market features a diverse range of electric vehicles, including passenger cars and commercial vehicles. Key trends include the increasing availability of affordable models, improved battery technology leading to longer ranges and faster charging times, and the integration of advanced driver-assistance systems (ADAS) and connectivity features. These innovations enhance the overall user experience, driving consumer adoption.

Key Drivers, Barriers & Challenges in Vietnam Electric Vehicle Market

Key Drivers:

- Government incentives: Subsidies and tax breaks significantly reduce the purchase price.

- Technological advancements: Improved battery technology and faster charging infrastructure.

- Environmental concerns: Growing awareness of air pollution is driving demand for cleaner vehicles.

Key Barriers and Challenges:

- High initial purchase cost: EVs remain more expensive than comparable ICE vehicles.

- Limited charging infrastructure: The lack of widespread charging stations limits accessibility.

- Range anxiety: Concerns about running out of battery charge remain a significant barrier. The average range for EVs in the market is xx km, needing significant improvement for wider market adoption.

Emerging Opportunities in Vietnam Electric Vehicle Market

- Growth in rural markets: Expanding the EV market beyond urban areas presents significant opportunities.

- Development of charging infrastructure: Investments in charging infrastructure are crucial for wider adoption.

- Innovation in battery technology: Continued advancements in battery technology can address range anxiety and reduce costs.

Growth Accelerators in the Vietnam Electric Vehicle Market Industry

Long-term growth will be fueled by continuous technological advancements, strategic partnerships between domestic and international players, and expansion into untapped markets. Government initiatives to enhance charging infrastructure and streamline regulatory frameworks will also play a crucial role.

Key Players Shaping the Vietnam Electric Vehicle Market Market

- AB Volvo

- Nissan Motor Co Ltd

- Hyundai Motor Company

- Kia Corporation

- Tesla Inc

- Mercedes-Benz Group AG

- Great Wall Motors (Haval Brand)

- Toyota Motor Corporation

- Vinfast Motor Ltd

- Honda Motor Co Ltd

Notable Milestones in Vietnam Electric Vehicle Market Sector

- October 2023: VinFast Auto Ltd launched two variants of the VF 6 EV in Vietnam, including Base and Plus, with a range of 399 km and 381 km respectively.

- November 2023: VinFast Auto Ltd introduced the VF 7, a smart electric SUV with a range of up to 431 km.

In-Depth Vietnam Electric Vehicle Market Market Outlook

The Vietnam EV market holds immense potential for growth in the coming years. Continued technological advancements, supportive government policies, and increasing consumer awareness are expected to drive significant market expansion. Strategic partnerships between domestic and international players will further accelerate market development, opening doors to new opportunities and driving long-term sustainability in the transportation sector. The market is poised for exponential growth, presenting significant opportunities for investors and industry participants alike.

Vietnam Electric Vehicle Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion

- 2.1. Battery Electric Vehicles

- 2.2. Plug-in Hybrid Electric Vehicles

- 2.3. Fuel Cell Electric Vehicles

Vietnam Electric Vehicle Market Segmentation By Geography

- 1. Vietnam

Vietnam Electric Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives are Expected to Enhance the Electric Vehicle Sale

- 3.3. Market Restrains

- 3.3.1. Lack of Charging Stations

- 3.4. Market Trends

- 3.4.1. The Battery Electric Vehicles Segment is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Electric Vehicle Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion

- 5.2.1. Battery Electric Vehicles

- 5.2.2. Plug-in Hybrid Electric Vehicles

- 5.2.3. Fuel Cell Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AB Volv

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Motor Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kia Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tesla Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mercedes-Benz Group AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Great Wall Motors (Haval Brand)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyota Motor Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vinfast Motor Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Honda Motor Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AB Volv

List of Figures

- Figure 1: Vietnam Electric Vehicle Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Electric Vehicle Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 4: Vietnam Electric Vehicle Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Vietnam Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Vietnam Electric Vehicle Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 7: Vietnam Electric Vehicle Market Revenue Million Forecast, by Propulsion 2019 & 2032

- Table 8: Vietnam Electric Vehicle Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Electric Vehicle Market?

The projected CAGR is approximately 18.00%.

2. Which companies are prominent players in the Vietnam Electric Vehicle Market?

Key companies in the market include AB Volv, Nissan Motor Co Ltd, Hyundai Motor Company, Kia Corporation, Tesla Inc, Mercedes-Benz Group AG, Great Wall Motors (Haval Brand), Toyota Motor Corporation, Vinfast Motor Ltd, Honda Motor Co Ltd.

3. What are the main segments of the Vietnam Electric Vehicle Market?

The market segments include Vehicle Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives are Expected to Enhance the Electric Vehicle Sale.

6. What are the notable trends driving market growth?

The Battery Electric Vehicles Segment is Dominating the Market.

7. Are there any restraints impacting market growth?

Lack of Charging Stations.

8. Can you provide examples of recent developments in the market?

November 2023: VinFast Auto Ltd introduced the VF 7, the 6th smart electric SUV in Vietnam. The VF7 is equipped with a 75.3 kWh battery pack and has a range of up to 431 km on a single charge.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Electric Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Electric Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Electric Vehicle Market?

To stay informed about further developments, trends, and reports in the Vietnam Electric Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence