Key Insights

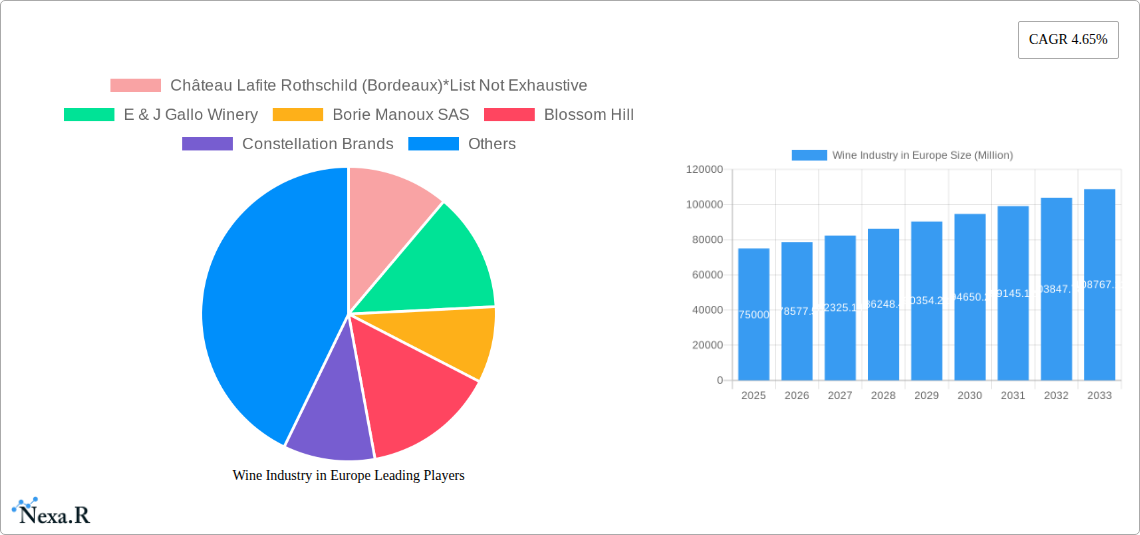

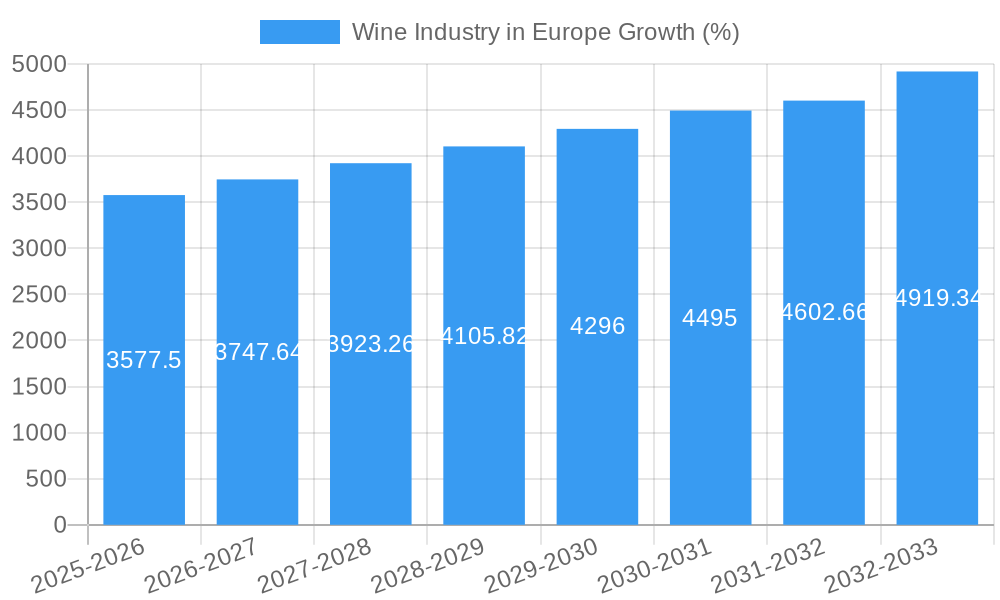

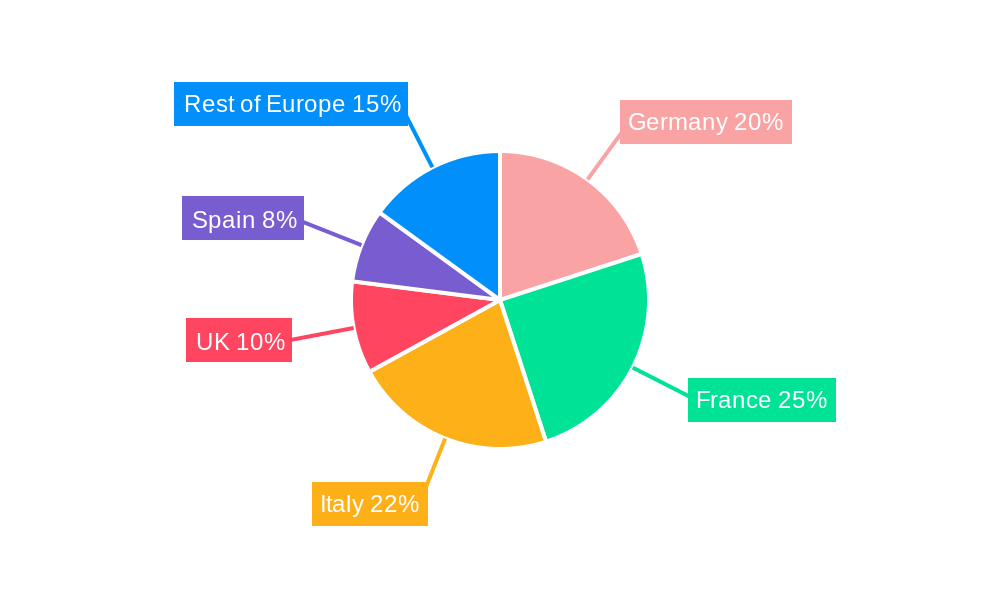

The European wine market, a significant global player, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.65% from 2025 to 2033. This expansion is driven by several factors. Increased consumer disposable incomes across many European nations, particularly in the growing middle class, fuel demand for premium wines. The rising popularity of wine tourism and associated experiences contributes to elevated sales, especially within specific regions renowned for their vintages. Furthermore, evolving consumer preferences towards healthier lifestyle choices, with moderate wine consumption often included, are supporting market growth. The diverse range of wine styles, from classic still wines to sparkling varieties, caters to a broad consumer base. However, certain challenges remain. Fluctuations in grape harvests due to climate change pose a risk to production and pricing stability. Furthermore, increasing competition from other alcoholic beverages and the prevalence of health concerns surrounding excessive alcohol consumption could exert some restraint on market growth. Segmentation analysis reveals that still wine holds the largest market share, followed by sparkling wines. The off-trade channel (e.g., supermarkets, wine shops) dominates distribution, although the on-trade (restaurants, bars) segment is expected to witness gradual recovery and growth post-pandemic. Key players like Château Lafite Rothschild, E & J Gallo Winery, and Constellation Brands compete in this dynamic market, leveraging brand recognition and innovative product offerings. Germany, France, and Italy represent the largest national markets in Europe.

The projected market size for 2025 is estimated to be approximately €X billion (assuming a reasonable market size based on existing market reports and the given CAGR, a figure needs to be found using an external source) Considering the CAGR, the market is expected to surpass €Y billion by 2033. This growth will be propelled by the factors discussed above but also influenced by ongoing developments in consumer preferences (e.g., organic wines, biodynamic wines), evolving distribution channels (e.g., online sales), and the resilience of established brands while new entrants explore niche markets. Geographic variations in consumption patterns and economic conditions across European nations also contribute to market complexity.

Wine Industry in Europe: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the European wine industry, covering market dynamics, growth trends, leading segments, and key players. With a focus on the period 2019-2033 (base year 2025), this report is an essential resource for industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The report incorporates detailed analysis of both parent markets (Wine Industry) and child markets (Red Wine, White Wine, Rose Wine, Sparkling Wine etc). All values are presented in million units.

Wine Industry in Europe Market Dynamics & Structure

The European wine market is characterized by a complex interplay of factors influencing its structure and growth trajectory. Market concentration is moderate, with several large players holding significant shares, yet a substantial presence of smaller, regional producers. Technological innovation, particularly in viticulture and winemaking, is a significant driver, although adoption rates vary across regions and company sizes. Stringent regulatory frameworks concerning labeling, production methods, and alcohol content significantly shape the industry, demanding compliance and potentially hindering rapid expansion for some operators. Furthermore, the market faces competition from alternative beverages (e.g., craft beers, spirits, non-alcoholic drinks), impacting consumer preferences and market share. End-user demographics are critical, with aging populations in some countries influencing consumption patterns, while younger consumers drive demand for new styles and formats. Finally, mergers and acquisitions (M&A) are frequent, leading to market consolidation and shifts in competitive landscape.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Precision viticulture, automated bottling, and advanced winemaking techniques are key drivers. Barriers include high initial investment costs and the need for skilled labor.

- Regulatory Framework: Strict regulations on labeling, sustainable practices, and alcohol content create both opportunities (premiumization) and challenges (compliance costs).

- Competitive Substitutes: Craft beers, spirits, and non-alcoholic beverages pose competitive pressure, especially amongst younger consumers.

- M&A Activity: A high volume of M&A activity (xx deals in the historical period) indicating consolidation and strategic growth among major players.

Wine Industry in Europe Growth Trends & Insights

The European wine market experienced fluctuating growth during the historical period (2019-2024) influenced by factors such as economic conditions, changing consumer preferences, and global events. While precise figures require proprietary data analysis (XXX), we project a compound annual growth rate (CAGR) of xx% from 2025 to 2033, driven primarily by increasing disposable incomes in certain regions and the continued appeal of wine as a beverage for various occasions. Technological disruptions in areas such as sustainable viticulture and precision winemaking are expected to improve production efficiency and product quality, further boosting market growth. Consumer behavior is changing; younger demographics demonstrate a preference for premium wines, organic options, and innovative packaging, influencing product development and marketing strategies. Market penetration rates vary considerably depending on the type of wine and distribution channel, with off-trade showing higher penetration overall.

Dominant Regions, Countries, or Segments in Wine Industry in Europe

France, Italy, and Spain continue to dominate the European wine market, contributing the largest share of total production and export volume (xx million units combined in 2025). However, other regions are experiencing growth, particularly in Eastern Europe. Red wine remains the dominant segment, accounting for xx% of the total market volume in 2025, followed by white and rosé wines. The off-trade channel accounts for the largest share of distribution (xx%), indicating strong demand in supermarkets, specialty stores, and online retailers. Still wine is the most popular type, representing xx% of total consumption.

- France: Strong established vineyards, brand recognition, and consistent quality drive its market leadership.

- Italy: Diverse wine regions, strong domestic consumption, and a focus on regional specialties contribute to its position.

- Spain: High production volumes, competitive pricing, and increasing exports support its market prominence.

- Red Wine: Continued high demand due to versatility and diverse flavor profiles across different varietals.

- Off-Trade Channel: Convenience, wider selection, and competitive pricing drive consumer preference.

- Still Wine: Maintains highest market share owing to its broad appeal and affordability.

Wine Industry in Europe Product Landscape

The European wine market showcases a diverse range of products characterized by both traditional styles and innovative offerings. Recent innovations focus on sustainability, organic production, and unique varietals catering to specific taste preferences. Technological advancements in winemaking processes lead to improved quality control, higher production efficiency, and greater consistency. Unique selling propositions frequently emphasize origin, terroir, and sustainable practices, creating premium options commanding higher prices. The market also sees increasing use of innovative packaging materials and formats.

Key Drivers, Barriers & Challenges in Wine Industry in Europe

Key Drivers:

- Growing consumer disposable incomes: Increased purchasing power, particularly in emerging markets, stimulates wine consumption.

- Evolving consumer preferences: Demand for premium, organic, and specialty wines drives innovation and product diversification.

- Technological advancements: Improved viticulture, winemaking, and packaging techniques contribute to enhanced efficiency and quality.

Key Challenges:

- Climate change: Changing weather patterns pose a significant threat to grape yields and quality, impacting production costs and supply. (xx% reduction in yield predicted in certain regions by 2033)

- Regulatory hurdles: Complex regulations regarding labeling, production methods, and alcohol content can impose significant costs on producers.

- Supply chain disruptions: Global supply chain challenges, logistics costs, and labor shortages impact production and distribution.

Emerging Opportunities in Wine Industry in Europe

- Expansion into premium and organic segments: Rising consumer demand for high-quality and environmentally friendly wines presents lucrative opportunities.

- Focus on younger demographics: Targeting millennials and Gen Z with innovative products and marketing strategies can unlock significant growth potential.

- Direct-to-consumer sales: E-commerce and online wine sales are expanding rapidly, offering new distribution channels and consumer access.

Growth Accelerators in the Wine Industry in Europe Industry

Technological breakthroughs in precision viticulture and sustainable winemaking are pivotal growth accelerators. Strategic partnerships between producers, distributors, and retailers enhance market access and efficiency. Market expansion strategies focusing on emerging markets and niche consumer segments drive long-term growth prospects.

Key Players Shaping the Wine Industry in Europe Market

- Château Lafite Rothschild (Bordeaux)

- E & J Gallo Winery

- Borie Manoux SAS

- Blossom Hill

- Constellation Brands

- Pernod Ricard SA (Brancott)

- Financière Pinault SCA (Groupe Artemis SA)

- Treasury Wine Estates (Wolf Blass)

- Louis Roederer

- Castel Group (Baron de Lestac)

Notable Milestones in Wine Industry in Europe Sector

- July 2022: Pernod Ricard launches a European pilot program for a digital labeling project, enhancing consumer transparency.

- August 2021: Pernod Ricard UK launches a new range of Australian wines, "Cafayate and Leaps & Bounds," targeting a specific consumer segment.

- January 2021: E. & J. Gallo Winery completes the acquisition of over 30 wine brands from Constellation Brands, significantly altering market share dynamics.

In-Depth Wine Industry in Europe Market Outlook

The future of the European wine market is bright, driven by a confluence of factors. Continued consumer demand, coupled with technological innovation, and dynamic adaptation to changing preferences will ensure robust growth. Strategic partnerships, and sustainable practices will be critical for long-term success. New market entrants and diversification strategies will play a crucial role in shaping the competitive landscape, creating diverse and appealing offerings for consumers, and ensuring the continued health of the European wine industry.

Wine Industry in Europe Segmentation

-

1. Product Type

- 1.1. Still Wine

- 1.2. Sparkling Wine

- 1.3. Other Product Types

-

2. Color

- 2.1. Red Wine

- 2.2. Rose Wine

- 2.3. White Wine

- 2.4. Other Wines

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Distribution Channels

Wine Industry in Europe Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. France

- 4. Germany

- 5. Italy

- 6. Rest of Europe

Wine Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Large Vineyard Area is Likely to Drive the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Still Wine

- 5.1.2. Sparkling Wine

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Color

- 5.2.1. Red Wine

- 5.2.2. Rose Wine

- 5.2.3. White Wine

- 5.2.4. Other Wines

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Germany

- 5.4.5. Italy

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Spain Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Still Wine

- 6.1.2. Sparkling Wine

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Color

- 6.2.1. Red Wine

- 6.2.2. Rose Wine

- 6.2.3. White Wine

- 6.2.4. Other Wines

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Still Wine

- 7.1.2. Sparkling Wine

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Color

- 7.2.1. Red Wine

- 7.2.2. Rose Wine

- 7.2.3. White Wine

- 7.2.4. Other Wines

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Still Wine

- 8.1.2. Sparkling Wine

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Color

- 8.2.1. Red Wine

- 8.2.2. Rose Wine

- 8.2.3. White Wine

- 8.2.4. Other Wines

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Still Wine

- 9.1.2. Sparkling Wine

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Color

- 9.2.1. Red Wine

- 9.2.2. Rose Wine

- 9.2.3. White Wine

- 9.2.4. Other Wines

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. On-trade

- 9.3.2. Off-trade

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Specialty Stores

- 9.3.2.3. Online Retail Stores

- 9.3.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Still Wine

- 10.1.2. Sparkling Wine

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Color

- 10.2.1. Red Wine

- 10.2.2. Rose Wine

- 10.2.3. White Wine

- 10.2.4. Other Wines

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. On-trade

- 10.3.2. Off-trade

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Specialty Stores

- 10.3.2.3. Online Retail Stores

- 10.3.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Still Wine

- 11.1.2. Sparkling Wine

- 11.1.3. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by Color

- 11.2.1. Red Wine

- 11.2.2. Rose Wine

- 11.2.3. White Wine

- 11.2.4. Other Wines

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. On-trade

- 11.3.2. Off-trade

- 11.3.2.1. Supermarkets/Hypermarkets

- 11.3.2.2. Specialty Stores

- 11.3.2.3. Online Retail Stores

- 11.3.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Germany Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Wine Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 E & J Gallo Winery

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Borie Manoux SAS

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Blossom Hill

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Constellation Brands

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Pernod Ricard SA (Brancott)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Financière Pinault SCA (Groupe Artemis SA)

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Treasury Wine Estates (Wolf Blass)

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Louis Roederer

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Castel Group (Baron de Lestac)

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Château Lafite Rothschild (Bordeaux)*List Not Exhaustive

List of Figures

- Figure 1: Wine Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Wine Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 4: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Wine Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Wine Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 16: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 20: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 24: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 28: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 32: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Wine Industry in Europe Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Wine Industry in Europe Revenue Million Forecast, by Color 2019 & 2032

- Table 36: Wine Industry in Europe Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Wine Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wine Industry in Europe?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Wine Industry in Europe?

Key companies in the market include Château Lafite Rothschild (Bordeaux)*List Not Exhaustive, E & J Gallo Winery, Borie Manoux SAS, Blossom Hill, Constellation Brands, Pernod Ricard SA (Brancott), Financière Pinault SCA (Groupe Artemis SA), Treasury Wine Estates (Wolf Blass), Louis Roederer, Castel Group (Baron de Lestac).

3. What are the main segments of the Wine Industry in Europe?

The market segments include Product Type, Color, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Large Vineyard Area is Likely to Drive the Market in the Region.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

Pernod Ricard has announced the launch of a digital labeling project that will cover its entire portfolio, including wine and spirits. The project, under which every bottle of Pernod Ricard's products carries its QR code on the back label, is being implemented to provide consumers with more transparency on ingredient and health information. According to Pernod Richard, a European pilot program for the digital label solution will begin in July 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wine Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wine Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wine Industry in Europe?

To stay informed about further developments, trends, and reports in the Wine Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence