Key Insights

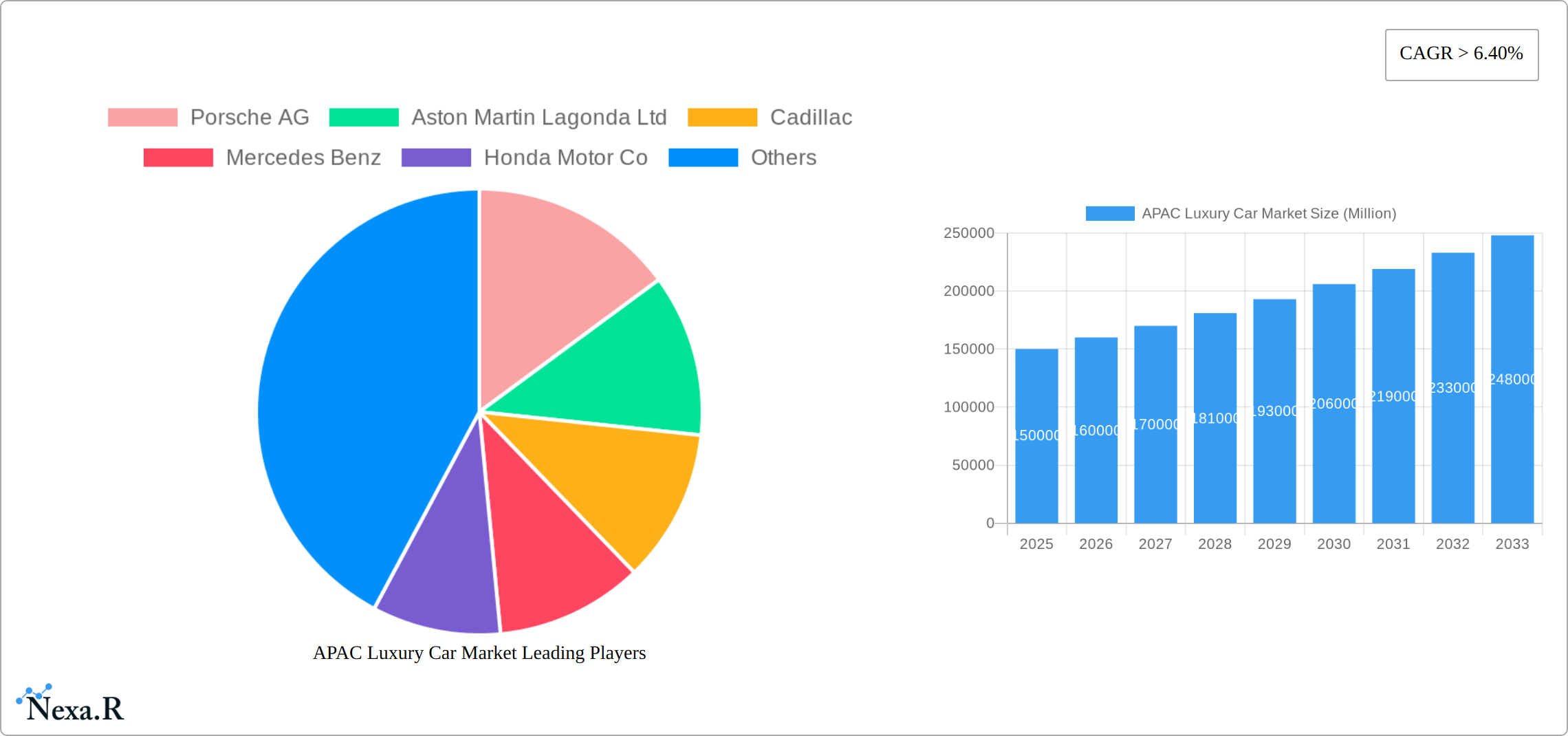

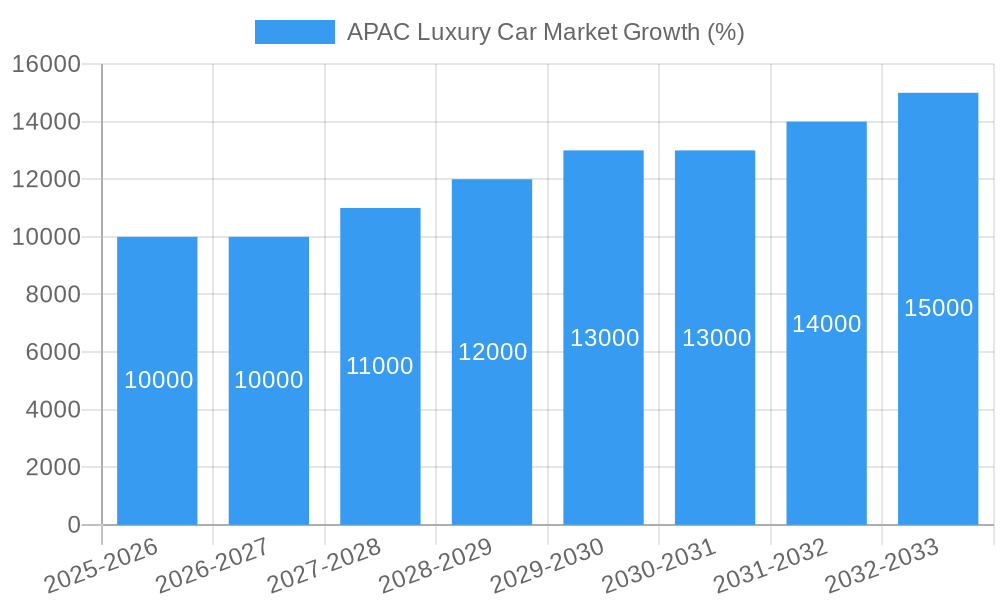

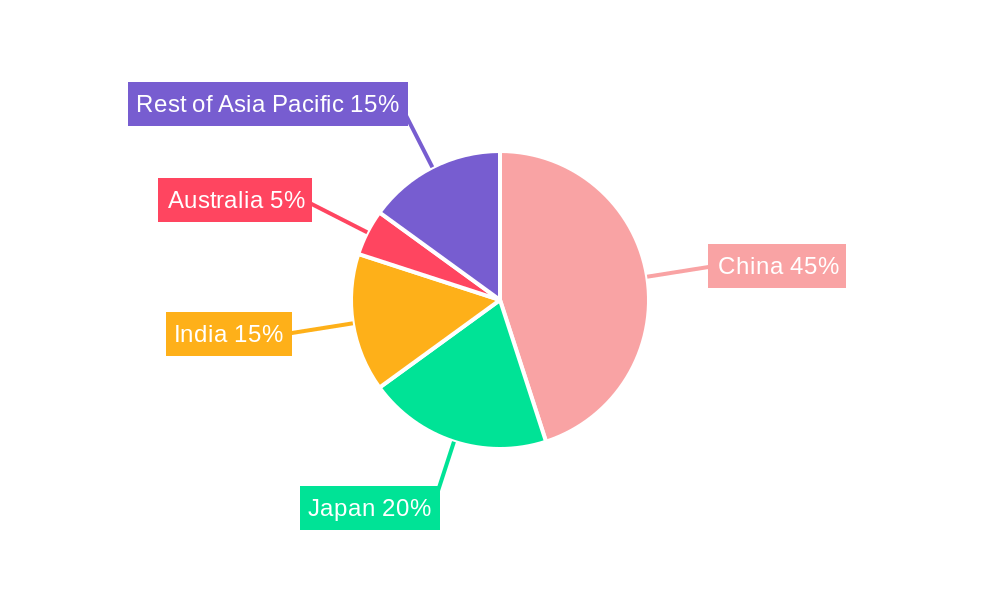

The Asia-Pacific (APAC) luxury car market is experiencing robust growth, driven by rising disposable incomes, a burgeoning middle class, and a preference for premium vehicles among affluent consumers. The market's Compound Annual Growth Rate (CAGR) exceeding 6.40% from 2019-2024 indicates a significant expansion. Key growth drivers include increasing urbanization, a desire for enhanced status symbols, and technological advancements in luxury vehicles, such as advanced driver-assistance systems (ADAS) and electrification. China, Japan, and India are major contributors to this market, with China expected to maintain its leading position due to its large and increasingly affluent population. However, economic fluctuations and government regulations regarding emissions and fuel efficiency could pose challenges to sustained growth. The market is segmented by vehicle type (hatchback, sedan, SUV) and drive type (internal combustion engine (ICE), electric), reflecting consumer preferences and technological shifts. The electric vehicle (EV) segment is expected to witness accelerated growth, propelled by government incentives and increasing environmental awareness, although ICE vehicles will likely remain dominant in the near term. Competition is fierce, with established players like Porsche, BMW, Mercedes-Benz, and Toyota vying for market share alongside emerging Chinese luxury brands like Hongqi. The forecast period (2025-2033) suggests continued expansion, with the SUV segment expected to retain its popularity, particularly in emerging markets. The market's success hinges on factors like consistent economic growth, successful navigation of regulatory hurdles, and the ability of manufacturers to meet the evolving demands of discerning luxury car buyers. This includes providing innovative features, personalized experiences, and sustainable solutions.

The competitive landscape is highly dynamic, with both established international brands and emerging domestic players vying for market dominance. The success of individual manufacturers depends on factors such as brand image, product innovation, effective marketing strategies, and adaptability to changing consumer preferences. Furthermore, the availability and affordability of financing options will play a significant role in influencing consumer purchasing decisions. While the forecast indicates positive growth, manufacturers must remain vigilant in addressing potential challenges like supply chain disruptions, geopolitical instability, and the unpredictable nature of global economic conditions. Successful navigation of these factors will be critical in securing long-term profitability and market leadership in the lucrative APAC luxury car market. Analyzing the market across key countries like China, Japan, and India will provide granular insights into unique consumer behaviors and localized market dynamics, allowing for targeted marketing and product development strategies.

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) luxury car market, covering the period from 2019 to 2033. It meticulously examines market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis and expert forecasts to illuminate current market conditions and predict future trajectories. The base year for this analysis is 2025, with the forecast period spanning 2025-2033 and the historical period encompassing 2019-2024. Market size is expressed in million units.

APAC Luxury Car Market Dynamics & Structure

This section delves into the intricate structure of the APAC luxury car market, analyzing market concentration, technological innovation, regulatory landscapes, competitive dynamics, and evolving consumer demographics. We examine the influence of mergers and acquisitions (M&A) activities, providing quantitative insights into market share distribution among key players and the volume of M&A deals.

- Market Concentration: The APAC luxury car market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share. (Specific market share percentages will be detailed in the full report).

- Technological Innovation: Technological advancements, particularly in electric vehicle (EV) technology and autonomous driving systems, are major drivers of market transformation. (Further details on specific innovations and their impact will be provided).

- Regulatory Frameworks: Government regulations concerning emission standards and safety features significantly impact market dynamics. (Specific examples of regulations and their consequences will be analyzed).

- Competitive Landscape: Intense competition among established luxury car brands and the emergence of new EV players create a dynamic and evolving competitive landscape. (Detailed competitive analysis, including SWOT analysis of major players, will be included).

- End-User Demographics: The rising affluence of the middle class and changing consumer preferences are shaping demand for luxury vehicles in the APAC region. (Detailed demographic analysis including age, income, and lifestyle preferences of target customers).

- M&A Trends: The APAC luxury car market has witnessed a notable number of M&A activities in recent years, driven by strategic expansion and technological collaborations. (Specific examples of M&A deals and their impact will be presented, along with projected deal volume for the forecast period).

APAC Luxury Car Market Growth Trends & Insights

This section analyzes the historical and projected growth of the APAC luxury car market, providing detailed insights into market size evolution, adoption rates across various segments, technological disruptions, and shifting consumer behavior. We will present specific metrics like compound annual growth rate (CAGR) and market penetration rates to provide a nuanced understanding of market growth trajectories.

(This section will contain a detailed 600-word analysis leveraging market research data and expert forecasts. It will include specific data points, CAGR, and penetration rates for various segments such as electric vehicles, SUVs, and sedans across major APAC countries).

Dominant Regions, Countries, or Segments in APAC Luxury Car Market

This section identifies the leading regions, countries, and segments within the APAC luxury car market, providing in-depth analysis of their dominance factors and growth potential. Key drivers, such as economic policies, infrastructure development, and consumer preferences, will be highlighted.

- By Vehicle Type: (Analysis of market share and growth for Hatchback, Sedan, SUV segments. The dominant segment will be identified with justifications.)

- By Drive Type: (Analysis of market share and growth for IC Engine and Electric vehicles. The dominant segment will be identified with justifications. Projected growth of EV segment will be thoroughly discussed).

- Dominant Regions/Countries: (Detailed analysis of top-performing countries within APAC, highlighting their unique market dynamics and growth drivers). (Examples: China, Japan, South Korea, Australia).

(This section will contain a detailed 600-word analysis identifying the leading region/country/segment and justifying its dominance with data-driven insights, including market share, growth potential, and driving factors.)

APAC Luxury Car Market Product Landscape

This section provides an overview of the product innovations, applications, and performance metrics characterizing the APAC luxury car market. We will highlight unique selling propositions (USPs) and technological advancements that are shaping the competitive landscape.

(This section will contain a 100-150 word paragraph detailing key product innovations, technological advancements, and applications within the APAC luxury car market).

Key Drivers, Barriers & Challenges in APAC Luxury Car Market

This section identifies the key factors driving market growth and the challenges hindering its expansion.

Key Drivers:

- Technological advancements (e.g., electric and hybrid powertrains, autonomous driving features).

- Rising disposable incomes and a growing middle class in several APAC countries.

- Favorable government policies promoting sustainable transportation.

(This section will contain a 150-word analysis).

Key Barriers and Challenges:

- Supply chain disruptions and component shortages.

- Stringent emission regulations and their impact on production costs.

- Intense competition from both established and new entrants.

(This section will contain a 150-word analysis, providing quantified impacts where possible).

Emerging Opportunities in APAC Luxury Car Market

This section highlights emerging trends and untapped opportunities within the APAC luxury car market.

- Growth of the electric vehicle (EV) segment.

- Increasing demand for luxury SUVs and crossovers.

- Expansion into less penetrated markets within APAC.

(This section will contain a 150-word analysis of emerging opportunities, emphasizing areas with high growth potential).

Growth Accelerators in the APAC Luxury Car Market Industry

This section explores the key catalysts driving long-term growth in the APAC luxury car market.

(This section will contain a 150-word paragraph analyzing growth accelerators, including technological innovations, strategic partnerships, and market expansion initiatives).

Key Players Shaping the APAC Luxury Car Market Market

- Porsche AG

- Aston Martin Lagonda Ltd

- Cadillac

- Mercedes Benz

- Honda Motor Co

- Bayerische Motoren Werke AG (BMW)

- Volvo Group

- Hongqi (FAW Group)

- Jaguar Land Rover

- Tesla Inc

- The Lincoln Motor Company

- Rolls-Royce Motor Cars Limited

- Audi AG

- Nissan

- Bentley Motors

Notable Milestones in APAC Luxury Car Market Sector

(This section will contain a bullet-point list of notable milestones, including product launches, mergers, and acquisitions, with associated dates and descriptions of their impact on market dynamics).

In-Depth APAC Luxury Car Market Outlook

(This section will contain a 150-word summary of growth accelerators, focusing on the future market potential and strategic opportunities within the APAC luxury car market).

APAC Luxury Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

APAC Luxury Car Market Segmentation By Geography

-

1. By Country

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

APAC Luxury Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. High Net Worth Individuals Expected to Be the Prominent Customers for Luxury Car

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. By Country

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 8. India APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 9. Australia APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 10. Rest of Asia Pacific APAC Luxury Car Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Porsche AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aston Martin Lagonda Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cadillac

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mercedes Benz

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Honda Motor Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bayerische Motoren Werke AG (BMW)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volvo Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hongqi (FAW Group)*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaguar Land Rover

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tesla Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Lincoln Motor Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Rolls-Royce Motor Cars Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Audi AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nissan

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Bentley Motors

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Porsche AG

List of Figures

- Figure 1: APAC Luxury Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: APAC Luxury Car Market Share (%) by Company 2024

List of Tables

- Table 1: APAC Luxury Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: APAC Luxury Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: APAC Luxury Car Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 4: APAC Luxury Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: APAC Luxury Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Australia APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: APAC Luxury Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: APAC Luxury Car Market Revenue Million Forecast, by Drive Type 2019 & 2032

- Table 13: APAC Luxury Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Australia APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Asia Pacific APAC Luxury Car Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Luxury Car Market?

The projected CAGR is approximately > 6.40%.

2. Which companies are prominent players in the APAC Luxury Car Market?

Key companies in the market include Porsche AG, Aston Martin Lagonda Ltd, Cadillac, Mercedes Benz, Honda Motor Co, Bayerische Motoren Werke AG (BMW), Volvo Group, Hongqi (FAW Group)*List Not Exhaustive, Jaguar Land Rover, Tesla Inc, The Lincoln Motor Company, Rolls-Royce Motor Cars Limited, Audi AG, Nissan, Bentley Motors.

3. What are the main segments of the APAC Luxury Car Market?

The market segments include Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

High Net Worth Individuals Expected to Be the Prominent Customers for Luxury Car.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Luxury Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Luxury Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Luxury Car Market?

To stay informed about further developments, trends, and reports in the APAC Luxury Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence