Key Insights

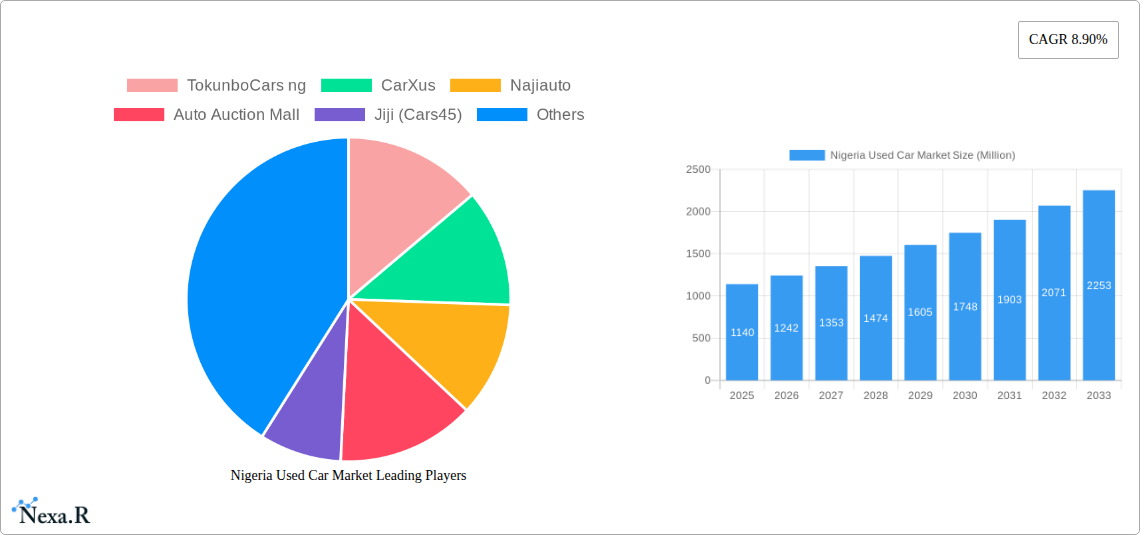

The Nigerian used car market, valued at $1.14 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8.90% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization and a burgeoning middle class are driving demand for personal transportation, with used cars offering a more affordable entry point than new vehicles. The preference for SUVs and MPVs, reflecting a need for spacious vehicles suitable for families and diverse terrains, significantly impacts market segmentation. The presence of both organized and unorganized sales channels caters to varying consumer preferences and budgets, while the availability of diverse fuel options—petrol, diesel, electric, and others—provides flexibility. However, challenges remain, including the prevalence of vehicle import restrictions and the condition of many used cars. Government regulations aiming to improve vehicle quality and safety standards, as well as initiatives promoting eco-friendly transportation, will influence market dynamics in the coming years.

Nigeria Used Car Market Market Size (In Billion)

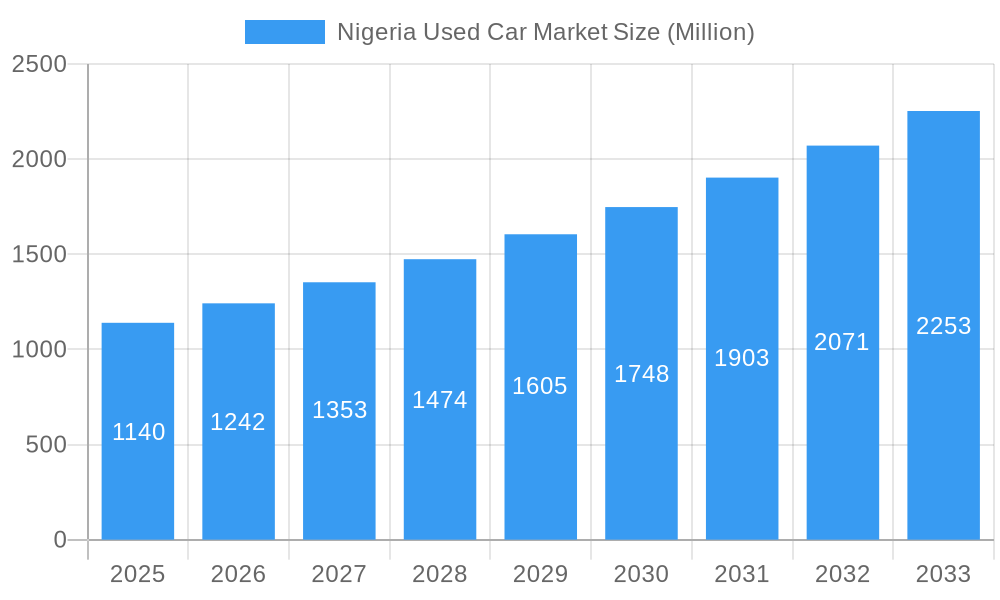

The competitive landscape is characterized by a mix of established online platforms like CarXus and Jiji (Cars45), and numerous smaller dealerships and individual sellers operating offline. These businesses cater to a wide range of customer needs and budgets, contributing to the market's dynamism. Growth strategies often involve enhancing online presence and improving customer service, while also focusing on expanding into underserved regions. The market's future trajectory hinges on the successful integration of technology, the implementation of stricter quality controls, and continued economic growth within Nigeria. Strategies addressing challenges related to vehicle maintenance, financing options, and consumer education will be critical for sustained market expansion and the overall development of the Nigerian automotive sector.

Nigeria Used Car Market Company Market Share

Nigeria Used Car Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Nigeria used car market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This analysis is crucial for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The report segments the market by vehicle type (Hatchbacks, Sedans, SUVs/MPVs), vendor type (Organized, Unorganized), fuel type (Petrol, Diesel, Electric, Others), and sales channel (Online, Offline), providing a granular understanding of the market landscape.

Nigeria Used Car Market Market Dynamics & Structure

The Nigerian used car market is characterized by a fragmented structure with a mix of organized and unorganized players. Market concentration is relatively low, with no single dominant player commanding a significant share. However, the emergence of online platforms and organized dealerships is gradually altering this landscape. Technological innovations, such as online marketplaces and digital financing options, are driving significant market growth. The regulatory framework remains a key factor, impacting both market entry and operations. Competition from new and certified pre-owned cars serves as a significant substitute. The end-user demographics are diverse, ranging from individuals to businesses, with varying needs and purchasing power. Significant M&A activity has recently been observed, signaling industry consolidation and investment interest.

- Market Concentration: Low, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Online platforms, digital financing, and mobile apps are driving accessibility and market expansion.

- Regulatory Framework: Government policies on vehicle importation and licensing influence market dynamics.

- Competitive Substitutes: New and certified pre-owned vehicles pose a competitive threat.

- End-User Demographics: Primarily individual buyers, with growing business segment interest in fleet vehicles.

- M&A Trends: Significant increase in M&A activities since 2022, with xx deals recorded in 2023.

Nigeria Used Car Market Growth Trends & Insights

The Nigerian used car market has experienced substantial growth during the historical period (2019-2024), driven by factors such as rising population, increasing urbanization, and a growing middle class. The market size is estimated at xx Million units in 2025, exhibiting a CAGR of xx% during the historical period. Technological disruptions, such as the rise of online marketplaces, have significantly accelerated market adoption. Consumer behavior shifts towards online purchasing and financing options are further fueling this growth. The forecast period (2025-2033) anticipates continued growth, driven by sustained economic development and expanding infrastructure. Market penetration is expected to reach xx% by 2033.

(Note: XXX refers to specific data sources and analytical models used to arrive at the quantitative insights provided. Detailed methodology will be included in the full report.)

Dominant Regions, Countries, or Segments in Nigeria Used Car Market

Lagos and Abuja, as the largest cities in Nigeria, represent the most significant regional markets, accounting for approximately xx% of total sales in 2025. The SUV/MPV segment dominates by vehicle type, driven by the preference for larger vehicles and family needs. The organized vendor segment is growing steadily, with online sales channels exhibiting the fastest growth. Petrol remains the dominant fuel type, although a gradual shift toward diesel vehicles is observable within commercial segments. Economic growth and favorable government policies contribute to regional dominance.

- Key Drivers: Urbanization, rising incomes, increasing demand for personal mobility, and the growth of online sales channels.

- Dominance Factors: Population density, economic activity, infrastructure development, and consumer preferences.

- Growth Potential: Significant potential for growth in less developed regions, particularly with improved infrastructure.

- Market Share: Lagos and Abuja hold the largest market share, followed by other major cities.

Nigeria Used Car Market Product Landscape

The Nigerian used car market offers a diverse range of vehicles, from compact hatchbacks to larger SUVs. Product innovation focuses on improving vehicle quality, offering extended warranties, and enhancing online platforms for seamless customer experiences. Technological advancements, such as the integration of telematics systems, are enhancing vehicle safety and management. Key selling propositions include affordability, financing options, and post-sale services.

Key Drivers, Barriers & Challenges in Nigeria Used Car Market

Key Drivers: Rising disposable incomes, increasing urbanization, limited access to new vehicles, and expansion of online marketplaces all drive market growth. Government initiatives focusing on infrastructural development further amplify this growth.

Challenges: Counterfeit parts, lack of standardized vehicle inspection, inadequate financing options in certain segments, and concerns regarding vehicle history and authenticity pose significant challenges to market expansion. Supply chain disruptions from global events also impact availability and pricing. The informal market continues to present a regulatory challenge.

Emerging Opportunities in Nigeria Used Car Market

Untapped markets in rural areas present significant growth opportunities. Expansion of financing options for low-income consumers could significantly boost market penetration. The rise of online platforms coupled with stringent quality standards will further reshape the market, presenting opportunities for players prioritizing credibility and transparency.

Growth Accelerators in the Nigeria Used Car Market Industry

Technological advancements, specifically mobile-first solutions and fintech integration, are pivotal in boosting market expansion. Strategic partnerships between online platforms and financial institutions will expand access to credit and lower barriers to entry for potential buyers. Government regulations supporting fair market practices and standardizing quality checks will drive sustainable growth.

Key Players Shaping the Nigeria Used Car Market Market

- TokunboCars ng

- CarXus

- Najiauto

- Auto Auction Mall

- Jiji (Cars45)

- Betacar

- NigeriaCarMar

- BuyCars ng

- OList

- Carmart

- Spicyauto

- Autochek Africa

Notable Milestones in Nigeria Used Car Market Sector

- July 2023: Carloha Nigeria opens new outlet in Lagos, partnering with HD Motors.

- April 2023: Autochek acquires majority stake in AutoTager (Egypt).

- July 2022: CFAO Motors partners with Autochek for Suzuki car financing.

In-Depth Nigeria Used Car Market Market Outlook

The Nigerian used car market is poised for continued growth driven by favorable demographics, economic expansion, and technological advancements. Strategic investments in technology, infrastructure, and financing solutions will unlock significant opportunities. Players focusing on transparency, quality assurance, and customer experience will gain a competitive advantage in this dynamic market. The projected market size for 2033 is estimated at xx Million units, reflecting robust future growth potential.

Nigeria Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedans

- 1.3. Sports U

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types (LPG, CNG, etc.)

-

4. Sales Channel

- 4.1. Online

- 4.2. Offline

Nigeria Used Car Market Segmentation By Geography

- 1. Niger

Nigeria Used Car Market Regional Market Share

Geographic Coverage of Nigeria Used Car Market

Nigeria Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Digital Technologies; Others

- 3.3. Market Restrains

- 3.3.1. Increasing Used Car Prices due to the Hike in Import Duty

- 3.4. Market Trends

- 3.4.1. Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedans

- 5.1.3. Sports U

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types (LPG, CNG, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TokunboCars ng

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CarXus

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Najiauto

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Auto Auction Mall

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jiji (Cars45)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Betacar

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NigeriaCarMar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BuyCars ng

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OList

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Carmart

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Spicyauto

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Autochek Africa

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 TokunboCars ng

List of Figures

- Figure 1: Nigeria Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Nigeria Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Nigeria Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Nigeria Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Nigeria Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Nigeria Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Nigeria Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Nigeria Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 8: Nigeria Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 9: Nigeria Used Car Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Nigeria Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Used Car Market?

The projected CAGR is approximately 8.90%.

2. Which companies are prominent players in the Nigeria Used Car Market?

Key companies in the market include TokunboCars ng, CarXus, Najiauto, Auto Auction Mall, Jiji (Cars45), Betacar, NigeriaCarMar, BuyCars ng, OList, Carmart, Spicyauto, Autochek Africa.

3. What are the main segments of the Nigeria Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Digital Technologies; Others.

6. What are the notable trends driving market growth?

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market.

7. Are there any restraints impacting market growth?

Increasing Used Car Prices due to the Hike in Import Duty.

8. Can you provide examples of recent developments in the market?

July 2023: Carloha Nigeria, a global automobile company that specializes in sales and services of quality used vehicles, opened an HD Autos outlet, a new automobile shop in Lagos, Nigeria, to offer a wide range of reliable and stylish used vehicles to customers willing to purchase a used vehicle. Further, to enhance this venture further, Carloha Nigeria partnered with HD Motors, a renowned name in the automotive industry, known for its high-quality vehicles and exceptional customer service, to strengthen its presence in the used car market in Nigeria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Used Car Market?

To stay informed about further developments, trends, and reports in the Nigeria Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence