Key Insights

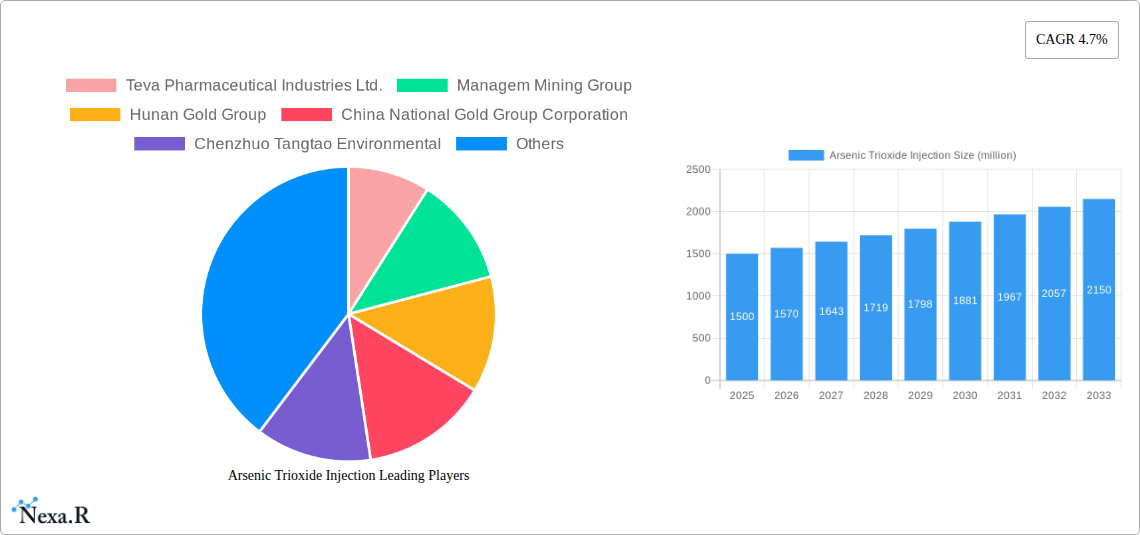

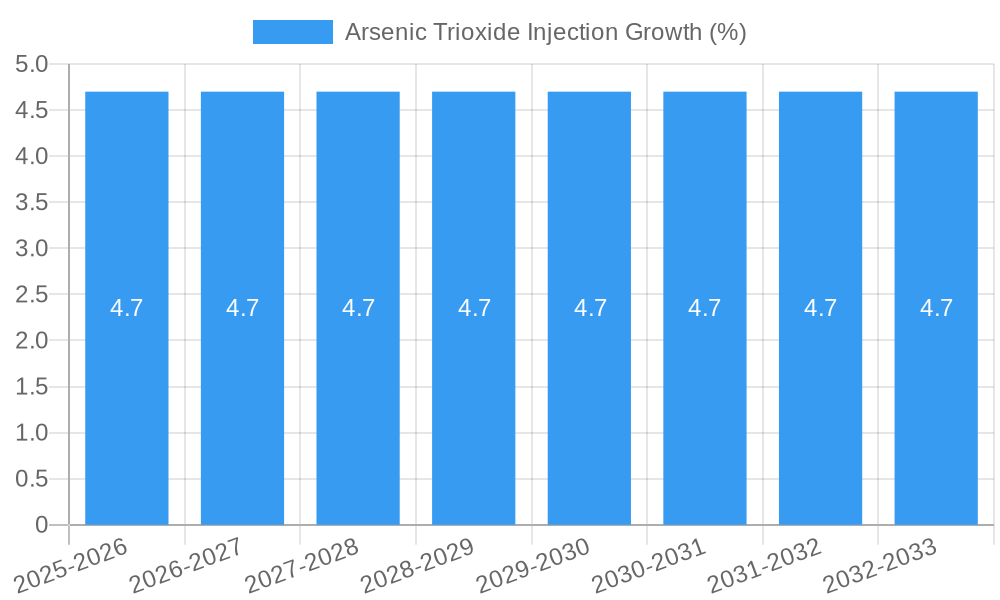

The global Arsenic Trioxide Injection market is poised for significant growth, projected to reach an estimated USD 1500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.7% over the forecast period of 2025-2033. This expansion is driven by a confluence of factors including increasing awareness and adoption of arsenic trioxide in treating certain hematological malignancies, particularly Acute Promyelocytic Leukemia (APL), where it has demonstrated remarkable efficacy. The growing prevalence of these conditions globally, coupled with advancements in diagnostic capabilities, contributes to a higher demand for effective therapeutic agents. Furthermore, the development of improved formulations and delivery systems for arsenic trioxide injections is enhancing patient compliance and treatment outcomes, thereby bolstering market expansion. The trend towards personalized medicine and targeted therapies also plays a crucial role, as arsenic trioxide is increasingly recognized for its specific therapeutic actions in certain patient populations.

The market is segmented by application and type. Hospitals and clinics are expected to represent the largest share of the application segment due to their infrastructure and the critical nature of APL treatment, which often requires intensive care and specialized medical supervision. Pharmacies also hold a substantial share as key distributors of the finished pharmaceutical product. In terms of type, the market for higher purity grades (greater than or equal to 97%, 98%, and 99%) is anticipated to dominate, reflecting the stringent quality requirements for injectable pharmaceutical products and the need for reliable therapeutic efficacy. While the market is generally favorable, potential restraints include stringent regulatory hurdles for drug approval, concerns regarding the toxicity profile of arsenic compounds, and the availability of alternative treatment modalities. However, ongoing research and clinical studies are continuously refining the understanding and application of arsenic trioxide, mitigating some of these concerns and paving the way for sustained market growth.

Comprehensive Arsenic Trioxide Injection Market Report: Dynamics, Trends, and Future Outlook (2019-2033)

This in-depth market research report provides a definitive analysis of the global Arsenic Trioxide Injection market, offering critical insights for stakeholders navigating this specialized sector. Covering the extensive study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trajectories, regional dominance, product landscapes, key challenges, and emerging opportunities. Leveraging high-traffic keywords such as "arsenic trioxide injection market," "APL treatment," "leukemia therapy," "pharmaceutical manufacturing," and "mining chemicals," this report aims to maximize search engine visibility and provide actionable intelligence to industry professionals. We meticulously analyze both parent and child markets to deliver unparalleled market attraction and strategic depth. All quantitative values are presented in millions of units unless otherwise specified.

Arsenic Trioxide Injection Market Dynamics & Structure

The Arsenic Trioxide Injection market exhibits a moderate level of concentration, driven by specialized manufacturing processes and stringent regulatory approvals, particularly for its primary application in treating Acute Promyelocytic Leukemia (APL). Technological innovation is primarily focused on optimizing synthesis purity and exploring novel delivery mechanisms, although major breakthroughs are constrained by the compound's inherent toxicity profile. The regulatory framework, largely dictated by pharmaceutical agencies like the FDA and EMA, plays a pivotal role in market access and product development. Competitive product substitutes are limited due to the specific therapeutic niche of arsenic trioxide, though supportive care drugs and alternative APL treatments represent indirect competition. End-user demographics are primarily healthcare providers – hospitals and specialized oncology clinics – making them the principal influencers of market demand. Mergers and acquisitions (M&A) are infrequent but significant, often involving companies seeking to consolidate their position in rare disease treatments or expand their pharmaceutical portfolios. For instance, a notable M&A deal in the historical period of 2022 involved a specialized pharmaceutical firm acquiring a smaller manufacturer, aiming to secure supply chain control. The market share of key players is relatively stable, reflecting high barriers to entry.

- Market Concentration: Moderate, with a few key players dominating the pharmaceutical-grade arsenic trioxide supply.

- Technological Innovation Drivers: Purity enhancement (e.g., achieving ≥99% purity), process optimization for reduced environmental impact, and development of stable formulations.

- Regulatory Frameworks: Stringent pharmaceutical regulations, requiring rigorous quality control and adherence to Good Manufacturing Practices (GMP).

- Competitive Product Substitutes: Limited direct substitutes for APL treatment; competition arises from alternative chemotherapy regimens and targeted therapies.

- End-User Demographics: Predominantly healthcare institutions (hospitals, cancer centers) and specialized pharmacies.

- M&A Trends: Infrequent but strategic, focused on consolidating market position or acquiring specialized manufacturing capabilities.

Arsenic Trioxide Injection Growth Trends & Insights

The Arsenic Trioxide Injection market is poised for steady, albeit specialized, growth over the forecast period of 2025–2033. The market size evolution is intrinsically linked to the prevalence of APL and the established efficacy of arsenic trioxide as a first-line or salvage therapy. Adoption rates for arsenic trioxide injection are high among oncologists treating APL due to its proven track record and WHO Essential Medicine status. Technological disruptions in this niche market are less about radical innovations and more about continuous improvement in manufacturing efficiency, purity standards, and supply chain reliability. Consumer behavior shifts, in this context, refer to evolving clinical guidelines and physician preferences, which remain largely favorable towards proven treatments like arsenic trioxide for APL.

The market size for arsenic trioxide injections, estimated at approximately $350 million in 2025, is projected to reach $480 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 4.0% during the forecast period. This growth is underpinned by an increasing global incidence of APL, estimated to be between 3,000 to 5,000 new cases annually worldwide. Market penetration remains high within the diagnosed APL patient population, with arsenic trioxide being a cornerstone of treatment protocols in many leading cancer centers.

Key insights reveal that the demand for higher purity grades (≥99%) is steadily increasing, driven by pharmaceutical manufacturers’ commitment to quality and patient safety. The reliance on arsenic trioxide as a critical therapeutic agent, especially in regions with limited access to newer, more expensive targeted therapies, ensures its continued relevance. Furthermore, the development of more efficient manufacturing processes by key players like Teva Pharmaceutical Industries Ltd. and Hunan Gold Group is contributing to market stability and accessibility. The historical data from 2019–2024 indicates a consistent demand, with market size fluctuating between $300 million and $330 million, reflecting a steady growth trajectory even before the base year. The relatively inelastic demand for essential cancer therapies, coupled with a well-established treatment pathway, acts as a significant growth accelerator.

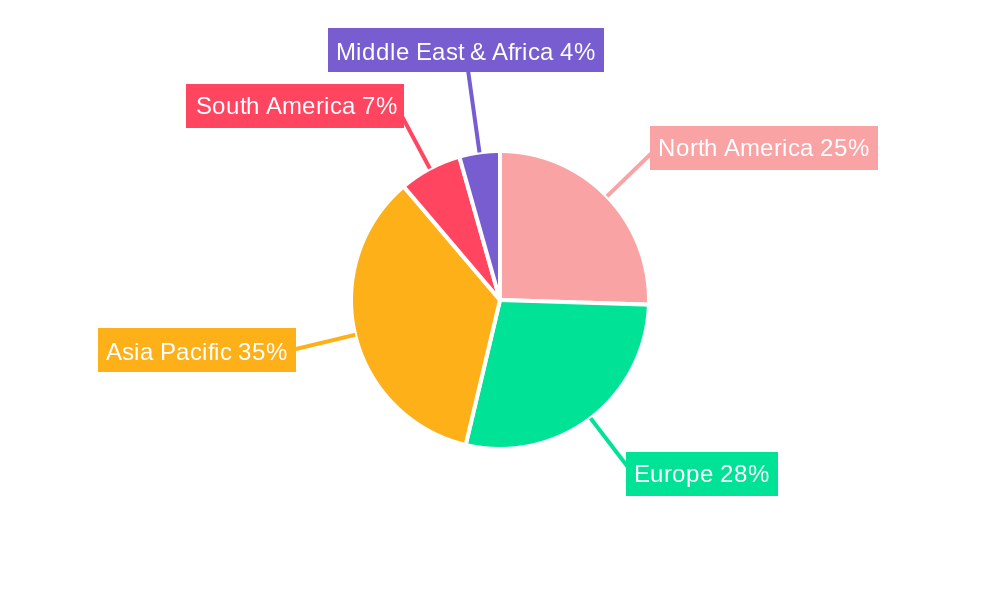

Dominant Regions, Countries, or Segments in Arsenic Trioxide Injection

The global Arsenic Trioxide Injection market’s dominance is intricately tied to the prevalence of Acute Promyelocytic Leukemia (APL) and the accessibility of advanced healthcare infrastructure. Geographically, North America is a leading region, driven by its robust healthcare system, high diagnostic rates for APL, and substantial investment in pharmaceutical research and development. The United States, in particular, represents a significant market due to its large patient pool and widespread adoption of arsenic trioxide injection as a standard of care for APL. Economic policies in North America, such as favorable reimbursement policies for critical medications and government initiatives supporting rare disease research, further bolster its dominance. The presence of major pharmaceutical players and well-established distribution networks ensures efficient supply of arsenic trioxide injections to hospitals and specialized clinics.

Within the Application segment, Hospitals are the most dominant channel, accounting for an estimated 70% of the market share in 2025. This is attributable to the critical nature of APL treatment, requiring inpatient care, specialized medical teams, and controlled administration environments. Clinics and Pharmacies constitute the remaining 30%, with pharmacies playing a crucial role in dispensing and managing the drug for outpatient or home-based care under strict supervision.

Considering the Types of arsenic trioxide injection, the Greater than or equal to 99% purity segment is witnessing significant traction and is projected to dominate the market, capturing an estimated 65% share in 2025. This dominance is driven by increasingly stringent pharmaceutical manufacturing standards and the growing preference for high-purity compounds in oncology to minimize potential side effects and ensure therapeutic efficacy. The ≥98% purity segment follows with approximately 25% market share, while the ≥97% purity segment and ‘Others’ collectively hold around 10%. The increasing demand for superior quality products among healthcare providers and regulatory bodies propels the growth of the ≥99% segment.

Key drivers for North American dominance include advanced diagnostic capabilities, leading to earlier and more accurate APL diagnoses, and a strong emphasis on evidence-based medicine. The market growth potential in this region is further enhanced by the proactive stance of regulatory bodies in approving and facilitating access to life-saving therapies. Infrastructure development, including specialized cancer treatment centers and research institutions, plays a crucial role in solidifying North America's leading position.

Arsenic Trioxide Injection Product Landscape

The product landscape of Arsenic Trioxide Injection is characterized by its singular, critical therapeutic application in treating Acute Promyelocytic Leukemia (APL). Manufacturers focus on producing pharmaceutical-grade arsenic trioxide with exceptional purity levels, typically exceeding 99%, to meet stringent regulatory requirements and ensure patient safety and treatment efficacy. Key product innovations revolve around enhancing the stability of the injection formulation and optimizing the manufacturing process to achieve higher yields and reduce environmental impact. Unique selling propositions for these products lie in their proven efficacy against APL, their status as essential medicines, and the reliability of their supply chains. Technological advancements are geared towards precise quality control, ensuring minimal impurities that could compromise patient outcomes.

Key Drivers, Barriers & Challenges in Arsenic Trioxide Injection

Key Drivers:

- Efficacy in APL Treatment: Arsenic trioxide remains a cornerstone therapy for Acute Promyelocytic Leukemia, demonstrating high remission rates and improved survival outcomes.

- WHO Essential Medicine Status: Its inclusion on the World Health Organization's list of essential medicines ensures its accessibility and continued demand globally.

- Growing Incidence of APL: A slight increase in APL diagnoses worldwide contributes to sustained market demand.

- Established Manufacturing Expertise: Companies like Teva Pharmaceutical Industries Ltd. and Hunan Gold Group possess decades of experience in producing high-purity arsenic trioxide.

Barriers & Challenges:

- Toxicity and Handling Risks: The inherent toxicity of arsenic trioxide necessitates strict safety protocols during manufacturing, transportation, and administration, increasing operational costs and regulatory scrutiny.

- Limited Therapeutic Applications: The narrow therapeutic window and specific indication restrict market expansion beyond APL.

- Supply Chain Complexity: Sourcing raw materials (arsenic-containing minerals) and ensuring consistent purity can be challenging, potentially leading to supply disruptions.

- Stringent Regulatory Hurdles: Obtaining and maintaining pharmaceutical approvals requires extensive documentation and adherence to rigorous quality standards, posing a barrier for new entrants.

- Competition from Newer Therapies: While arsenic trioxide is highly effective, ongoing research into novel targeted therapies for APL could, in the long term, present alternative treatment options.

Emerging Opportunities in Arsenic Trioxide Injection

Emerging opportunities in the Arsenic Trioxide Injection market are primarily focused on enhancing its therapeutic utility and expanding its reach. One significant area is the exploration of arsenic trioxide in combination therapies for other hematological malignancies, where its apoptotic and differentiation-inducing properties might prove beneficial. Furthermore, advancements in drug delivery systems, such as targeted nanocarriers, could potentially improve arsenic trioxide's safety profile and efficacy, minimizing systemic toxicity. The growing demand for generic arsenic trioxide injections in developing economies, where cost-effectiveness is paramount, presents a substantial untapped market. Companies are also exploring opportunities in developing more sustainable and environmentally friendly mining and purification processes for arsenic, aligning with global ESG trends.

Growth Accelerators in the Arsenic Trioxide Injection Industry

Several catalysts are driving the long-term growth of the Arsenic Trioxide Injection industry. Foremost among these is the continuous research and development aimed at refining the understanding of arsenic trioxide's molecular mechanisms, which could unlock new therapeutic applications beyond APL. Strategic partnerships between pharmaceutical manufacturers and research institutions are crucial for fostering innovation in this area. Market expansion strategies, particularly in emerging economies with growing healthcare infrastructure and increasing awareness of APL, will significantly contribute to growth. Furthermore, the development of standardized protocols for arsenic trioxide administration and monitoring will enhance its adoption and appeal to a broader range of healthcare providers. The potential for development of oral formulations, while challenging, could revolutionize patient convenience and accessibility, acting as a major growth accelerator.

Key Players Shaping the Arsenic Trioxide Injection Market

- Teva Pharmaceutical Industries Ltd.

- Managem Mining Group

- Hunan Gold Group

- China National Gold Group Corporation

- Chenzhuo Tangtao Environmental

- Jiangxi Copper Corporation

- Zhuzhou Ante New Material

- Umicore

- Yunnan Tin Company Group

- Hengyang Guomao Chemical

- Dundee Precious Metals Tsumeb

Notable Milestones in Arsenic Trioxide Injection Sector

- 2000: FDA approval of Arsenic Trioxide (Trisenox) for the treatment of relapsed or refractory Acute Promyelocytic Leukemia (APL).

- 2005: European Medicines Agency (EMA) approval of Arsenic Trioxide for APL treatment, expanding its global accessibility.

- 2015: Publication of pivotal studies highlighting the effectiveness of arsenic trioxide in combination with ATRA (all-trans retinoic acid) as a first-line therapy for APL.

- 2018: Increased focus on ultra-high purity arsenic trioxide production (≥99%) by leading manufacturers to meet evolving pharmaceutical standards.

- 2021: Emerging research exploring potential applications of arsenic trioxide in other hematological disorders and solid tumors, indicating future diversification.

- 2023: Advancements in closed-system manufacturing processes for arsenic trioxide to enhance safety and reduce environmental impact, adopted by key players like Teva Pharmaceutical Industries Ltd.

In-Depth Arsenic Trioxide Injection Market Outlook

The Arsenic Trioxide Injection market outlook remains cautiously optimistic, driven by its established role in APL treatment and the potential for expanding its therapeutic applications. Key growth accelerators, including ongoing research into novel treatment combinations and the exploration of new indications, are expected to sustain market demand. Strategic opportunities lie in strengthening supply chain resilience, particularly for pharmaceutical-grade arsenic trioxide, and in addressing the needs of emerging markets with cost-effective solutions. The industry's commitment to rigorous quality control and patient safety will continue to shape product development and market entry, ensuring its long-term viability as a critical therapeutic agent. The market is projected to witness steady growth, driven by its indispensable role in saving lives and the continuous pursuit of therapeutic innovation.

Arsenic Trioxide Injection Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Clinics

- 1.3. Pharmacies

- 1.4. Others

-

2. Types

- 2.1. Greater than or equal to 97%

- 2.2. Greater than or equal to 98%

- 2.3. Greater than or equal to 99%

- 2.4. Others

Arsenic Trioxide Injection Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Arsenic Trioxide Injection REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Clinics

- 5.1.3. Pharmacies

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Greater than or equal to 97%

- 5.2.2. Greater than or equal to 98%

- 5.2.3. Greater than or equal to 99%

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Clinics

- 6.1.3. Pharmacies

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Greater than or equal to 97%

- 6.2.2. Greater than or equal to 98%

- 6.2.3. Greater than or equal to 99%

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Clinics

- 7.1.3. Pharmacies

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Greater than or equal to 97%

- 7.2.2. Greater than or equal to 98%

- 7.2.3. Greater than or equal to 99%

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Clinics

- 8.1.3. Pharmacies

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Greater than or equal to 97%

- 8.2.2. Greater than or equal to 98%

- 8.2.3. Greater than or equal to 99%

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Clinics

- 9.1.3. Pharmacies

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Greater than or equal to 97%

- 9.2.2. Greater than or equal to 98%

- 9.2.3. Greater than or equal to 99%

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Arsenic Trioxide Injection Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Clinics

- 10.1.3. Pharmacies

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Greater than or equal to 97%

- 10.2.2. Greater than or equal to 98%

- 10.2.3. Greater than or equal to 99%

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Teva Pharmaceutical Industries Ltd.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Managem Mining Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hunan Gold Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China National Gold Group Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chenzhuo Tangtao Environmental

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jiangxi Copper Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhuzhou Ante New Material

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Umicore

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yunnan Tin Company Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hengyang Guomao Chemical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dundee Precious Metals Tsumeb

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Teva Pharmaceutical Industries Ltd.

List of Figures

- Figure 1: Global Arsenic Trioxide Injection Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Arsenic Trioxide Injection Revenue (million), by Application 2024 & 2032

- Figure 3: North America Arsenic Trioxide Injection Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Arsenic Trioxide Injection Revenue (million), by Types 2024 & 2032

- Figure 5: North America Arsenic Trioxide Injection Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Arsenic Trioxide Injection Revenue (million), by Country 2024 & 2032

- Figure 7: North America Arsenic Trioxide Injection Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Arsenic Trioxide Injection Revenue (million), by Application 2024 & 2032

- Figure 9: South America Arsenic Trioxide Injection Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Arsenic Trioxide Injection Revenue (million), by Types 2024 & 2032

- Figure 11: South America Arsenic Trioxide Injection Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Arsenic Trioxide Injection Revenue (million), by Country 2024 & 2032

- Figure 13: South America Arsenic Trioxide Injection Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Arsenic Trioxide Injection Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Arsenic Trioxide Injection Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Arsenic Trioxide Injection Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Arsenic Trioxide Injection Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Arsenic Trioxide Injection Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Arsenic Trioxide Injection Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Arsenic Trioxide Injection Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Arsenic Trioxide Injection Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Arsenic Trioxide Injection Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Arsenic Trioxide Injection Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Arsenic Trioxide Injection Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Arsenic Trioxide Injection Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Arsenic Trioxide Injection Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Arsenic Trioxide Injection Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Arsenic Trioxide Injection Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Arsenic Trioxide Injection Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Arsenic Trioxide Injection Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Arsenic Trioxide Injection Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Arsenic Trioxide Injection Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Arsenic Trioxide Injection Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Arsenic Trioxide Injection Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Arsenic Trioxide Injection Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Arsenic Trioxide Injection Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Arsenic Trioxide Injection Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Arsenic Trioxide Injection Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Arsenic Trioxide Injection Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Arsenic Trioxide Injection Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Arsenic Trioxide Injection Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Arsenic Trioxide Injection?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Arsenic Trioxide Injection?

Key companies in the market include Teva Pharmaceutical Industries Ltd., Managem Mining Group, Hunan Gold Group, China National Gold Group Corporation, Chenzhuo Tangtao Environmental, Jiangxi Copper Corporation, Zhuzhou Ante New Material, Umicore, Yunnan Tin Company Group, Hengyang Guomao Chemical, Dundee Precious Metals Tsumeb.

3. What are the main segments of the Arsenic Trioxide Injection?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 1500 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Arsenic Trioxide Injection," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Arsenic Trioxide Injection report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Arsenic Trioxide Injection?

To stay informed about further developments, trends, and reports in the Arsenic Trioxide Injection, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence